On August 5, the cryptocurrency market experienced "Black Monday", the worst three-day sell-off in nearly a year. Bitcoin fell to $49,000 at one point, and the cryptocurrency market plummeted 17%. Weak US non-farm payrolls data, the US dollar rate cut and the expectation of a Japanese yen rate hike were the direct triggers for this plunge. This market event not only reflects the high volatility of the cryptocurrency market, but also reveals its close correlation with macroeconomic indicators.

The value of cryptocurrencies is more determined by market supply and demand and investment trust. Crypto market fluctuations are closely related to macroeconomic indicators, especially US economic indicators. Why can the Americans have such a big impact on the crypto?

For more information, please visit Weibo Tuantuan Finance here .

Federal Reserve Rates and the Cryptocurrency Market

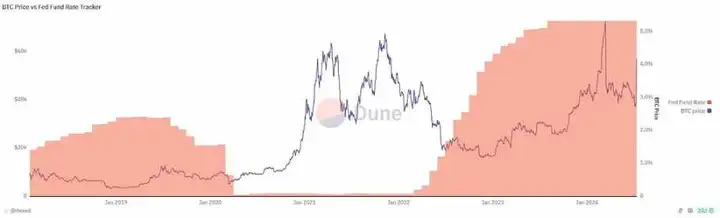

The Federal Reserve controls the money supply and market liquidity by adjusting the benchmark interest rate. When the Federal Reserve raises interest rates, borrowing costs rise, and the borrowing demand of enterprises and individuals decreases, which leads to a decrease in funds in the market and a decrease in financial market liquidity. Conversely, a rate cut reduces borrowing costs and increases liquidity in the market.

The cryptocurrency market is highly sensitive to changes in liquidity. When the Fed raises interest rates, liquidity decreases and investors are more inclined to withdraw from high-risk assets, such as cryptocurrencies, and turn to more stable investments, such as government bonds. This flow of funds usually causes cryptocurrency prices to fall. Conversely, when the Fed cuts interest rates, market liquidity increases and investors have more funds to invest in high-risk, high-return assets, such as cryptocurrencies, driving their prices up.

When expectations of a global recession increase or instability intensifies, investors' risk appetite decreases and they are more inclined to hold cash or invest in low-risk assets. At this time, market liquidity is usually negatively affected and investment in high-risk assets such as cryptocurrencies decreases.

As a high-risk asset, cryptocurrencies are often sold off by investors during periods of economic instability. Unlike safe-haven assets such as gold, cryptocurrencies lack stability and security, so when economic uncertainty increases, funds will flow out of the cryptocurrency market, causing prices to fall.

Analysis of the macroeconomic background of recent crypto market fluctuations

This week, the cryptocurrency market also plummeted amid a global market slump. After falling below $60,000, Bitcoin quickly dropped to below $49,000. Panic spread in the market, and the total market value of cryptocurrencies decreased by nearly 20% in 24 hours. This round of plunge is not just an isolated incident in the cryptocurrency market, but part of the turmoil in the global financial market, and the result of the combined effect of multiple macroeconomic factors.

Trigger: Weak US non-farm payrolls data

The end of arbitrage: US dollar rate cuts plus yen rate hike expectations

Selling panic: An interpretation of jump trading and Buffett's market operations

Chain reaction: Global financial markets fell

The decline in global stock markets reflects investors' concerns about economic recession and rising risk aversion. The cryptocurrency market has not been spared, and due to its high-risk attributes, it has become the preferred target for capital withdrawal and risk aversion operations. Investors have sold off crypto assets, causing prices to fall sharply.

In addition, concerns about escalating tensions in the Middle East and uncertainty in the US election have also led to an increase in investors' risk aversion, putting pressure on risky assets such as Bitcoin and fueling volatility in the crypto market.

Analysis of future economic outlook and crypto market trends

In the second half of 2024, the global economy still faces many challenges and uncertainties. The interweaving of various factors will jointly determine the direction of the crypto market in the second half of 2024.

Global economic growth slows

The latest forecasts from the International Monetary Fund (IMF) and the World Bank show that global economic growth is likely to slow down. The main reasons include inflationary pressure, geopolitical tensions and supply chain disruptions. Although the economic recovery momentum in some regions is strong, the risk of overall slowdown in growth remains.

Fed rate cut expectations

The market generally expects the Fed to cut interest rates at least twice in the second half of 2024, a total of 75 basis points, to cope with the pressure of slowing economic growth. The Fed's expected rate cuts will increase market liquidity and promote investment in high-risk assets. The increased liquidity will help drive up cryptocurrency prices while increasing the willingness of market participants to invest.

Employment Data and Economic Policy

The health of the labor market directly affects investor confidence and economic policies. Although the U.S. employment data fell short of expectations, it has not yet shown clear signs of a recession. If the employment data deteriorates further in the coming months, it may prompt the Federal Reserve to adopt a more relaxed monetary policy, which will increase market liquidity and support the cryptocurrency market.

Inflows into Bitcoin and Ethereum Spot ETFs

The approval and listing of Bitcoin and Ethereum spot ETFs have injected new momentum into the entire crypto ecosystem. Recently, global wealth management giant Morgan Stanley announced that it will allow financial advisors to recommend Bitcoin exchange-traded funds (ETFs) to eligible clients. The convenience and legality of ETFs make it easier for more institutional investors and retail investors to participate in the cryptocurrency market.

Old American election

The dynamics of the US presidential election will have a significant impact on market sentiment and the cryptocurrency market. The policies of different candidates vary greatly, and their stances on crypto assets will directly affect market trends. As the election approaches, market volatility may increase.

Regulatory and policy environment of the cryptocurrency market

The regulatory and policy environment of the cryptocurrency market is constantly changing. The attitudes and policies of governments and regulators towards cryptocurrencies will have a significant impact on the market. Strengthened regulation may improve market transparency and security, but it may also limit market growth and innovation. Investors need to pay attention to policy developments around the world, especially policy changes in major economies such as the United States and China.

Geopolitical tensions

Geopolitical conflicts such as the Middle East situation, the Russian-Ukrainian war, and instability in other regions may have a negative impact on the global economy and the crypto market. When geopolitical risks increase, investors usually turn to safer assets such as gold and the US dollar, which may lead to capital outflows and price declines in the cryptocurrency market.

In conclusion, despite facing many uncertainties, the cryptocurrency market still has great potential for development. Technological innovation, market demand and improved institutional environment all provide new growth opportunities for the market. However, investors need to be alert to the high volatility and potential risks of the market, allocate assets rationally and avoid excessive speculation.

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or private TTZS6308. All information platforms are Tuanzi Finance .

I plan to accept three more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.