Author: Greythorn

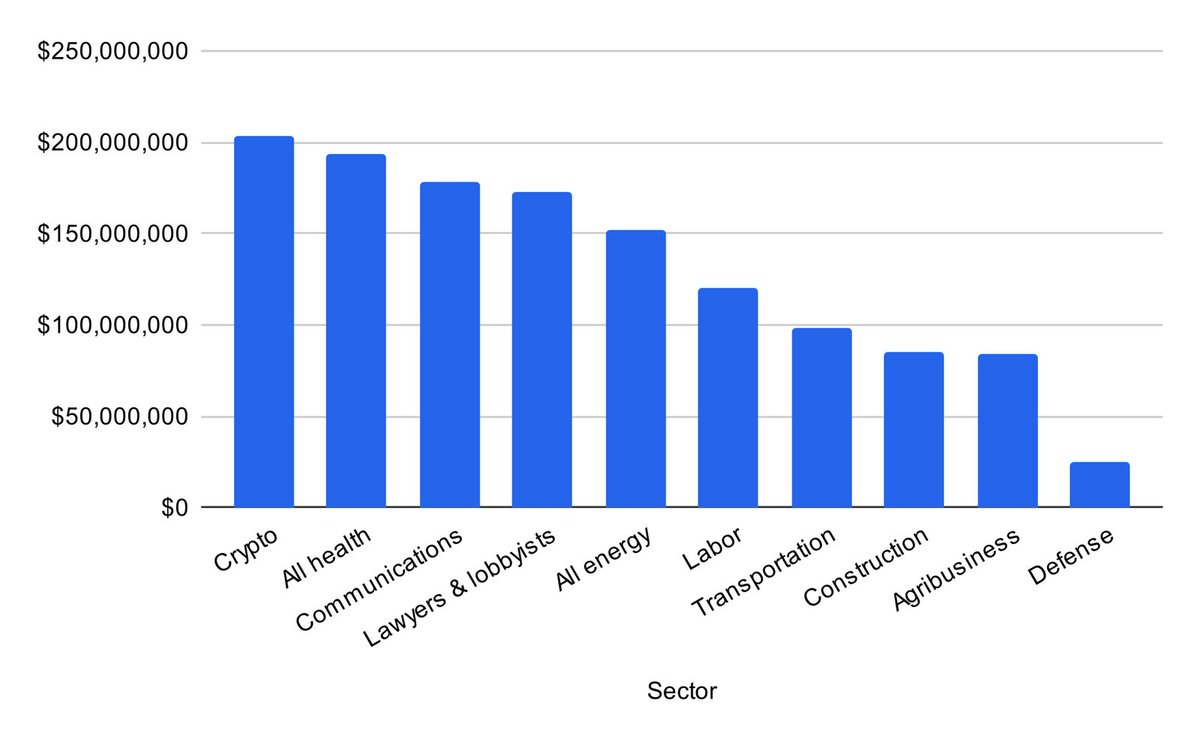

As Bitcoin gains political attention in the 2024 U.S. presidential election, the phenomenon is reshaping the electoral landscape. Influential figures such as the Winklevoss brothers and Kraken's Jesse Powell have donated millions of dollars to politics , sparking heated debate within the crypto community. In fact, the cryptocurrency industry is spending more than the entire energy and healthcare industries in the 2024 U.S. election.

Source: OpenSecrets

Trump’s sudden support for Bitcoin at the last Bitcoin conference took the industry by surprise and reflects a broader trend: Bitcoin and other cryptocurrencies are not just financial instruments, but key topics of political discussion. The crypto community, especially on platforms like Crypto X, is divided. Some openly support Trump and believe that his support for Bitcoin is good for the industry, while others feel pressured to support him due to the hostility of the Democratic administration towards cryptocurrencies. Arthur Hayes was one of the main figures to express his concerns, believing that Trump’s support for cryptocurrencies is not sincere and is just a strategy to attract donations. He believes that Trump will forget about cryptocurrencies once he is elected. In today’s article, we will dive deeper into this topic and explore various possible outcomes for Bitcoin based on different election and post-election scenarios.

General opinion: Trump is good for cryptocurrencies

As the election approaches, several candidates have made their stances on Bitcoin clear, indicating a significant shift in the perception of the digital asset. Robert Kennedy Jr., Vivek Ramaswamy, and Ron DeSantis have all publicly supported Bitcoin , pushing for policies that protect and encourage its use. Recently, Donald Trump has also shown support for Bitcoin, which came as a surprise to many as he was previously skeptical of Bitcoin. This has been well received in the crypto community because:

Although his previous terms tended toward protectionist policies, Trump has generally favored deregulation and free markets, suggesting his administration may take a less restrictive approach to cryptocurrency regulation than a Biden administration.

His focus on economic growth and job creation could lead to policies that encourage investment in cryptocurrency businesses, foster an environment conducive to start-ups and innovation, and promote economic activity and job creation.

Trump has expressed skepticism about the development of CBDCs (Central Bank Digital Currency), allowing Bitcoin to dominate the market.

His administration is likely to adopt a competitive approach toward other countries, aimed at ensuring that the United States maintains a leading position in financial technology and the global cryptocurrency market.

At the Bitcoin 2024 conference, Donald Trump showed remarkable support for the cryptocurrency industry, marking a shift in his stance toward Bitcoin from his previous criticism.

Source: The New York Times

By contrast, the Democratic scenario looks less favorable:

A tighter regulatory framework may be established, increasing compliance costs for cryptocurrency businesses.

The Biden/Harris administration has shown interest in developing a U.S. CBDC, which could lead to more scrutiny and regulation of existing cryptocurrencies, paving the way for a digital dollar.

Both Biden and Kamala Harris emphasize climate change and environmental sustainability, which could lead to policies targeting PoW (proof of work) cryptocurrencies such as Bitcoin.

There could be an increased tax focus on cryptocurrency transactions and stricter reporting requirements for individuals and businesses.

We don’t claim to be political experts, but this seems like a fair insight into the general community perception of both candidates’ attitudes towards crypto.

Another view: Trump may be bad for cryptocurrencies

At least not as well as it might initially seem. As mentioned earlier, Arthur Hayes , a well-known figure in the cryptocurrency space, recently argued that Trump is not really in favor of cryptocurrency. He believes that Trump's support for cryptocurrency is more about getting votes in key swing states than an actual promise. Hayes believes that Trump, like many politicians, will say anything to get re-elected, but will not actually follow through on those promises once in office. He also warned cryptocurrency supporters that they may be naive to trust Trump's promises, suggesting that they demand specific pro-cryptocurrency legislation before the election.

We think this is a very interesting point of view, as history shows that candidates often fail to deliver on their promises. Maybe Trump is actually willing to deliver on his promises about Bitcoin, we don’t know. Regardless, it’s a point of view we should all pay attention to. Now, for another opinion on Trump’s complete reliance on cryptocurrencies:

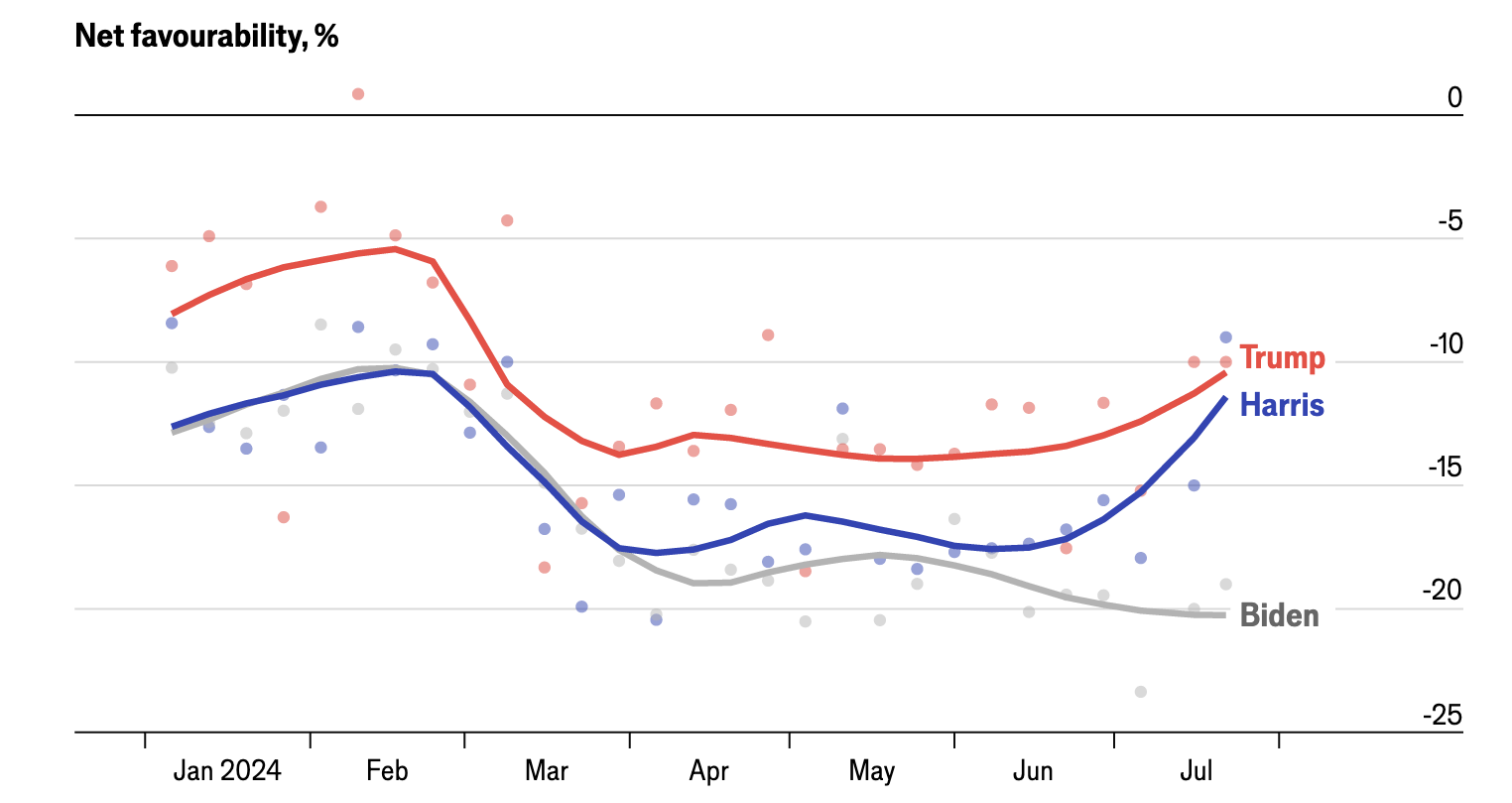

Trump may lose

The current political climate is unpredictable, with many polls showing different results. In the United States, polls show that Trump may win. However, global trends show that the political landscape is changing dynamically.

Source: The Economist

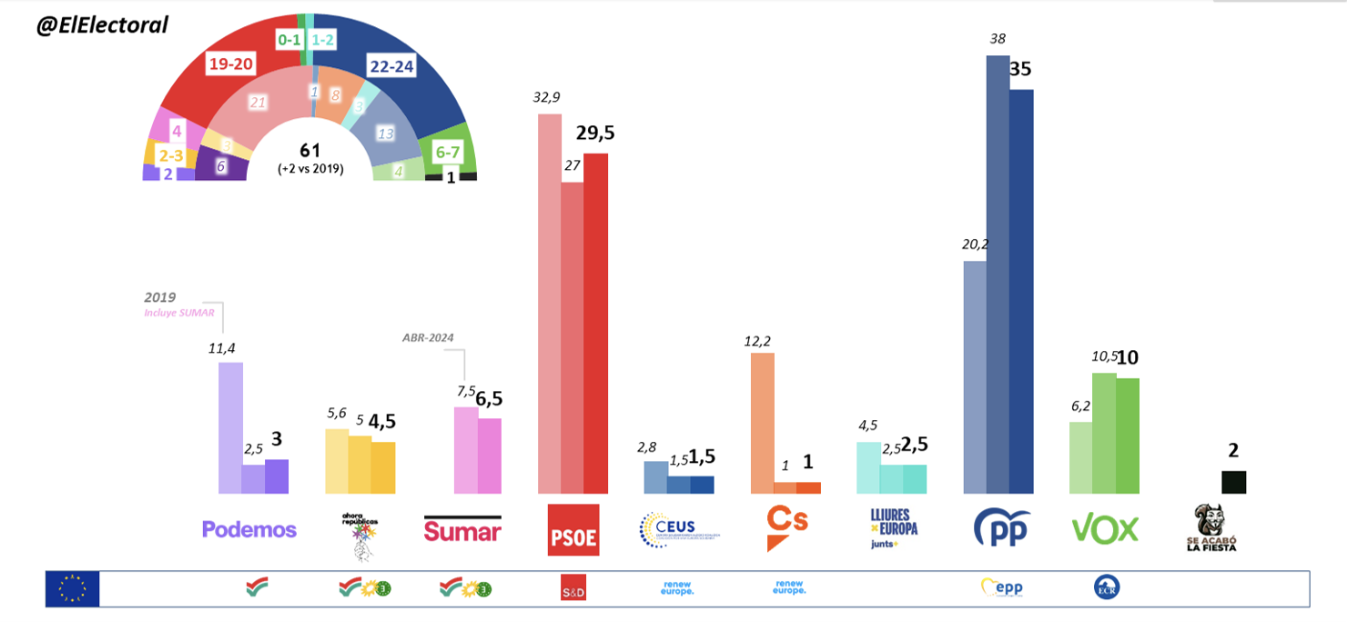

Spanish election

In Spain, the right-wing People's Party (PP) was expected to win, with pre-election polls suggesting a possible majority with the support of the far-right Vox. The PP (blue) won the most votes and 136 seats in Congress, but fell short of an absolute majority even with Vox's 33 seats. Unexpectedly, the left-wing Socialist Workers Party (PSOE, red) performed better than expected, winning 122 seats under Prime Minister Pedro Sánchez, who successfully negotiated with smaller parties to stay in power.

Source: ElElectoral

Political surprise in France

In France, the far-right National Front, led by Marine Le Pen, seemed poised to win. However, in an unexpected turn of events, Le Pen's party suffered a major defeat in the second round of elections and failed to come in second place. This result was largely due to the left-wing factions uniting to face the right-wing challenge.

Source: The Guardian

The revival of the British Labour Party

The political landscape in the UK has undergone a historic shift. The left-wing Labour Party, led by Keir Starmer, won a landslide victory in the 2024 general election, ending 14 years of Conservative rule. Labour won 412 seats, while the right-wing Conservatives, led by Rishi Sunak, suffered the worst defeat, winning only 121 seats. This marked the return of the Labour Party to power with a strong mandate.

Source: CNBC

Recent elections in Spain, France and the UK showcased a wider trend of political unpredictability and shifting allegiances. Right-wing movements typically make a lot of noise, with Trump supporters and wealthy individuals making their voices heard on a variety of platforms. However, their policies often favour the wealthy and fail to resonate with ordinary people, who are facing high living costs, layoffs and a weakening social welfare system.

These everyday individuals may not have the same platform to speak out, but their votes count just as much as the wealthy. This is not about which side to support, but about being prepared for unexpected outcomes that could impact the market, especially Bitcoin.

Given the possibility of Trump losing the election, what would the impact be on Bitcoin and the market if Kamala Harris were elected?

She has shown some interest in the cryptocurrency space, leading to speculation about her stance on Bitcoin. Recently, there were rumors that she might speak at the Bitcoin 2024 conference. This raised hopes among some in the crypto community that she might soften her stance on digital currencies. However, she ultimately decided not to attend or speak at the event. This decision was seen as a missed opportunity to engage with a growing number of crypto enthusiasts and voters. Her stance seems to be cautious, and while she has not made a clear statement against Bitcoin, her decision not to engage directly with the Bitcoin community at such a high-profile event suggests that she may not have fully embraced the space yet.

in conclusion

The purpose of this article is to try to provide an unbiased view of the current state of cryptocurrencies and their political impact, exploring the potential benefits and risks for the crypto community in aligning with a particular political party. The question remains whether Trump will deliver on his promises if elected, and whether aligning with him will damage the reputation of cryptocurrencies among the general public. As a community, the best course of action would be to ensure that Bitcoin and other cryptocurrencies remain nonpartisan, focus more on fighting for clear cryptocurrency regulation before the election, and prioritize practical results over political promises, as Arthur suggests.