Dongzhong reported at the beginning of this month that data from SoSoValue showed that the net subscription and net redemption volume of Hong Kong Bitcoin and Ethereum spot ETFs had been 0 for many days.

Although SoSoValue later officially stated that Hong Kong crypto ETF supports cash and physical subscription, since the ETF shares purchased through physical BTC or ETH physical subscription will not generate cash inflow of the asset, it cannot simply be included in the daily net inflow statistics. volume; but it still cannot change the sluggish trading situation in the Hong Kong market.

Executive Director of OSL Exchange: Hong Kong Cryptocurrency ETF Faces Systemic Obstacles

In response to this situation, Gary Tiu, executive director and head of regulatory affairs at Hong Kong’s licensed cryptocurrency exchange OSL, said during a discussion at Foresight 2024 on Sunday that Hong Kong cryptocurrency ETFs face systemic obstacles. He explained:

In Hong Kong, especially in funds and structured products, there is usually a very rich set of intermediaries between issuers and end investors - brokers, banks, private banks, retail banks, etc., and those intermediaries make money by distributing financial products. made a lot of money.

Tiu said that because ETFs allow anyone to execute trades in the market, the commissions for these brokers are only about 1% to 2% of the commissions for selling structured products, so it is very important for them to offer such products to clients. Few incentives

Therefore, I think Hong Kong's incentive system is one of the reasons why it is difficult for ETFs to develop as financial instruments.

On the other hand, Tiu also said that Hong Kong regulators and financial institutions as a whole still have a negative bias against cryptocurrencies such as Bitcoin and Ethereum, which also has a subtle negative impact.

Hong Kong Cryptocurrency ETFs Also Lack of Dealers and Brokers

Chen Zhao, director of digital assets at Fosun Wealth, also added: Hong Kong cryptocurrency ETFs also lack traders and brokers. He explained: Market participants in Hong Kong are mainly divided into three categories: Western institutions, Chinese institutions and Hong Kong institutions.

- Brokers and traders in China, they are not allowed, or they choose not to handle the product

- For Western financial institutions, there is no need for them to trade these products because they can get more fees and incentives and have easier access to U.S. ETFs.

That said, the remaining players from Hong Kong are very small compared to the two major players, which is a major limiting factor for the growth of Hong Kong cryptocurrency ETFs.

Hong Kong BTC, ETH spot ETF scale is less than 0.5% of the United States

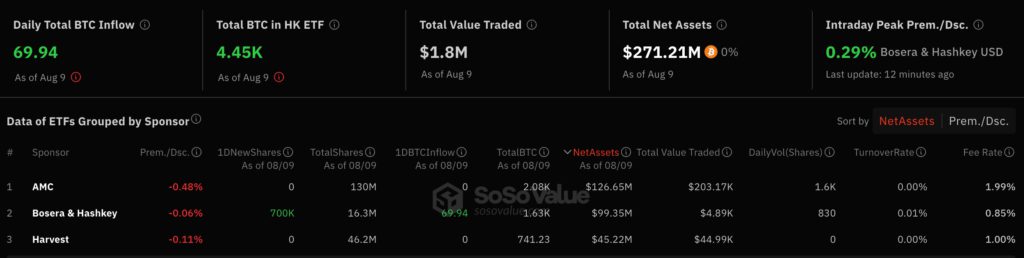

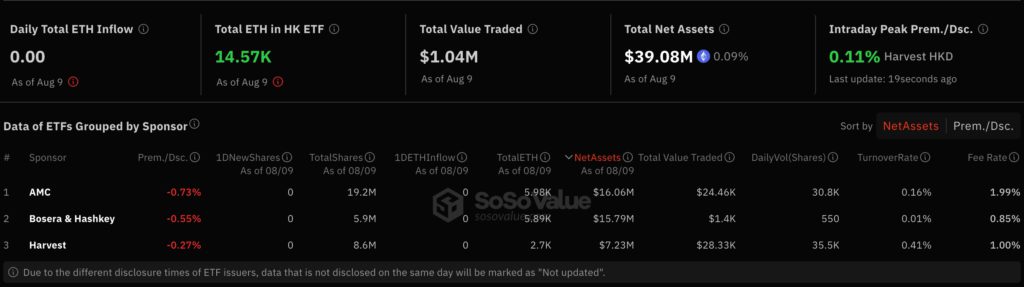

At present, the total assets of Hong Kong's Bitcoin spot ETF are only US$270 million, and the total assets of Ethereum spot ETF are only US$39.08 million. Compared with the US$55.1 billion and US$7.28 billion in scale, the gap is quite large. The two combined are less than the United States. 0.5%.

In general, if Hong Kong’s cryptocurrency ETFs want to continue to improve their market position in the future, they may still need to make great efforts. Hong Kong's dream of becoming a Web3 center still requires continued observation.