Bitcoin (BTC) saw a slight recovery following its recent dip below the $50,000 mark. Earlier this week, the king coin plummeted from a high of $65,790 to $49,500. Are Bitcoin investment opportunities still strong? Let’s find out.

The asset surged by 2.85% at press time and landed at $57,093. While several panicked and exited the market, seasoned traders took advantage of this downturn.

Whales Jump on the ‘Buy the Dip’ Trend

The whales were the first ones to jump on the ‘buy the dip’ trend. This Bitcoin accumulation frenzy was highlighted by market analyst Ali Martinez.

Martinez took to X and shared information from the market research tool Santiment to show that these whale addresses have acquired 30,000 BTC tokens worth $1.62 billion throughout this period.

In the past 48 hours, #Bitcoin whales acquired over 30,000 $BTC, valued at approximately $1.62 billion. This is evident from the surge in exchange outflows and the decrease in #BTC supply held on exchanges. pic.twitter.com/oV1aVu2tKc

— Ali (@ali_charts) August 6, 2024

Also Read: Marathon Digital Increased Bitcoin Holdings by $124M in July

Institutions Are Buying the Bitcoin Dip

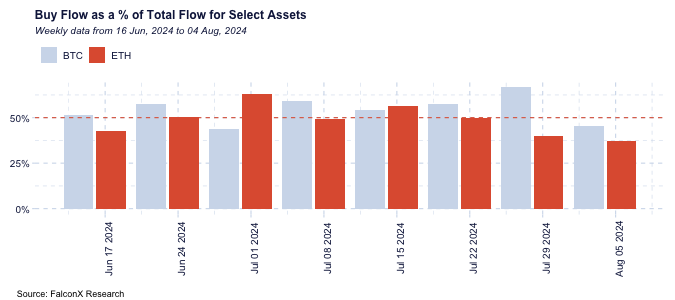

Institutions have been snatching up Bitcoin following the latest downfall. This aligns with the most recent data from institutional brokerage and cryptocurrency trader FalconX, which stated that interest in Bitcoin “remains elevated.”

Institutional Interest in Bitcoin

The company noted that it is selling for over three times as much as competitor Ethereum [ETH]. The tweets include retail aggregators at 72%, hedge funds at 63%, venture funds at 61%, and proprietary trading desks at 57% of all buy-side flows.

The firm said:

“Institutions are buying the dip. We saw pretty much all investor personas as net buyers today.”

Semler Scientific’s Bitcoin Investment

Semler Scientific, a BTC treasury company, has added $6 million in BTC to its balance sheet.

This pushed total BTC holdings to 929 BTC, valued at $52.2 million at press time. This is greater than the medical company’s entire Q2 earnings.

Also Read: Bitcoin: Is Elon Musk Buying The Dip?

Semler acknowledged that its second-quarter earnings were $5.4 million. It now has $63 million in Bitcoin investments, resulting in an average cost per coin of $67,814. Since Semler started purchasing on May 28, its investment has decreased by 17.41%.