Author: Tom Mitchelhill, CoinTelegraph; Translated by: Wuzhu, Jinse Finance

A New York judge has given final approval for defunct cryptocurrency exchange FTX and its sister trading firm Alameda Research to repay $12.7 billion to FTX creditors as part of a settlement with the U.S. Commodity Futures Trading Commission (CFTC).

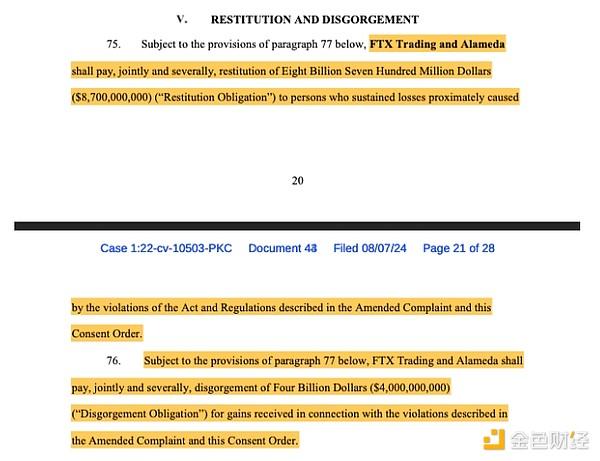

In a document filed on August 7, U.S. District Judge Peter Castel formally approved the $12.7 billion consent order that FTX and Alameda signed to resolve the CFTC’s 20-month-long lawsuit.

FTX agrees to pay $12.7 billion to settle CFTC enforcement action. Source: CourtListener

FTX and Alameda initially reached a settlement on July 12, but the lawsuit still needs to await final court approval, with District Judge Castel making the final ruling on August 7.

Notably, the commodities regulator did not seek civil penalties, meaning the entire $12.7 billion will be used to directly repay FTX creditors.

FTX and Alameda agreed to repay $8.7 billion to investors who were defrauded by founder Sam Bankman-Fried. They were also ordered to return another $4 billion.

The order will also permanently ban FTX and Alameda Research from “deceiving or defrauding” commodity customers from conducting transactions involving “digital asset commodities” and from purchasing or selling digital asset commodities on behalf of third parties.

The commodities regulator is listed by FTX – which is being taken over by bankruptcy specialist John Ray III – as the “single most significant creditor” in its ongoing bankruptcy case.

The CFTC sued FTX, its former CEO Sam Bankman-Fried, and Alameda Research in December 2022, claiming that the company committed fraud and made false statements by promoting itself as a "digital commodity asset platform."

Based on the USD value of FTX’s asset prices when it files for bankruptcy in November 2022, the current version of FTX’s reorganization plan would generate a 118% return for 98% of creditors (those with claims of less than $50,000).

However, many FTX creditors have expressed a desire to be paid in cryptocurrency in kind, which would take into account that the total market capitalization of the cryptocurrency market has increased by approximately 150% since FTX filed for Chapter 11 protection.

Creditors are currently voting on how they want to be paid. They have until Aug. 16 to file, and U.S. Bankruptcy Court Judge John Dorsey is due to make a final decision on Oct. 7.