Written by: TechFlow

Trading is the pulse of the entire crypto world, and there will always be new players in the DEX track that supports trading needs.

On August 8, the ZK-powered DEX Vessel Finance announced that it had received US$10 million in financing, and attracted participation from Sequoia Capital, Scroll co-founders Sandy Peng and Ye Zhang, Avalanche Foundation, Algorand Foundation, IMO Ventures, Folius Ventures, Incuba Alpha, and a group of angel investors.

Data from DefiLlama shows that the current DEX track is very crowded, with more than 1,000 DEXs of all sizes, and more than 20 DEXs with TVL exceeding 100M.

In such a competitive environment, how can Vessel Finance break through? ZK technology is often used in infrastructure projects. What improvements will it bring when used in DEX?

Why do we need a new DEX?

In a market where there are already so many DEXs, why do we need another new trading platform like Vessel?

To answer this question, we need to examine the status quo and limitations of the current DEX ecosystem.

Limitations of existing DEX:

Performance bottleneck:

Currently, most DEXs are built on mainstream public chains such as Ethereum, which are limited by the processing power of the underlying blockchain. Although Layer 2 solutions have greatly improved transaction speeds, some L2s may also face scalability bottlenecks as the number of users and transaction volumes increase.

Cost and scalability issues:

Layer 2 has indeed significantly reduced gas fees, but the entire ecosystem still faces challenges. L2 decentralization leads to dispersed liquidity and user groups, and cross-chain interactions may still face high costs and waiting times. The user experience between different L2s is inconsistent, which increases the learning cost.

Liquidity dispersion:

Liquidity is not only scattered across different DEX platforms, but also scattered across various L2 networks. This dispersion may lead to larger slippage, affecting transaction efficiency and prices, especially for large traders.

Poor user experience:

Compared with centralized exchanges, many DEXs have complex user interfaces and cumbersome operation procedures. For users with non-technical backgrounds, using DEX may be a high barrier to entry.

In the face of these ongoing challenges, Vessel has put forward an ambitious vision: not only to solve the problems faced by current DEXs (including DEXs built on L2), but also to provide a more comprehensive and efficient solution for the entire DeFi ecosystem, combining the advantages of centralized exchanges (CEX) and decentralized exchanges (DEX).

In practice, the general plan of Vessel is:

By building a unified Layer 3 platform , Vessel aims to integrate the advantages of different L2s to provide users with a one-stop trading environment.

Leveraging L3 and ZK , transaction costs are reduced to levels lower than existing L2 solutions.

Improve scalability and liquidity aggregation by aggregating liquidity from multiple sources, providing better price discovery and lower slippage.

Drawing on the essence of CEX usability, it provides a unified and intuitive user interface.

Vessel Finance's core workflow

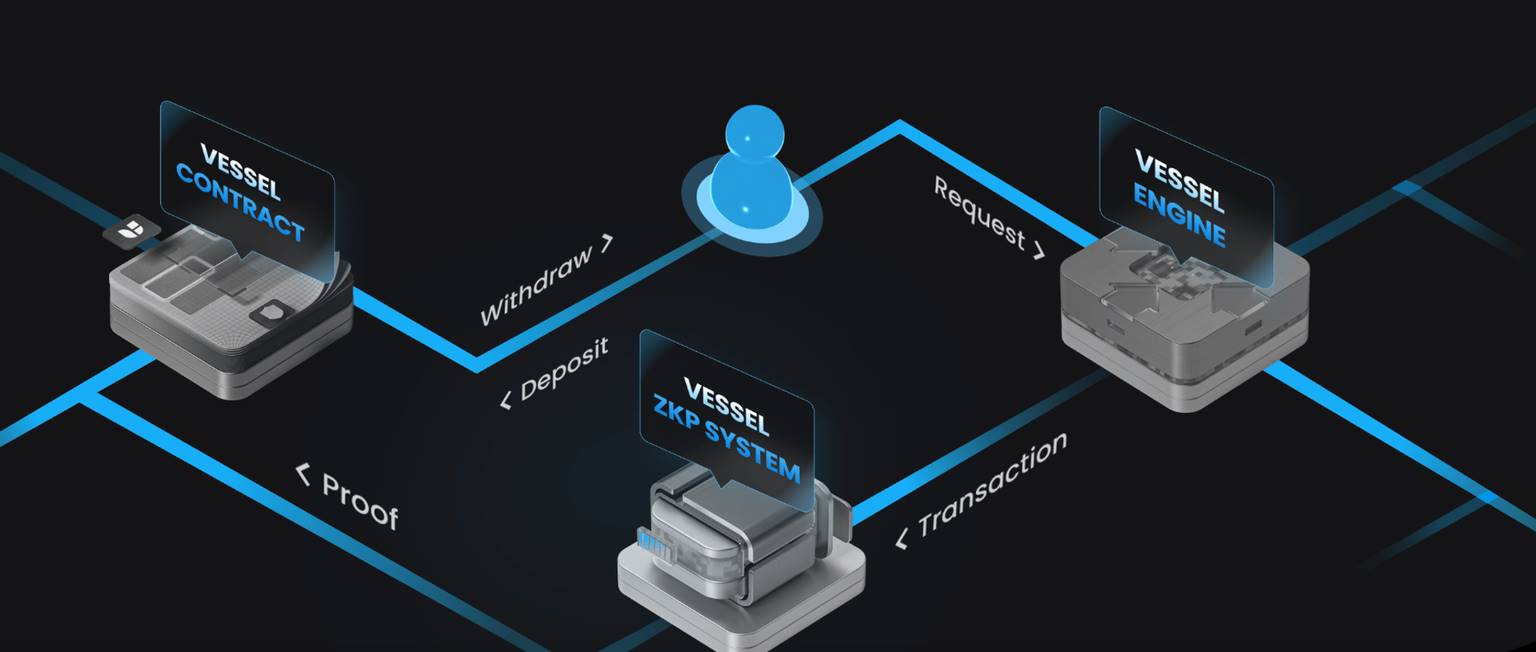

From a technical perspective, the Vessel protocol can be viewed as a state machine consisting of user state (accounts, orders, balances, etc.) and system state (timestamps, price oracles, etc.).

Each time a user submits a request, the system performs a series of operations to update specific elements of the current state.

Don’t understand? If we think of Vessel as a bank vault system, then every transaction is equivalent to a status update of our “bank vault system”. This update includes changes in user balances, changes in order status, and even small fluctuations in market prices.

In traditional blockchain systems, each of these small updates needs to be made on-chain, which results in high gas fees and slow processing speeds. But in Vessel, these state updates are done efficiently off-chain, and then the correctness of these updates is verified on-chain through ZK proof technology.

For example, suppose that within 5 minutes, the system processed 10,000 similar transactions. At the end of these 5 minutes, Vessel will generate a ZK proof that can prove to anyone: "In these 5 minutes, 10,000 transactions occurred, all of which are valid, and the final state of the system is correct." This proof can be quickly verified on the chain, greatly improving the efficiency and scalability of the entire system.

Specifically, Vessel's workflow involves three main components: Sequencer, Prover, and Smart Contract . The three components work together to complete the above tasks in steps.

Step 1: Sequencer:

When a user submits a transaction request, it is first processed by the sorter. The sorter is a transaction execution engine that can process requests instantly, just as fast as the servers of centralized exchanges. At the same time, it also generates an execution trace for the prover to use in the subsequent creation of SNARK proofs.

For example, when a user submits a transaction request (such as wanting to buy 100 tokens), the sorter will process the request immediately. It not only records the detailed information of the transaction, but also records the position of the transaction in the entire queue, submission time, etc. These detailed records constitute the "execution track".

Step 2: Prover:

The prover is responsible for generating proofs for state machine operations. It runs the ZKP protocol and generates proofs based on the execution traces of the sorter. This process ensures that all operations follow specific rules and prevents unauthorized creation or transfer of funds.

In the Vessel system, the prover checks all transactions processed by the sorter. For example, it verifies that user A does have enough balance to buy 100 tokens, that the transaction price is in line with the current market price, and so on. Then, it generates a mathematical proof that can prove to anyone: "Yes, these transactions are correct and there are no irregularities.

Step 3: Smart Contract :

The smart contract consists of a validator and a vault. Once the prover generates a SNARK proof, it is forwarded to the smart contract. The validator verifies the proof to confirm the validity of the state change. At the same time, the vault holds the user's assets and only allows the assets to be moved if a valid proof is received. This mechanism ensures that all transactions are authorized and secure.

For example, if the proof shows that user A successfully purchased 100 tokens, the smart contract will deduct the corresponding funds from user A's account and add 100 tokens to his balance.

Combination of ZK with VAELOB, order books and AMM

Zero-knowledge proof technology plays a core role in Vessel’s workflow:

By using concise ZKP, Vessel is able to transform complex computational processes into easily verifiable proofs. This allows the system to batch process user requests, calculate state changes off-chain, and then generate proofs to confirm their correctness. This greatly improves the efficiency and scalability of transaction processing.

ZKP technology ensures that each transaction is valid without exposing the specific details of the transaction. This not only protects the privacy of users, but also maintains the overall security of the system. As Vessel's slogan says: "Don't Trust, Verify".

Vessel's ZK system also supports cross-chain operations, making asset transfers and transactions between different blockchain networks more secure and efficient.

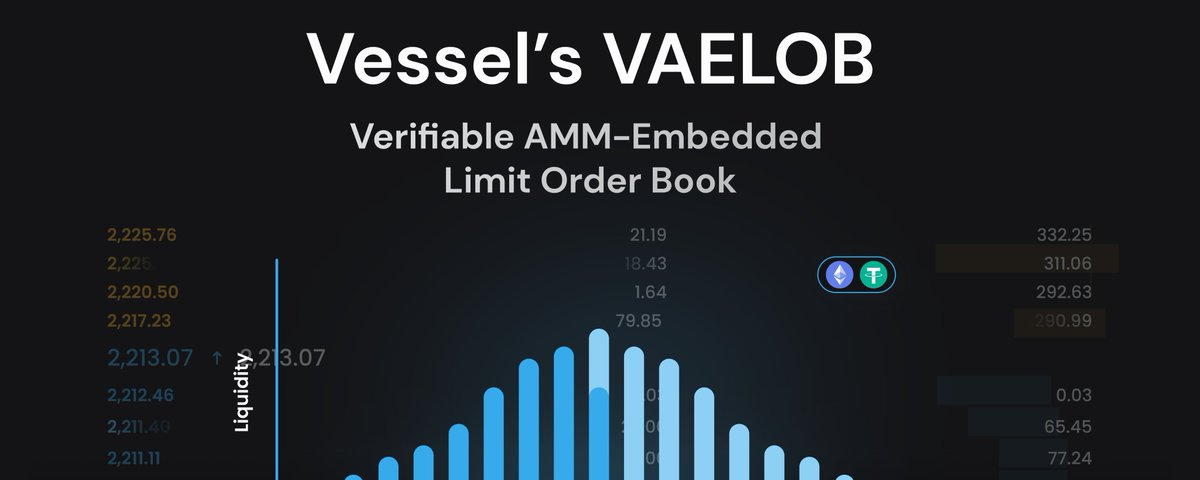

In addition, another innovation of Vessel worth mentioning is its verifiable AMM - Embedded Limit Order Book.

This is the core technology of the Vessel platform, which cleverly combines the advantages of traditional order books and automated market makers (AMMs), while also ensuring the verifiability of the entire transaction process.

How to do it specifically? Here is a more popular science:

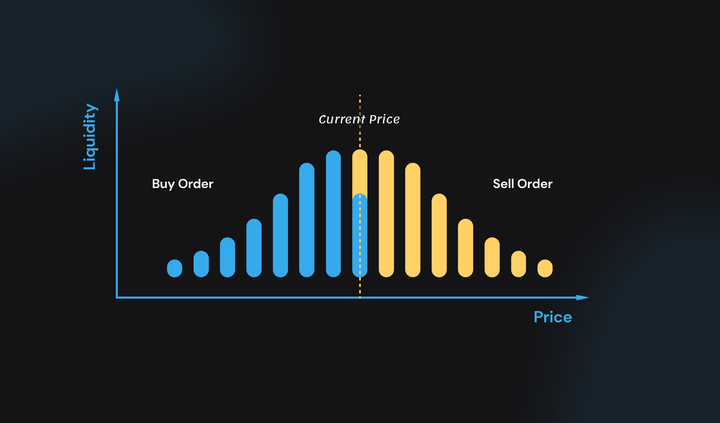

Traditional centralized exchanges (CEX) are like a busy stock trading floor with many traders shouting out the prices and quantities they want to buy and sell. This is the order book model, which is intuitive and efficient, but requires a high degree of trust in centralized institutions.

A decentralized exchange (DEX) is more like a vending machine. You put in a token, and the machine automatically calculates and gives you another token based on a preset formula. This is the AMM model, which is decentralized and transparent, but may be less efficient and susceptible to price slippage.

VAELOB is like moving this vending machine ( AMM ) into the trading floor (order book) and giving everyone a pair of special glasses so that they can check and verify the operation of the machine at any time.

Specifically:

It retains the intuitiveness and efficiency of a traditional order book

Incorporates the liquidity and automation features of AMM

The verifiability of the entire process is ensured by zero-knowledge proof technology

Let's understand this with a simple example:

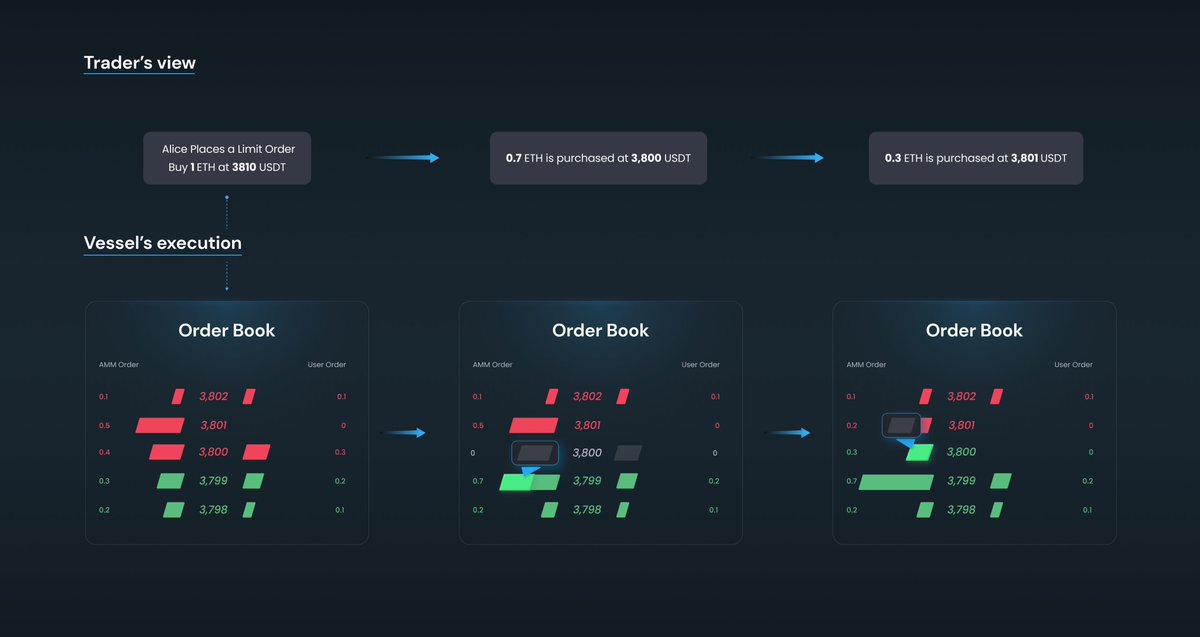

Suppose Alice wants to buy 1 ETH and the current market price is $3810.

a) In a traditional order book, the system would look for a sell order closest to this price.

b) In VAELOB, the system will not only match the user's orders, but also utilize the liquidity of the AMM pool. For example:

0.7 ETH may come from the $3,800 sell order (including 0.4 ETH from the AMM pool and 0.3 ETH from other users), and the remaining 0.3 ETH may come from the $3,801 AMM pool sell order

c) When an order from the AMM pool is matched, it will automatically place a new order at an adjacent price point to maintain market liquidity.

The benefits of doing this are:

a) Capital efficiency: Liquidity providers can choose a specific price range to provide liquidity, similar to Uniswap V3, but more flexible.

b) Better price discovery: combines the immediacy of an order book with the continuous liquidity of an AMM.

c) Reduce slippage: Reduce the price impact of large transactions through precise price point and range management.

d) Transparent and verifiable: All operations can be verified through zero-knowledge proofs, which improves security and trust.

e) User-friendly: Traders can place orders just like on traditional exchanges while enjoying the decentralized benefits of DEX.

Roadmap and Participatory Space

Currently, Vessel is still in the closed alpha testnet stage , but its Official Twitter indicates that the mainnet will be launched soon.

In the context of high financing, choosing to participate in the test network early for interaction may be a good choice; currently users can visit here to join the waiting list of its test network, and can only participate in the test network interaction after obtaining the invitation code.

Once the user logs in to the product interface with an invitation code, he or she can perform various operations such as setting up wallets, switching networks, injecting funds, depositing, trading and withdrawing funds. The process is not much different from that of general DEX.

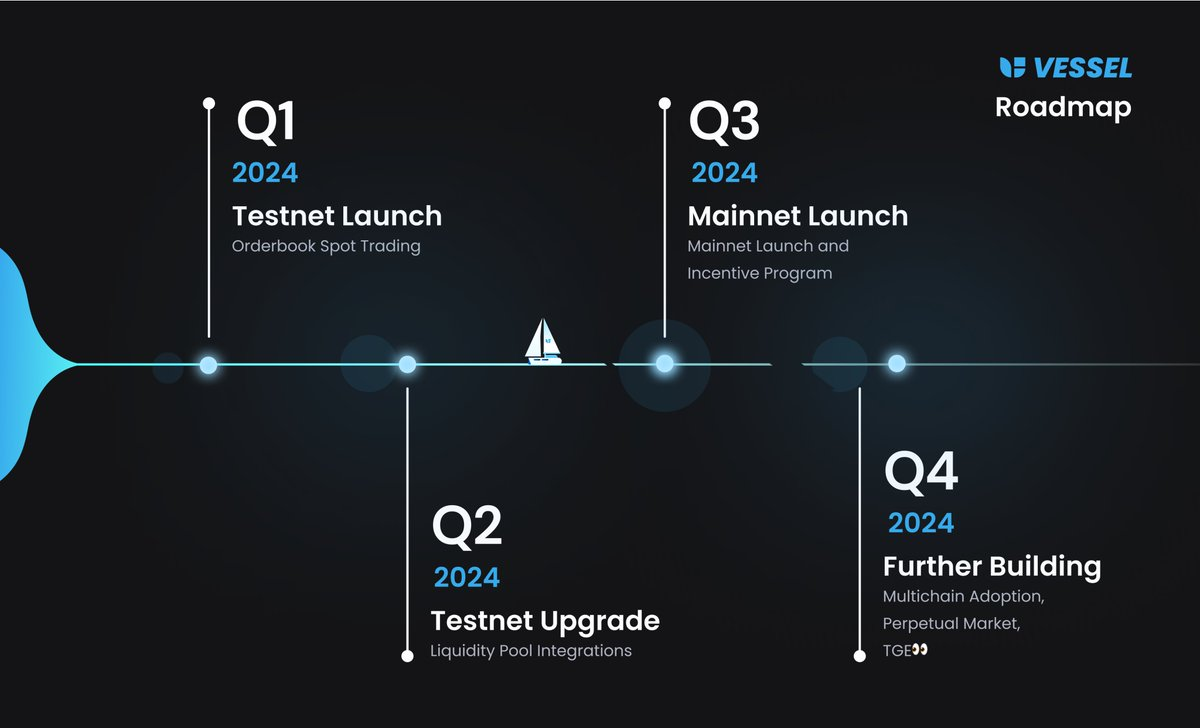

The roadmap shows that the project’s mainnet will be launched in the third quarter, and various features will also be developed, including perpetual DEX, liquidity aggregation, and sequencer decentralization.

The DEX track is becoming increasingly inward-looking. Sufficient incentives, low transaction costs, rich trading pairs and security will be the key to a project's success. How Vessel performs remains to be seen.