“Match has established an efficient social network of value by deeply integrating narratives such as SocialFi, meme effects, and AI technology, solving the problem of accurate matching between users and projects, realizing the combination of social interaction and wealth, and continuing to provide impetus for the Web3.0 social track to break through traditional boundaries.

The Web2.0 world with intensified monopoly effects

In the Web 2.0 world, Internet platforms represented by Twitter, Google, Facebook, etc. are becoming an indispensable part of the lives of most users.

Of course, while providing long-term services to users, these platforms not only attract huge attention, but also continue to monopolize data.

On the one hand, companies like Google or Facebook can store our data for ten years until they can monetize it for their own benefit. After all, there is almost no marginal cost in storing data. Web2.0 platforms that control a large amount of data and attention can not only obtain huge commercial benefits, but also, with the intensification of monopoly and the lack of willingness to share data or open APIs, the interests of users and developers are being exploited.

Web2.0 platforms are usually separated and non-interoperable. This is because in Web2.0 networks, users' data and social networks are usually the moat of the platform. If users are allowed to interact with social networks through third-party applications, the platform's chances of capturing user data will be reduced. After all, users will no longer use products controlled by the platform. If users can simply transfer their network of friends and family to another application, they have no motivation to return to your application.

So in the current Internet world, it is very likely that your parents are Facebook users, you are an Instagram and Snapchat user, and your sister is a TikTok user. But we cannot watch TikTok videos on Facebook and share them with my Facebook friends at the same time, and I cannot move my friend list from Twitter to Thread. So in essence, users do not have the initiative and ownership of data, and it is difficult to manage their own social graphs away from the platform.

At present, the Internet world still does not have a sharing agreement for social applications of the scale of Facebook or Twitter, which is related to the incentive structure of the Internet giants themselves. On the contrary, a Web2.0 product with an open social relationship network will face problems of competition and declining revenue, neither of which may be an ideal result.

The original intention of the Internet was to help people quickly obtain information and communicate, but it is obvious that the current development trend is contrary to this.

Web3.0 represents a new ideology. Everyone who becomes a network contributor, user, or participant also owns part of the network. It emphasizes the value of people and redistributes value in a bottom-up manner through institutional technologies such as blockchain, returning data ownership to users. Web3.0 is ideologically advanced and is expected to improve the various monopoly phenomena that exist in the Web2.0 world. However, judging from the actual development of the social field of Web3.0, its performance is not ideal.

The growth dilemma of Web3.0 social networking

In the field of SocialFi, there are indeed some social ecosystems that have impressed us.

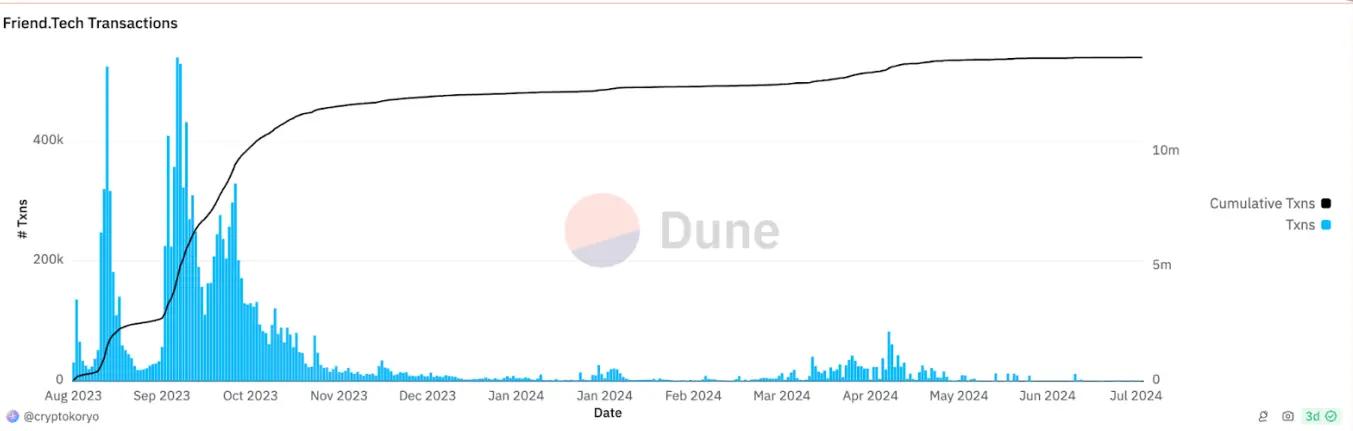

One example is the SocialFi application Friend.tech, which became popular last year. The protocol, based on Key's equity, the social fission mechanism of the joint curve, and the FOMO effect, attracted a lot of attention in a short period of time. The protocol generated more than 130,000 transactions on the first day of its launch. As a financial product based on the Twitter social user network, the SocialFi application has a strong interdependence with Web2.0 social products. Although it does not create new social relationships or introduce any new communication modes, it makes good use of the social graph of Web2.0 products and promotes the financialization and tokenization of influence and social relationships.

Although it made rapid progress in the early stages of development, in fact, after the early explosive period, as the market focus shifted to the inscription field and was squeezed by competitors and imitations, Friend.tech's user activity declined rapidly, and its average daily transaction volume is currently less than 500.

Data source: https://dune.com/cryptokoryo/friendtech

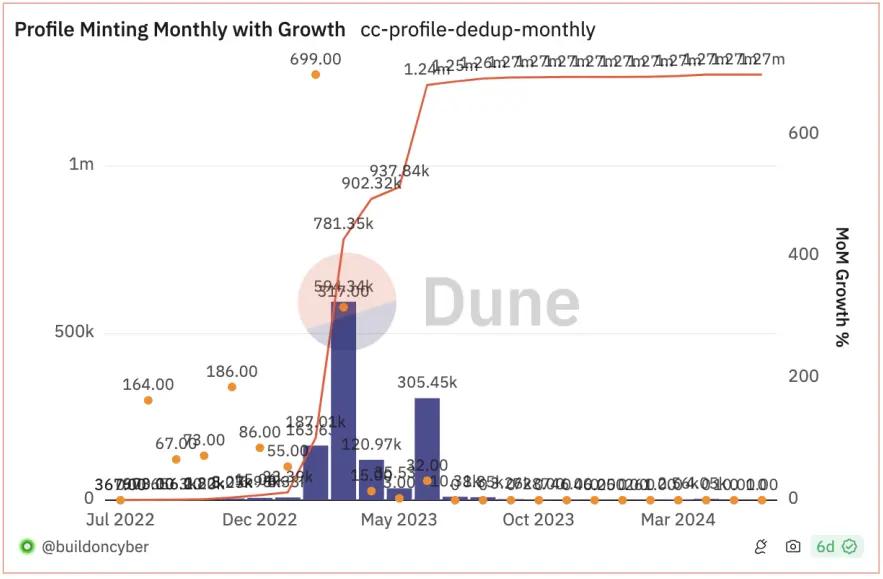

Another example is Cyberconnect, which is the leading protocol layer application in the SocialFi field. Its user pool base is quite impressive, and it was previously able to maintain around 1 million. But after it issued an airdrop in August last year, we saw a cliff-like decline in its growth, and a considerable number of users in the existing user pool also use multiple accounts to obtain airdrop rewards, which means that the Web3.0 marketing method based on airdrops is backfiring on it. From another perspective, the number of users of Cyberconnect, a leading protocol, is relatively small in the social track.

Image source: https://dune.com/buildoncyber/cyberconnect-link3-metrics

In fact, Web3.0 social itself lacks applications that can create a breakthrough effect.

On the one hand, most users are accustomed to using mainstream Web 2 social products on the market for free. For Web3.0 social products, users need to purchase Profile NFTs, pay for Gas interactions, and other payment behaviors to conduct social interactions. This usually costs several dollars but lacks visible profit expectations (especially in Ethereum and other underlying costs are higher), which makes users lack motivation. At the same time, most Web3.0 social applications simply imitate the model of Web2.0 social platforms. In the absence of major innovations, the pain points they try to solve have limited appeal to users, and for most users or creators, these needs are not important.

On the other hand, for non-Web3.0 users, these users have already established a number of mature relationship circles in Web2.0 social products. There are fewer users who give up their original social capital and enter non-customary products. It is difficult for Web3.0 social to divert these users . For native Web3.0 users, in the absence of other major needs, using only Web2.0 social applications such as Twitter, Discord, and Telegram can actually meet their needs. However, for social products, the scarcity of users and creators will eventually lead to insufficient hematopoietic capacity.

In addition, X To Earn, which relies solely on SocialFi, may not be the final answer.

In fact, the long-term success of Web2.0 social products does not rely solely on the WRITE TO EARN model to attract users, but rather on users being able to find a sense of belonging on a social platform and discovering things that are suitable and valuable to them. An example is platforms such as Twitter and TikTok, where products do not rely on rewards, but are able to truly impress users and retain them, and this process also requires the support of long-term high-quality content.

Although the X TO EARN model can motivate users to be active for a certain period of time, like most GameFi applications, it is difficult to generate long-term and sustained attraction to users by relying solely on the X TO EARN model. We have seen that when some one-off incentive events occur and long-term incentive expectations decline, the activity and growth of Web3.0 social protocols will reach a bottleneck. For example, after CyberConnect issued the CYBER token, the token performed poorly, causing the overall performance of the ecosystem to fail to meet expectations.

The lack of high-quality content moat has led to the short life cycle of most SocialFi projects, which eventually no one is interested in. Therefore, to attract high-quality content creators and users, whether in Web2.0 or Web3.0, good social products require the long-term accumulation of the number and quality of users and creators.

Although the overall development trend of the crypto industry is positive, SocialFi has reached an awkward stage of development. In fact, only when the SocialFi product itself achieves better qualitative changes can it further promote the development of this field.

At present, with the emerging Web3.0 social project Match facing the market, the development of the Web3.0 social track is ushering in a new turning point. We have seen that Match pioneered the organic combination of meme narrative and AI technology with SocialFi to establish a set of efficient and valuable social networks with wealth effects.

As a protocol layer, Match supports projects in building scalable social graphs and innovative asset solutions based on meme economy and AI technology. This can achieve accurate matching between users and projects, better distribute wealth, promote users' enthusiasm for participating in ecological construction and using products, and promote the continuous formation of social effects among users to break the growth dilemma of the track.

Its AI solution can further provide users with a series of personalized services, accumulate high-quality content, and match supply and demand on the content side. Based on massive social data and user data, it will continue to promote the innovation of its AI model, thereby continuously helping the Match ecosystem build a solid moat.

Gamebreaker Match

Match is an innovative Web3.0 social ecosystem, which is based on AI and data, and is committed to breaking down barriers to value social interaction. Match deeply integrates meme elements, builds social scenarios based on meme culture and wealth attributes, and creates a set of composable social graph systems. On this basis, it further builds social value based on AI technology, expands the scope of dissemination of highly accurate and effective content, and realizes the transformation from ecology to data and then to value through massive high-quality instant content.

From the product itself, Match has created a unique identity layer design based on the underlying data. This identity layer serves as a container for the user's unique Web3.0 identity. After entering the Match ecosystem, the user will first generate an identity identifier, which will serve as a carrier for the user to build a Web3.0 graph. This identity layer design not only includes basic personal information and investment preferences, but also integrates the user's interaction history, social network and behavioral characteristics, thereby constructing a comprehensive and three-dimensional user portrait.

The Match registration system can effectively screen out real users, making robot accounts and bulk-growing accounts unprofitable, while giving more incentives to high-quality content creators. In addition, Match strives to allow every real on-chain user to complete the identity transformation here, which will help attract a large number of real users.

Through this unique identity layer design, Match can provide users with a more personalized and accurate social experience, and aims to build a social system based on real identity to further enhance the trust and interaction quality between users. Based on this identity layer, Match can further establish account abstraction and chain abstraction, greatly reducing the threshold for Web2.0 users to enter the ecosystem, and providing a foundation for cross-chain interoperability of the entire chain and global Web3.0 social interaction across the ecosystem.

At the same time, Match can aggregate the scattered market data to the application layer, and conduct in-depth analysis and processing based on AI components to mine more valuable information. Accurate analysis of market behavior data allows users to find content and interactive objects that meet their interests and needs more quickly, reducing information overload and inefficient browsing time. This not only improves user satisfaction and stickiness, but also significantly improves the overall competitiveness of the platform.

From the product's own characteristics, it essentially represents the characteristics of Web3.0 social networking, and on this basis, it provides support for the migration of existing mature relationship circles and the assetization of social graphs. Match is not just a competitor to Web2.0 social products, but hopes to complement the Web2.0 social ecosystem and make up for the original deficiencies.

Take Twitter as an example. Although it is currently an important gathering place for Web3.0 Native users, it does not have the ability to segment portraits for different roles (such as value coin users, meme coin investors, airdrop parties, and Alpha users), so Match is expected to further make up for this deficiency. At the same time, Twitter requires users to subjectively follow many KOLs, wasting a lot of time looking for information, and is not directly combined with on-chain data monitoring. If you want to know real-time on-chain data information, you need to follow specific accounts, and this information is often drowned in the Twitter information flow unless users frequently pay attention to the updates of these accounts. Match will directly output data conclusions based on direct combination of AI, and its value will continue to highlight.

From the perspective of ecology, Match itself is also a low-level protocol with programmability, including service layer and infrastructure layer, as well as a series of AI components. Based on this infrastructure layer, Match supports the establishment of upper-level applications based on the bottom layer, and forms linkage with its identity system, and provides support to developers in a modular way, preparing for the subsequent outbreak of the social ecology.

User growth strategy

Cultural foundation and wealth effect based on meme

Match's growth strategy is not to drive growth through Web3.0 marketing like Lens Protocol and CyberConnect. Active marketing usually has drawbacks such as lack of scale effect and over-marketing, and it will backfire on the long-term development of the ecosystem.

One of Match's growth strategies is meme. Through meme culture, it hopes to build a more centripetal social ecosystem. At the same time, through the integration of the wealth effect brought by meme with the underlying social layer, it will further promote the fission of the ecosystem and continuously form growth potential.

In fact, meme culture has its own unique value logic. In traditional finance, the true value of assets is more based on valuation models, thereby finding undervalued assets. This method may effectively help financial investors to further find potential investment targets, thereby gaining returns through more rational thinking. However, in the crypto world, this valuation model seems to be "unsuitable". For example, assets such as BTC and LTC that have no dividends and no cash flow are usually regarded as "Ponzi" by the outside world, and traditional old-school investors represented by Warren Buffett, the stock god, are even more dismissive of crypto assets.

In fact, the value growth of the crypto world depends on consensus, not just valuation. The crypto world is a new ideology that claims to be decentralized, and brings together a group of people with common beliefs into a community, relying on the most basic supply and demand model, based on unchanged supply and increased demand, to continuously gain value growth.

Of course, compared with some "classical" crypto narrative genres based on technology and applications, the emerging crypto genres driven by meme culture seem to have become more and more popular after the Dogecoin explosion in 2020. For the crypto community, in addition to the fun and precise communication, the viral spread of memes also brings community cohesion and "wealth effect", and the spread effect of a good meme cultural narrative is often better than that of a long article.

Crypto meme culture usually spreads rapidly in a short period of time, rapidly increasing the demand for meme tokens while keeping the supply unchanged, attracting more people to chase meme assets, forming fomo (fear of missing out), and constantly attracting more "believers" to participate. In fact, meme crypto culture has a set of predictive logic and can achieve the effect of "instant precise communication".

In the last round of meme craze, the meme effect of Doge and Shib was sustained. Doge and Shib are also being accepted as a means of payment by some traditional commercial institutions, such as AMC Theatres, Uber Eats, and fresh food company meatmeCA. The new development narrative obtained through meme out of the circle is backed by a strong community scale.

Therefore, from the perspective of Match, the growth driver of the ecosystem does not have to rely solely on X To Earn and Web3.0 marketing. The meme growth theory has been verified in practice. Match creates a wealth effect by introducing new gameplay, using meme culture to resonate with crypto users, and the resulting strong community consensus and driving force for the development of the ecosystem.

The popularity of memes can lay the foundation for building a large-scale traffic pool. Based on its easy-to-understand features and high return potential, it will be able to quickly attract a large number of retail investors to Match. This broad market participation will also provide a sufficient user base for building the SocialFi platform. Through the popularity of meme culture, the platform can quickly accumulate a large amount of user data, laying a solid foundation for subsequent AI analysis and social interaction.

Accumulation and precipitation of high-quality content to build a moat for ecological development

As mentioned above, high-quality content is usually an important foundation for building a moat in a social ecosystem. In the Match ecosystem, AI technology helps the platform build a content system and provides users with a series of functions to meet users' investment and transaction needs in the Web3.0 world to the greatest extent and with the lowest threshold. While optimizing content matching, it further promotes the growth of the wealth effect.

AI is an important factor in Match's content driving and matching. In Match's ecosystem, KOLs (key opinion leaders) serve as an important bridge between the platform and users, playing the dual role of interpreters and user retention grabbers. Through their professional insights and strong influence, KOLs can not only help users better understand various information and opportunities on the platform, but also effectively drive the fan economy and promote the improvement of user activity and stickiness.

KOLs can provide users with in-depth and valuable content interpretations, helping users make wise decisions in a complex information environment. This precise content output not only enhances users' trust and reliance, but also enhances the platform's professional image and brand influence. This role not only plays a key role in information interpretation and user retention, but also provides a strong impetus for the platform's continued development driven by the fan economy. Match will give full play to the potential of KOLs to create an efficient, transparent, and win-win social financial ecosystem, create more value for users, and achieve sustainable development and innovation of the platform.

KOL is the initial foundation for establishing the platform's content system. On this basis, the AI system will help users match with high-quality KOL content, which will bring users a better content experience and continue to generate revenue for KOL, thereby encouraging KOL to continue to contribute high-quality content output.

Therefore, based on AI, it can better help users discover clues to high-quality content, or discover early value, and provide key and timely information. The valuable projects will then be fermented through in-depth analysis by the industry and KOLs, and are expected to generate discussion and popularity.

Based on the effects of AI, the investment strategies and information matching for different people, Match itself is also attractive to KOLs. This is similar to the fact that before TikTok first expanded into overseas markets, platforms such as Twitter, Instagram, and SnapChat were already popular, but TikTok relied on its algorithmic capabilities to solve the problem of user retention, had seed users, attracted KOLs, and had the ability to incubate KOLs internally. Through the accumulation of KOL content, it further retained users and gradually became a unicorn.

At the same time, AI itself is also a tool for producing high-quality content . In the rapidly changing cryptocurrency market, Match uses its extensive social data, combined with state-of-the-art AI analysis, to provide users with unparalleled insights into social activities and market sentiment. This advanced integration of AI technology not only enhances the ability to track and analyze social interactions, but also provides key market sentiment indicators, which are essential for making informed decisions. This forward-looking approach enables investors and traders to take advantage of emerging trends and narratives, occupy a favorable position in the market, and accelerate the wealth effect trend of users.

The huge user scale and high frequency of AI call rate provide feedback for the training of AI models through huge data sets, which in turn brings more scenarios and applications to users and achieves precise matching. Users benefit and thus form a positive cycle, namely the "AI flywheel."

So we see that AI technology is becoming a key force in driving the market development of the Match social ecosystem. Similar to how the iPhone led the era of smartphones, AI will bring revolutionary changes in the field of cryptocurrency. Through intelligent data monitoring, accurate user portraits and AI recommendation engines, the platform can quickly discover key investment opportunities and help users find the most valuable investment opportunities in massive amounts of information. AI technology can not only significantly improve the efficiency of users' investment decisions, but also significantly reduce the operating costs of the platform, thereby achieving real cost reduction and efficiency improvement. In the long run, AI-driven will not only enable Match ecosystem users to stay for a long time due to the high-quality services and accurate investment advice provided by the platform, but also have the ability to continue commercialization.

Most Web3.0 social ecosystems have certain shortcomings in the long-term accumulation of high-quality content, while Match can not only achieve supply and demand matching of high-quality content based on AI technology, but also enable high-quality content producers and demanders to continue to benefit from it. At the same time, AI is also a tool for producing high-quality content. Through continuous training and learning, it will greatly improve the scale and quality of the Match ecosystem content pool and enhance the sustainability of Match ecosystem development. On the other hand, as a highly promising narrative direction, AI also represents that the Match ecosystem has high development potential. With the interaction with more cutting-edge technology fields, the future development valuation of the Match ecosystem will continue to be improved.

Overall, based on the above system, Match is building a value flywheel system based on the four major elements of wealth, traffic, social, and information, that is, the wealth effect brings traffic aggregation, traffic aggregation derives social scenarios, social scenarios construct information dissemination, and information dissemination amplifies the wealth effect.

Match's asset system

In order to enhance social interaction and promote closer connections between users, the Match ecosystem has designed an economic model to support the development of its social system.

In the Match ecosystem, there are two important assets: Match NFT and RFG tokens. Match NFT is an incentive tool for users on the platform. By holding and using NFT, users can obtain RFG tokens, unlock more platform functions and gain higher social value.

RFG Token

RFG is the project's Meme token, referred to as Refugee, which symbolizes blockchain digital nomads, carries a self-deprecating and playful meaning, and is rooted in Meme culture. RFG tokens are completely owned by the community, with no private placement, low circulation, and low market value. As a community-driven meme asset, it is completely linked to the community consensus and has super high appreciation space. Users can stake RFG tokens and earn income from the Match network. Currently, users can choose to stake RFG tokens in different periods such as current, 60 days, 90 days, 180 days, and 360 days in the network. The longer the staking period, the higher the yield.

At the same time, users can also accelerate the income from staking Match NFT assets by staking RFG tokens. The longer the staking period and the more staking, the higher the income bonus provided. This bonus factor is up to 2 times. This also means that RFG tokens have remained tight since they were launched on the market.

NFT Assets

Match defines its NFT assets as a social catalyst, aiming to make them play an important role in social interaction through joint staking mining. In the Match system, NFT staking is the only way to obtain RFG tokens in the early stage, and it is also a reward and incentive for NFT holders. Users can become native residents of the Match ecosystem through staking and enjoy a series of rights and interests.

The pledged NFT not only increases the mining income of users, but also optimizes the process of pledge, income distribution and exit settlement through dynamic allocation algorithm. At the same time, the Match Square function derived from the AI big model can intelligently and accurately recommend matching relationships to ensure that the assets pledged by users can maximize their potential income, which is expected to improve the user's return on investment and enhance the actual value and function of NFT.

Match has a total of 45,000 NFT assets (90% of which are auctioned to the community and 10% are used for team operations), and there are three types, representing different mining weights, numbered α, β, and γ. Among them, Match γ NFT has the highest mining weight, so its value is relatively higher. (Various weights: α 1.1--β 1.2--γ 1.3)

In fact, whether it is the acquisition or staking of NFTs, it is interesting and promotes interaction between users based on benefits.

In terms of acquisition, 90% (40,500) of Match NFTs will be auctioned in a decentralized, unpriced form. During the auction, the shares will be sold according to the bid amount, and the unsuccessful bids and the part of the bids that have won but exceeded the bid price will be returned to the bidders. Each address can participate in up to two auctions, and can obtain up to two NFTs in each auction. The specific number of people who obtain two NFTs is based on the algorithm. At the same time, the type of NFT obtained by the user is also random, and the open source algorithm ensures the fairness and justice of the auction process. This means that NFT itself can be distributed to users in a more fair way, avoiding the negative effects of malicious users and krypton gold users on the ecological economic model.

In terms of staking, the novel staking model makes NFT an important tool for participating in Match social activities.

From the perspective of traditional staking models, users are usually independent and rarely interact with each other. Match has created its own SMS mechanism and Match NFT staking ecosystem to create a highly sticky community in all aspects.

For this purpose, Match has set up three types of NFT staking pools, namely single NFT pool, double NFT pool and triple NFT pool, aiming to attract users to actively interact and increase the social activity of the product.

Single NFT pool: Users pledge one NFT for mining, which provides stable income and a low annualized rate of return.

Dual NFT pool: Users stake two NFTs in pairs, in any combination (such as α and β, α and γ, β and γ), with an annualized rate of return higher than a single pool.

Three NFT Pools: Users stake three NFTs (α, β, γ) at the same time, with the highest annualized rate of return.

Due to the differences in the yields of different NFT pools, the Match platform encourages users to find teammates on the Match Square page to form a team for staking and build a network of social relationships. In the Match Square, users can find suitable teammates, communicate through social tools, and reach a consensus on jointly staking NFTs to increase yields. On the Square page, if a user holds an α NFT, he can find teammates holding β or γ NFTs. Through negotiation, one person produces an α NFT and the other produces a γ NFT, and they enter the dual NFT pool for mining together. Users can also form a team with multiple people to build a three-NFT pool for mining.

RFG tokens and NFT asset value growth logic

RFG Token

RFG token is the main asset of the Match ecosystem. As a meme asset, it has no pre-mining and early market share, which means it has no risk of selling pressure in the early market. Its output method is limited to RFG single-coin staking mining or NFT mining.

From the demand side of RFG tokens, the first is the pledge demander. As mentioned above, the staking income of RFG in Match is related to the staking period and the amount of staking funds, and staking RFG tokens will increase the yield of NFT staking. There will be many pure RFG token holders and NFT holders in the network. In order to pursue higher returns, they will have a higher rigid demand for RFG tokens, and there will be many pledgers who choose medium and long staking periods. This is an important factor in limiting the flow of RFG tokens and forming early rigid demand.

RFG token is a meme asset. As the ecosystem develops, it will derive multiple application scenarios and uses in the expansion of the social system. From the consensus level, the value social graph built by Match provides a huge user base, paving the way for RFG to build consensus.

In general, RFG tokens will always be in a deflationary state, and the price will continue to rise. The rise in the price will once again encourage more users to hold and pledge for a long time, forming a virtuous cycle of value growth.

NFT Assets

From the perspective of NFT acquisition, the purchase of NFT assets is random, that is, it is uncertain whether a user can obtain NFT each time they participate in an auction. As the number of auction participants increases, the probability of obtaining 2 NFTs gradually decreases. The total number of NFTs available for sale is limited to only 40,500. This also means that NFTs are extremely scarce and difficult to obtain due to their randomness and fixed total amount.

From the output side, the value of RFG tokens is on the rise. At present, the FDV is only 4.5 million US dollars. Compared with the market value of DOGE, SHIB and other tens of billions of US dollars, the RFG token has a potential increase of more than 100 times. The staking of NFTs is an important way to produce RFG tokens. Therefore, staking NFTs and joint staking to increase the yield will become the main demand. This will further increase the demand for NFT assets and increase their value.

The rise of RFG tokens and the strong demand for joint pledge will further strengthen the close connection of the ecosystem. Accelerate the cohesion of the Match social ecosystem in the social direction and continue to promote new growth and fission. At the same time, this also promotes the continuous innovation of AI components, which will benefit the Match ecosystem in the long run. Ultimately, it will accelerate the rotation of the flywheel of "wealth effect brings traffic aggregation - traffic aggregation derives social scenes - social scenes build information dissemination - information dissemination amplifies wealth effect".

Ecological development potential

Previously, Xin, a co-partner of Old Fashion Research (OFR), said in his article that product strength, subculture creativity and a good token model are considered as a triangle. A successful project usually needs to have at least two of these three points. If a project wants to attract users and survive for a long time, it needs to have all three elements at the same time.

As an innovative Web3.0 social ecosystem, Match is able to better balance the above three factors. Based on a powerful social protocol foundation, an extensible social graph and continuously improving AI components, it meets the needs of users in terms of social interaction, investment and capturing high-quality content, and continuously accumulates users and high-quality content. Based on the cultural attributes of meme, subculture is created, and the culture is continuously expanded and extended, making it an important cornerstone for community cohesion and wealth growth capture. Based on the meme token RFG and Match NFT assets, it can deeply empower its social system and continuously accelerate the rotation of the ecological value flywheel based on economic factors. Compared with the vast majority of existing Web3.0 social ecosystems, Match has more potential for customer acquisition and long-term survival.

From the perspective of Web2.0 social networking, social networking is one of the most important foundations of the traditional Internet and has huge market potential in the capital market, with more than 4.62 billion users, equivalent to 58.4% of the world's total population. Whether it is Facebook, whose peak market value exceeds 1 trillion US dollars and whose global product series has an average daily active user of nearly 3 billion, or the valuations and market values of a number of social operating companies such as Twitter and Snapchat, they all show that the ceiling of the social track is extremely high.

On the other hand, according to Triple-A data, there are about 420 million cryptocurrency users, accounting for less than 5% of the world's population. Web3.0 social users account for an even smaller proportion, indicating that Web3.0 social is still in the very early stages of development. As a potential killer application, Match is expected to quickly capture the market during this window period and become a long-term leader in the development of this field.

In addition, Match's narrative covers potential areas such as SocialFi, meme, and AI. With the support of multiple narrative directions, it is expected to significantly increase the valuation of the Match ecosystem, and its development potential is far higher than the current top SocialFi application. With its long-term development, the ecological value attributes will also be further reflected in RFG and Match NFT.