Author: Climber, Jinse Finance

On August 5, the global financial market suffered a "Black Monday", and the crypto market fell as much as the "312". The recently approved Ethereum ETF also failed to reduce the damage to ETH. Instead, it fell to as low as $2,100 under the influence of the continuous selling of market maker Jump Crypto. Many communities and analysts even regarded this behavior as one of the reasons for the plunge in the entire crypto market.

In fact, Jump Crypto's selling behavior has already occurred, and it is almost a "clearance". On-chain data shows that the cumulative value of ETH sold in the past 10 days has exceeded US$300 million. The ETH collection behavior includes unstaking ETH from Lido and transferring it from other wallets many times. Currently, the proportion of stablecoins in its marked positions has exceeded 96%.

There are various speculations about Jump Crypto's selling behavior. Some suspect that it was liquidated due to the CFTC investigation, while others believe that the company converted assets into stablecoins to cope with economic risks. Given Jump Trading's tradition of high confidentiality, after sorting out past information, the author is more inclined to infer that Jump Trading cut off the Jump Crypto department in advance to prevent being involved in the $4.47 billion settlement dispute in the Terra case.

Jump Crypto "clearance-style" sell-off, speculation from all sides

The earliest abnormal transfer record of the on-chain wallet address marked as Jump Trading occurred on July 17, when an address starting with 0x401c transferred 9,998 ETH to the Jump Trading address, worth approximately US$34.4 million.

After comparing its token balance history on Arkham Intelligence, it was found that the company had been selling its Ethereum holdings since July 19, not just last weekend.

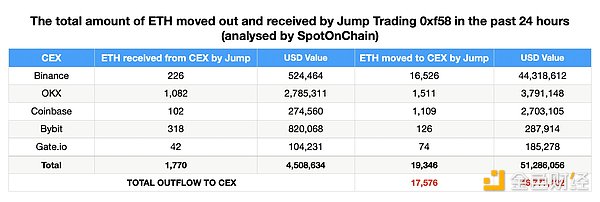

Spot On Chain data also shows that from July 25 to August 5, a wallet marked as Jump Crypto recharged a total of US$279 million worth of ETH to the CEX exchange.

According to public information, Jump Trading has previously released a large amount of ETH staked from Lido and transferred it in batches from other addresses.

According to on-chain analyst Ember’s monitoring, Jump Trading redeemed 83,000 wstETH for 97,500 ETH from July 25 to August 4, of which 66,000 ETH flowed into the exchange.

As of writing, there are still 37,600 wstETH in its wstETH storage address that have not been transferred out. 11,500 stETH in the ETH redemption address are being redeemed into ETH; 20,000 ETH in the ETH transfer to the exchange address are also entering the exchange in batches.

Additionally, it has deposited nearly $300 million worth of ETH into different centralized exchanges, including top players like OKX, Binance, Coinbase, and Gate.io.

At present, Jump Trading's stablecoin positions account for more than 96%, with a total value of US$324 million. Tracking agency data also shows that Jump Trading has been cashing out for days. Since Jump Trading started selling ETH on July 24, it has withdrawn 617.8 million USDC from Binance and deposited 558.2 million USDC into Coinbase. USDC deposited in Coinbase may be exchanged for US dollars at a ratio of 1:1.

There are different speculations about Jump Trading's selling and cashing out.

The CEO of crypto investment company Cake Group said that the massive sell-off in the crypto market in recent days may be due to Jump Trading, or because the traditional market was called on for margin and needed liquidity, or because of regulatory reasons to exit the cryptocurrency business.

Mads Eberhardt, senior crypto analyst at Steno Research, believes that Jump Trading has been borrowing yen to finance its high-frequency trading business, perhaps to have sufficient liquidity or acquire crypto assets due to the surge in the yen against the dollar. The cost of repaying loans denominated in US dollars has increased significantly, and their underlying collateral may have also been hit, and Jump Trading may have received a margin call on its loans.

It is worth mentioning that BitMEX co-founder Arthur Hayes spoke out at this time. He said that he learned through news channels in the traditional financial field that a "big guy" collapsed and sold all his crypto assets, and this "big guy" was speculated by the community to be Jump Crypto.

The $4.47 billion settlement in the Terra case may become the biggest burden

Jump Trading is a Chicago-based financial company known for high-frequency trading. It later established Jump Crypto to focus on cryptocurrency business. However, Jump made huge profits through secret transactions in the process of trying to restore the fixed exchange rate of TerraUSD (UST), but ultimately failed to avoid the collapse of UST, which caused global investors to lose about $40 billion. Similarly, this incident also put Jump Trading in a reputation crisis.

As the Terra case progressed, the SEC began investigating whether the president of Jump Crypto had entered into a secret agreement with Do Kwon during the collapse of UST, where Jump Crypto was accused of manipulating the price of the stablecoin TerraUSD to make a profit of $1.28 billion. At the time, Kanav Kariya refused to answer this question.

Although Jump Crypto did not obtain any evidence of wrongdoing or be accused of any misconduct in the investigations by the SEC and the U.S. Commodity Futures Trading Commission (CFTC) in April and June of this year, Jump Crypto President Kanav Kariya quickly announced his resignation, ending his six-year career at Jump Trading.

It is unknown whether Jump Trading and Terraform Labs have other illegal secrets, but Jump Trading's whistleblower helped the US SEC to file a case against Do Kwon, and the Montenegrin court recently ruled that Do Kwon would be extradited back to South Korea.

At the end of May this year, Terraform Labs and Do Kwon agreed to a settlement in a securities fraud case for $4.47 billion.

Previously, FTX and the CFTC reached a settlement agreement of $12.7 billion, and the settlement agreement between Binance and the CFTC included CZ paying $150 million to the CFTC and Binance paying $2.7 billion to the CFTC. But it is clear that Terraform Labs and Do Kwon are currently having difficulty paying the fine.

After the settlement was reached, Terraform Labs CEO Chris Amani announced that the company plans to dissolve its business and ask the community to take charge of the business. In addition, the company is also considering selling its four businesses.

In view of this, we cannot rule out the possibility that the SEC will continue to hold other responsible persons for the Terra bankruptcy case accountable, and Terraform Labs and Do Kwon may reveal more insider information about Jump Crypto in order to reduce their guilt, and Jump Trading has also reported the former before.

In addition, the CFTC chairman also publicly stated in May this year that cryptocurrencies are facing an inevitable wave of enforcement actions, and a "enforcement action cycle" will occur in the next six months to two years.

Combined with previous speculations from all parties, perhaps the "big guy" Jump Crypto is really going to fall.

On the other hand, Jump Trading originally had a wide range of businesses and attached great importance to confidentiality. The Jump Crypto encryption department was only one of them. By sacrificing the car to save the driver early, it can also stop the loss early and avoid greater reputation and financial losses.

According to the Chapter 7 liquidation case regulations of the U.S. Bankruptcy Code, after a company files for Chapter 7 bankruptcy, the court appoints a bankruptcy administrator (trustee) in the liquidation case. All states in the United States allow debtors to retain their necessary property (i.e. exempt property). The bankruptcy administrator will collect the debtor's non-exempt property, sell it and distribute the proceeds to creditors. At the end of the Chapter 7 case, both exempt and unpaid debts will be wiped out.

Conclusion

Jump Crypto chose the most unreasonable time to sell off a large amount of ETH. The approval of the US Ethereum ETF, bull market expectations, interest rate cuts, and the downward trend of the crypto market all indicate that it is not suitable to liquidate at this time. For a business unit backed by Jump Trading, such a large-scale sell-off is most likely to be a "survival dilemma." If it is only for arbitrage, it is obviously not in line with the investment strategy it has always advocated.

The settlement of $4.47 billion is obviously unrealistic for Terraform Labs and Do Kwon at this time. With the help of various factors, US regulatory authorities such as the SEC and CFTC need to find the "second person responsible." If more crimes of Jump Crypto are involved in the follow-up, it will undoubtedly be more troublesome for Jump Trading.