Author: Luke|DeFi

Before we start discussing ETHENA, let’s move the timeline to May 2022.

At that time, the issuance of UST broke the record high, and various exchanges began to gradually support the trading pairs of UST against mainstream cryptocurrencies (such as BTC/ETH/SOL). The Terra ecosystem was full of vitality, and the mother currency Luna hit a record high at the beginning of the year and remained strong in the downward market in Q1; after several unpegging and re-pegging, the market seemed to have believed or Terra believed that the algorithmic stablecoin model it designed was indestructible.

However, everything ended in a death spiral. After the dust settled, the market was left with a mess - billions of dollars of bad debts of Genesis and 3AC, the subsequent collapse of Celsius and Blockfi, and the bankruptcy of tens of millions of Korean families behind them.

To some extent, the collapse of Terra brought/marked the real beginning of the last bear market, which reached its climax when 3AC was liquidated (how many people still remember the three-digit ETH in June 2022?), and finally ended when FTX fell. After that, it was the well-known rebound (the author does not think that the market from the second half of 23 to the present can be called a bull market, so I will not elaborate on it here).

After that, the algorithmic stablecoin track was silent for a long time. Until the beginning of this year, ETHENA came out with its synthetic asset concept.

What is ETHENA? How does it work?

The author tries to use the simplest description to help readers understand the operating principle of ETHENA.

If Xiao Ming has 1 ETH, Xiao Ming chooses to deposit 1 ETH in ETHENA.

At this time, the price of ETH is 2500 USD per coin. Xiao Ming gets 2500 USDe after depositing ETH.

Xiao Ming can pledge USDe to obtain the high APY rewards provided by ETHENA.

Where do these rewards come from?

After receiving the ETH pledged by Xiao Ming, the project team of ETHENA will open a 1x short-selling coin-based ETH contract in several centralized exchanges, and the liquidation price of this contract is always 0.

The income comes from the funding rate income brought by short in the currency standard.

ETHENA has drawn a beautiful picture for exchanges, VCs and users - a synthetic dollar composed entirely of on-chain assets, with no risk of liquidation, which can contribute contract and futures fee income to exchanges and provide users who deposit money with a good return on their years. It seems that there are no losers in this game - at least that's what it looked like in early April when the ENA token list was listed.

More than a month before LIST, ETHENA completed a round of financing, with a valuation of 300 million US dollars and 14 million US dollars in financing. In this win-win game among exchanges, VCs and retail investors, VCs are the first to win. Even at today's price (ENA is quoted at about 0.3 US dollars on August 9, 2024), the VCs who invested in the last round have a return on investment of up to 15 times, not to mention the ATHs that were repeatedly set in early April.

The author does not intend to criticize ENA with unfounded conspiracy theories, "death spirals" and the replica of LUNA on ENA, like many FUD KOLs did when ENA was just listed. Fundamentally speaking, ENA is a rare innovative product in the DEFI field in this cycle. Compared with ZKL2, which is a repetitive process, Gamefi, which is dead after each launch, cross-chain bridges, which are the hardest hit areas for VCs, or the girlfriend coins on BN, ENA at least has valuable and real innovations that users pay for. Too many idiots have done the repetitive process. Even though ENA has many problems, the good thing is that it is a good project created by an excellent team driven by an excellent IDEA.

The ENA team has a grand vision, but the facts seem unable to support their grand vision.

In the ETHENA dashboard, the latest data shows:

They have accumulated positions of more than $17 billion in more than a dozen CEX/DEXs.

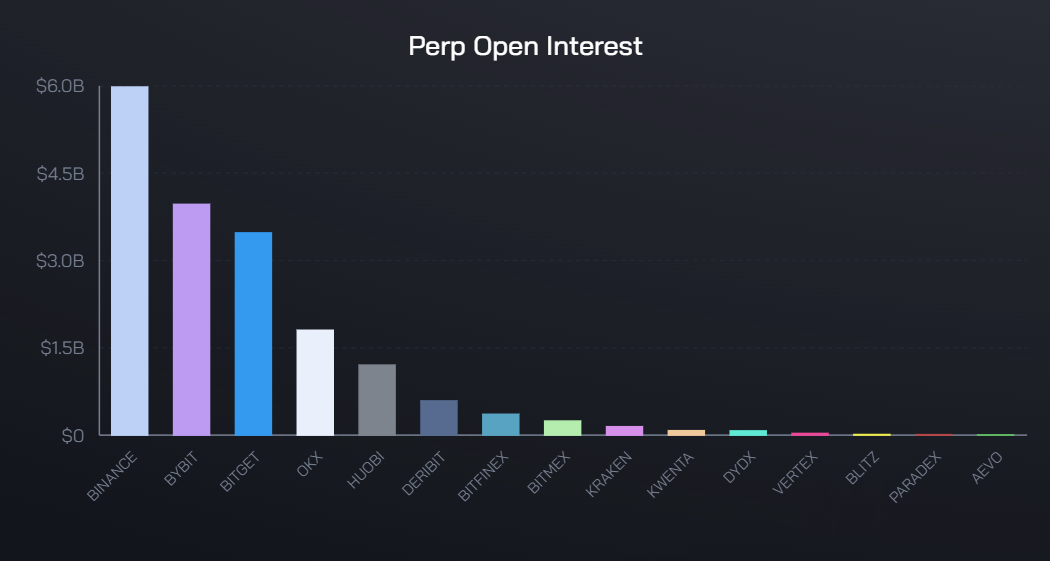

Taking BN as an example, in order to guarantee the income of ETH staking users and USDe, ETHENA opened a contract position of 2.8 billion US dollars in BN.

Here, I don’t know whether the data of ENA or BN is wrong. I simply added them together and found that the total open interest of BN’s current ETH-based and U-based contracts is approximately US$4.1 billion.

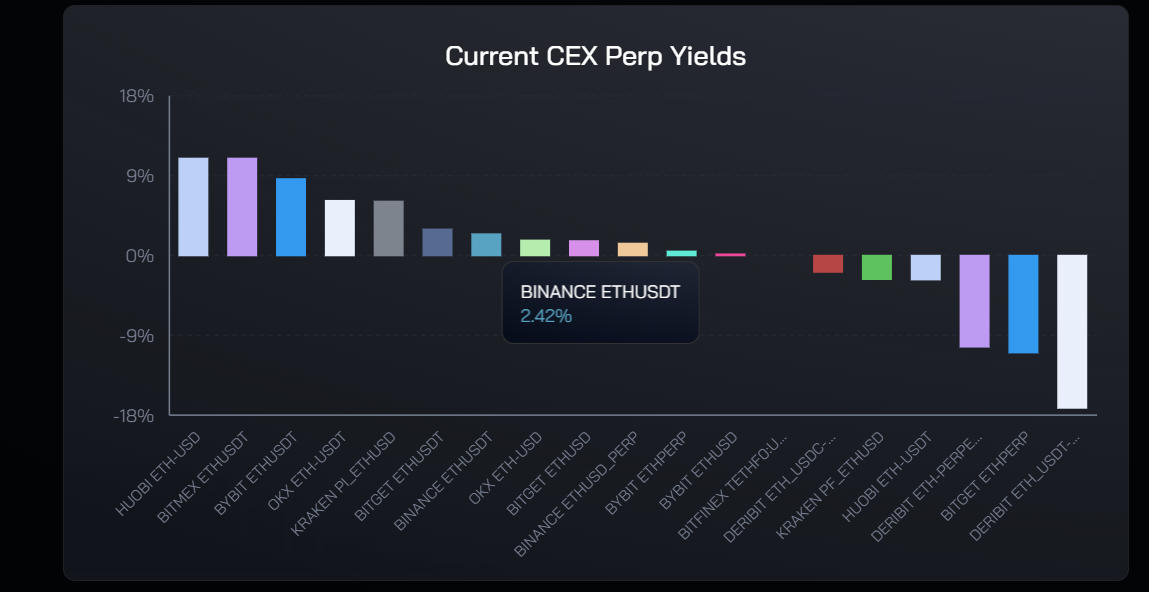

If ETHENA really opened a contract position of 2.8 billion US dollars, then the contract funding rate APY displayed in DASHBOARD would definitely not be a positive number.

When a counterparty holds more than half of the total position and the direction is the same, the funding rate must be opposite. That is, if ETHENA opens a short position in the ETH contract they claim (regardless of whether it is coin-based) with a leverage of 1x, then its contract funding rate must be negative.

One of BINANCE and ETHENA must be committing fraud.

Considering that the author may have miscalculated/omitted the transaction volume/position, it is not feasible for ETHENA to give the contract funding rate as income to users to support the value of USDe and encourage more people to mint and use USDe.

The most important thing is that the current trading volume of various exchanges is far from enough to meet ETHENA's ambition for native synthetic assets. There is a stalk on the Chinese Internet: the bigger xx, the smaller xx. Here I can say that the more ETHENA has, the smaller the user's income.

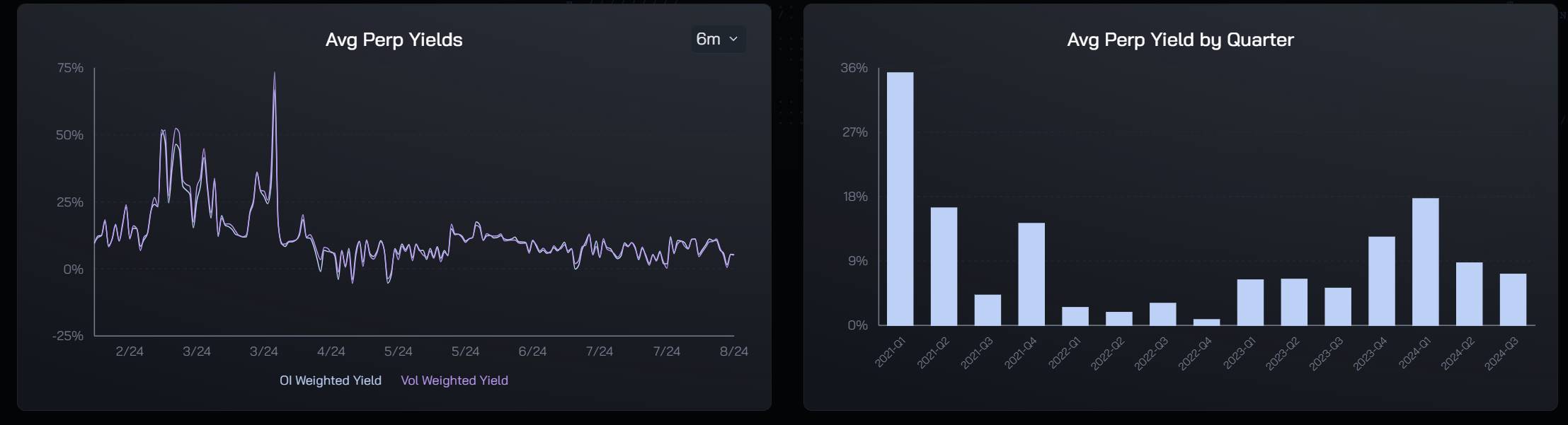

There is a ceiling on the trading volume of CEX and DEX. The increasing issuance of USDe means that the required short position of ETH will be larger - until ETHENA affects the market balance and single-handedly pulls down the funding rate of ETH to a negative number for a long time (the short side pays the long side funding fee).

Not to mention that in the future bear market cycle, even if ETHENA does not affect the market balance, the long-term negative funding rate will cause its protocol revenue to be insufficient to cover expenses.

ETHENA's underlying design of using contract funding rate as a source of income is a double-edged sword: it can provide users with stable income in most cases (data is not falsified and positions do not affect the long-short ratio), but it also sets the upper limit of the ETHENA project - with limited market volume, USDe cannot be continuously issued, otherwise users' income will inevitably be affected.

On the other hand, the use case of USDe does not seem to be as smooth as the ETHENA project team imagined. To this day, the largest investor and exchange, BINANCE, still does not support USDe as a collateral asset. The dual flywheel envisioned by ETHENA: the increase in USDe demand drives the rise in ETH, which is more difficult to achieve in the current market.

At the same time, as a project on the chain and in the field of DEFI, ETHENA is not transparent. As a user, there is no API to observe whether the relevant hedging positions have been opened for your funds. To some extent, this goes against the essence of blockchain: decentralization . Hedging in the black box of the exchange, any data presented to the user can be tampered with and written.

Finally, ETHENA's choice to issue stablecoin USDe to generate income for users is a good one, but issuing stablecoins essentially puts a glass ceiling on the entire project. ENA can only obtain the contract funding rate of these assets by supporting one asset after another to mint USDe, but these assets are not all - there are still countless copycat contracts in the market whose funding rates become a bonus for retail investors, and ETHENA cannot support the minting of USDe by all crypto assets.

There are still many tests waiting for ETHENA in the long bear.

Oh, I forgot to mention another asset issued by ETHENA besides USDe, the so-called governance token ENA. ETHENA just updated the token economics of ENA at the end of June. But it is still old wine in a new bottle. The problem of ENA's scarcity of use cases and scarce empowerment, which has been criticized by many people, has not been solved.

I don’t understand why the most basic staking function has to wait for several months after the list is implemented? And the APY given to users is only in the single digits - not even as good as the yield of staking ETH.

The team seems to be a Pi Xiu that only takes in but does not give out. A large amount of token income and transaction fee income is directly divided up, with no thought of giving back to users. Instead, it increases the user's unlocking cycle.

Yes, after all, ENA is what you claim to be a "governance token." Apart from changing the users' vested ENA from monthly unlocking to weekly unlocking overnight and forcing them to lock up 50%, have any other proposals been passed?

Finally, let me reiterate my point: ETHENA is an innovative and promising project, but the ENA token is a complete shitcoin.