After the stock market experienced a bloodbath of panic last Monday, investors gradually calmed down. The three major U.S. stock indexes closed narrowly higher on Friday (8/9), almost recovering from the previous tragic decline. Bitcoin once again stood at the 60,000 mark, and Ethereum returned to around 2,600.

Table of contents

ToggleInvestors' panic subsides

Data released by the U.S. Department of Labor showed that the number of people claiming initial unemployment benefits fell to 233,000 on a seasonally adjusted basis in the week ended August 3, indicating that the previous employment data was affected by severe weather and people were worried about the collapse of the labor market. Concerns are exaggerated.

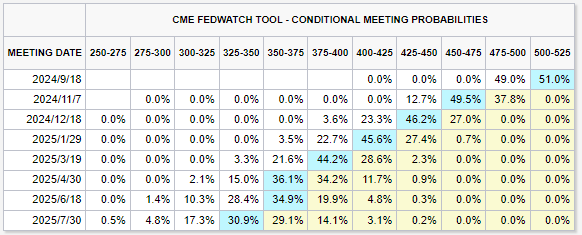

CME FedWatch data shows that the chances of a one-digit and two-digit rate cut are evenly divided in September. Compared with the 70% chance of a two-digit rate cut when the market was panicked before, the expected rate cut by the end of the year has also increased from 5 percent to 5 percent. Down to four yards. Previously, people were worried that the Federal Reserve would have to cut interest rates quickly to save the economy due to economic downturn. The three major U.S. stock indexes ended narrowly higher on Friday (8/9), almost recovering from their previous tragic losses.

Investors await key consumer price index (CPI) data due next Wednesday. There is growing confidence that U.S. inflation is slowing, which will give the Federal Reserve enough confidence to cut interest rates starting in September.

BTC returned to the 60,000 mark, and ETF net outflows were 89.73 million

After briefly falling below the 50,000 mark last week, Bitcoin finally returned above the neckline and stood back at the 60,000 mark.

According to previous reports, JP Morgan analysts estimate that the average production cost of Bitcoin is about $49,000. Once the price falls below this price, it will put pressure on miners and further affect the price of Bitcoin. Fortunately, Bitcoin has successfully escaped from this price, and analysts believe that Bitcoin futures are at a higher premium than spot, showing that futures investors are confident. In addition, FTX's cash claims for creditors may further boost demand in the crypto market. However, the market outlook still needs to be viewed with caution.

According to SoSoValue , Bitcoin spot ETFs had a net outflow of US$89.73 million yesterday, of which Grayscale GBTC had an outflow of US$77 million, Fidelity's FBTC had an outflow of US$19.85 million, and Bitwise's BITB had an outflow of US$18.14 million.

ETH returned to 2,600, and ETF had a net outflow of 15.71 million

Affected by the liquidation of Jump Trading , Ethereum's trend is relatively weak, with a cumulative weekly decline of 12%, and it has not reached the neckline of about 2,800.

According to SoSoValue, the Ethereum spot ETF had a net outflow of US$15.71 million yesterday, and inflows from other funds were unable to offset Grayscale ETHE's net outflow of US$41.68 million.