In this bull market, in addition to the Bitcoin spot ETF driving the rise of Bitcoin and the overall cryptocurrency market, the biggest attraction is the "meme currency craze" led by the Solana ecosystem. However, Ethereum, which has never been absent from previous bull markets, has been bleak in this bull market.

It was originally expected that the "Cancun Upgrade" would bring a large number of new users to the Ethereum ecosystem, but it backfired. The numerous Ethereum Layer 2s on the market led to scattered liquidity and the emergence of ghost towns on the chain, making the community ridicule the "Cancun Upgrade". ” It’s better to rename it “Bumpy Upgrade”.

After that, no new narrative emerged in the Ethereum ecosystem. What is the current situation of Ethereum? This article will analyze through four pieces of data.

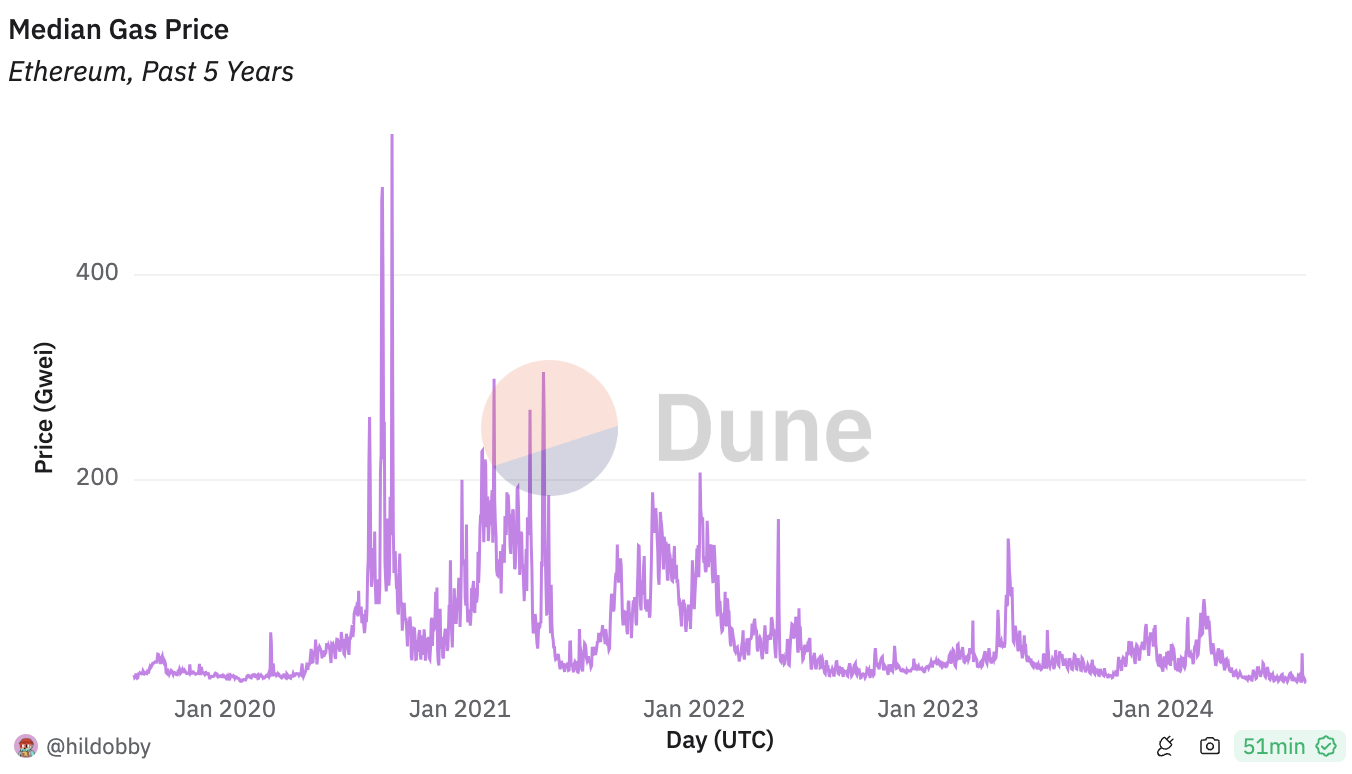

The median gas fee on the chain is the lowest in the past five years

According to data from Dune Analytics, the median gas fee for transactions on the Ethereum blockchain has fallen to its lowest point in nearly five years. On August 10, the median gas fee for Ethereum dropped to 1.9 gwei. This is the highest level since August 2019. The lowest level since then, down nearly 98% from the high of 83.1 gwei so far in March.

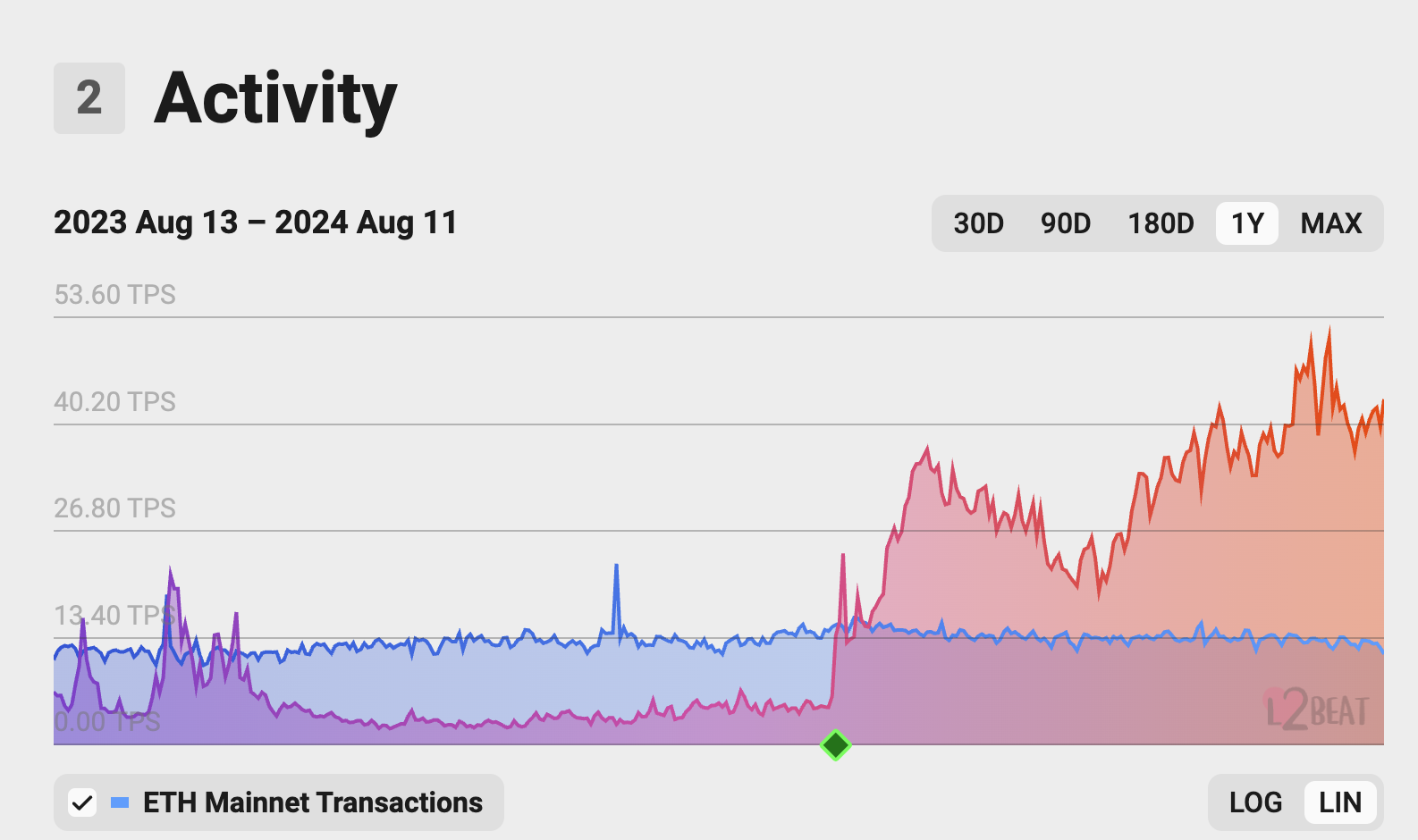

However, according to L2Beat data, in the past 30 days, the number of Ethereum Layer2 Base transactions was as high as 109 million, and the number of Arbitrum transactions was 58.04 million. In comparison, the number of Ethereum transactions was only 33.52 million.

In addition, from the observation of Base transaction data in the past year, after the Cancun upgrade, the number of Base chain transactions has increased significantly. Therefore, the author judges that Ethereum users may switch to Base, Arbitrum, etc. for interaction on Layer 2.

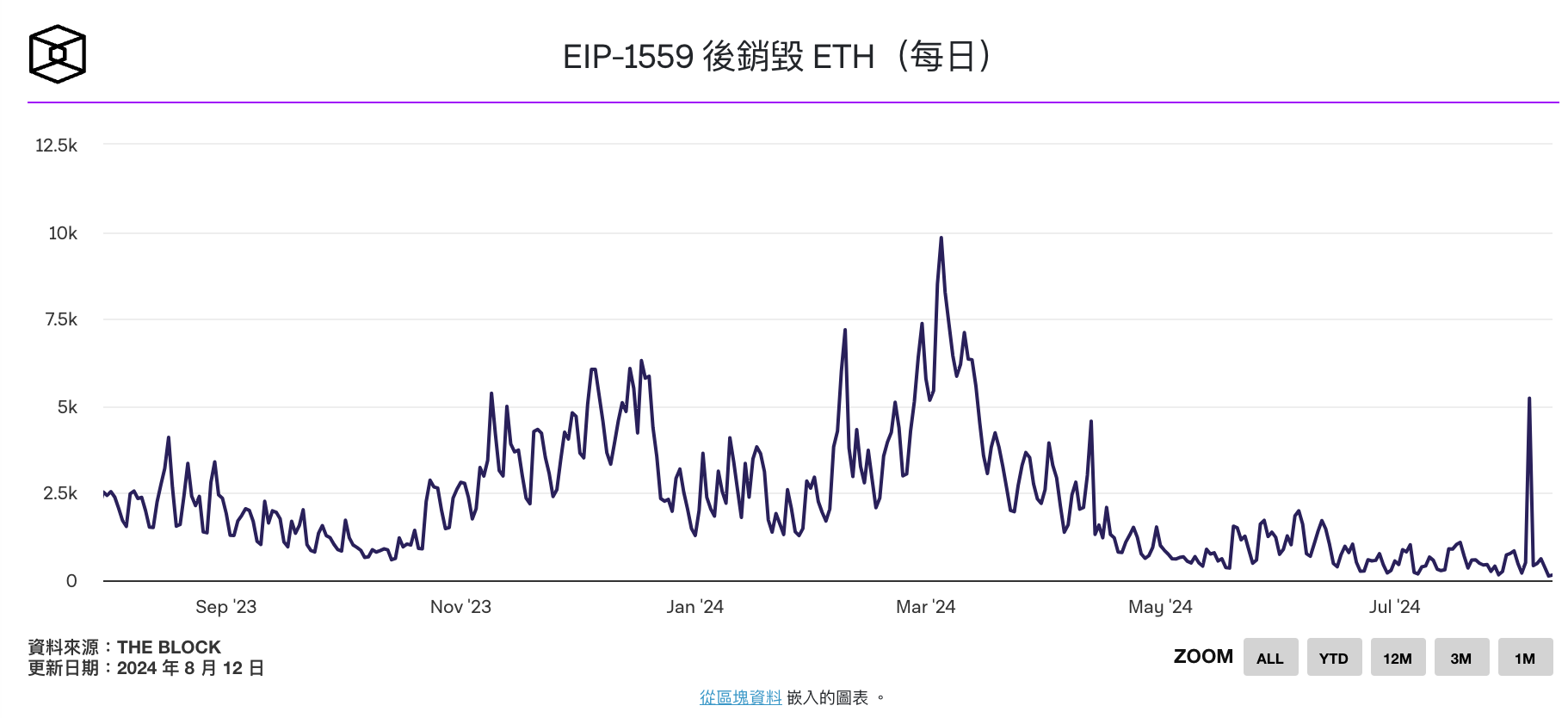

Ethereum continues to experience inflation, with only 210 ETH destroyed last Saturday

In addition, according to The Block report, with Gas fees remaining low, the Ethereum network burned only 210 ETH last Saturday (10), the lowest level of the year. In comparison, when the gas fee reached 100 gwei on August 5, the daily burning volume also surged to 5,000 ETH.

Since gas fees have been at extremely low levels for a long time, Ethereum's inflation rate has increased. According to data from The Block, although 210 ETH were destroyed on Saturday, the net issuance of ETH exceeded 2,100 ETH.

In view of inflationary trends, Gnosis founder Martin Köppelmann suggests temporarily increasing the Gas limit:

Base fees are at their lowest levels in years, at about 0.8 gwei.

It takes 23.9 gwei to offset the staking rewards. In my opinion, Ethereum needs to increase L1 activity again, and even though it sounds counterintuitive at such low rates, raising the gas limit can be part of the strategy.

Ethereum spot ETF performed poorly after listing

According to Sosovalue data , after the Ethereum spot ETF was listed in the United States on July 23, there were net outflows of funds for 9 days in 14 days, and there were net outflows of funds for three consecutive days recently.

In addition, the total net assets of the Ethereum spot ETF currently reach 7.28 billion U.S. dollars. Compared with the total net assets of the Bitcoin spot ETF launched in January of 55.11 billion U.S. dollars, the asset size is only 13.2% of the Bitcoin spot ETF. Mechanism Capital co-founder Andrew Kang's conservative forecast of 15% is less than 15%.

Extended reading: Is the Ethereum spot ETF theme weak? Andrew Kang: Price could fall to $2,400 after approval

The top 10 tokens by market capitalization were the worst performers

On the other hand, according to Coingecko data, Ethereum performed the worst in the past month, with a decline of 17.9%, ranking last. Although the Ethereum spot ETF was listed on the 23rd of last month, the price of Ethereum There is still no significant improvement, and it is currently quoted at $2,571.