Written by: Nancy, PANews

As the driving force behind the global stock market crash, the Japanese stock market triggered the circuit breaker mechanism twice. Today (August 7), the deputy governor of the central bank, Shinichi Uchida, spoke for the first time after the historic stock market crash in Japan to appease the market, saying that if the financial market is unstable, the Bank of Japan will not raise the policy interest rate. At the same time, the improvement of US economic indicators also eased concerns about economic recession, bullish sentiment was released, and US stocks stabilized and rebounded. Stimulated by the recovery of risk appetite in the financial market, market sentiment was boosted and the crypto market rebounded sharply.

Supported by the rebound, the trading volume hit a new high and buy the dips funds entered the market

The improvement of market risk appetite has eased investors' anxiety to a certain extent. According to the data from the alternative, the Fear and Greed Index today (August 7) is 29, which is less than yesterday's market panic, but market concerns still exist.

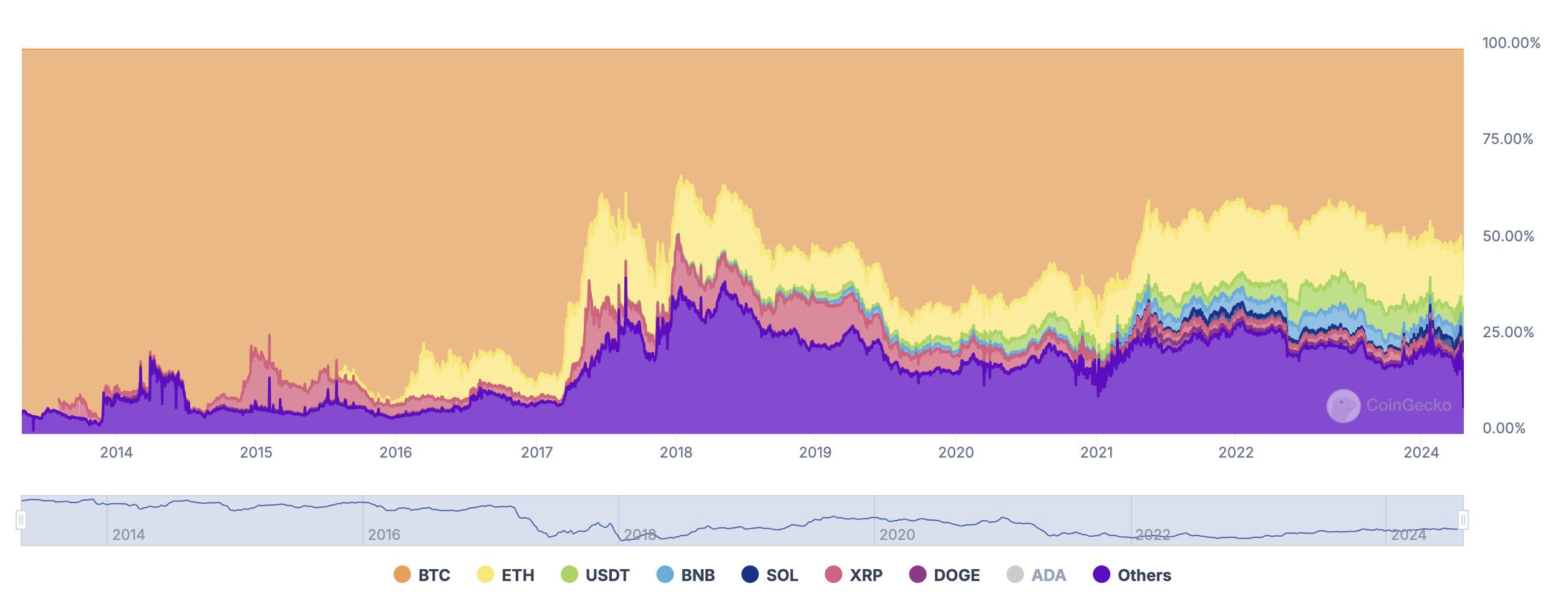

The crypto market has recovered some of its losses in a strong rebound, with the total market value rebounding to more than $2 trillion. CoinGecko data shows that the total market value of cryptocurrencies is $2.1 trillion, of which BTC accounts for 52.4%, a new high since April 2021, and ETH accounts for 14.2%.

Binance market data shows that as of this writing, Bitcoin prices have rebounded strongly to over $57,000, up 16.9% from the low point of this round of plunge; Ethereum has risen 21.1% from its low point, reaching a high of over $2,500. In addition, Solana has also staged a relatively strong rebound, with a 37.9% increase from its low point, and TradingView data shows that as of this writing, the SOL/ETH ratio has reached 0.0599, setting a record high.

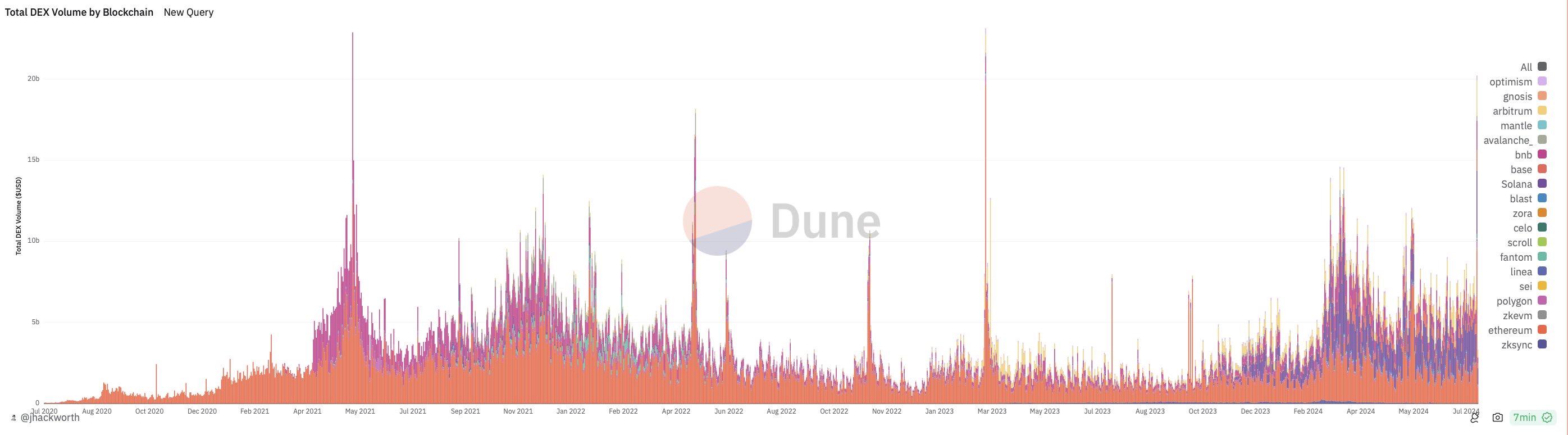

At the same time, the trading volume of the crypto market during this period has continued to hit new highs. Dune data shows that the daily trading volume of DEX exceeded US$20.2 billion on August 5, setting the third highest record in history. The previous two records were the Silicon Valley bank run ($23.1 billion) and the flash crash in May 2021 ($22.8 billion); and Blockchain.com data showed that Bitcoin's trading volume on August 6 also hit a new high after the halving, with a trading volume of more than US$1.14 billion.

Behind the high trading volume, many institutions and whale took the opportunity to buy the dips at the bottom. Crypto analyst Ali wrote on the X platform yesterday that the surge in outflows from exchanges and the decrease in the supply of BTC held by exchanges show that in the past 48 hours, Bitcoin whale have acquired more than 30,000 BTC, worth about $1.62 billion; according to Lookonchain monitoring, when the market panicked due to the collapse, the entity "7 Siblings" with $1.57 billion in assets quietly bought 56,093 ETH (US$129 million) at the bottom, with an average purchase price of $2,305. In addition, 5 whale addresses also bought a total of 144,071 ETH (about 330 million US dollars) during this period; @ai_9684xtpa monitored that James Fickel, founder of Amaranth Foundation, bought 4,336 ETH (about 10.94 million US dollars) on the chain at an average price of 2,523 US dollars; IntoTheBlock pointed out in an article that wallet addresses holding 1,000 to 10,000 BTC have shown confidence in the recent price drop and continued to increase their holdings.

In addition, institutional digital asset broker FalconX also tweeted that institutions are buying on dips in this crash. In the observation on August 7, it was noted that almost all investors were net buyers, including proprietary trading departments (57% of total buyer traffic), hedge funds (63%), venture funds (61%) and retail aggregators (72%). "The buy/sell ratio that was below 50% last week is now over 50% today." Among them, Bitcoin is still the largest crypto asset, with a trading volume 2.8 times that of ETH, and the trading volume of both is more than twice that of Altcoin.

Rebound or reversal? Market concerns are excessive but caution is still needed in the short term

Most people believe that this round of global stock market sell-offs is a panic-driven decline caused by excessive market sentiment. As the global financial market recovers, is the improvement in the current crypto market a result of a technical rebound or a market reversal?

Rob Hadick, partner of Dragonfly, believes that the market may still be painful in the short term, but the medium- to long-term outlook is bullish. He explained that the major deleveraging event brought about by the yen carry trade this week is not expected to last beyond this week, but it is still facing some contagion risks caused by the above events. The higher possibility of financial intervention by Japan will help to resist some risks. At the same time, concerns about certain US economic data indicators are exaggerated, and most smart funds believe that these concerns are oversold. Stocks are expected to rebound strongly when risk appetite recovers, but emergency rate cuts are unlikely to occur, which will reduce the market's panic before the Jackson Hole meeting. And Iran seems to be retracting its most destructive remarks, and a large-scale conflict should be avoided. In the next few months (less than a year), the market will usher in new quantitative easing policies, a large number of interest rate cuts, and the eventual resumption of accelerated business cycle growth.

He also added that non-crypto native investors will not return for a long time because these users are over-leveraged on long-tail assets. The next liquidity return may be concentrated on mainstream cryptocurrencies, and most Altcoin may never reach (or get close to) historical highs, especially without strong product market fit (PMF) or long-term expectations.

QCP Capital, an encryption investment institution, also said that the discussion about emergency rate cuts...is unlikely because it will seriously damage the credibility of the Federal Reserve, exacerbate market panic and people's belief in an impending recession. The agency believes that asset prices may continue to fluctuate and the market will remain turbulent until the policies of the Federal Reserve and the Bank of Japan become clear. With the price plunge, it may be time to start considering accumulating Bitcoin and Ethereum spot.

Raoul Pal, founder of Real Vision, said that this is a violent wash and reset of risk leverage. A strong rise will be the overall feature of 2024/2025. The next week is the last opportunity to enter or fully build a position in 2024/2025. But liquidity/policy response takes time. Every government and central bank wants the dollar to depreciate and interest rates to fall, so they may tend to let this situation continue for a while and then stop. The Fed's final rate cut will also bring a period of weakening of the dollar, which will help form a macro summer/autumn. The market is now in an extreme fear zone. Hang in there and make a plan that suits your risk tolerance and time frame. Stay safe, and good luck will come to those who wait. The market is never easy. The bull market's mission is to try to disappoint you, and it will all pass.

"Bitcoin has experienced significant price volatility since the yen carry trade began to unwind, and a decline in open interest and negative funding rates suggest that sideways trading is more likely for Bitcoin. And expected central bank intervention soon makes Bitcoin attractive at current price levels," said Jamie Coutts, crypto analyst at Bloomberg.

Coinbase researcher David Duong said that market conditions on Tuesday indicated the possibility of a short squeeze amid increased trading activity on centralized exchanges. He believes that the market will remain volatile in the short term, but shorts may be squeezed here, which could lead to a market rebound in the coming days. The recent decline in the crypto market does not represent the beginning of a new long-term trend or market cycle. On the contrary, the current sell-off is consistent with our defensive strategy in the third quarter of 2024 and a more constructive outlook for the fourth quarter of 2024.

In addition, Ki Young Ju, founder and CEO of CryptoQuant, also posted on the X platform that as long as Bitcoin can stay above $45,000, it may break through the all-time high again within a year. Although some indicators now show bearish signals. But in fact, there is still a possibility of a rebound, so we need to observe whether it will stay at this level for a week or two. If it lasts longer, the risk of a bear market will increase, and if it lasts for more than a month, recovery may be difficult.