In the contract market, exchanges, which should be neutral, rely on the "eyes of God" formed by data to constantly detect the slightest movement in the crypto and the flow of abnormal data, and constantly push the market towards a direction that is more favorable to them. Even in extreme market conditions, they harvest market users who are not rich by shutting down the system and unplugging the network cable. In contrast, in the spot market, although there is not much "artificial technology" secretly supporting it, there is still a lot of flirting between the platform and the project party. From the trend of many VC coins this year, it can be clearly seen that most VC coins peaked when they were launched, and then walked out of a beautiful downward parabola.

Compared with the "high-end and sophisticated" operation of God's eyes, the simple "what you see is what you see" of mortal eyes has largely driven the market to become more popular.

DEX trading volume surges compared to CEX, with meme coins becoming the main driving factor

According to CoinGecko statistics, the CEX spot trading volume reached 3.4 trillion US dollars in the second quarter of 2024, a decrease of 12.2% from the previous quarter. Binance is still the largest CEX, with a market share of 45%, and Bybit's market share has increased to 12.6%. Although the number of new currencies launched on exchanges has increased significantly, only four of the top ten CEXs have seen an increase in trading volume.

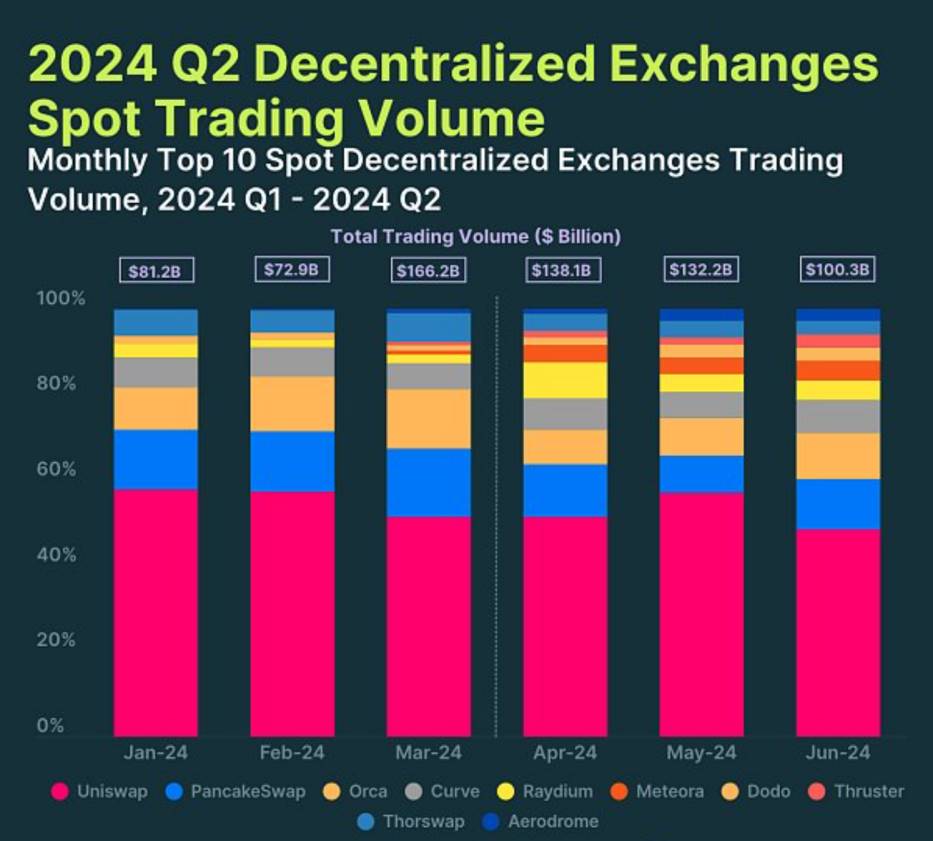

In the DEX market, however, the market has seen a completely different data growth. In the second quarter of 2024, the spot trading volume of the top ten DEXs reached US$370.7 billion, a month-on-month increase of 15.7%. Uniswap is still the dominant DEX, with a market share of up to 48%.

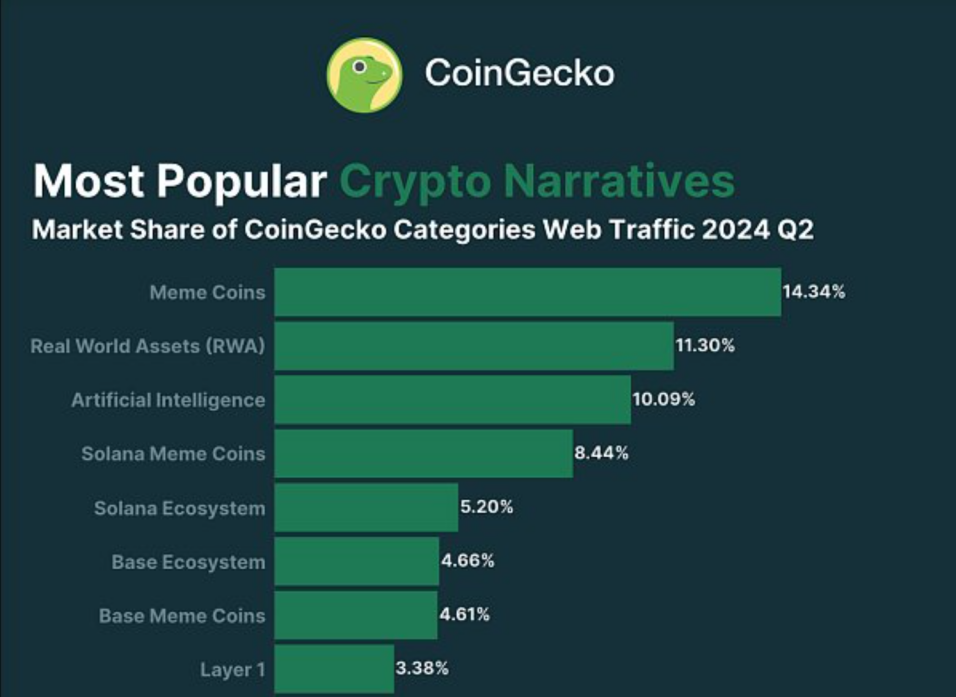

The counter-trend growth of DEX relative to CEX is mainly attributed to the surge in the number of meme coins and the substantial increase in trading volume in the second quarter. Because the birth and early development of most meme coins are attached to DEX, data shows that meme coins are the most popular narrative in the second quarter of 2024, accounting for 14.3% of the market share. Among them, 4 of the top 15 most popular crypto narratives are related to meme coins. Therefore, the large-scale emergence of meme coins in the first half of this year has greatly increased the trading volume of DEX, which also reflects to a certain extent the flow of user traffic and funds, and more users have become holders of meme coins.

Compared with the contract market and VC coins, the natural "user-heavy" attribute of meme coins gives users more control and a stronger sense of participation.

The decentralization pursued by the crypto has been maximized in meme coins

For market users, the texture of meme coins seems to be more real, and at the same time, it has achieved the greatest degree of decentralization. Although there are certain insider trading and so-called small whale, the vast majority of the rise and fall of meme coins still rely on the joint promotion and maintenance of market users. In fact, meme coins are no longer controlled by project parties or dealers, but by community users. The decentralized nature of blockchain has been vividly demonstrated in the world of meme coins.

However, although the development of meme coins has been in full swing in the past six months, most of them have difficulty entering the eyes of first-tier exchanges. As the most influential "non-decentralized" existence in the decentralized world, these exchanges are indifferent to meme coins, which are uncontrollable and inferior to "strongly decentralized" coins, because the benefits brought by these coins are far less than those of contracts and VC coins.

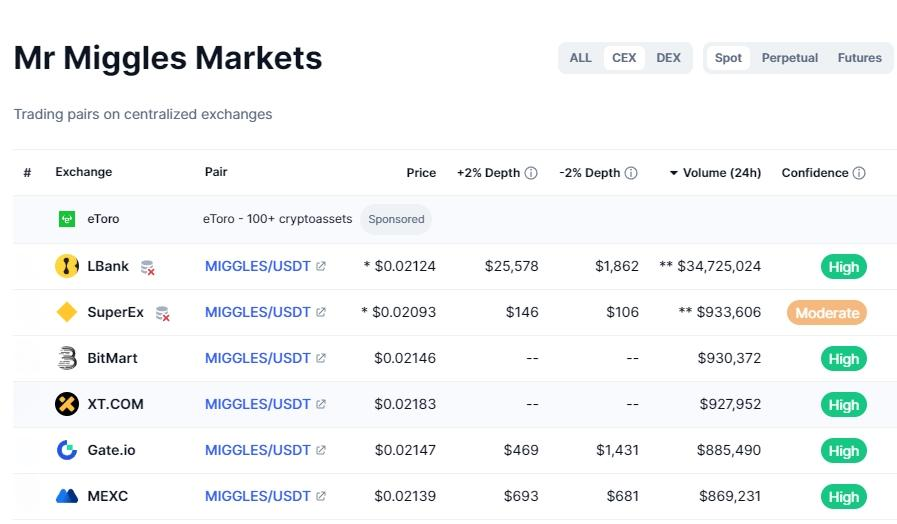

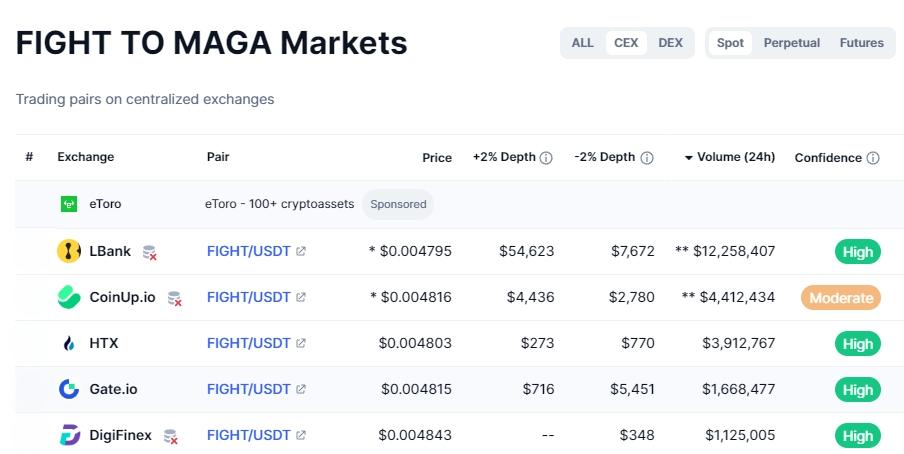

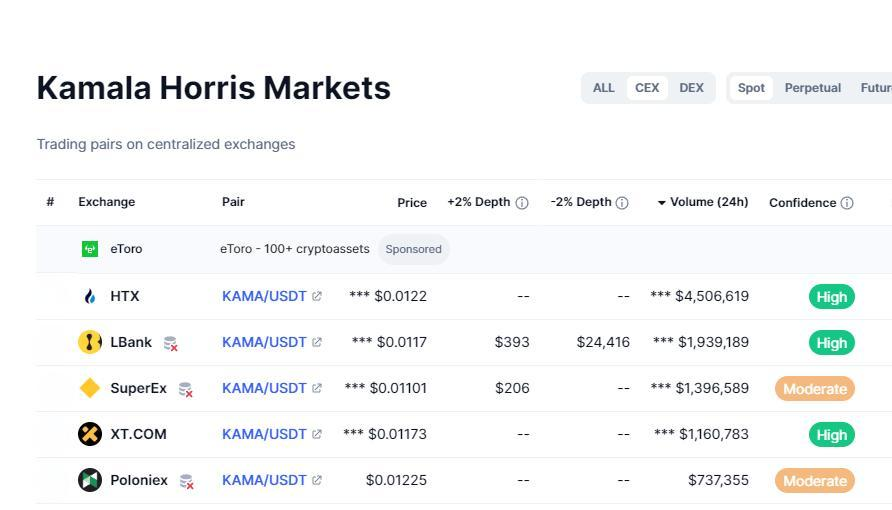

Take the most popular meme coins MIGGLES, FIGHT, and KAMA as examples. From the picture (data source: CMC), we can see that these popular meme coins have not been listed on first-tier well-known exchanges. Most of these coins are listed on second-tier exchanges, such as LBank, MEXC, Gate.io, BitMart, etc. Among them, LBank's circulation, transaction depth, and transaction volume are leading. These data reflect that LBank has a "main disk" status in these popular meme coin fields, which to a certain extent guarantees the user's trading experience, can achieve smooth transactions, and reduce slippage, and these characteristics are crucial for meme coin transactions.

Of course, when these exchanges launched meme coins, they also naturally took over part of the user traffic of the meme coin market. Take LBank as an example. Through the recent continuous listing of popular meme coins, its 24-hour total volume has gradually increased, gradually approaching the second-tier well-known exchanges. At the same time, the number of market users' views has also entered the forefront of the market.

Judging from the market trend and sentiment, meme coins will continue to play the leading role in this bull market for a long time to come. How to better serve these meme coin users and undertake the huge amount of user traffic should become the development focus of exchanges, and this part of traffic will also feed back to exchanges and help them break through the siege.

The God's eyes of the first-tier exchanges will naturally not pay attention to the needs of these low-level meme coin users. Whether other exchanges can become famous with the help of meme coins through the eyes of mortals, we will have to wait and see.