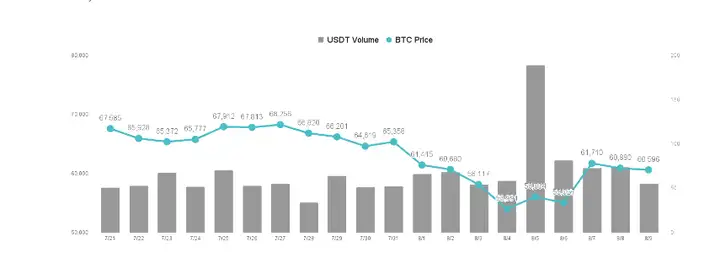

Last week, both the U.S. stock market and the cryptocurrency market saw roller coaster-like trading scenarios. Bitcoin fell from $64,000 to $60,000 in an instant last Monday, and continued to decline with the panic selling of U.S. stocks. The lowest price even reached $49,000. The decline was nearly 25% in less than a week. Due to the large decline, traders who opened contracts with more than five times leverage were liquidated, and market confidence was once very low.

For more information, please visit Weibo Tuantuan Finance here .

However, when the market was falling wildly, any reason could be explained, and the community was filled with a very pessimistic mood. At that time, prices were falling every moment, and many people said that cryptocurrencies would fall even lower and tried to short the market. Subsequently, there were continuous surges and plunges, and the daily news topics were basically bullish, saying prices would rise, and bearish, saying prices would fall.

When the Bank of Japan announced that it would not raise interest rates again, the market rebounded strongly, and Bitcoin rose from US$50,000 to US$54,000. After the US government released optimistic employment figures, the price even rose back to US$62,000. In just two days, the price difference reversed by 25%. This time, a large number of short orders were forcibly liquidated. At this time, the community was filled with an optimistic atmosphere, and the media once again brought out the trend that the US economy was better than expected. At this time, funds began to buy the dips risky assets again.

The ever-changing trading trends and economic data make people feel like they are living in a parallel world every day. The sharp rise and fall have doubled the difficulty of trading, and we don’t even know the context behind it. At the same time, prices go up and down, and the social trends are constantly changing. The market is currently in a stage of rapid deleveraging and is constantly clearing market chips. If the cryptocurrency market can successfully survive this volatility, the increase after the interest rate cut at the end of this year will be worth looking forward to, and it will only be a matter of time before Bitcoin returns to $70,000.

It is expected to stabilize the chips under the volatility cleaning

The sharp price fluctuations in the cryptocurrency contract trading market last week threw many people out, and both short and long long were likely to suffer heavy losses. As just mentioned, prices either short or plummeted every day, and finally approached flat, causing trading positions with slightly higher leverage to be easily forced to liquidate. Contract trading is extremely difficult, and under the premise that the situation is unclear, it is still safer to hold spot.

However, what makes the market curious is that even with the support of the ETF listing theme, the price decline of Ethereum is more severe than that of Bitcoin. The reason is that the investor funds raised before the listing all fled in this wave of panic. The relatively large net outflow of funds and the relatively shallow market liquidity made the decline of Ethereum even heavier. The weekly decline once lagged behind Bitcoin by more than 10%, but fortunately, there was subsequent buying to make up for the rise and narrow the gap.

Although cryptocurrencies will continue to fluctuate for a while in the short term, the more the topic of the US economic recession is hyped, the higher the probability of the Fed cutting interest rates will be. Recently, the market believes that the Fed will definitely have a preventive rate cut in September. According to CME interest rate futures, about 45% believe that the rate will only be cut by one basis point, and another 55% believe that the rate cut will be 2 basis points. In short, the Fed’s interest rate cut is almost certain to hint to the market through various channels, and the interest rate cut will be conducive to the rise in crypto asset prices.

At present, the trend of interest rate cuts in the medium and long term has been determined. When the Fed starts to really cut interest rates, the market will realize that the value of the US dollar, which has maintained a strong trend for two years, will really decline. At that time, the prices of Bitcoin and other risky assets will continue to rise. Faced with the hidden danger of economic recession, the US government can only continue to print money to save the economy. Judging from the recent measures of the Fed directors and the US government, the global economy will remain loose in the long run and the inflation target may be raised from the past 2% to 3%.

Under this scenario, funds will definitely flow into Bitcoin as an anti-inflation tool, reproducing the upward trend in the second half of 2020, and benefiting other cryptocurrencies. Considering that this wave of panic selling is too strong, most traders with insufficient confidence or excessive leverage have exited the market, and the subsequent upward momentum will be healthier. We still believe that Bitcoin has long-term growth potential, and the reasonable price this year is also US$70,000. The current trading price will gradually increase according to the extent of future interest rate cuts.

Current market conditions

The market is now starting to correct again. Large funds should beware of negative news this week and withdraw early.

Three possible negative factors this week

(1) Iran begins attacking Israel

Iran held military exercises yesterday, which will last until Tuesday, and the exercise troops are missile forces.

Israel began preparing for a possible Iranian attack this week.

(2) BTC in Mentougou moves

Two weeks ago, a trial transfer transaction of BTC took place in Mentougou

In the next 1-2 months, there will be movement

(3) Inflation data is released, which may be higher than expected

If the above negative factors occur, it is possible to go to 5.5 or 5.3. If Iran is still bluffing this week, Mentougou still does not move, and data shows that inflation has subsided, the market can stabilize at 60,000, then there should be no further sharp drop.

Focus on two data this week

At 20:30 on Tuesday, the US PPI for July was released. A result higher than expected was bearish, while a result lower than expected was bullish.

At 20:30 on Wednesday, the US CPI for July was released. If it was higher than expected, it would be negative, but if it was lower than expected, it would be positive.

The market usually falls before the data is released, and those who are short can choose to buy the dips at the bottom.

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or private TTZS6308. All information platforms are Tuanzi Finance .

I plan to accept three more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.