According to a report by CoinDesk, large Bitcoin (BTC) holders took advantage of the two-way price fluctuations in July to accumulate Bitcoin at the fastest rate in years.

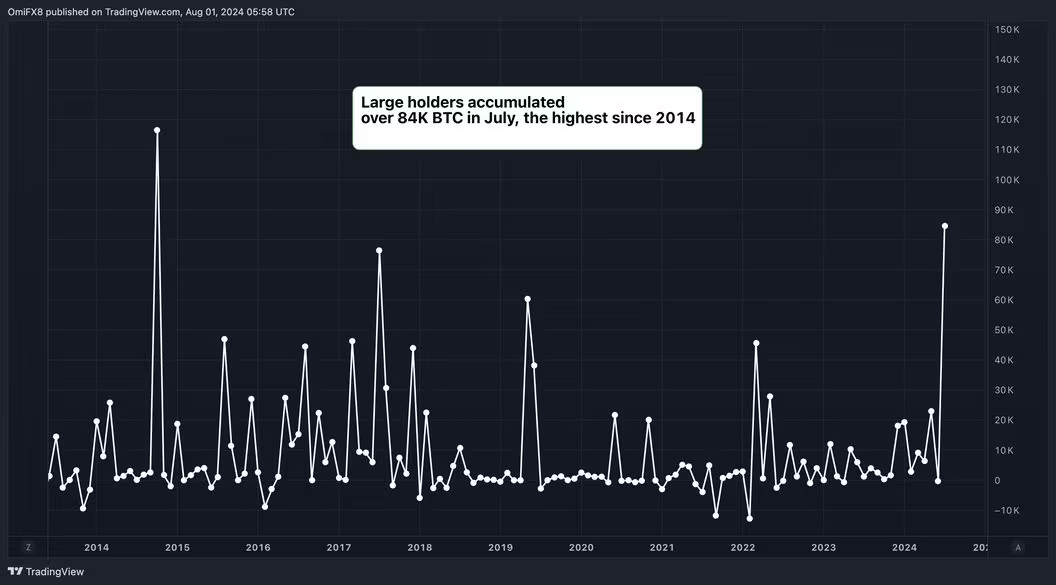

Data tracked by blockchain analysis company IntoTheBlock and market-watching software TradingView show that large holders (addresses with at least 0.1% of the circulating supply of BTC) accumulated a total of more than 84,000 Bitcoins in July, calculated based on current market prices. Approximately US$5.4 billion. In terms of BTC volume, this is the largest single-month increase in holdings since October 2014.

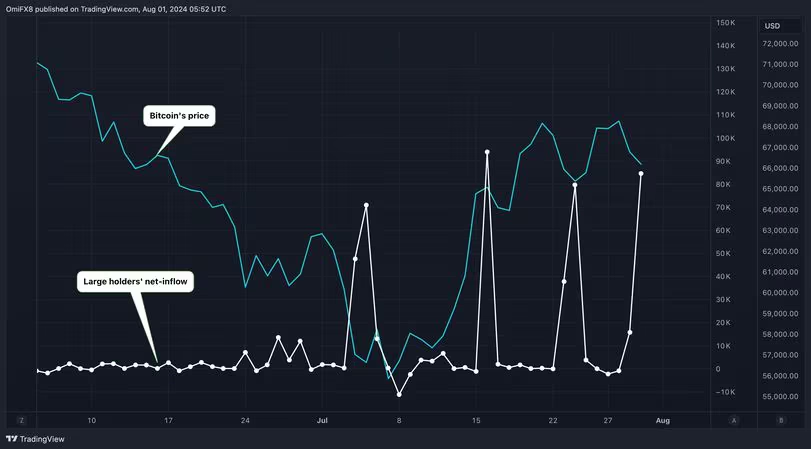

The data shows that these large holders bought on the dip when Bitcoin price fell below $55,000 in early July, then paused when the price recovered to $69,000, and held on for the long term during two price corrections in late July. Net inflows have increased.

This strategic accumulation may indicate that accumulators are convinced that the consolidation phase between $50,000 and $70,000 will eventually end with a bullish breakout, extending the initial rally from $16,000.

Some analysts are optimistic about Bitcoin’s price outlook. Jag Kooner, head of derivatives at cryptocurrency exchange Bitfinex, said:

“A rate cut in September will create bullish sentiment and may generally increase liquidity in the market, which will be beneficial to Bitcoin and other cryptocurrencies as investors seek higher returns outside of traditional assets. As Investors seek to profit from a more favorable environment for risk assets, which could lead to upward pressure on Bitcoin prices and increased ETF inflows.”

The U.S. Federal Reserve announced an interest rate decision in the early morning of Thursday (1st) Taiwan time, maintaining the target range of the federal funds rate at 5.25% to 5.50%. Federal Reserve Chairman Jerome Powell said at a press conference that an interest rate cut may be discussed as early as the September meeting, and emphasized that potential loose monetary policy needs to be supported by economic data.

Kooner also said the weakening impact of negative news has led to increased market confidence. He said:

“Confidence in the market is high at the moment, especially since potentially negative news likethe Mt.

Bullish sentiment also comes from stablecoin inflows. According to digital asset data company CCData, the total stablecoin market capitalization rose 2.11% to $164 billion in July, the highest monthly increase since April, indicating that new funds were flowing into the market and reflected in positive prices in July On the trend.