Author: BREAD, Translator: Jinse Finance xiaozou

It’s critical that Ethereum abandons its ultra-sound money narrative — I’m not sure if that’s a good thing or a bad thing.

Why do I say this? Because now that users have migrated from mainnet, it is unlikely that we will see L2 regain the ETH burn levels seen before the Dencun upgrade (March 24th).

L2 is:

Get execution rewards

Own user relationship

Scaling throughput while keeping Ethereum costs relatively constant (in the case of Alt-DA)

1. The world we envision

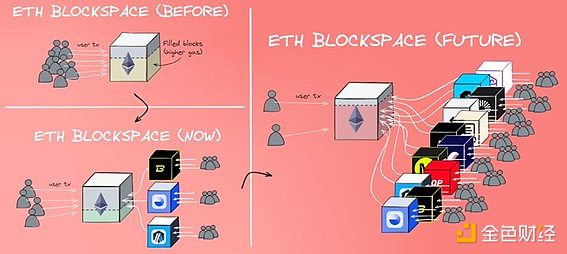

The modular roadmap has always had significant issues with user migration, and as on-chain participants migrate to one or a few of their favorite L2 solutions, activity on the mainnet will drop. This is to be expected.

Over time, the user flow will basically look like this:

Activity will decline, with a small number of users spread across several early L2s, mainnet, and Alt-L1s.

Then a large number of L2s will stimulate a surge in activity, and these L2s will be extremely active and actively compete for block space.

ETH block space demand (from less cost-sensitive users, i.e. L2), burn levels recovered, and the Ethereum ecosystem both maintained its ultrasonic currency narrative (ETH deflation) and attracted large-scale users through scalable L2. Great!

However, things are different after Dencun is upgraded.

2. What we see

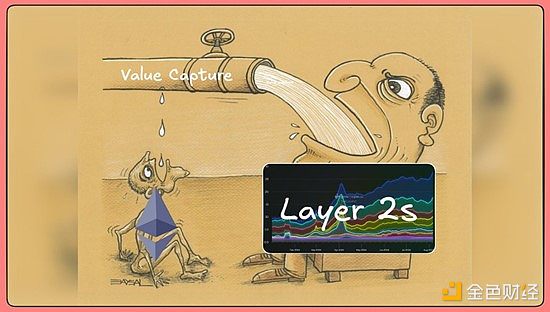

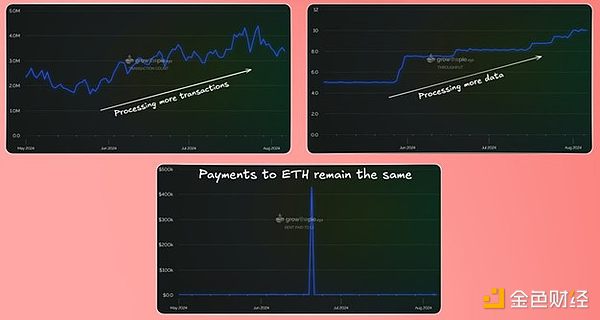

Now that L2 has been able to significantly reduce transaction costs with the introduction of the blobspace mechanism, we are witnessing the formation of another trend: L2s are swallowing up more and more transactions and throughput while keeping Ethereum costs relatively stable.

Here are the Base metrics for the past 90 days:

Trading volume increased by about 75%

Throughput increased by about 100%

Ethereum payments remain flat

What happens when the L2 ecosystem grows infinitely without additional ETH spending? They devour other L2 users, and no additional ETH is burned. They are like black holes, absorbing users within the Ethereum ecosystem.

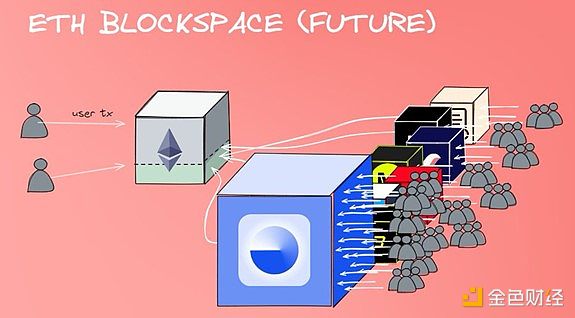

This means you will (most likely) end up with something like this:

The exponential law takes effect, with the dominant L2 absorbing a disproportionate number of users, while Ethereum remains underutilized because the cost of paying into Ethereum remains relatively constant despite user growth.

This is why I think it’s time to abandon the ultra-sound money narrative: because it likely won’t be a determining factor for a long, long time (especially on crypto timescales).

I don't think it's a bad thing either. If you want ETH to be a currency, then now it's a settlement and security chain, not a user chain, and inflation is not a bad thing, it will help spread quickly in all these ecosystems.

Making it (artificially) scarce would compromise some of these properties (see Bitcoin). It’s a nice narrative and it does matter.

3. Other ideas

Please note that these are all remarks about ultra-robust narratives, not about the prospects of the asset itself, and I remain bullish on Ethereum assets.

I think it would be better for the core developers to continue to push the modular roadmap rather than fully reverting to L1 extensions. They should have tried to extend L1 earlier before giving in to L2, but right now, user education and the further benefits to the L2 economy from it outweigh the benefits of L1 extensions.

Make some optimizations (e.g. block time) to reduce unnecessary complexity like pre-confirmations, but be sure to stick to it.

The importance of ETFs to ETH cannot be overstated. They are structural game changers and all current talk will be irrelevant to them in the next few years.

Ironically, L2 abuse of ETH is bullish? If I were a corporate entity looking to make money from my user base, Coinbase has laid out the perfect blueprint for me. So that means I am still in the Ethereum ecosystem, continuing to scale the narrative, but not buying into it. Not sure which side of the pendulum is more important.