The whale who participated in the Ethereum ICO in 2015 transferred 48,500 ETH to OKX

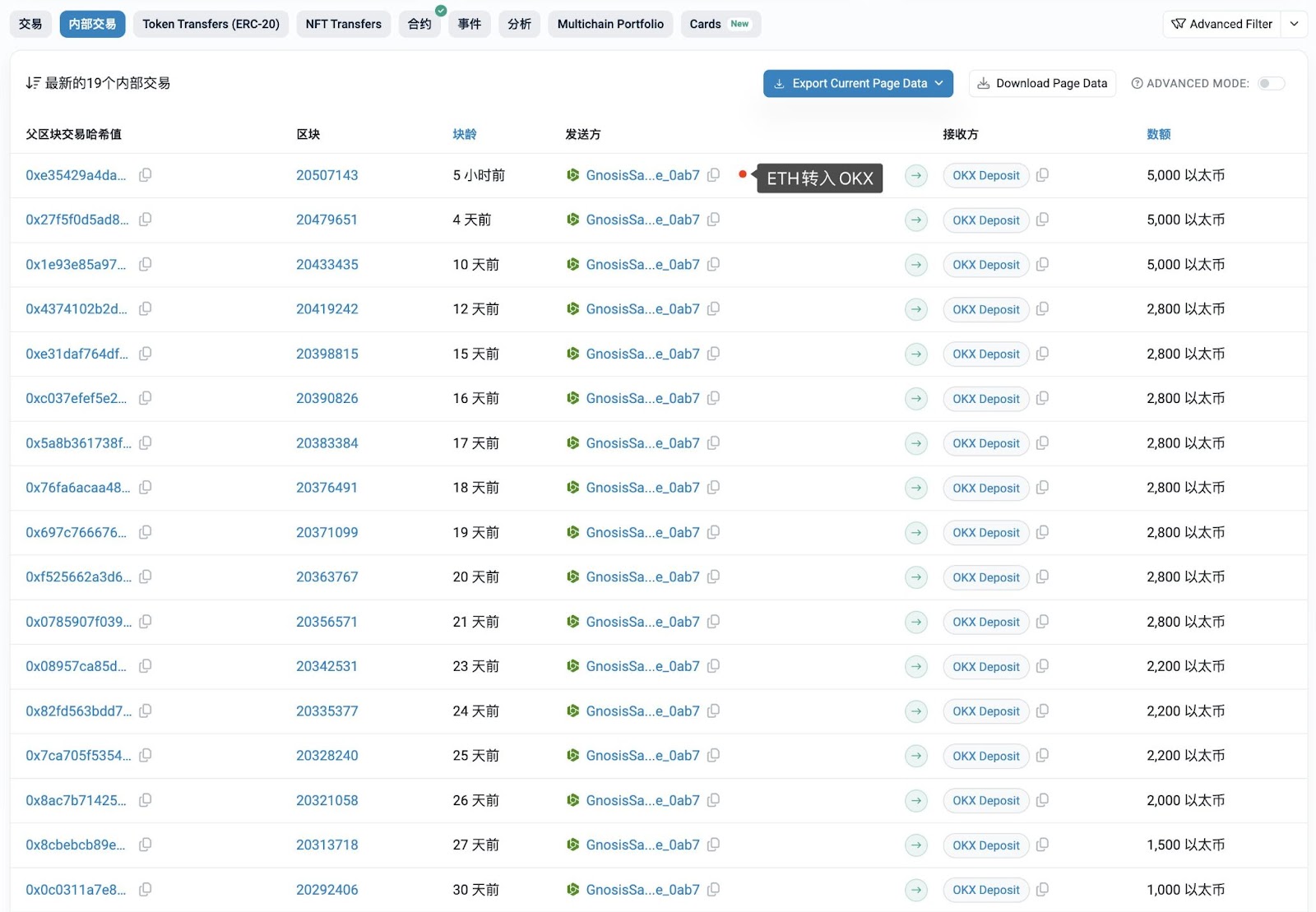

According to the latest monitoring data, a whale/institution that purchased 1 million ETH in the Ethereum ICO in 2015 (ICO price $0.311) transferred 48,500 ETH (about $154.01 million) to OKX in the past month.

- They transferred 64,100 ETH to address 0xe17...Ab7 through address 0x7d6...1B4, and transferred ETH to OKX in batches through this address.

- Tracking found that the ETH in the address 0x7d6...1B4 came from the address 0x193...284, which received 1 million ETH from the Ethereum Genesis Block on July 30, 2015.

- Currently, the whale/institution still holds 682,000 ETH (about $1.756 billion), of which:

1. 345,000 ETH were pledged through the address 0xb05...8d3;

2. 287,000 ETH held through address 0x7d6...1B4;

3. 50,000 ETH were pledged through the address 0xd65...22d.

Galois Capital’s associated address transferred 1.68 million UNI to Aave and lent 5.7 million USDC

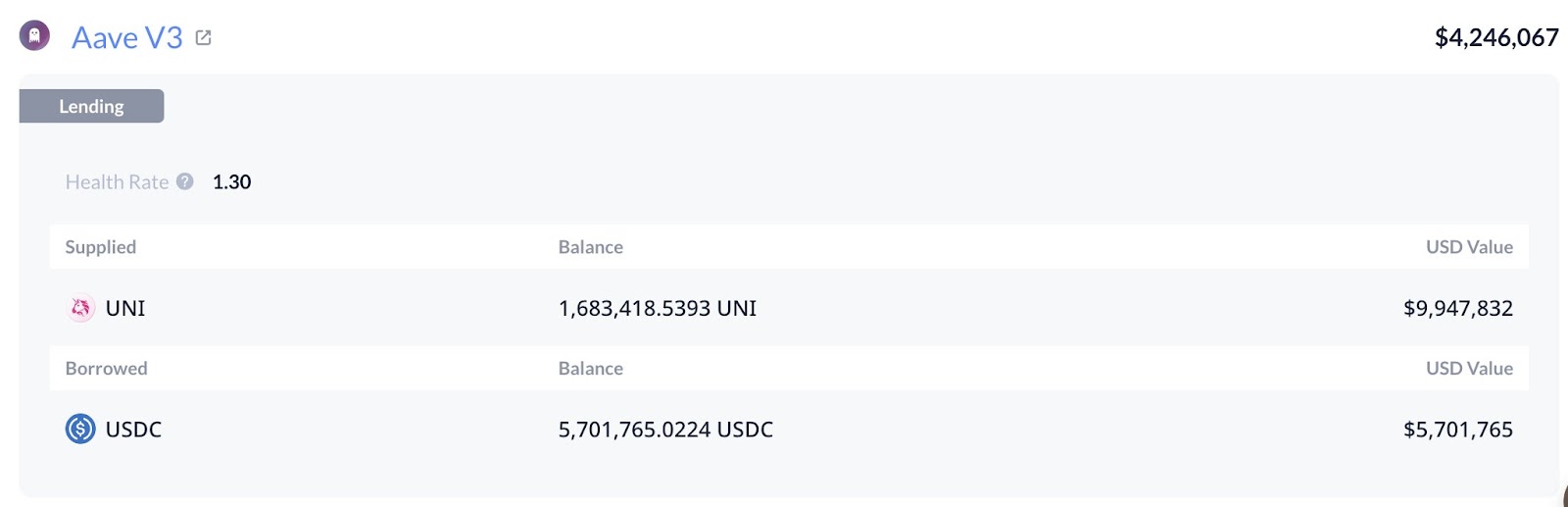

According to the latest on-chain data, the Galois Capital-related address has built a position of 1.68 million UNI (worth approximately $10.68 million) in the past 11 months, with an average cost of approximately $6.35. The address has currently suffered a floating loss of $720,000.

Seven hours ago, this part of UNI was transferred to the address 0xd9A...bbFe7, and after being deposited in Aave, 5.7 million USDC was borrowed to repay the Aave debt of the address 0xefa...aaf7d.

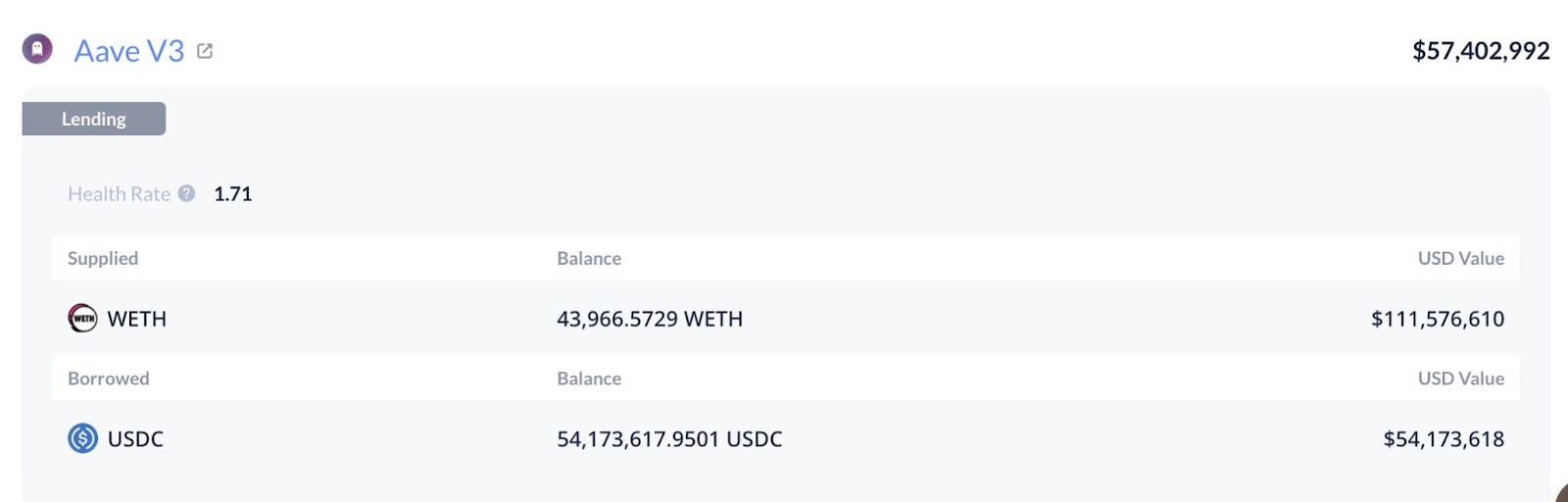

The latter currently has 43,966 WETH pledged on Aave and lent out 54.17 million USDC, with a health level of 1.71 and a net position value of up to US$57.4 million.

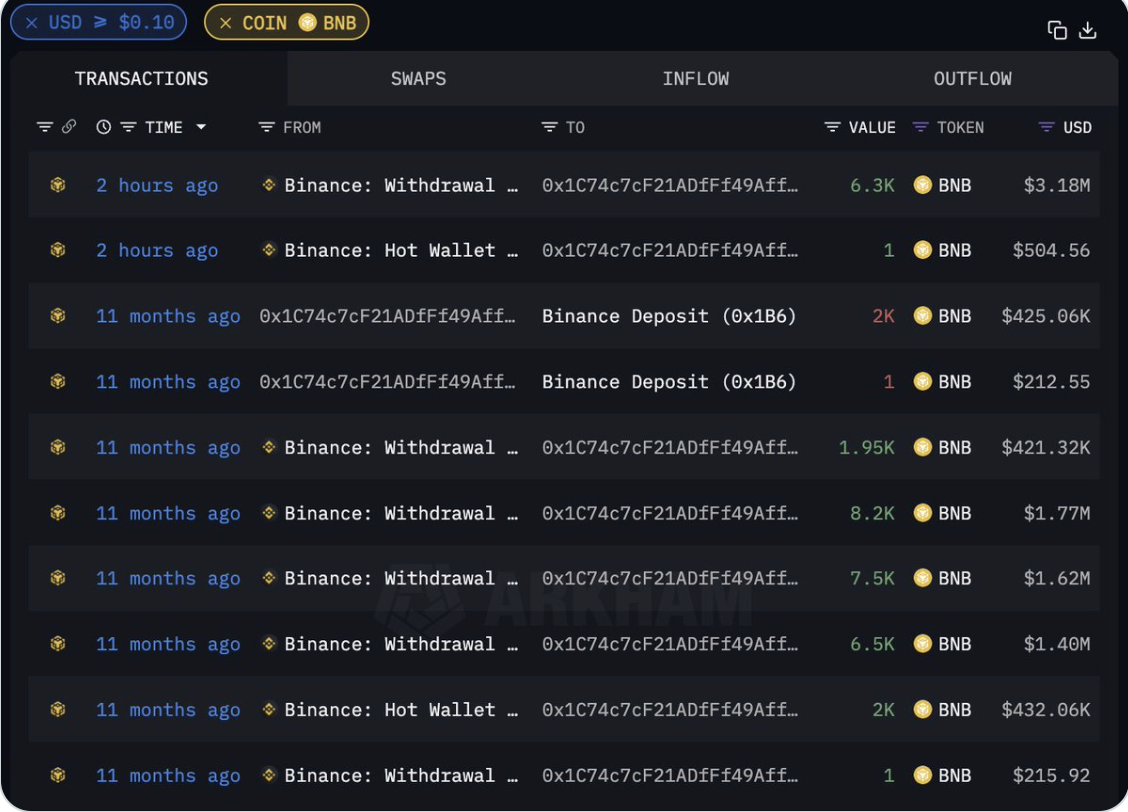

In 2017, the OG address once again built a BNB position, and the holding increased significantly

An OG address that has been active since 2017 has built a BNB position again after 11 months. The whale withdrew 26,150.997 BNB from Binance at an average price of $216 on September 17, 2023. It has currently made a profit of $7.61 million, with a return rate of 134%.

Two hours ago, the address suddenly added 6,301 BNB (about 3.17 million US dollars) at a cost of $504. Currently, the address holds a total of about 15.37 million US dollars worth of BNB, and the overall cost has increased to $272.

The whale that sold ETH at the high point in May bought it at a low point two hours ago, and its ETH holdings increased to 5,025

According to on-chain data, the whale that sold 3,586 ETH (about $13.15 million) at a high of $3,667 on May 21 has repurchased ETH two hours ago.

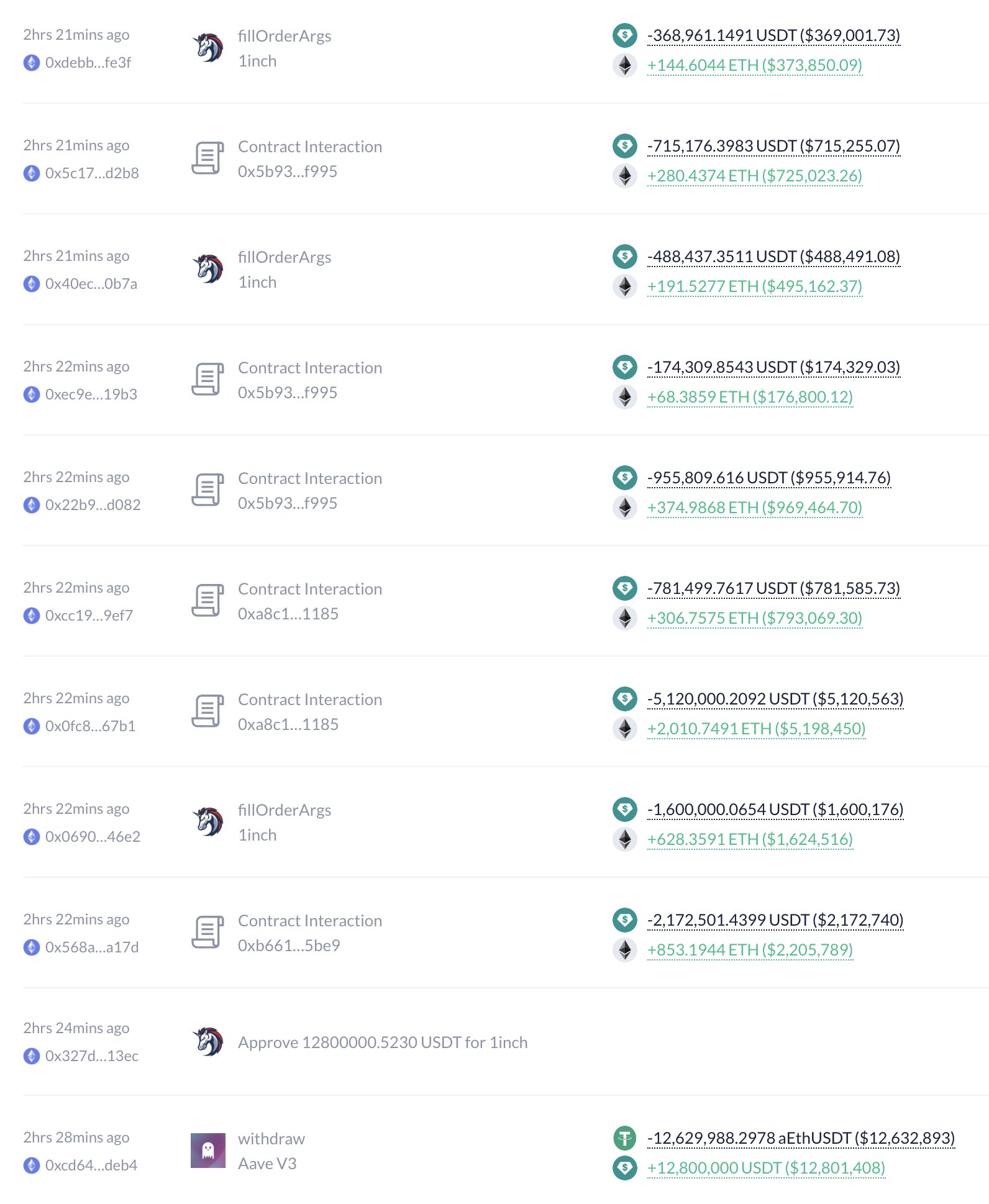

After selling ETH, the whale deposited 13.15 million USDT into Aave. Two hours ago, he withdrew 12.8 million USDT and bought 5,025 ETH at $2,547. This wave of high-selling and low-buying operations increased his holdings of ETH from 3,586 to 5,025.