Bitcoin is once again at a key support level, facing a critical test that could affect its short-term outlook. There is a positive shift in the market at the moment, but there are warnings about the impact of US CPI, which will affect where BTC goes next.

BTC’s bullish outlook

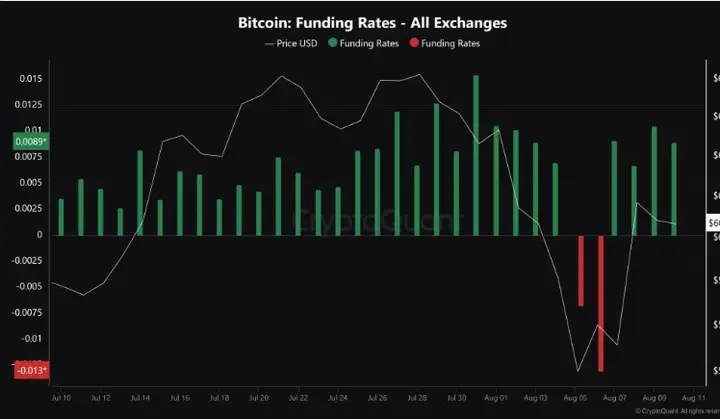

The cryptocurrency market continued its recovery in the short term after massive liquidations occurred after Bitcoin fell to $49,000 on August 5. The plunge also cleared out long positions, allowing for “clearer positioning,” which could boost the market.

I think clearer positioning could be a positive technical indicator for the cryptocurrency, which could suggest that the market may have priced in pessimism.

At press time, sentiment among futures market traders has turned positive, as evidenced by the positive funding rate. This also coincides with BTC’s rebound from $49,000 to its previous range low of $60,000.

The bullish momentum for BTC is strong and structural. Demand for BTC call options expiring in 2025 with strike prices close to 100k has been steady throughout the week (despite the volatility).

Current Market Sentiment

As of now, Bitcoin is hovering around the $60,000 to $61,000 support area. It’s almost like a leisurely Sunday ride for Bitcoin.

But market sentiment is another story. The Crypto Fear & Greed Index is flashing fear, and it’s not hard to understand why. The global cryptocurrency market cap took a slight hit, falling 0.98% to close at around $2.12 trillion.

On the futures market side, a tug-of-war is going on. Bitcoin futures open interest rose 1.8% to $28 billion. This means that while some traders are bearish, most are betting on the future potential of the cryptocurrency.

This past week, Bitcoin experienced a “bull reprieve” — a temporary rebound in price after a period of oversold conditions. Such rallies are not uncommon in bearish trends, with short-lived upward or sideways price action occurring as markets reset. Amid all the chaos, Bitcoin’s current trend has a decidedly bullish tone. After the leverage collapse earlier this week, BTC appears to be back on track for a strong close.

Key support and resistance levels

As of now, Bitcoin is hovering around the $60,000 to $61,000 support zone, a key area that has historically served as both resistance and support. A confirmed break above this level is a positive sign, as seen recently, but the market remains cautious.

For the general trend to return to bullish, Bitcoin needs to break through multiple resistance levels, with the first important resistance level being $63,000. In addition to this, the $67,000 to $68,300 range is another major resistance area that may determine the short-term direction of Bitcoin's price.

Looking ahead

The market is influenced by market stability and upcoming macroeconomic events. The Federal Reserve’s September meeting and the Jackson Hole Symposium are both expected to provide important insights into the economic situation. These events could affect central bank policy and, in turn, Bitcoin’s trajectory toward all-time highs.

Even amid broader economic challenges, Bitcoin’s investment thesis remains strong. As concerns about inconsistent monetary and fiscal policies mount, Bitcoin’s role as a hedge against economic instability and inflation could become increasingly attractive, supporting its potential climb to new highs.

Will the US CPI data determine the next trend of BTC?

I think the short-term price action for BTC, Ethereum [ETH], and Solana [SOL] is likely to continue. But macro factors will determine the next move for investors. The US CPI (Consumer Price Index) data, due on August 14, is a key factor to watch.

We expect some of the selling pressure to ease and believe that macro dominance is likely to continue. For example, given this week's events, inflation data next week on August 14 may receive more attention.

However, traders and investors can use the PPI (Producer Price Index) data to begin positioning themselves accordingly to gauge the likely outcome of the CPI. The PPI data tracks inflation from the producer's perspective.

On the other hand, CPI measures inflation by tracking consumer spending on major goods and services. The Federal Reserve uses both sets of data to make interest rate decisions. PPI data will be released on August 13.

However, it is expected that many market participants will pay attention to PPI the day before in order to understand the direction of CPI in advance, which may also affect market performance.

in short

The market is currently experiencing a positive shift, but the US CPI is expected to see a new round of market volatility, which will determine the direction of BTC and the market this week. Market sentiment is good, and BTC is expected to continue its recovery momentum in the short term and return to the official track. In the long run, the Federal Reserve’s September meeting and the Jackson Hole Symposium are expected to affect central bank policies, and thus affect Bitcoin’s trajectory to historical highs. At the same time, investors should remain cautious to cope with potential market fluctuations in the future.