Changes in trading volume tend to exacerbate rising or falling stock prices.

U.S. stocks suffered a heavy blow on Monday (August 5), with the S&P 500 index plummeting 3%, the biggest one-day drop since 2022. High valuations, weak employment data, and the unwinding of yen carry trades have triggered investor panic.

Stocks rebounded on Tuesday, with the S&P 500 closing up about 1%, but market sentiment remained nervous, with the VIX fear index continuing to remain above 25, its highest level this year.

The yen, corporate earnings and recession fears all contributed to Monday's sharp drop in U.S. stocks, but there's another culprit that isn't talked about enough: lackluster trading volume.

History shows that changes in trading volume can exacerbate stock market volatility in the coming weeks.

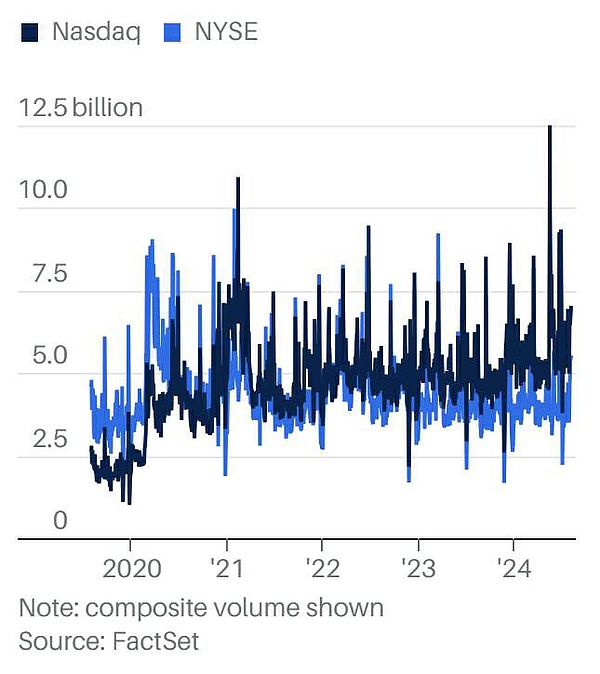

Nasdaq's trading volume recently surpassed that of the New York Stock Exchange

“The sharp moves in the stock market in recent sessions have been amplified by the lack of liquidity in August,” Jim Reid, an analyst at Deutsche Bank Research, said in a report published Tuesday.

August is typically the quietest month of the year for trading activity, with about 9.3 billion shares changing hands a day on major U.S. exchanges, down nearly 30% from a peak of 13.2 billion in March, according to Dow Jones Market Data.

Every August, Wall Street professionals in the northeastern United States usually go to the beach for vacation, and as the number of trading department managers decreases, the number of buyers and sellers in the market decreases accordingly.

That in turn means lower liquidity. On days like Monday when there are many potential sellers scrambling to unload shares, a scarcity of buyers can cause stock prices to fall quickly, and such declines tend to be self-reinforcing.

(A similar situation has recently emerged in the housing market, where a shortage of would-be sellers has sent home prices spiraling upward despite rising interest rates and other factors.)

Steve Sosnick, strategist at Interactive Brokers, told Barron's on Tuesday that August is usually low, but last week was particularly low as investors took a "wait-and-see" stance after the Fed's meeting last Wednesday. Volumes rose sharply late last week before peaking on Monday.

These phenomena can be seen in the changes in trading volume of the SPDR S&P 500 Trust (SPY), the largest exchange-traded fund in the market by assets. The ETF has averaged about 81 million shares per day over the past three years, according to FactSet data. Before Monday, daily trading volume fell to 47 million shares in July, but on Monday, nervous investors suddenly pushed trading volume up to 146 million shares.

This was the ETF's highest volume day since early 2023, but to put it in perspective, daily volume of 150 million shares or more is not unheard of for this ETF during periods of heightened stock market volatility, with more than a dozen such days occurring in 2022.

Sosnick noted that traders may start to return in September. However, historically, stock trading volume in September and October has only risen slightly, and Dow Jones Market Data shows that the average daily trading volume of U.S. stocks usually does not exceed 10 billion shares before November.

Of course, traders may have to return earlier this year, especially if stocks see more sharp declines, and there are many factors that make investors nervous.

The market is still basically holding on to the hope that the Fed can achieve a "soft landing" and reduce inflation while avoiding a recession, but this hope seems to be becoming increasingly slim. Data from the futures market shows that the probability of the Fed cutting interest rates by 50 basis points in September has risen to more than 60%, indicating that the Fed may have to take more decisive action than most investors thought a few weeks ago.

The upcoming U.S. presidential election adds another layer of uncertainty as the two presidential candidates are now neck and neck in the polls after Vice President Kamala Harris recently joined the race.

"We continue to expect the S&P 500 to fall below its July 16 all-time high before the November election," Yardeni Research said in a report released Monday. The agency believes that once the election dust settles, the S&P 500 will set new highs, but also acknowledges that "the premise is that many things cannot go wrong."