On Monday, the cryptocurrency markets were rocked this week with over $1 billion worth of liquidations, sending the fear and greed index into extreme fear territory.

As markets teeter on the edge of uncertainty, seasoned analysts offer insights and strategies to navigate the situation.

What's Next After Major Crypto Market Corrections?

After Monday’s market carnage , Bitcoin briefly fell to $49,000, sparking widespread panic and a surge in trading activity. Despite the initial drop, Bitcoin has managed to recover somewhat and has bounced back to nearly $57,000.

However, the overall mood remains cautious, with the fear index still remaining in the 'fear' zone.

Read more: What is the Cryptocurrency Fear and Greed Index?

Marcus Thielen, head of research at 10X Research, points out that there is no new capital flowing into the market. He points out that the market has degenerated into a zero-sum game between traders without new money flowing in, and that excessive leverage is making things worse.

“The recent sell-off has resulted in far more liquidations than in April and June, which has significantly reduced the ‘leverage’ pool,” Thielen said .

He suggested that although prices have rebounded, traders still need to reevaluate their risk management strategies.

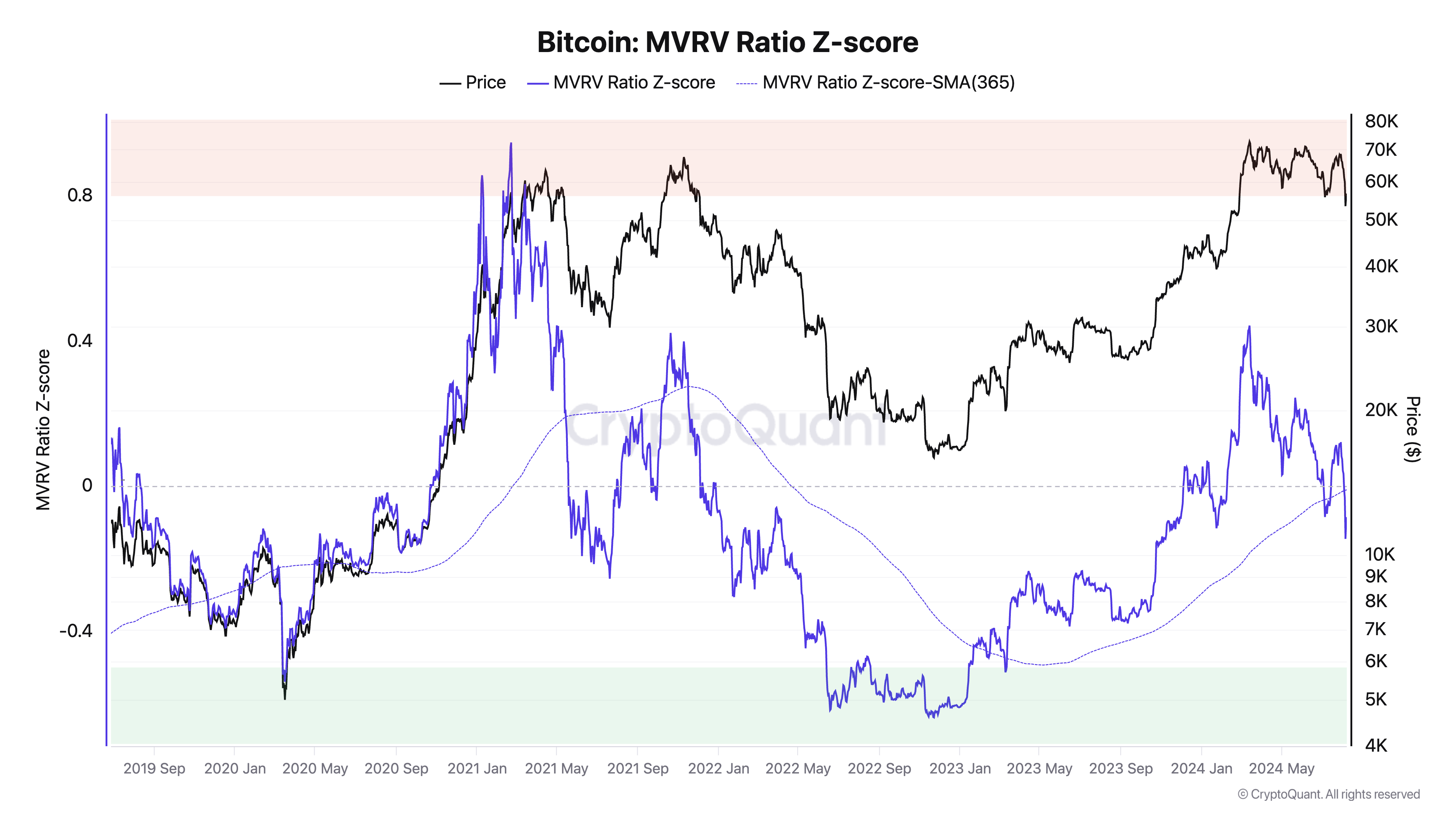

Additionally, the CryptoQuant report shared with BeinCrypto analyzed the market from a valuation perspective. The report raised concerns about Bitcoin’s market value to realized value (MVRV) ratio.

“The MVRV ratio has fallen below its 365-day moving average, which in previous cycles signaled an extension of the price decline or the start of a bear market,” the CryptoQuant report noted.

For the market to re-enter a bullish trend, MVRV must once again cross above its 365-day average.

Another prominent market analyst, Eugene Ngacio, commented on the structural weaknesses revealed by the market correction. Ngacio’s strategy involves strict risk management, especiallyin volatile market phases , reflecting a cautious approach to the current instability.

“The market structure for all the majors is broken or looks extremely bleak. I generally don’t want to be aggressively long when there’s this much uncertainty and a sustained bear market,” he said .

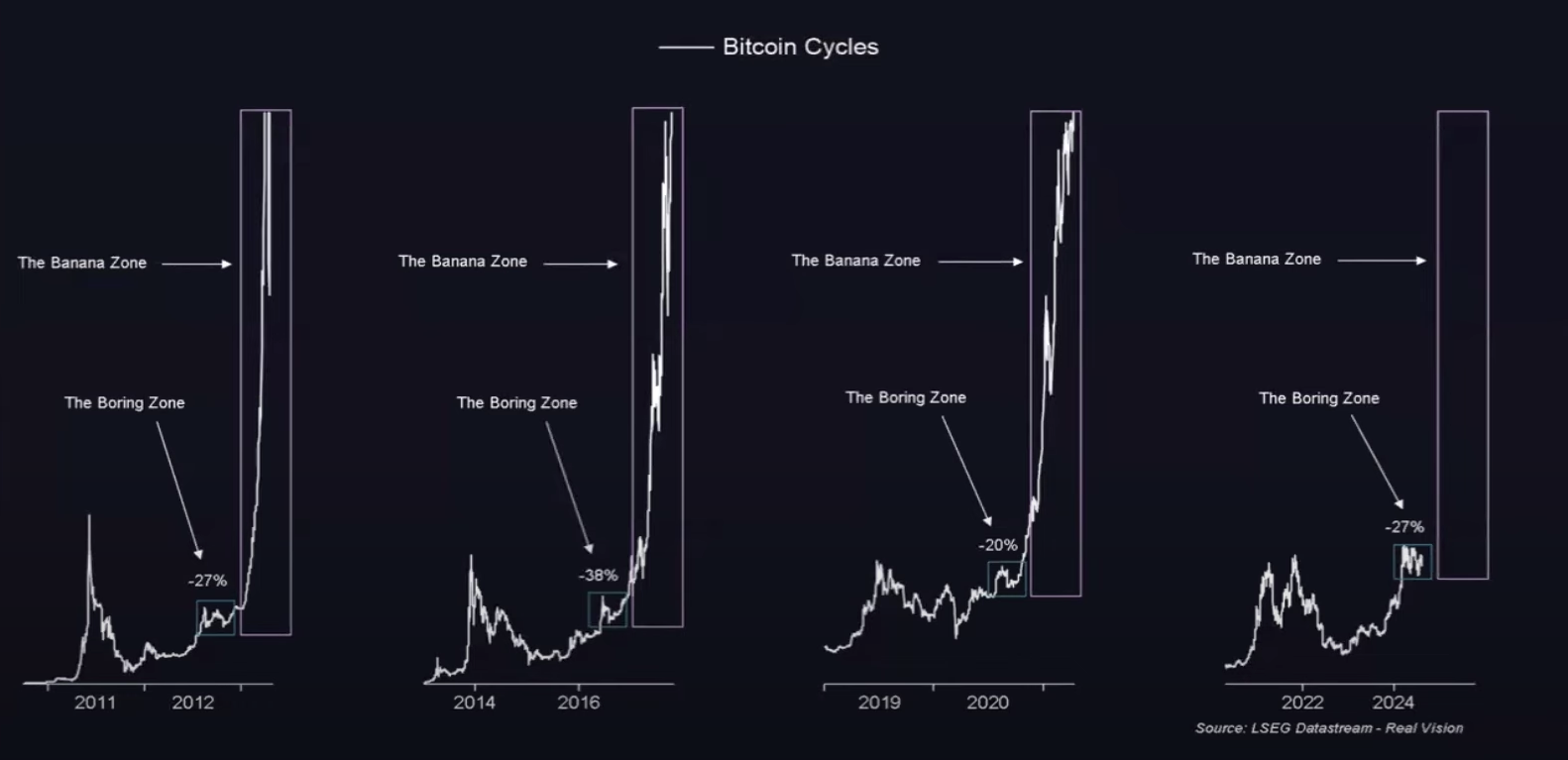

Despite the widespread fears in the markets, Raoul Pal maintained an optimistic outlook, citing past patterns as an example.

“The next step is the banana zone. I don’t want to miss this opportunity because I’m stuck in the short-term view of Twitter traders,” Pal explains.

He cited previous market cycles where significant corrections were followed by strong recoveries, suggesting the current market may be gearing up for a similar rally.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Meanwhile, CryptoQuant CEO Ki-young Joo hinted that long-term holders are quietly accumulating significant amounts of bitcoin. He said that over the past 30 days, 404,448 bitcoins, worth about 23 billion won at the current price, have been transferred to permanent holder addresses.

The lord anticipates that this strategic accumulation could herald a significant institutional announcement that could make those who abandoned Bitcoin due to short-term fears regret it.

“Within a year, some institutions, whether trading financial institutions, corporations, or governments, will announce that they have acquired Bitcoin in Q3 2024. And individual investors will regret not buying Bitcoin because of the German government selloff, Mt. Gox, or concerns about the macro economy,” says Young- joo .