About VC

- All VCs with normal rhythm in the last cycle made money.

- These VCs have increased their fund size by 3-10 times in this cycle to raise funds again, resulting in excessive funds on hand.

- But there are not enough good projects, so in order to spend money, they have to increase rounds of financing to raise valuations, or even get funds they don’t need.

- Old projects that failed three years ago can also be refinanced.

- This significantly increases the VC costs of good projects and the psychological expectations of coin holders.

- Neither VCs nor project owners are stupid, and the essence of the game has become a game of cutting LPs. After the project is invested, the tokens cannot be issued, which makes the meeting very embarrassing.

- Finally, a good project has issued a coin, so hurry up and PR it. Sell the coins after they are unlocked after 6 or 12 months, and cash out if they are not unlocked.

- In short, if VCs don’t make money, LPs suffer the most.

About the new project

- Mature founders invest the same amount of time into small or big projects, and sell their coins the same way, so they only work on big projects.

- Big projects = high valuations = infrastructure (infra).

- Infrastructure projects are popping up in large numbers, but they have no applications or revenue and can only be self-sufficient.

- Your own money comes from VC, which is free anyway.

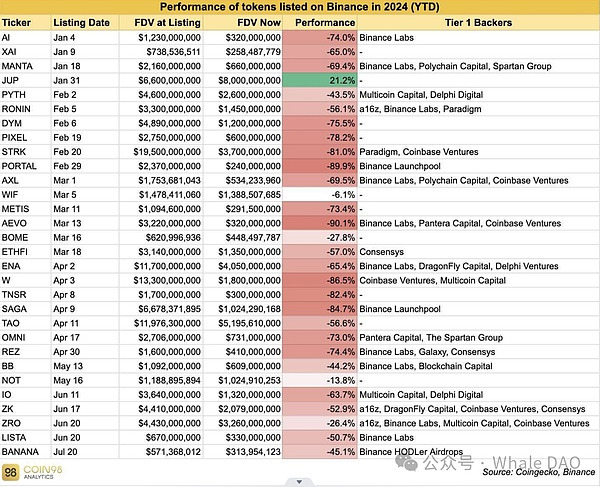

- Understand the Playbook for listing and opening of coins. The goal is to sell coins at the opening. Sell the least coins at the opening with a high valuation and get the most money.

- The buying power dries up at the opening, but the coins still need to be sold. It is impossible not to sell the coins.

- After a coin opens and the buying ends, it can only fall, usually within 1-3 days, and basically cannot last more than three days.

- Then create fluctuations and continue to sell coins. If the market is good, it will rise occasionally, and then continue to sell coins.

- In short, the first principle of doing a project is to sell coins, and only a very small number of projects create value or rely on protocol income.

- Some of the inflated volume projects are actually fake user projects. They will be reset to zero as soon as they go online, and have no trading volume, so their market value is meaningless.

About old projects

- Dead projects are raising funds again using the high-quality cap table they invested in three years ago. Most of them use KOL rounds, and a small number of them look for funds to take over.

- In order to go public, they continue to raise funds and brush up data, but there are no real users and real use cases.

- Unable to be listed on exchanges, the only way is to bribe other exchanges or DEXs to list the token.

- Listing coins on DEX = zero, bribing the exchange = zero (bribe money must be earned back by selling coins).

- In short, this type of project can only be reset to zero because they are unlikely to do it seriously.

About the Top Exchanges

- The exchange provides on-chain pool services for project parties.

- Adding a pool to a coin is good for the project, so the project will definitely give money to the exchange. This is business common sense.

- The exchange needs to please the big players, and projects that are in the interests of the big players need to be launched, so all LRT projects have to be launched.

- Projects that are in line with their own interests must also be listed, including projects that have users, new things, and can compete with other exchanges.

- Because liquidity is king, listing on an exchange becomes the most important part of a project.

- Exchanges play an important role in user education and liquidity provision and should be given an important position and corresponding profits.

- Then he will accept your principal silently.

In summary, doing a project has become creating an illusion. There is no need to do anything real, as long as the coins can be sold. There is no difference between VC coins and meme coins.

About ETH

- The big players changed their mindset and adopted POS. Anyway, it is not POW, nor is it a cryptocurrency speculation idea, nor is it a deposit and payment idea. It is just a freeloading idea.

- Large investors do not participate in real construction and do not have a direct positive impact on the price of ETH, including but not limited to making memecoins, pulling high-quality memecoins, creating a unique ETH culture, etc. They do nothing.

- The only two reasons to buy ETH in this cycle are re-staking and ETF, but this has nothing to do with retail investors, so there is no strong reason to buy ETH.

- ETH still has the most developers, nodes, and ecological projects, and is the most robust blockchain.

- But all the projects on ETH have ulterior motives and want to sell air coins to retail investors just to make money for themselves.

- In short, it is difficult for retail investors to make money on ETH.

About SOL

- Large investors stick together, have a big picture, and understand the thinking of retail investors.

- The scale of large investors is 400,000-2mil SOL. They spend 10,000 SOL to make a cult memecoin or find someone to make a memecoin. It is very easy.

- Work together to boost the meme, create a bunch of small pools of memecoin, and send them to 100-500mil.

- Retail investors are dazzled by the number of memecoins and go crazy with FOMO.

- KOLs earn attention by shill and complete wealth transfer, and these coins really appreciate.

- KOLs form a gradient and shill range, with top streamers such as Hsaka and Ansem in one tier, some with 100k followers in one tier, and others in another tier (mainly KOCs), shouting coins in different market value ranges, including lottery players with a market value of 500mil+, 100-500mil, 10-100mil, and less than 10mil.

- This increases the vitality of the SOL ecosystem and allows retail investors to support their SOL.

- Because retail investors all hold SOL, they naturally form the SOL maxi army, and the SOL flip ETH sentiment is high, forgetting the rollback risk of SOL and the fact that memecoin is essentially air.

- SOL enters the positive feedback loop stage, the main character shill, and retail investors continue to FOMO.

- When will it end? I don't know. It will end when everyone dislikes memecoin.

- In short, SOL has become the best casino and chips in this cycle, and everyone needs SOL.

judge

- The memecoin supercycle was established, 20 memecoins appeared in the top 100 market capitalization coins, and a large number of memecoins were between 100-300mil, mainly on SOL.

- A successful memecoin-focused CEX emerges.

- The project continued to open with a high market value, but the opening valuation was significantly lowered. The PR draft stated that the valuation of the project party was reasonable, the pattern was large, and the project was careful to protect its reputation.

- VCs can only look for web2 financing in the next round. They are very jealous of the industry, but it will be painful to report to LPs.

- High-quality real-use case projects that do not raise excessive amounts of money from VCs (or even raise no money at all) begin to emerge, using other more respectable means to transfer benefits.

- Audit/security companies that truly create value are slowly gaining attention, and high-quality audits are becoming an important part of the industry: BlockSec, Hexagate, Hypernative.

- For non-meme projects, the market will return to favoring projects with real revenue, monopoly, and use cases (hopefully they can innovatively link tokens to businesses).