Compiled by: Deng Tong, Jinse Finance

On August 5, the crypto market suffered a "Black Monday". Bitcoin plummeted 15% in 24 hours to below $53,000; Ethereum plummeted 30% in 24 hours to around $2,100, wiping out the gains since 2024; other Altcoin fell even more miserably.

In the past week, the crypto market has experienced its biggest sell-off in nearly a year. Bitcoin fell from $70,000 to more than $52,000, and Ethereum fell from $3,300 to $2,100. The entire crypto market value fell by nearly $500 billion.

Over the past month, the crypto market has digested negative news such as the German government selling 50,000 bitcoins and Mentougou starting to pay compensation. It has also welcomed major positive news such as the approval of the Ethereum ETF, support for cryptocurrencies by US politicians such as Trump, and a high probability of a rate cut by the Federal Reserve in September. Why did it experience a big drop in early August?

Jinse Finance tried to analyze multiple factors: the main reason for the decline in the crypto market may be the Bank of Japan's interest rate hike and the appreciation of the yen; other factors include weak US employment data, slowing growth of major technology stocks, and renewed concerns about a recession; Jump's selling of ETH; escalation of geopolitical conflicts between Iran and Israel; seasonal downward trends, etc.

Bank of Japan rate hike + yen appreciation

The direct trigger for the current large-scale correction in cryptocurrencies and traditional markets may be the Bank of Japan's interest rate hike.

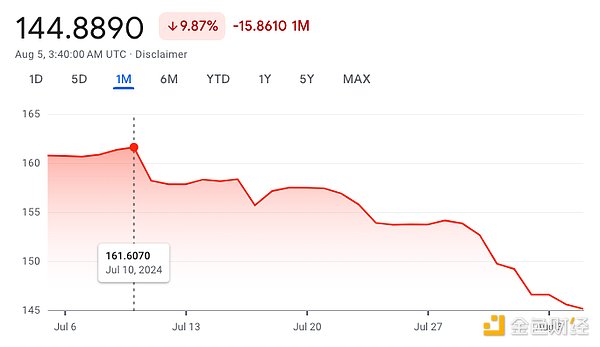

The Bank of Japan decided to raise interest rates at its monetary policy decision meeting on July 31, raising the policy rate (unsecured overnight lending rate) from 0 to 0.1% to 0.25%. The policy will be implemented from August 1, and the bank announced a gradual reduction in the monthly bond purchase scale to 3 trillion yen, which is more tightening than market expectations. The yen monetary tightening policy caused the yen to soar, and the USD/JPY exchange rate soared from 160 to 145.

Japanese stocks subsequently plunged, with the Nikkei index falling about 15% in the past three trading days and 20% from its mid-July high, entering a technical bear market.

On August 5, Mitsubishi UFJ Bank's share price fell by 21%, hitting a record low. The Tokyo Stock Exchange Index fell, triggering a circuit breaker mechanism.

Nick Ferres, chief investment officer of Singapore securities investment company Vantage Point Asset Management, said: The sell-off of Japanese stocks was "massive, rapid and emotional." Make Novogratz, CEO of digital asset management company Galaxy, posted on the X platform that according to the information he knows, Japan's interest rate hike has triggered global risk aversion.

Japanese Chief Cabinet Secretary Yoshimasa Hayashi pointed out that stock prices are affected by many factors, including the economic situation and corporate activities. No comments are made on daily stock market fluctuations at this time. Urgent attention is paid to market dynamics.

The "interest rate hike by the central bank of Japan + appreciation of the yen" is a major negative for the US stock market. Because of Japan's long-term low interest rates, the yen is used by international capital as a "financing currency" for arbitrage, such as issuing bonds in Japan for financing and then buying US technology stocks. Once "Japan raises interest rates + the yen appreciates", arbitrage funds will suffer exchange rate and interest rate losses and be forced to sell US technology stocks and pay back the yen. The arbitrage model of "borrowing yen to buy US technology stocks" will collapse. According to Huachuang Securities Research, the scale of arbitrage funds borrowing yen to invest in US dollar assets is about 1 trillion US dollars.

Concerns about the US economic recession have led to a collapse in the market, and industry giants are not optimistic about the US economic outlook

The negative trend in Japanese stocks spread to the United States, with the Nasdaq index falling more than 5% in the last two trading days of last week. Nasdaq futures fell 2.5% on Sunday night. Several large companies, including Microsoft and Intel, reported second-quarter results that missed expectations, while market leader Nvidia was hit by expectations of an upcoming interest rate cut in September, causing capital to flow back to smaller, lagging companies.

In addition, Australia's benchmark stock index fell more than 3%, its biggest one-day drop since June 2022. South Korea's KOSPI index fell 5% to 2,542.13 points. The Korea Exchange initiated a temporary suspension of trading, suspending program trading for 5 minutes.

Traders' expectations that the Federal Reserve will be able to facilitate a soft landing for the U.S. economy are shifting rapidly. Data released on Friday showed that the U.S. unemployment rate unexpectedly climbed to 4.3%, higher than the Fed's year-end forecast, raising concerns about the SAM recession indicator. "With the unemployment rate higher than expected and core personal consumption expenditure inflation currently below the Fed's year-end forecast, we believe the balance of risks favors the Fed to take more aggressive action," said John Burrows, senior U.S. economist at UBS Wealth Management.

Goldman Sachs Group economists are also not optimistic about the momentum of the U.S. economy and raised the probability of a recession in the U.S. economy in the next year from 10% to 25%, but said that even if the unemployment rate rises, there are multiple reasons not to worry about a recession. "We still believe that the risk of a recession is limited," said Jan Hatzius, chief economist of Goldman Sachs, in a report released to clients on Sunday. The U.S. economy overall looks "still good", there are no major financial imbalances, and the Federal Reserve has a lot of room to cut interest rates and can act quickly if necessary. Goldman Sachs' forecast for the Federal Reserve is not as aggressive as JPMorgan Chase and Citigroup. Hatzius' team expects the Federal Reserve to cut interest rates by 25 basis points in September, November and December respectively. JPMorgan Chase and Citigroup expect policymakers to cut interest rates by 50 basis points in September.

Not only major financial giants, but also the stock god Buffett seems to have foreseen this. Berkshire Hathaway, owned by Buffett, reduced its Apple holdings by nearly half in the second quarter. Its holdings are now about $84 billion, down from about $140 billion at the end of March. The company sold a net $75.5 billion of stocks in the second quarter, bringing its cash reserves to a record $276.94 billion, including cash equivalents. Previously, Berkshire Hathaway had reduced its holdings of its second largest holding, Bank of America, for twelve consecutive days. Berkshire Hathaway's net profit in the second quarter was $30.3 billion, and operating profit excluding some investment income increased to $11.6 billion.

Musk said Buffett increased his cash reserves to $277 billion in the second quarter, saying that Buffett obviously expected some kind of market correction or simply thought there was no better investment than U.S. Treasuries. The Fed needs to cut interest rates, and it would be stupid for them not to do so.

Jump sells ETH

On-chain analyst Ember monitored that Jump Trading may be selling ETH : they are currently redeeming a wstETH worth $410 million (120,000) in batches into ETH and then transferring it to exchanges such as Binance/OKX. So far, they have unpacked and redeemed 83,000 wstETH into 97,500 ETH in the 9 days since July 25. Among them, 66,000 ETH (191.4 million USD) have entered the exchange.

At present, there are still 37,600 wstETH in their wstETH storage address that have not been transferred out; 11,500 stETH in the redemption ETH address is being redeemed into ETH; and 20,000 ETH in the ETH transfer address to the exchange are waiting to enter the exchange in batches.

Some market commentators also cited a series of sell-offs at Jump Crypto as an exacerbating factor, with the trading firm dumping hundreds of millions of dollars of assets from its books over the past few days, according to Arkham Intelligence.

Arthur Hayes, co-founder of BitMEX, posted on social media that he learned through traditional financial sources that a "big guy" had collapsed and sold all his crypto assets. Currently, most of the community speculates that he is referring to JumpCrypto.

According to Coingecko data, the market value of Ethereum fell below the $300 billion mark. According to MarketCap data, due to the short-term decline of ETH, the current market value of Ethereum has been surpassed by LVMH, Coca-Cola and Bank of America, falling to the 40th place in global asset ranking.

Iran-Israel geopolitical conflict escalates

According to AXIOS, three people familiar with the matter said that US Secretary of State Blinken told the leaders of the Group of Seven on Sunday that attacks by Iran and Hezbollah on Israel could begin as early as Monday. Blinken called the call to coordinate with allies and try to exert diplomatic pressure on Iran and Hezbollah at the last minute to minimize their retaliation. He stressed that limiting the impact of the attack is the best chance to prevent a full-scale war. Sources said Blinken emphasized that the United States believes that both Iran and Hezbollah will retaliate. Blinken said it is unclear what form Iran's retaliation will take. Sources said Blinken told the G7 foreign ministers that the US's increase in troops in the region is only for defensive purposes. At the same time, Blinken sounded frustrated when briefing the ministers on recent negotiations with Israel on Gaza hostages and a ceasefire agreement.

Hezbollah in Lebanon announced that it used multiple drones to attack the headquarters of the 91st Division of the Israeli Army in Ayelet HaShahar in the early morning of August 5. Hezbollah said the attack was a response to assassinations and attacks launched by the Israeli army in multiple locations in southern Lebanon.

Many countries have issued warnings about the recent security situation in the Middle East: France urged French citizens in Lebanon, especially those traveling in Lebanon, to "leave Lebanon while commercial flights are still operating" and advised French citizens living in Iran to temporarily leave Iran if they are able; Italy asked Italian citizens not to travel to Lebanon and urged Italian citizens already in Lebanon not to travel to southern Lebanon and to return to Italy on commercial flights as soon as possible; Saudi Arabia once again called on Saudi citizens in Lebanon to evacuate Lebanon; Brazil recommended that Brazilian citizens living or passing through Lebanon leave Lebanon, and also asked Brazilian citizens not to travel to Lebanon unless necessary; Britain announced the withdrawal of family members of its embassy staff in Lebanon and once again called on its citizens to leave Lebanon.

Seasonal decline in market trends

Coinbase analysts David Duong and David Han said that August is usually a month that is not conducive to seasonal factors in the cryptocurrency market. Historically, market activity in August is relatively sluggish. For example, compared with June 2023, Bitcoin spot trading volume in August of the same year fell by 19%. Bitcoin futures trading volume on global centralized exchanges also fell by 30% during the same period. They added: "Over the past five years, Bitcoin has fallen an average of 2.8% in August, and reduced liquidity and trading volume may lead to increased volatility in August." Coinbase analysts said that we may see the same sluggish market performance this year.

How will the market trend develop in the future?

As we all know, the trend of the crypto market depends on the buying and selling comparison and macro fluctuations in the short term, and monetary policy in the long term.

In the short term, the US and Japanese markets are in a critical period of policy fluctuations. Galaxy CEO Make Novogratz wrote on the X platform that Japan's interest rate hike has triggered global risk aversion.

10x Research analyst Markus Thielen pointed out: It is clear that the US economy has been weaker in the past 48 hours than the Fed initially thought, and the weak ISM index has brought a shock to risky assets. The Fed hinted that the fall interest rate cut will not stop the economic downturn. If the stock market follows the downward trend of the ISM manufacturing index and even begins to anticipate an impending recession, then stocks may fall sharply in the next few quarters. If this happens, Bitcoin may suffer a sharp sell-off, and its price may fall below $50,000, or even lower.

Dan Dolev, senior analyst at Mizuho Securities, said: Bitcoin is not yet the safe-haven tool that people hope for. If the unemployment rate rises and people lose their jobs, investors will have to cash out their tokens. This also means that Bitcoin may be at risk of falling again.

In the long run, as the Federal Reserve begins to cut interest rates, the United States is about to start a new round of monetary easing. As more and more US dollars enter the capital market, I believe the crypto market will rise with it.

Therefore, a reasonable conclusion may be that the short term is unpredictable and the long term is bullish.

Jeremy Allaire, co-founder and CEO of Circle, also said: “I am as bullish on the crypto industry as I was six weeks ago. Focus on technology, industry and adoption. Don’t pay attention to the prices of digital commodities in the face of global macro fluctuations.”

Source: Jinse Finance, Jinshi Data, CoinTelegraph, CoinDesk.