Author: Stacy Muur Source: substack Translation: Shan Ouba, Jinse Finance

The last time we saw a similar drop in crypto market cap was in early July when Germany began selling off BTC. This time, the catalyst came from Web2, specifically the stock market.

Stock Market, Interest Rates, and Unemployment

First, let’s explain some fundamental factors that are critical to the global economy and directly affect the stock market and cryptocurrency market.

Lower interest rates: When interest rates fall, companies can borrow money more cheaply and reinvest their earnings more efficiently. This is seen as a positive sign for the stock market as the economic environment becomes more favorable.

Now, let’s dive into the current drama.

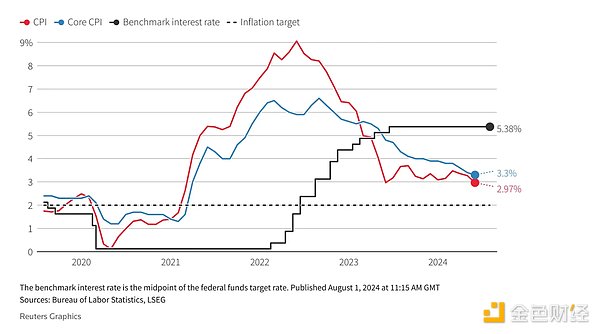

July 31: Jerome Powell announced that interest rates could be cut in September if the U.S. economy develops as expected. This potential rate cut has already been factored into stock prices, becoming a clear positive catalyst for the stock market's growth over the past few months.

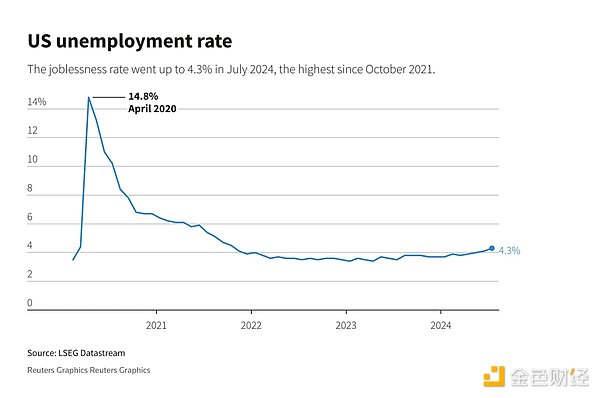

August 2: The Labor Department releases a jobs report showing that the U.S. unemployment rate jumped to 4.3% in July, close to its highest level in three years. The increase increases the likelihood of an immediate rate cut — the sooner the better — but also casts a different shadow on the U.S. economy: a higher-than-expected increase in unemployment.

In June, U.S. central bank policymakers projected just one rate cut this year and expected unemployment to reach 4% by the end of the year. However, given the current situation, multiple rate cuts are possible.

You might argue, “ Lower interest rates are a good thing—that’s exactly what you said. ”

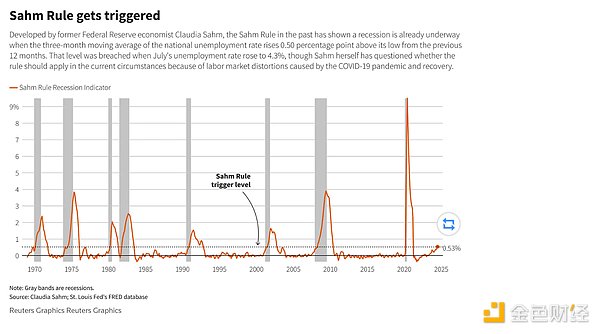

Yes, but the unemployment rate is the more critical potential bearish catalyst. The rise in the unemployment rate in July set off the so-called Sam's Rule, a historically accurate early indicator of recessions.

What happened next? A wave of panic selling.

details make a difference

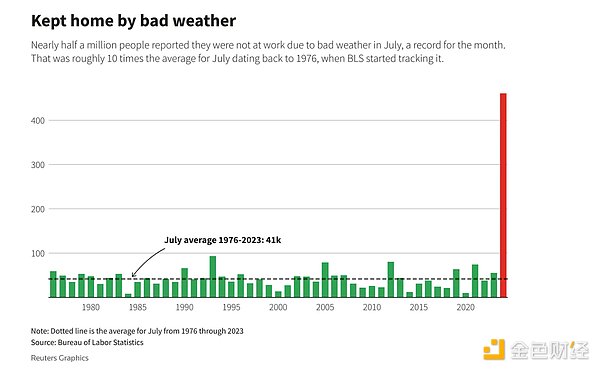

As media headlines often do, the focus of the story (often exaggerated) appears first, with more background information revealed near the end, but the end is the least read.

First, a note on Hurricane Beryl . The household survey showed that 436,000 people reported they were unable to work due to severe weather last month, the highest number ever for July. In addition, 249,000 people were temporarily laid off.

Second, consider immigration . About 420,000 people entered the labor force last month, while household employment increased by only 67,000. The number of people working part-time for economic reasons increased by 346,000 to 4.6 million. However, the number of permanently unemployed and long-term unemployed people was almost unchanged.

Claudia Sahm, an economist who formerly worked at the Federal Reserve and the creator of the Sahm Rule, warned against taking too strong a signal from her rule.

Long story short, recession fears are probably overblown — but weaknesses do exist and need to be addressed.

Japan raises interest rates

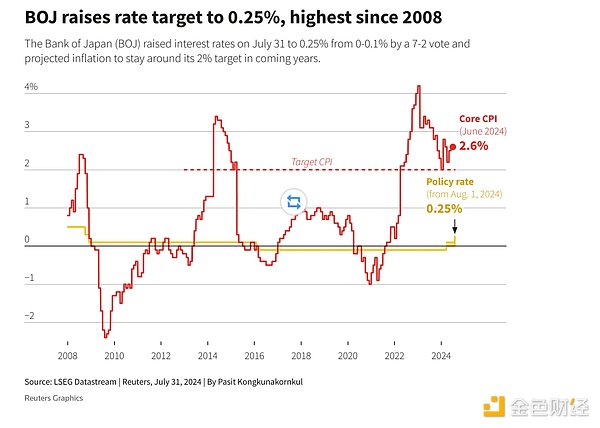

The second catalyst for the global repricing was the Bank of Japan’s hike in its interest rate target to 0.25% – the highest level since 2008.

During periods of negative interest rates, many Japanese investors borrow yen at low rates to buy higher-yielding U.S. Treasuries, a practice often referred to as the "carry trade." However, as the Bank of Japan raises rates, that trade becomes less effective and some investors may bring that money back home.

Panic is poison

Whatever the reason, the next jobs report and further action from the FOMC on rate cuts will play a fundamental role in market pricing.

The stock market reacted immediately to the news.

The dollar fell to its lowest in four months against a basket of currencies.

U.S. Treasury prices rose, with the benchmark 10-year note yield falling to its lowest level since December.

The CBOE Volatility Index, a gauge of expected futures prices, rose to its highest level since April.

Japan's Nikkei index also fell nearly 5%, its biggest one-day drop since 2022.

Naturally, the turmoil impacted the cryptocurrency market, leading to a series of long-term liquidations.