The current DeFi data shows a positive trend, and the economic narrative of dividend repurchase is also widely recognized. The market seems to be setting off a new round of DeFi value discovery. In this round of stress testing, the DeFi field, as the cornerstone of liquidity, has shown stronger stress resistance than before because there is no serious decoupling and bad debt risks.

The recession panic of " Black Monday" dominated the global market, and a magnificent "green wave" hit again, and the crypto market was violently deleveraged. In this round of stress testing, the DeFi field, as the cornerstone of liquidity, showed stronger stress resistance than before because there was no serious decoupling and bad debt risks.

At the same time, the current DeFi data shows a positive trend, and the economic narrative of dividend repurchase is also widely recognized. The market seems to be setting off a new round of DeFi value discovery. However, the market performance of DeFi tokens is not satisfactory, and the recent large-scale selling of chips by DeFi protocols such as Uniswap and MakerDAO has also caused market concerns.

Multiple data confirm the recovery trend, and the adverse market situation highlights the resilience of DeFi

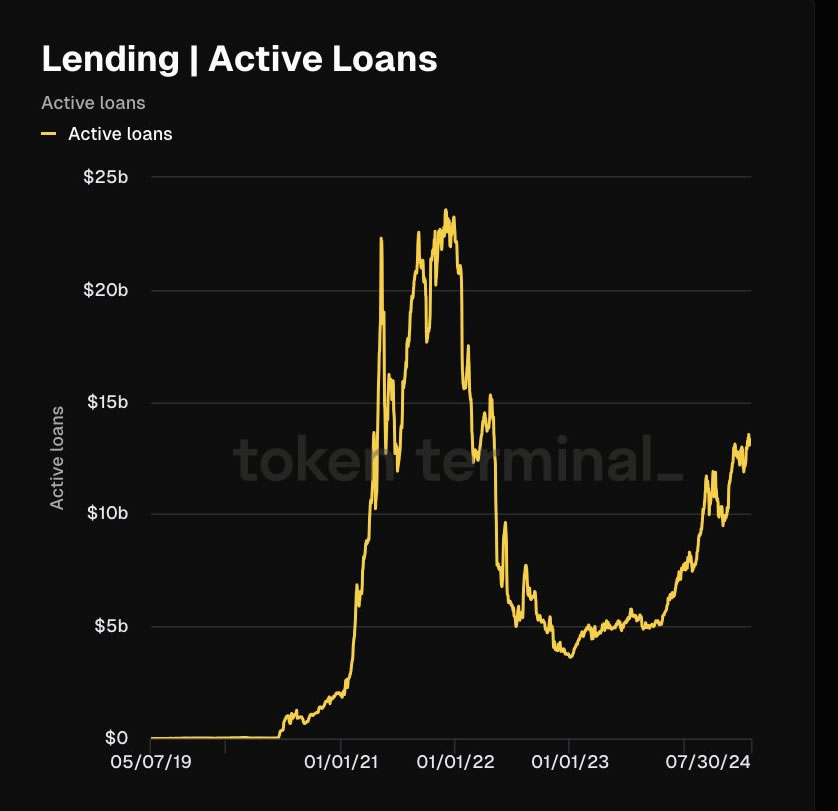

Data shows that the long-depressed DeFi sector is reviving. DeFiLlama data shows that after DeFi's TVL fell to a low of about US$36 billion in 2023, it once exceeded US$109 billion this year and recovered to the TVL level in mid-2022. At the same time, Token Terminal recently pointed out that the active loan amount of DeFi has returned to its highest point since the beginning of 2022, at about US$13.3 billion.

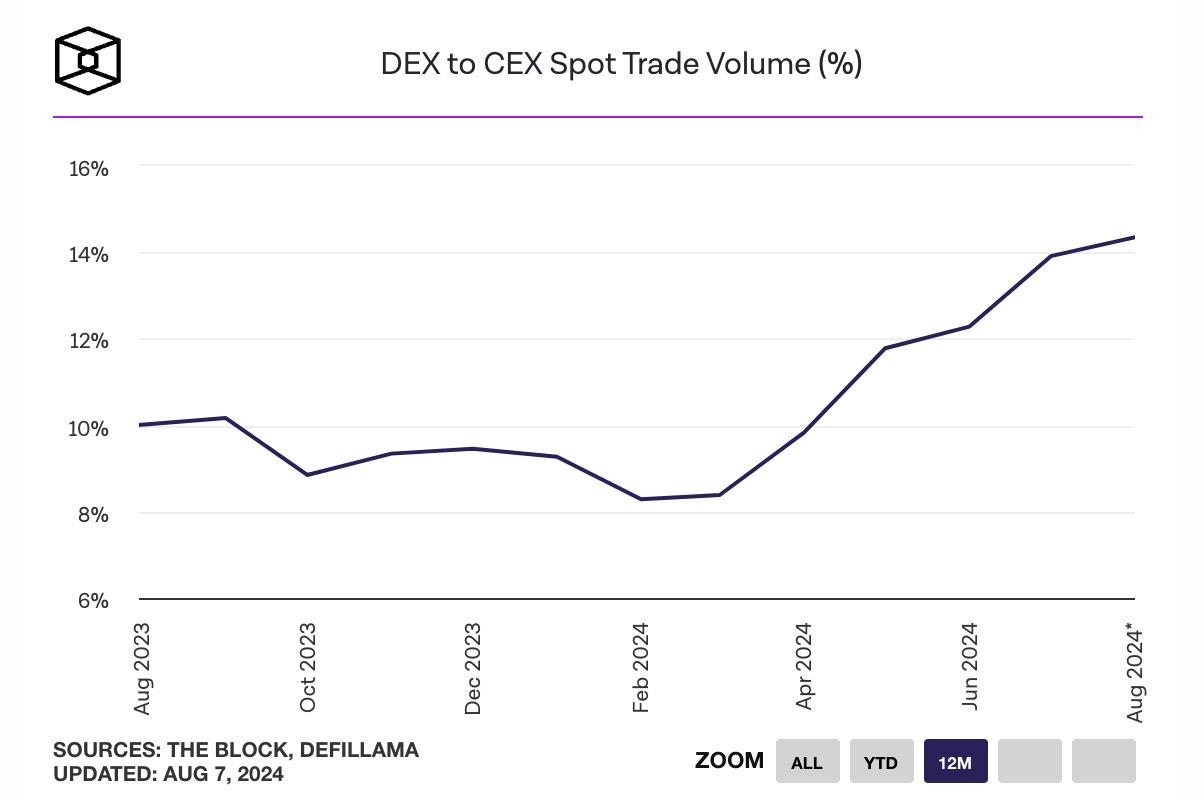

In addition, the market share of DEX is also growing rapidly. According to data from The Block, as of August 7, the monthly trading volume of DEX relative to centralized exchanges (CEX) reached 14.4%, setting a record high. In particular, the DEX trading volume on Solana has skyrocketed recently, and in July, it surpassed Ethereum for the first time with a monthly trading volume of US$55.876 billion.

As the value recovers, DeFi's risk resistance has also improved. As we all know, every extreme environment is a test for the DeFi track, including large liquidations, large decouplings, and a large number of bad debts. In the past, DeFi's liquidity in extreme market conditions was often not optimistic, which also led to market concerns and doubts about the long-term development of the track.

At a time when market liquidity is again in danger, although large-scale liquidations still occurred in the DeFi field, according to Parsec Finance data, the Ethereum DeFi protocol set a record for liquidations this year on August 5, with a liquidation amount of more than US$350 million, but there was no panic stampede.

"Although the market has experienced severe fluctuations, the DeFi sector remains robust." DeFi researcher Ignas interpreted the current situation of the DeFi market under the pressure of the plunge in many aspects, including that Lido's stETH withdrawal queue has not increased significantly, the decoupling of the main LST token is not obvious, and there is no major decoupling of major stablecoins. For example, the founder of Aave posted on the X platform that the protocol has withstood the market pressure of various L1 and L2 in 14 active markets, ensuring $21 billion in value and earning $6 million in revenue through liquidation overnight, "which proves the value of DeFi construction."

The resilience shown by the current DeFi track has also resonated with the community, and all of them said that the field's resistance to pressure is becoming stronger. For example, crypto KOL Chen Mo said that DeFi is currently the only confirmed demand, and it has truly crossed the cycle from 0 to 1, and its position is basically the same as that of centralized exchanges; @Cody_DeFi also said that compared with before, DeFi has handled a batch of high leverage on the chain more methodically, especially LST has basically not been decoupled, indicating that Leveraged Staking is still very safe, and the ecosystem within the circle is becoming more and more proficient in handling such "accidents."

Crossing the bubble and opening a new cycle narrative, business data is improving

Despite the recovery of the DeFi market, it is undeniable that after the high returns are gone, DeFi seems to no longer be the center of the narrative, which is even more vividly reflected in this bull market cycle. CoinGecko data shows that as of August 7, the market value of the DeFi sector is about 67.54 billion US dollars, ranking 17th among many crypto segments, lower than the market value of the fourth-ranked Solana single project. At the same time, The Block data shows that as of August 8, DeFi's dominance has fallen to 3.16%, the lowest since January 2021.

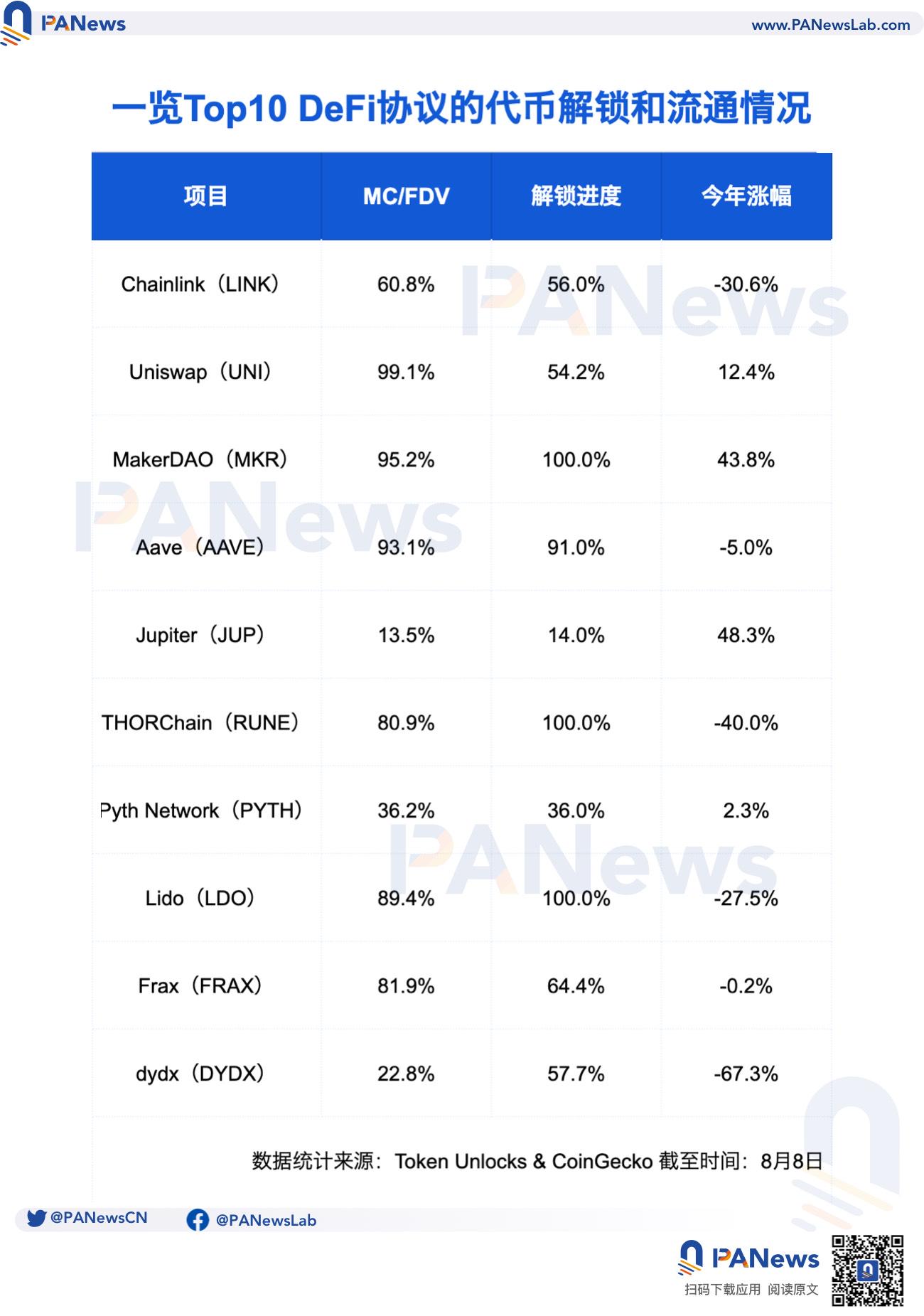

According to the market performance of the top 10 DeFi tokens by market value counted by PANews, the average decline of these tokens this year is 6.4%, but after removing the two extreme values of MKR and JUP, the average decline is 19.5%. The unlocking and circulation of projects are important factors affecting investor sentiment, especially the large-scale selling of some DeFi protocols has made investors more concerned. For example, the UniswapLabs-related address has sold approximately $86.599 million worth of UNI in the past month, and the MakerDAO team-related address has transferred approximately $92.08 million worth of MKR in 4 consecutive months.

PANews statistics show that the overall unlocking progress of these ten DeFi tokens has exceeded half, with an average unlocking amount of 67.3%. Among them, MKR, LDO, RUNE and AAVE are close to or in full circulation, which means that these tokens do not have excessive selling pressure, thus putting pressure on the price of the currency. At the same time, MC (market value)/FDV (fully diluted valuation) is also one of the important indicators for evaluating the potential of currency prices. Especially at the moment when low circulation and high FDV are resisted, the smaller the ratio, the higher the risk of long-term holding. From the MC/FDV ratio of the ten DeFis counted above, the average ratio exceeds 67.2%, and after removing the extreme value of JUP, it is as high as 73.3%.

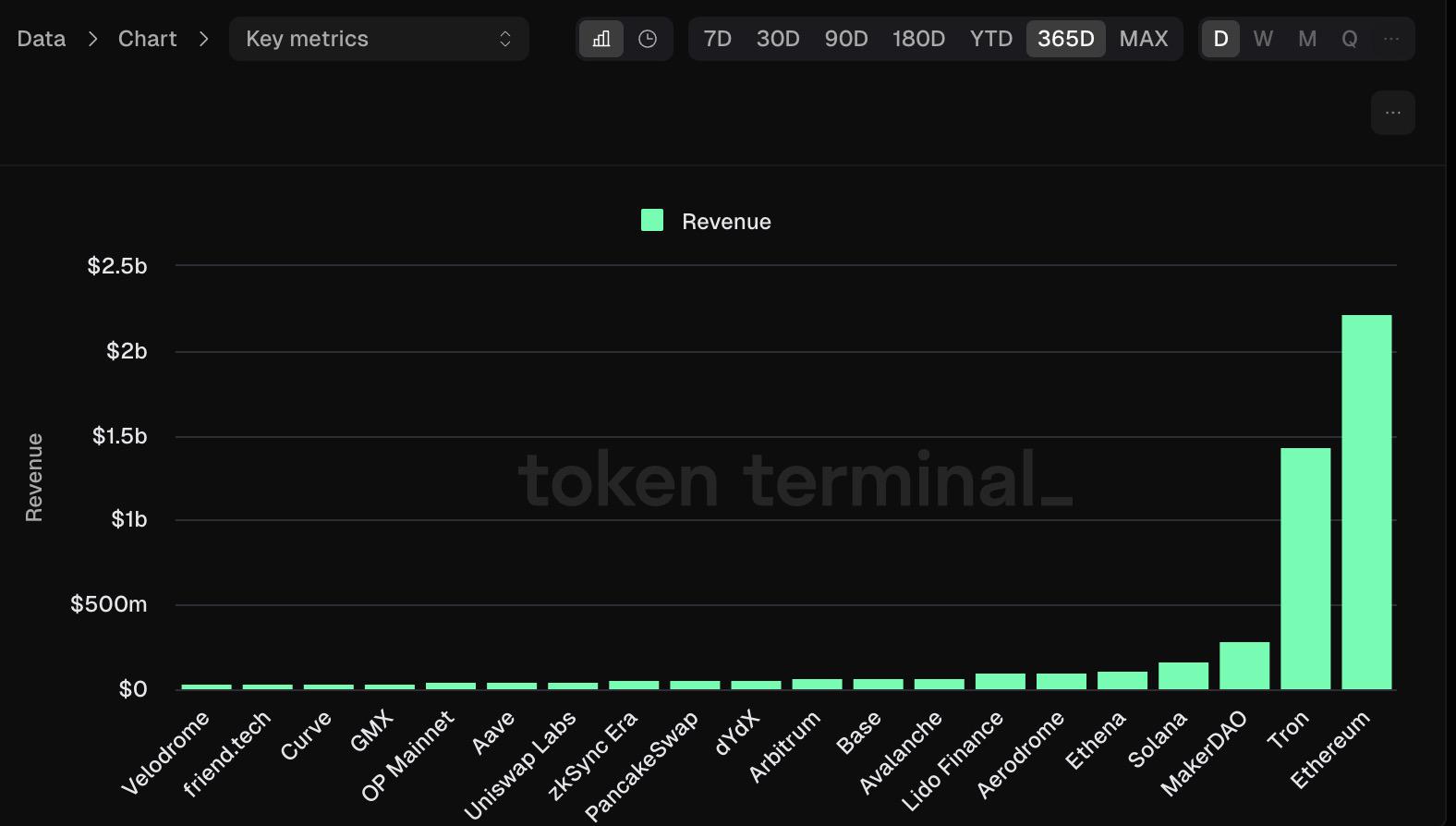

In addition, in addition to the above fundamentals, DeFi is also one of the few value narratives that is supported by real income. In fact, the DeFi track already has a relatively clear profit model, such as transaction fees, pledge commissions, loan interest, asset management fees, etc., especially the top projects have extremely high moats. According to Token Terminal data, 11 of the top 20 protocols in terms of revenue in the past year are from the DeFi track, mainly involving sub-sectors such as DEX, lending, derivatives and stablecoins.

In addition, many mainstream DeFi protocols currently use dividend repurchase mechanisms as a popular strategy to further enhance their own value capture. For example, the old DeFi protocol MakerDAO deployed a smart destruction engine to upgrade the repurchase and destruction mechanism last year, Aevo has launched a 6-month AEVO token repurchase process, the GMX community recently launched a proposal vote to "change the income distribution model to repurchase and distribute GMX", and Aave's new proposal considers starting a fee conversion to return part of the net excess income.

In general, as crypto investment becomes more rational, the bubble of false prosperity has been burst by liquidity shortage. Crypto applications with economic value narratives, PMF (product-market fit) capabilities and resilience may be more likely to usher in the main upward trend.