I may get criticized for saying this, but I'll say it anyway...

So if you bought the $ETH spot ETF at launch, you would now be losing about 25%.

I believe that fundamentally, it remains overvalued.

My opposite idea, please listen to me

1) The value of $ETH comes from two key factors:

- Scarcity, similar to Bitcoin

- Potential for future returns.

However, the merged Ethereum network has introduced some worrying developments that call these value drivers into question.

2) First, the merger is deflationary. But more importantly, it demonstrates the Ethereum Foundation’s (EF) ability to actively manage token supply.

This undermines the scarcity narrative as EF has shown a willingness to intervene in Ethereum’s monetary policy.

Even if the current monetary system is deemed more beneficial (which I doubt), it could still change in the future, and the Ethereum Foundation has shown a willingness to adapt. Therefore, ETH remains scarce until it is no longer scarce.

3) Compounding this issue, the recent Dencun upgrade has caused Ethereum transaction fees to drop significantly — down by more than 50% in the second quarter of 2022 alone. While increased activity from layer 2 solutions may help offset some of the revenue decline, it is unclear whether this will fully make up for the reduction in mainnet fees.

4) Ethereum is in a precarious situation. High fees on the L1 network have forced many projects to move to alternative chains, forcing the Ethereum Foundation to drastically reduce fees, especially on Layer 2 solutions.

But this reduction in fees directly limits the value of Ether, as its value is primarily based on these fees.

For the value of $ETH to increase, on-chain activity and layer 2 solutions must upgrade. However, achieving this with extremely low fees (which is necessary for scaling) is a major challenge. In essence, the value of ETH is likely to remain low because low value and scalability are interrelated prerequisites.

5) Just because a Bitcoin ETF attracted billions of dollars in a matter of weeks doesn’t mean the same will happen with an Ethereum ETF. Traditional financial investors need time to adapt to new investment products, so I don’t think Ethereum will be as immediately successful as a Bitcoin ETF.

Bitcoin is viewed as digital gold, while Ethereum is viewed as a decentralized world computer. These are very different narratives, and it will take time for TradFi investors to understand Ethereum’s unique value proposition.

However, this view I am presenting differs from the market pricing theory. In this case, the market may price ETH higher due to external factors such as ETFs or speculative future potential. However, in the long run, I expect the market price to be closer to its intrinsic value.

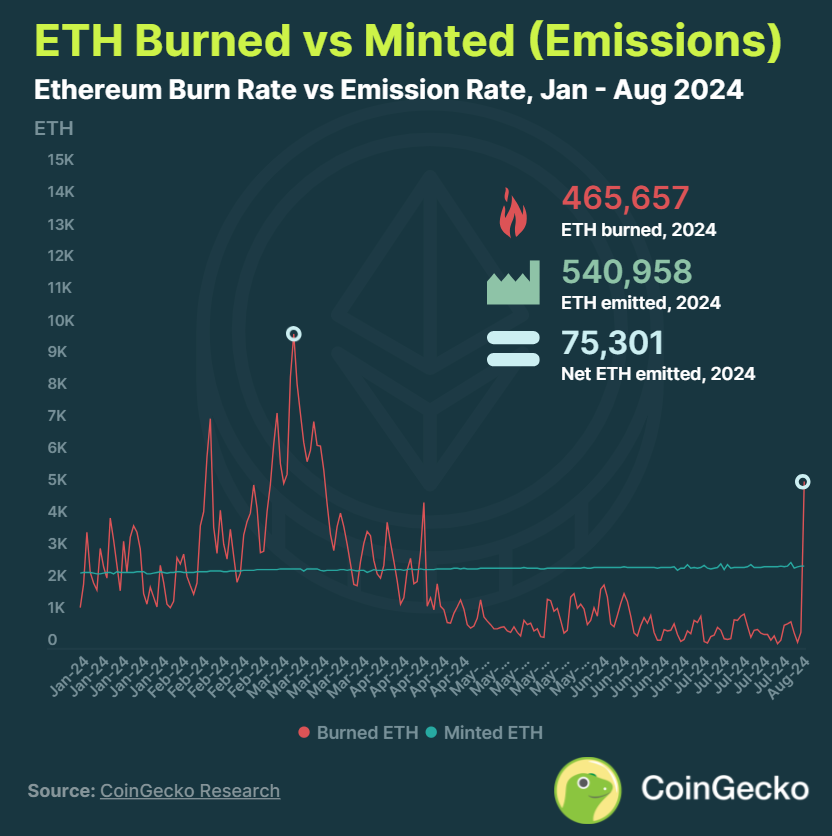

In addition, as of August 5, 2024, the Ethereum network has destroyed a total of 465,657 ETH since the beginning of the year. After the implementation of EIP-1559 in June 2021 , a total of 4.36 million ETH were destroyed.

Meanwhile, 107,725 ETH were destroyed in Q2 2024 , a -67.7% decrease from Q1. 333,555 ETH were destroyed in Q1 2024.

In July 2024, 17,114 ETH were destroyed, a new monthly all-time low for 2024, down -35.0% from June. Meanwhile, 147,620 ETH were destroyed in March 2024, a new monthly all-time high for 2024. However, this figure is far from the all-time high of 398,061 ETH destroyed in January 2022 (at the peak of the last bull run).

Is Ethereum inflationary or deflationary?

While Ethereum was deflationary between Q4 2022 and Q1 2024, it is now inflationary . ETH issuance has exceeded destruction, with 540,958 ETH added to the Ethereum network since the beginning of 2024. Meanwhile, 465,657 ETH have been destroyed, resulting in a net increase of 75,301 ETH to the Ethereum network in 2024 .

On a quarterly basis, Q1 2024 was deflationary, with 220,454 ETH issued and 333,555 ETH destroyed. This resulted in 113,100 ETH being removed from the Ethereum supply. However, as network activity declined throughout Q2 2024, Ethereum began to become inflationary. Throughout the quarter, 228,543 ETH was issued, 107,725 ETH was destroyed, and 120,818 ETH was added to the blockchain.

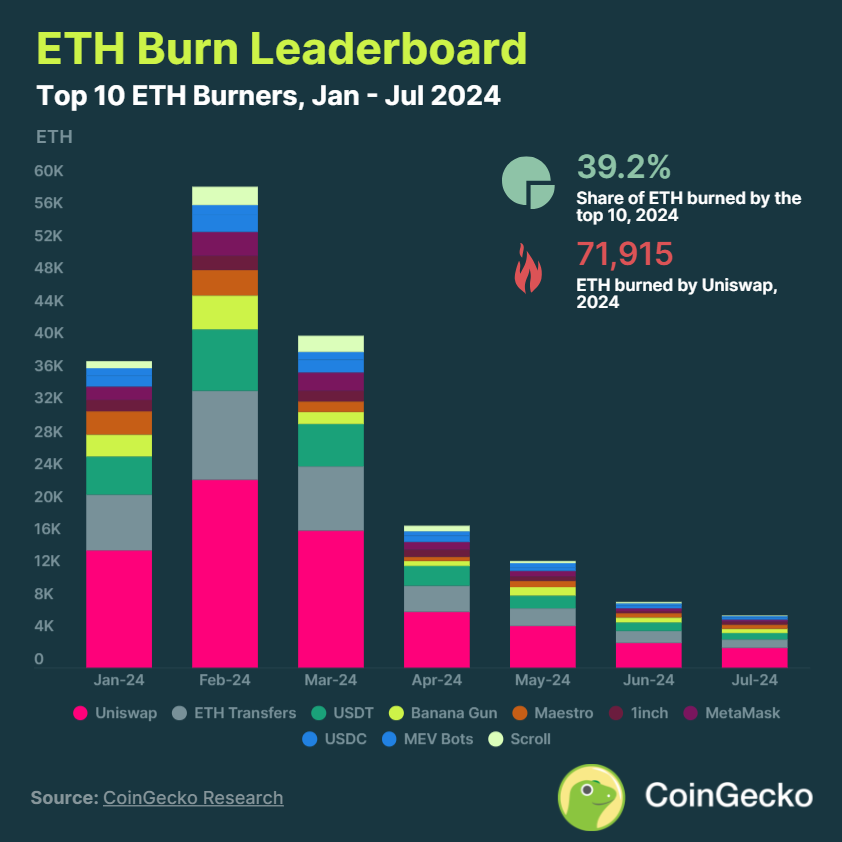

What destroyed the most ETH?

Uniswap is still the largest destroyer of ETH, destroying a total of 71,915 ETH in 2024 ; in July 2024, Uniswap destroyed a total of 2,470 ETH. Although Uniswap has always been the leader in ETH destruction, the amount of ETH destruction has dropped sharply. Its destruction rate fell by -72.4% month-on-month, from 54,413 ETH in the first quarter to 15,031 ETH in the second quarter. The top ten ETH destroyers accounted for 39.2% of the total destruction in 2022 .

ETH transfers are the second largest contributor to ETH destruction, with 33,538 ETH destroyed so far this year. In the first quarter, ETH transfers destroyed 25,668 ETH, which fell to 6,838 ETH in the second quarter, a month-on-month decrease of -73.4%.

Tether ( USDT ) was the third largest destroyer, destroying 23,332 ETH in 2024. Like Uniswap and ETH transfers, its destruction rate fell by -70.9% quarter-on-quarter from 17,480 ETH in Q1 to 5,091 ETH in Q2.

The fourth largest destruction contributor was Banana Gun ( BANANA ), which destroyed 11,060 ETH. Telegram trading bot destroyed 2,150 ETH in Q2, down 74.3% from Q1 (8,364 ETH). The decline in DEX trading on its supported blockchains affected its destruction rate. The rest of the top ten protocols destroyed less than 10,000 ETH each.

Top ETH Burners (2024)

The top ten ETH destroyers from January 1, 2024 to August 5, 2024 are ranked as follows:

Methodology

The study examined the issuance and destruction of Ethereum (ETH) in 2024 using data from Dune Analytics and Etherscan from January 1, 2024 to August 5, 2024.

The study also investigated the top ten methods of destroying the most ETH: Uniswap, ETH Transfers, Tether, Maestro, 1inch, MetaMask, Circle USD, MEV Bots, and Scroll.