Written by: BitpushNews Mary Liu

On Wednesday, the Federal Reserve kept interest rates unchanged, in line with market expectations. U.S. stocks were higher in midday trading, as Fed Chairman Jerome Powell's speech laid the foundation for a September rate cut, boosting market confidence.

While Powell said the Fed had “not made any decisions about future meetings, including September,” he noted that “the committee’s overall view is that the economy is approaching levels at which it would be appropriate to lower the policy rate.”

Powell said the decision to cut rates would depend on inflation falling or in line with expectations, economic growth remaining fairly strong and the labor market remaining consistent with current conditions. If those criteria are met, "a September rate cut could be under consideration."

According to CME FedWatch data, traders are betting that the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 90.5%, and the probability of cutting interest rates by 50 basis points is 9.5%.

The market reacted positively to Powell's remarks. At the close, the S&P, Dow Jones and Nasdaq indices all rose, up 1.58%, 0.24% and 2.64% respectively.

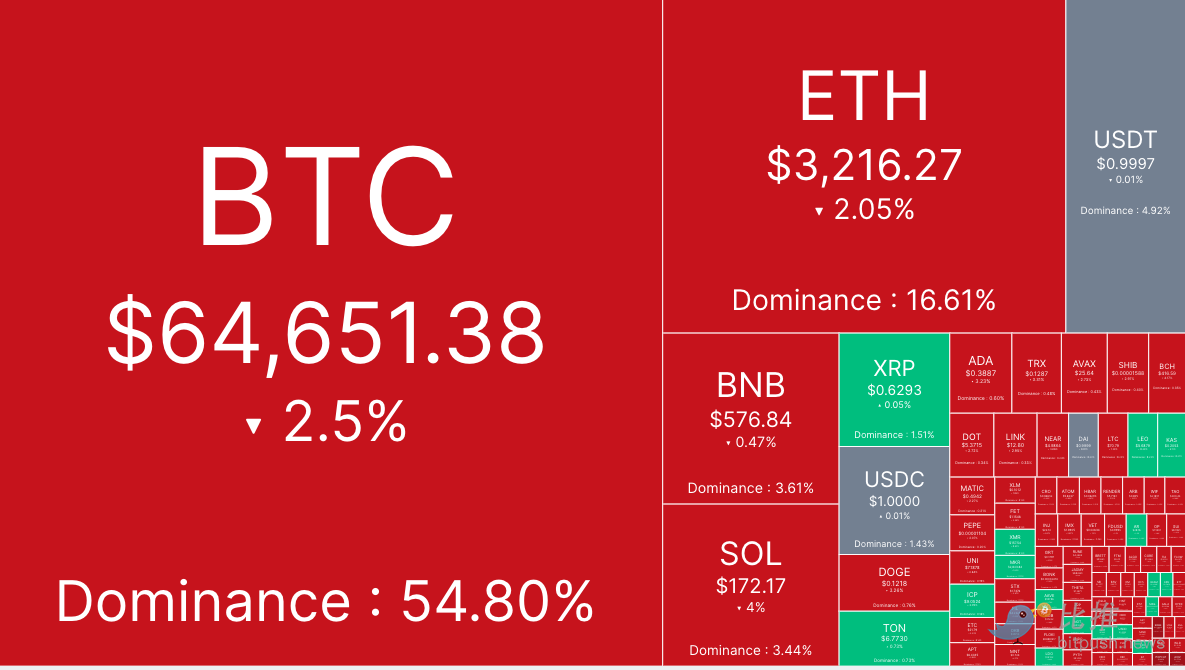

The crypto market fell instead of rising. According to Bitpush data, Bitcoin rose to $66,830 after Powell's comments, but encountered strong resistance from short sellers and retreated to the $64,500 support level, falling more than 2% in the past 24 hours. At press time, BTC is trading at $64,643, down 2.5% in 24 hours.

Altcoin are struggling to hold onto recent gains, with most of the top 200 Altcoin by market cap falling on Wednesday.

Among the rising coins, Centrifuge (CFG) had the largest increase, up 9.3% and trading at $0.482, followed by cat in a dogs world (MEW) up 8.3% and Beam (BEAM) up 6.8%. JasmyCoin (JASMY) led the decline, down 7%, while AIOZ Network (AIOZ) and Book of Meme (BOME) fell 5.4% each.

The current overall market value of cryptocurrencies is $2.36 trillion, with Bitcoin accounting for 54.8% of the market share.

The correlation between gold, Fed monetary policy and BTC

Jag Kooner, head of derivatives at Bitfinex, said in a note: "A rate cut in September would create a bullish sentiment and could generally increase market liquidity, which is good for Bitcoin and other cryptocurrencies as investors seek higher returns outside of traditional assets. This could lead to upward pressure on Bitcoin prices and increase ETF inflows as investors look to take advantage of an environment more favorable to risk assets."

Kooner added: “There is a lot of confidence in the market right now, especially since even potentially negative news like the Mt. Gox refund, the German government sell-off, and many recent major on-chain developments have failed to have a meaningful downside impact on the price of Bitcoin.”

Market analyst CryptoCon highlighted BTC’s correlation with gold as a potential indicator.

CryptoCon posted on the X platform: "The Bitcoin bull market started where the gold bear market started. It has been 208 weeks since the last gold bear market peak. The other bear markets were triggered in 196 and 213 weeks respectively. Bitcoin's big reversal and bull market are not far away."

The chart provided by CryptoCon shows a history of Bitcoin rising as gold prices fell, but there have been times when both rose simultaneously, such as in 2020, the last time the Federal Reserve cut interest rates in response to the coronavirus pandemic.

As traders widely expect the Federal Reserve to start cutting interest rates again in September, both assets may once again move higher together. According to CryptoCon’s analysis, once gold prices peak and begin to move lower, cryptocurrency traders should be wary of explosive moves in Bitcoin.

But with the U.S. national debt recently surpassing $35 trillion and showing no signs of slowing down, both Bitcoin and gold are likely to perform differently than in previous bull cycles.

Analysts at wavetraders.com believe that Bitcoin will catch up with gold in the short term, as BTC has been stagnant in recent months while gold has hit new all-time highs.

Captain Faibik, a well-known cryptocurrency analyst, emphasized that although Bitcoin is currently consolidating at support, the next area to watch will be around $60,000. He pointed out on X: "Daily MA128 ($65,200) is now a key support level. Bulls need to defend it, otherwise, Bitcoin may return to the $60,000 support area."

Analysts at Secure Digital Markets believe: "BTC is currently in defensive mode, while the yen has strengthened in the foreign exchange market due to the Bank of Japan's interest rate hikes and liquidity tightening measures. With major US technology companies reporting earnings this week, traders are preparing for more volatility."