Overnight, BTC continued to slightly recover to the 61-62k range. Hey, the dawn here is quiet. The bears have no illusions, and the bulls have no temper. Maybe five years later, there will be a joke in the industry: I have a friend who is still waiting for $20,000 BTC.

I saw on the Internet that quite a few netizens firmly believe that BTC will fall back to $20,000 or even $10,000. In fact, if you can see $10,000, you can see $1,000; if you can see $1,000, you can see $100, $10, $1... On the road of bearishness, you are not alone, and there is no end.

Yesterday, the community of the well-known DeFi project MakerDAO launched a proposal to clear the WBTC in Maker's collateral warehouse. The proposal caused a huge shock in the industry. After all, Maker is the largest collateral lending protocol in the industry, and currently manages nearly 5 billion US dollars of various digital assets on the chain. WBTC is the largest BTC cross-chain asset on the Ethereum chain, currently managing more than 150,000 BTC with a total value of nearly 10 billion US dollars.

Let’s read the original text of this proposal first:

Translate:

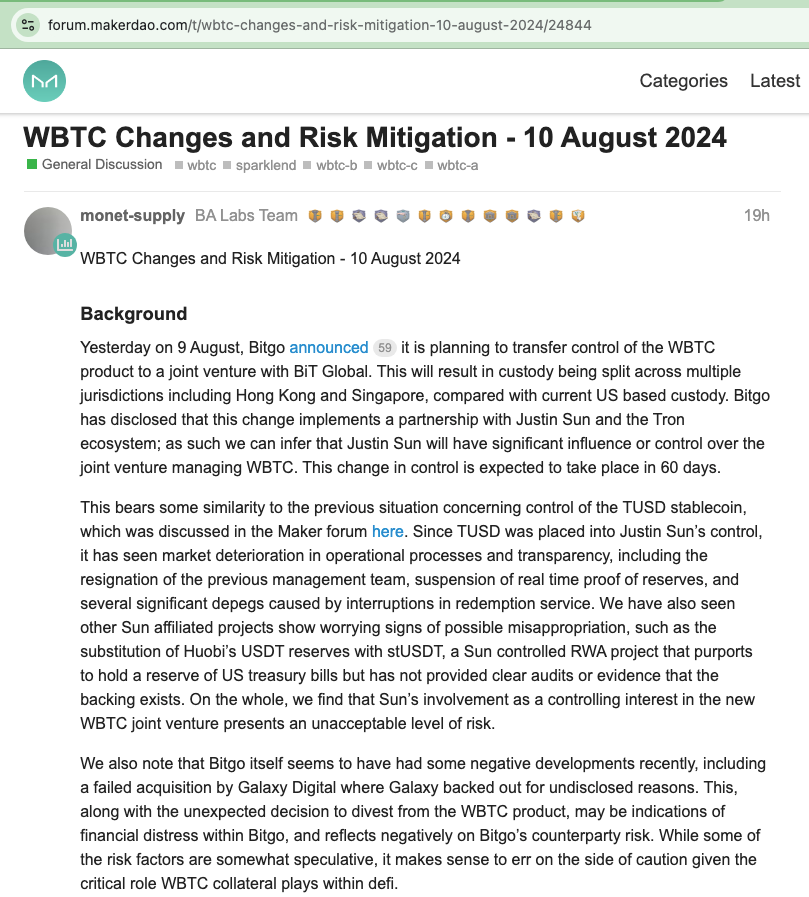

“ WBTC Changes and Risk Mitigation – August 10, 2024

background

Yesterday, August 9, Bitgo announced plans to transfer control of the WBTC product to a joint venture with BiT Global. This will result in custody being dispersed across multiple jurisdictions, including Hong Kong and Singapore, compared to the current custody in the United States. Bitgo disclosed that this change implements a and the Tron ecosystem; therefore, we can infer that Justin Sun will have significant influence or control over the joint venture that manages WBTC. The change of control is expected to be completed within 60 days.

This is somewhat similar to the previous situation regarding control of the TUSD stablecoin, which was discussed in the Maker forum. Since TUSD was placed under the control of Justin Sun, market operation processes and transparency have continued to deteriorate, including the resignation of the previous management team, the suspension of real-time reserve proof, and several major decouplings caused by the interruption of redemption services. We have also seen other Justin Sun related projects show worrying signs of possible misappropriation, such as replacing Huobi’s USDT reserves with stUSDT, an RWA controlled by Justin Sun. project, claiming to hold U.S. Treasury reserves without providing clear audits or evidence to back that up. Overall, we find that Justin Sun’s involvement as a controlling stake in the new WBTC venture carries unacceptable risks.

We also note that Bitgo itself appears to have had some negative developments recently, including the failed acquisition by Galaxy Digital, which Galaxy withdrew for undisclosed reasons. This, combined with the unexpected decision to divest WBTC products, could be a sign of financial distress within Bitgo and negatively impact Bitgo's counterparty risk. While some of the risk factors are purely speculative, it makes sense to exercise caution given the critical role WBTC collateral plays in DeFi.

Recommended Actions

Given the upcoming change of control, BA Labs believes that the integration of WBTC collateral on Maker and SparkLend carries a high level of risk. BA Labs recommends that stablecoin promoters propose the following immediate actions to limit the growth of WBTC risk, which will be included in the next executive vote on Monday, August 12:

Core Vault:

WBTC-A DC-IAM line (largest DC): reduced from 500 million to 0

WBTC-B DC-IAM line (largest DC): reduced from 250 million to 0

WBTC-C DC-IAM line (largest DC): reduced from 500 million to 0

SparkLend:

Disable WBTC lending

Reduce WBTC LTV from 74% to 0%

If Bitgo or other responsible parties cannot convincingly demonstrate that it is safe to maintain current collateral integrations, we will consider further proposed changes to parameters to protect the protocol and reduce counterparty risk, up to and including the possible complete removal of all Maker and Spark WBTC collateral integrations. ”

* * *

Friends who are not familiar with the complex relationships and development history of the crypto industry may be confused by these terms and concepts. I will briefly explain them to readers:

First of all, everyone needs to understand one question: Under what circumstances does your BTC truly belong to you?

The answer is that the BTC in the Bitcoin address that corresponds to and controls the private key that you and only you control is the BTC that truly belongs to you.

For example, "address" is the safe number, and "private key" is the key to open the safe. For more details, you can review the article "Small Science: Address, Private Key, Seed phrase" published by Jiaolian on September 28, 2021.

Quiz: You have 3 BTC in an exchange account. How many BTC do you have? The correct answer is: 0.

The situation of WBTC is more complicated than that of exchange accounts.

WBTC is also a so-called "digital asset", which is also placed in a "safe" (address) and controlled by your own "key" (private key). However, it is different from the above BTC situation:

1. The safes that hold WBTC are not the same as the safes that hold BTC. The safes that hold BTC are orange, while the safes that hold WBTC are blue. These blue safes have another name called “Ethereum”.

2. There is no real BTC in WBTC. It is just a "promissory note" locked in a blue safe.

For example, if BTC is electronic gold, then WBTC is electronic paper gold.

It can be seen that even assets that are personally owned through private keys and addresses may not be the real underlying assets.

Quiz: You have 1,000 USDT in your Ethereum address. How much USD do you have? The correct answer is: 0 USD.

The crypto industry is full of confusing concepts. Take the term "cross-chain" for example. A common narrative is this: you cross-chain 1 BTC to Ethereum, and then you have 1 WBTC in your Ethereum address.

The truth is: BTC can only exist in the orange safe of Bitcoin. BTC can never be "crossed" or "transferred" to other blockchains (safes of other colors), such as Ethereum.

The so-called “cross-chaining BTC to Ethereum”, the real story is:

1. You take out the BTC that you actually own from your own orange safe and give it to another orange safe managed by a company (such as BitGo mentioned above). After this step is completed, you lose your BTC.

2. This company, also known as the custodian, will issue a "white note" on Ethereum, or WBTC, in an amount roughly equal to the amount of BTC you gave to the company in the previous step (minus the handling fee), and then put the "white note" WBTC into your blue safe on Ethereum. After this step is completed, you get the "white note Bitcoin" - WBTC.

It can be seen that whether the WBTC in your hands can be exchanged for BTC depends entirely on whether the custodian is honest and reliable. Obviously, holding and using WBTC must always face third-party risks. This is an unavoidable cost.

WBTC’s design mechanism is to use (1) reliable custodians and (2) a multi-custodian strategy to reduce third-party risks.

Some smart friends may say that by using technical means to automate custody and completely eliminate the involvement of custodians, can't we avoid third-party risks? Unfortunately, the tortuous road of industry development has taught people a bitter lesson: the so-called automated code that eliminates the involvement of custodians cannot escape the clutches of hackers after all.

Code vulnerabilities, hackers stealing coins. The fourth-party risk has become the sword of Damocles hanging over everyone's head. The risk is far greater than the third-party risk. As a result, WBTC is still the most popular and largest (custodial BTC) cross-chain protocol for transferring BTC to Ethereum.

Jiaolian even pessimistically speculates that the difficulty of designing and implementing a fully automated, 100% reliable decentralized cross-chain protocol may be no less difficult than reinventing BTC. In other words, the probability of success is close to 0.

Okay, now everyone understands that as an important custodian behind WBTC, BitGo’s business transfer behavior will have a huge impact on the security of WBTC - in fact, the security of BTC behind it?

What's more, the object to which it intends to transfer is suspected to be controlled by Brother Sun, who has a controversial reputation in the industry, which has caused the community to have great concerns about the safety of assets.

Satoshi Nakamoto What was the original intention of inventing BTC? To eliminate the reliance on trusted third parties.

Don't trust human nature. Don't trust promises. Don't trust anyone.

Only real BTC held on the chain can be safely held without any trusted third parties.

Jiaolian once cross-chained some WBTC into Maker as collateral during the bull market in 2021, but later closed all positions and withdrew at the end of 2021. It currently does not hold any WBTC.

There is a saying that goes, "A gentleman should not stand under a dangerous wall." Let's encourage each other.