In the past 6 hours, Bitcoin (BTC) once hit $48,934, and Ethereum (ETH) was even worse, once falling to $2,084 (the lowest point this year was $2,051 on January 3), a single-day drop of more than 20%. , nearly halved from the historical high of $4,092.

Amid the violent fluctuations, the total market value of cryptocurrency has also fallen below US$2 trillion and is currently at US$1.91 trillion, a drop of more than 11% in 24 hours. In this regard, Jeff Dorman, Chief Information Officer of Arca, a digital asset management company, analyzed six major reasons for the collapse of the cryptocurrency market:

overall economy

Macro signals show that there is an obvious short-term selling signal on Friday (8/2).

The 10-year U.S. Treasury bond yield fell 40 basis points, oil prices plummeted, and the stock market continued to fall. The "VIX Index" which symbolizes the level of market panic rose 25% on Friday. But in the long term, the VIX index is expected to fall, the Federal Reserve will cut interest rates in September, and this is still an election year.

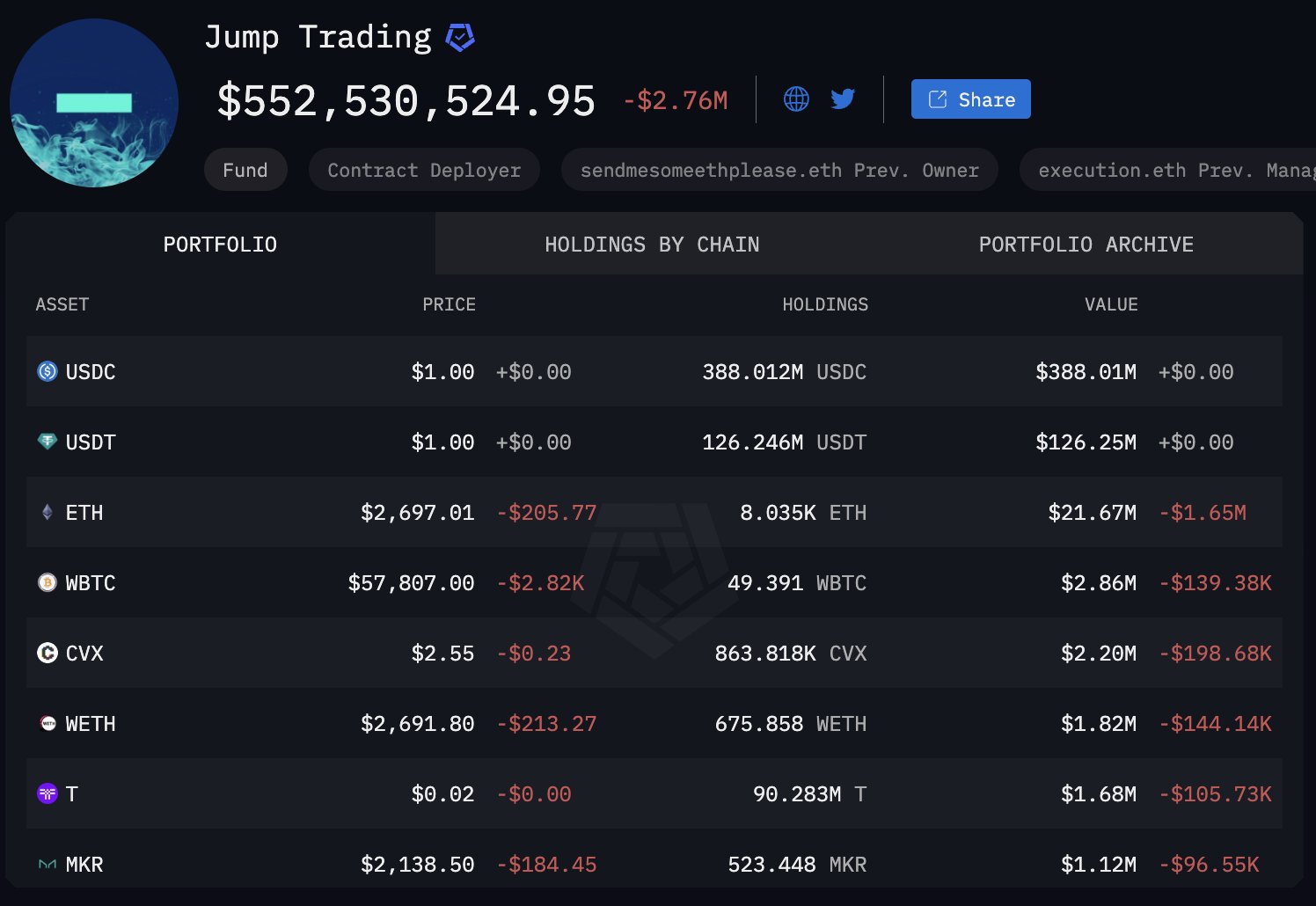

Jump Trading Sell

Jump Trading may have purchased puts prior to the sell-off. Over 90% of ETH is being sold on exchanges. Currently, $510 million of the $550 million in their wallets is in stablecoins. Interestingly, they transferred the stablecoins back to their own wallets rather than cashing them out directly on the exchange.

It’s worth mentioning that there are three possible reasons for Jump Trading’s sell-off:

- They are divesting or being forced to sell by the Federal Reserve and regulators.

- Worried that there will be a large-scale stock market sell-off similar to "Black Monday" tomorrow, we don't care about today's poor liquidity.

- They may be chasing stops, or have put options.

ETF Fund Flows

Unfortunately, the market doesn't have much of an advantage in this regard and will be affected by these flows this year. Bitcoin saw net outflows of $237 million on Friday, while Ethereum flows remained neutral. While the new ETFs have dealt a blow to the cryptocurrency market in the short term, in the long term this is a challenge that must be faced.

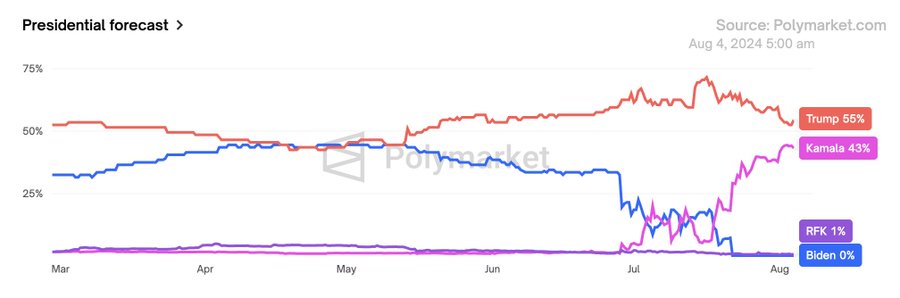

US presidential election

Harris' support for Trump is rising in polls, which is bad for the cryptocurrency market. Although the Democratic Party is less hostile to cryptocurrencies, the overall stock and crypto markets are more inclined to support a Trump victory.

Tensions in the Middle East

In the long term, it doesn't matter because it never really affects the market. Only short-term macro traders pay attention to this type of news. Moreover, oil prices have not responded significantly to this.

supply side

Mt Gox's fund distribution is basically completed, and now it is Genesis' turn to distribute ETH, BTC and SOL. Selling pressure appears to have eased on Grayscale, while a cash distribution from FTX is imminent.

in conclusion

In the end, Dorman concluded: It seems more worth buying than selling right now. Since the highs on March 13, TON and ONDO are the only coins I have been consistently bullish on.

Many coins have fallen 50-75% from their highs, and most are negative year-to-date. But if you were once bullish on the market, you should remain optimistic now.