Recently, due to the rising unemployment rate in the United States and the triggering of the "Sam Rule" that indicates an economic recession, the U.S. stock market has suffered heavy losses for several consecutive days. On Monday, the disaster even affected Asian stock markets such as Japan, South Korea, and Taiwan.

The U.S. stock market continued its decline after opening last night, and the four major U.S. stock indexes suffered another heavy setback. Specifically:

- Dow Jones Industrial Average: down 2.6%, or 1,033.99, to 38,703.27

- S&P: Down 3%, or 160.23, at 5,186.33

- Nasdaq: down 3.43%, or 576.08, to 16,200.08 points

- Philadelphia Semiconductor Index: fell 1.92% or 88.31 to 4,519.45 points

The Seven Heroes of U.S. Stocks Compare the Misfortune

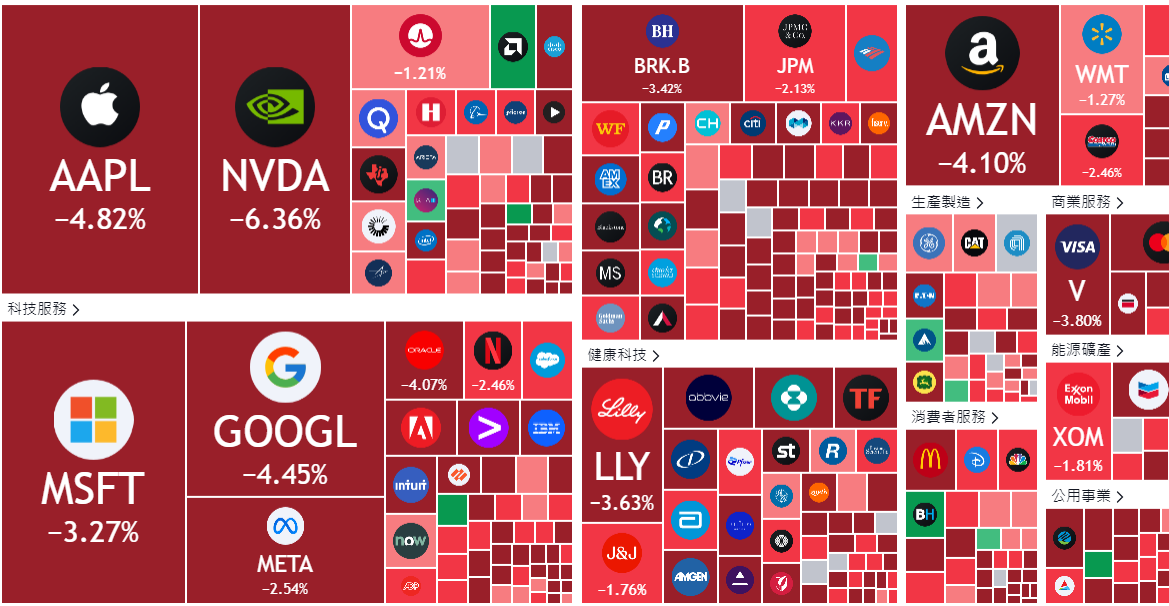

In terms of individual stocks, the seven major technology giants known as the Seven Heroes of the U.S. stock market have fallen even more, and they have been miserable one after another:

- Alphabet: Down 4.45% at $159.25

- Apple: down 4.82% to $209.27

- Amazon: Down 4.1% at $161.02

- Microsoft: down 3.27% to $395.15

- Huida: down 4.82% to $209.27

- Tesla: down 4.23% to $198.88

- Meta: Down 2.54% at $475.73

In addition, the Chicago Board Options Exchange's Volatility Index (VIX) also soared 64.90% to 38.57, once setting the largest increase since 1990, indicating that market panic seems to be intensifying.

However, in the cryptocurrency market, Bitcoin has rebounded: Resurrected! Bitcoin breaks through 55,000, Ethereum stands above 2,500 US dollars, and the decline of US stocks cannot be stopped

Fed official: Not yet in recession

However, in the face of such a stock market crash and market panic, Daly, the voting committee member of the 2024 FOMC meeting and Chairman of the San Francisco Federal Reserve, said in an interview last night that the weakness in the labor market will not worsen. Risks are leveling out:

July's jobs data gives us some confidence that our inflation is slowing but the economy is not yet in recession.

I don’t think the weakness in the labor market will worsen, and it will be worth watching closely to see whether the next jobs market report will reflect the same trend, or reverse it. If we just react to a data point, it's almost always wrong.

The "Financial Times" also published an article " Everyone calm down " yesterday, citing evidence that the economy is still very strong. For example, last Friday's non-farm payrolls report unexpectedly showed a sharp slowdown in the job market, but in July it was unable to do so due to severe weather such as hurricanes. There are more people going to work and going to work.

In addition, the Bank of America Securities Brokerage Team also issued a report stating that the Fed's interest rate cut in September is almost certain, but there is no need to take radical action:

Almost all of July's rise in unemployment came from layoffs, suggesting only temporary weakness in the labor market. Employment is likely to rebound in the August report, and the unemployment rate is also likely to fall. The U.S. would not have had a recession without layoffs, and current layoff rates remain low.

The interest rate cutting cycle will start in September, with interest rates reduced by 25 basis points every quarter until reaching a terminal interest rate of 3.25%~3.5% in mid-2026. Aggressive rate cuts of 50 basis points or more are done in an emergency, but we're not there yet.