USDC Getting Started Profile

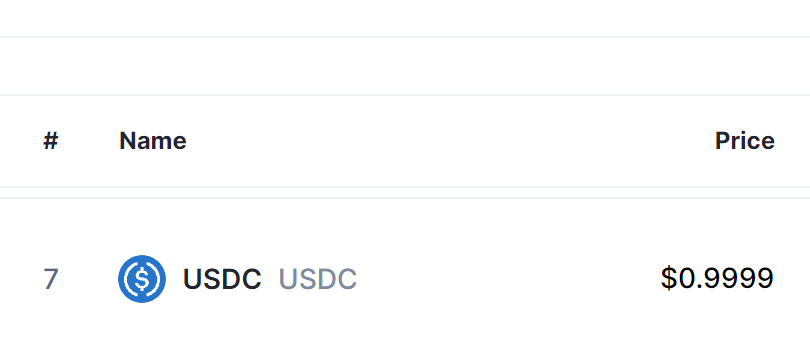

USDC price | USDC is a stable currency whose price is anchored to the US dollar, price = 1 US dollar |

USDC market capitalization and ranking | The current market capitalization of the article is US$33.5 billion, the seventh largest cryptocurrency, and the second largest stablecoin. |

USDC listing and issuance date | 2018 |

USDC Issuer | Circle Internet Financial |

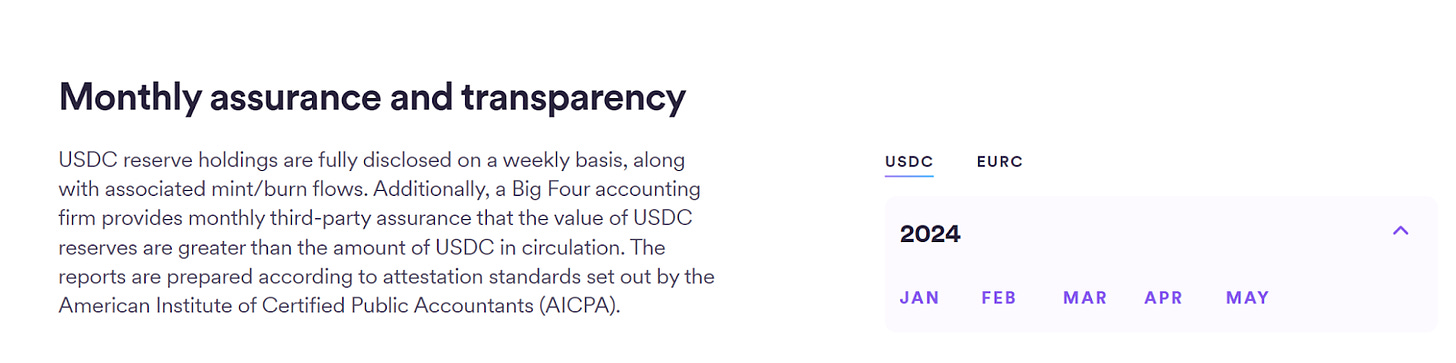

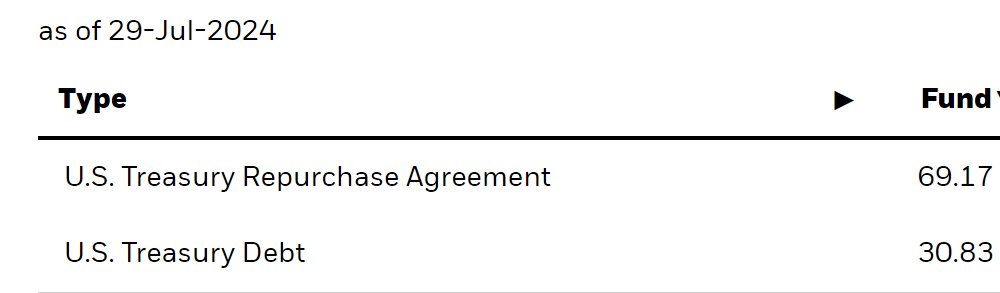

USDC Reserve | Reserve asset data is updated weekly, and each month the four major firms provide written reports to verify reserve assets; reserves are composed of short-term U.S. Treasury bonds, overnight reverse repos (with repurchase agreements), cash, etc. Reserve information https://www.circle.com/en/transparency |

USDC buying and selling channel | Newcomers who are new to cryptocurrency are advised to buy and sell on exchanges or buying and selling agencies, and avoid using C2C (other individual traders) methods. This can reduce the chance of encountering fraud. The correct buying and selling channels are provided at the end of this article. |

What is USDC

USDC is a stablecoin whose price is anchored to the U.S. dollar at a ratio of 1:1. Stablecoins refer to cryptocurrencies whose prices are anchored to fiat currencies and are basically unlikely to rise or fall.

https://defillama.com/stablecoins

The current total market value of stablecoins is US$164 billion, USDC ranks second, and the circulation volume is approximately US$33 billion, which is 3.4 times behind the first-ranked USDT.

USDC was announced by Coinbase and Circle in October 2018. Coinbase was established in 2012 and is the first listed cryptocurrency exchange in the United States. It is still among the top three cryptocurrency exchanges. Circle was established in 2013 to provide blockchain payment and financial services and was the first in New York. Legal operators that can provide virtual currency services. Coinbase cooperates with Circle to develop the stablecoin USDC, and Circle is responsible for the issuance. The issuer of USDC is Circle.

Circle actually has a bit of a relationship with Taiwan. In 2022, Circle acquired CYBAVO, a Taiwanese blockchain startup, and combined CYBAVO's security technology with Circle's core products.

Taiwanese startup CYBAVO is favored, and Fintech unicorn Circle announces merger and acquisition! Working together to strengthen Web3 security

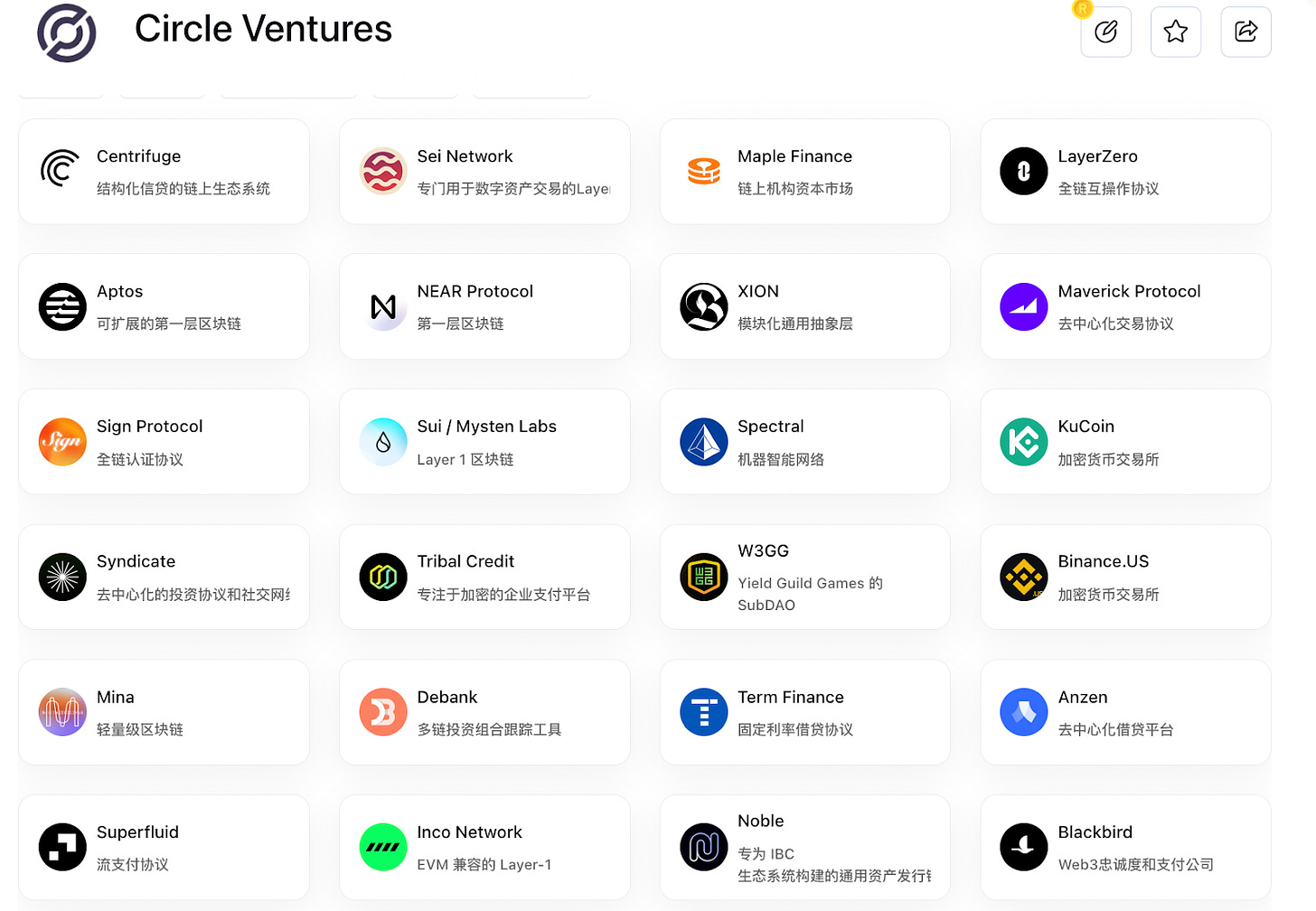

In addition to its stablecoin issuance business, Circle has also established a venture capital fund, Circle Ventures, to support and incubate the development of some projects using its stablecoins (USDC and EUROC). Famous investment projects include: Maple Finance, Layerzero, Sui, Debank, Anzen, Hyperlane, Milkomeda, etc. It is not difficult to find that Circle Ventures has a certain breadth in the selection of investment projects, covering public chains, RWA and even cross-chains related to itself. Infrastructure, after all, through the expansion of multiple chains, will also help increase the usage of $USDC in the market.

USDC price anchoring mechanism-reserve and cash out

Each issued USDC is backed by a sufficient reserve of U.S. dollar assets. The USDC reserve assets are inspected and reported every month by the four major accounting firms (currently Deloitte).

There is a sufficient asset reserve behind each piece of USDC, which means that each piece of USDC can be exchanged for the equivalent value of one US dollar. Qualified users can exchange USDC into legal tender through Circle's redemption mechanism.

Because there is a channel to ensure 1:1 redemption, when USDC is decoupled and the price drops sharply, qualified users can buy and arbitrage, and market forces will bring the USDC price back to 1:1, unless the reserve assets are no longer sufficient. Therefore, the focus is on whether the reserve assets are sufficient to be fully redeemed. This part is the weekly update and monthly report mentioned in the previous paragraph. Furthermore, you can even view the daily net value and performance of the reserve fund.

The monthly reserve asset report can be downloaded and viewed on the Circle website:

Transparency & Stability - Circle

View the Reserve Fund's portfolio, net worth and performance on BlackRock's website:

Circle Reserve Fund | USDXX | Institutional

USDC Circulation and Distribution - DeFi Players’ Favorite?

Source: On-chain data platform DeFiLlama

The current total circulation of USDC is 33.3 billion U.S. dollars, and the top three chains with the largest circulation on the USDC chain are:

Ethereum, 67.74%

BASE, 9.13%

Solana, 6.62%

Although USDT is the stablecoin with the largest market capitalization and the widest circulation, this is not necessarily the case in DeFi. USDC is the largest stablecoin on some chains.

The stablecoin on the Solana chain is dominated by USDC, with a proportion of 68%.

The proportion of USDC on the BASE chain exceeds 90%, while that of USDT is zero.

Higher circulation means that USDC has more application scenarios on certain chains or protocols, which has the opportunity to bring higher returns on funds.

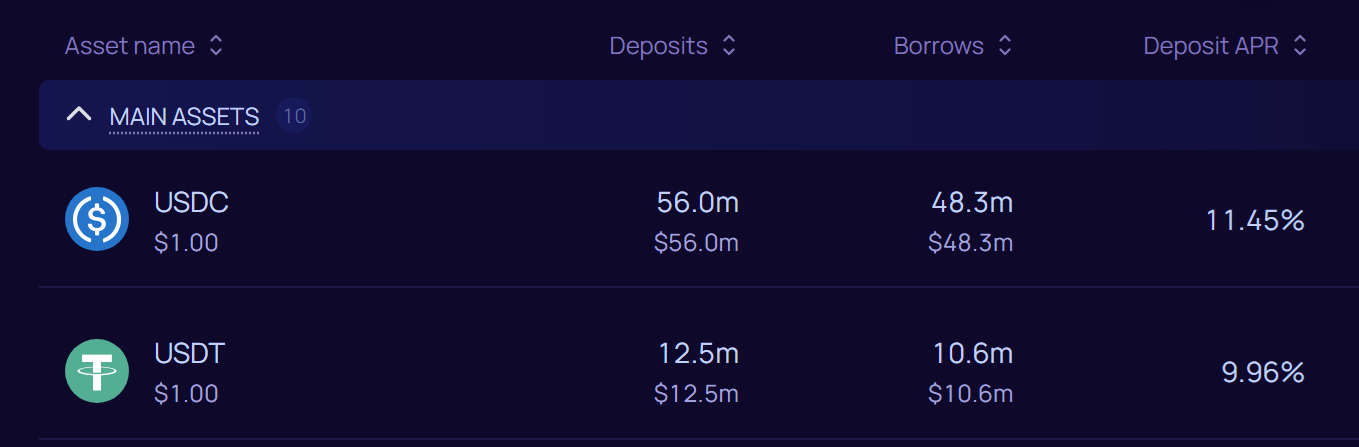

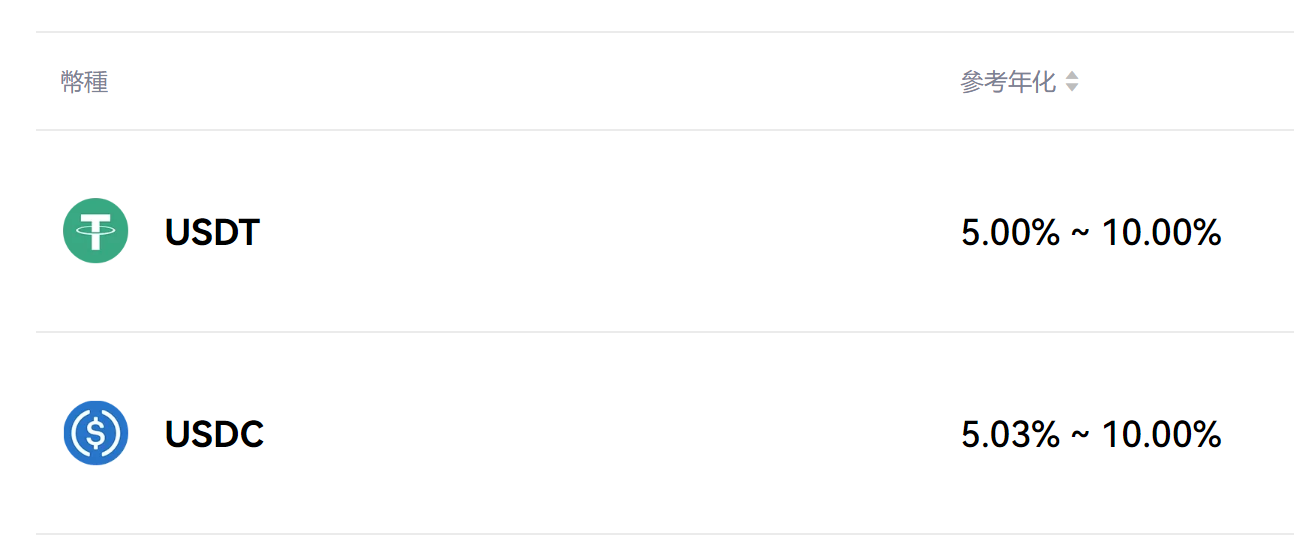

Or in financial products on exchanges, sometimes USDC also has higher interest rates.

Is USDC safe?

There are many types of stablecoins. If they are all US dollar stablecoins, then everyone’s price will be the same. The most important evaluation factor when choosing a stablecoin is safety.

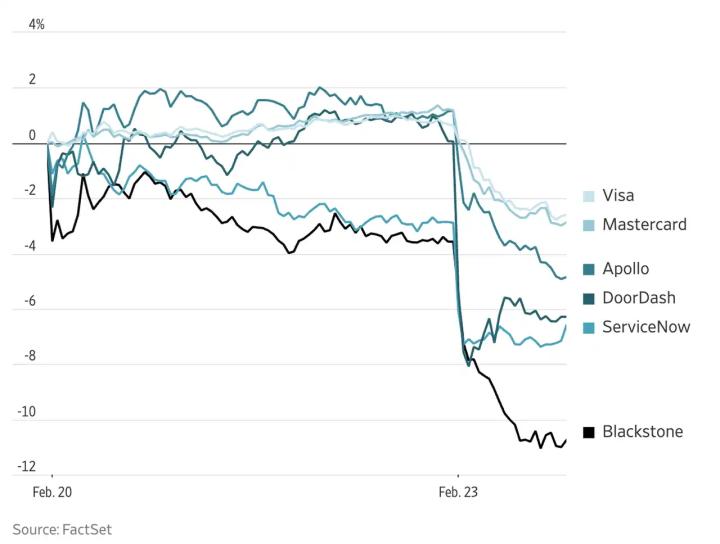

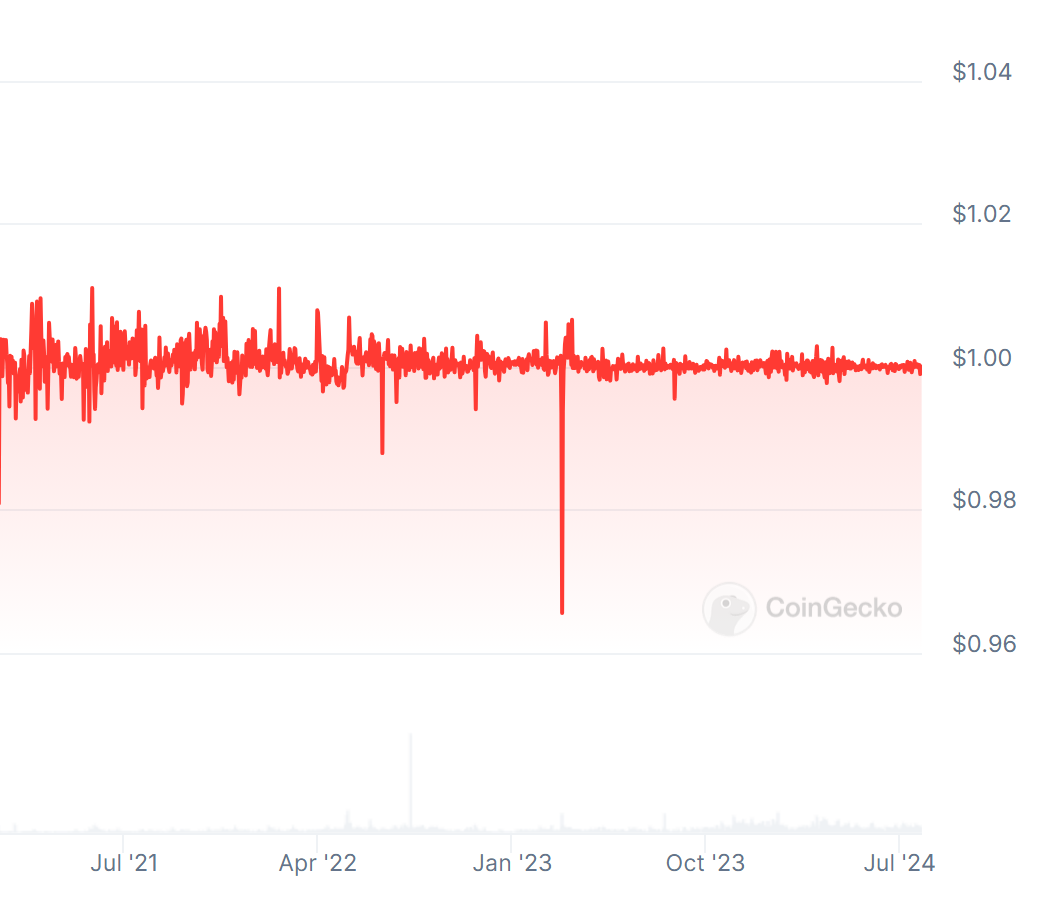

Let’s talk about the conclusion first: USDC is issued by a compliant Circle company, provides sufficient reserves and regularly updates reserve certificate reports. It is currently the second largest stable currency in market capitalization; according to CoinGecko’s price record, in the past few years, only in 2023 due to the collapse of the Silicon Valley Bank of the United States There was a relatively large decoupling in the event, which once reached 13%. However, the price soon recovered the decline, and it has become a relatively safe stable currency (the cryptocurrency industry is still not mature enough, and there is no absolutely safe place).

There are two main keys to evaluating the safety of stablecoins:

Who is the publisher? Is it credible?

If it is a decentralized issuance mechanism, there is no need to trust the contract and the blockchain. However, for a centralized issuance mechanism, it is necessary to evaluate whether the issuer is trustworthy. In the case of USDC, it is necessary to evaluate what kind of company Circle is.The mechanism by which it anchors the price - how to ensure 1:1 anchoring?

USDC adopts the method of casting/exchange/reserve. Only one block of USDC can be issued by providing 1 block of legal currency assets as a reserve. Each block of USDC can also be converted into 1 block of legal currency. The key point is to pay attention to whether the reserve is always sufficient and maintains sufficient liquidity. nature, and this reserve proves whether the information can be trusted.

If it is on-chain information, the blockchain itself is a trustless mechanism. However, the reserves of centralized stablecoins are not on-chain assets, but assets in the traditional world. Therefore, we need a trustworthy third-party organization to conduct research on reserve assets. verify.

Is the USDC issuing company Circle compliant? Do you have relevant licenses?

Founded in 2013, Circle provides blockchain payment and financial services and is the first legal operator in New York to provide virtual currency services. It has obtained multiple relevant licenses in the United States, the United Kingdom, Singapore, France, Bermuda and other places. Please refer to the official website for information: Circle | Licenses

Why is "compliance" important? The key is that this is a centralized stablecoin, which is issued, reserved, and managed by a single central entity. The central entity has centralization risks. What if it has bad intentions and does bad things and prints and issues unlimited money?

Supervision can reduce the chance of this happening. Of course, this also requires mature regulatory regulations. A compliant company has lower centralization risks. After all, it must comply with certain rules. There are also government units that will be responsible for supervision and inspection, which can reduce the risk of centralization. Risk (but still not zero risk).

News coverage on USDC/Circle compliance:

USDC Reserve

The reserve assets of centralized stablecoins have three key points:

Whether sufficient reserves remain anchored at 1:1 to ensure that they can be redeemed and cashed out, at least sufficient reserves are required, preferably excess reserves. According to the latest reserve information, USDC has a circulation of 33.7 billion US dollars and a reserve of 33.9 billion US dollars, which is slightly excessive.

Whether the reserve assets are liquid means that even if there are reserves, cash will be needed when faced with a large demand for redemption. When a bank fails due to a run, it is not necessarily because there are not enough reserves, but because there is not enough cash. Liquidity refers to how quickly an asset can be realized at a low price. If the reserve asset is a less liquid asset, such as a house or land, there will be problems when faced with a large amount of cash. It may be too late to provide cash, or Price losses during the realization process will eventually lead to the inability to cash out the full amount.

USDC’s reserves are composed of short-term U.S. Treasury bonds, overnight reverse repurchases, a small amount of cash, etc., which are all highly liquid asset classes.

Whether the reserve certificate is credible needs to be verified by a third-party organization. Currently, the one auditing the USDC reserve is Deloitte, one of the four major firms.

USDC’s reserve information and reports can be found on the official website here .

Who is the best stablecoin? USDC vs USDT stablecoin comparison

| USDT | USDC | |

price | US dollar stablecoin = 1 USD | US dollar stablecoin = 1 USD |

Market value | Win 114.4 billion US dollars (CMC) | US$33.5 billion (CMC) |

How many chains does it circulate on? | 76 chains (DeFiLlama) | Win 77 Chains (DeFiLlama) |

Number of trading pairs on the exchange | win There are 369 trading pairs on Binance | There are 75 trading pairs on Binance |

Publisher | Tether | Circle |

Is the publisher compliant? | It’s a bit gray. It faced accusations from the New York Department of Justice and settled for $18.5 million. It is also not in compliance with the EU’s MiCA Act. | win Yes (licensed in six countries), the first stablecoin issuer in Europe that complies with MiCA standards |

Whether to provide proof of reserves | yes | yes |

Whether it has been audited (Audit) | no | win It is https://www.sec.gov/Archives/edgar/data/1876042/000110465922056979/tm2124445-8_s4a.htm#tIND1 |

Whether there are sufficient reserves | yes | yes |

Whether reserve assets have good liquidity | Yes, primarily composed of U.S. Treasury bills and reverse repurchase agreements | Yes, mainly composed of short-term U.S. Treasury bonds and reverse repurchase agreements |

Decoupling history | The last major decoupling was in 2017, when it fell to around 0.92 | The last major decoupling was in early 2023, falling to 0.87 |

Similarities: prices are stable most of the time, both have experienced short-term decoupling, both provide regular reserve reports, have sufficient reserves, have good liquidity of reserve assets, and are widely distributed on the chain

Differences: USDT has a larger market capitalization and has more trading pairs on exchanges; USDC issuer Circle holds licenses from six countries and is a compliant stablecoin issuer. It has conducted audits and has More than just a visa report (Attestation)

The difference between the two:

Visa (Attestation) Report

Check and verify specific information, such as verifying only the reserve portion to see if it actually existsComprehensive audit (Audit)

More comprehensive inspections and assessments, such as reviewing the financial health of the entire company

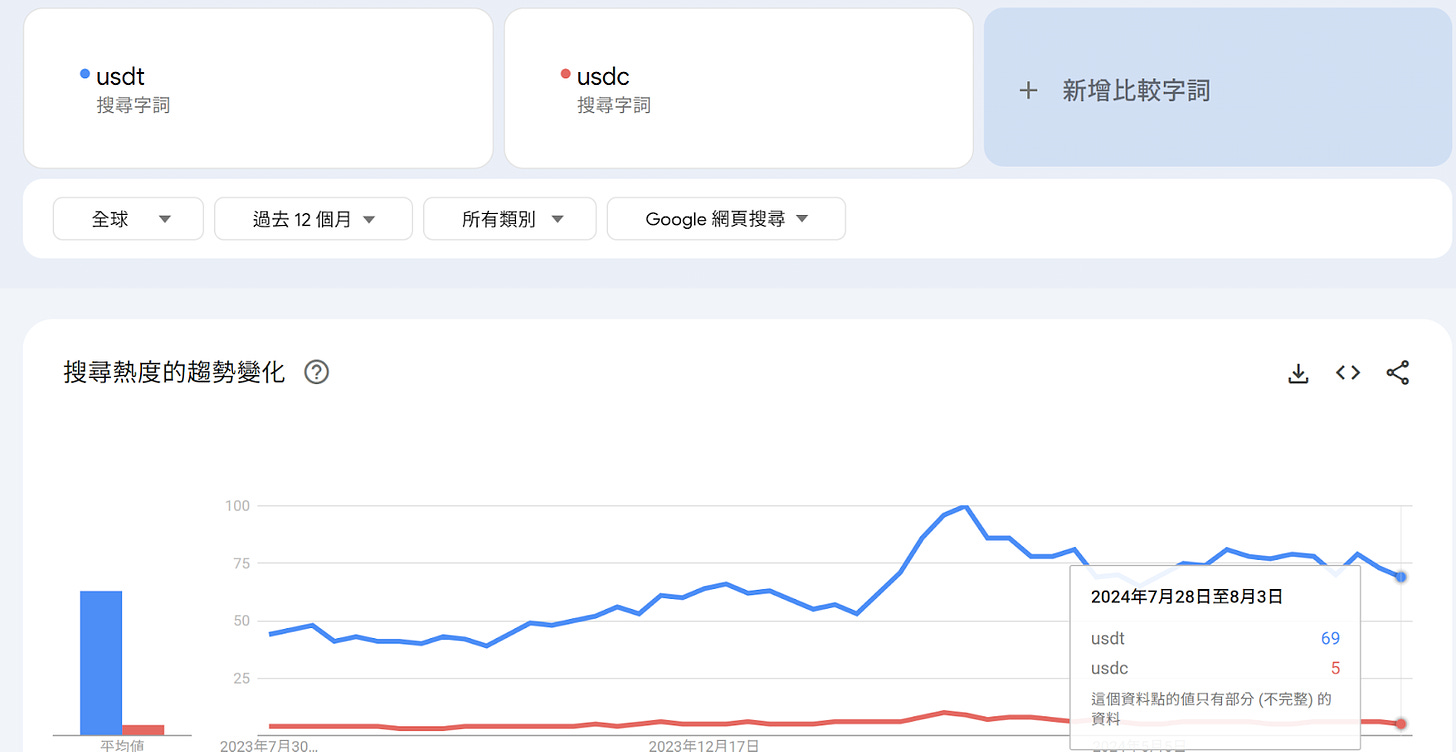

There is a huge gap in popularity. Comparing the search trends on Google Trend, the difference in search popularity between the two is more than ten times. This may be one of the reasons why USDT has more scams than USDC. The higher the popularity, the easier it is to deceive .

Which one is better, USDT / USDC?

As a trading medium, used to purchase other cryptocurrencies, USDT supports more trading pairs on exchanges, making transactions more convenient.

As short-term funds are parked, there is not much difference. It depends on which current interest rate is higher at that time.

Long-term holding risk considerations, future development is uncertain, current information assessment, Circle is a more compliant issuer, has also been audited, and faces lower regulatory risks and centralization risks.

Key point: Risks are all relative, and absolute risks are not zero. The ideal situation is to hold diversified stocks and not put all your eggs in one basket.

How to buy and sell USDC in Taiwan

If you are new to cryptocurrency and are not familiar with this field, you may not have the ability to identify it. It is recommended not to use C2C / P2P methods first. Simply put, do not find other "individuals" to buy or sell. The risk of fraud is higher. Choose public, well-known, and It is safer to buy and sell with legal businesses.

An inventory of the licenses, compliance status, and security of 7 Taiwan virtual currency exchanges

USDC deposit and withdrawal methods

Depositing money means buying coins. You can refer to these two tutorials on buying coins and buy them at a buying agency/exchange. The process is very convenient and you can even pay to buy coins at a convenience store:

How to play with cryptocurrency in 2024? 3 step-by-step instructions for buying coins for beginners

7-11 / Buying Bitcoin for the whole family? Tutorial on buying coins in convenience stores in Taiwan

To withdraw money, you need to exchange the cryptocurrency into Taiwan dollars. Please refer to this withdrawal instruction:

USDC Fraud Prevention

Common scams can be summed up in one thing: Fake!

Fake websites, fake APPs, fake coins... there are a lot of tricks, but there is only one way to prevent them: only buy and sell coins through correct and legal channels . No matter how fancy the other party says, how cheap price discounts, or how high the return on investment is, as long as you insist on buying and selling through correct and legal channels, it will be difficult to be defrauded by this method.

For other common cryptocurrency scams, please refer to these two articles:

What is USDT? How to buy USDT safely? Six types of fraud techniques and risk analysis

Summary - Although stablecoins will not rise, they may be more useful than you think

Don’t underestimate stablecoins just because they won’t rise. In practice, stablecoins have many uses. In addition to being used as a trading medium and parking idle assets, stablecoins can also be used to improve currency hoarding performance:

Or earn passive income with stablecoins:

Binance Financial Management Tutorial – Make Money by Holding Cryptocurrencies|Easily Earn 10-20%

The price of stablecoins is stable. Although there are fewer opportunities for excess returns, it can provide more stable investment income. However, remember that safety is the most important thing. No matter which stablecoin you choose to use, you must understand the reasons behind it. Mechanisms and risks, and invest appropriately.