- Ethereum (ETH) has formed a bullish ascending triangle pattern at a critical support level.

- If ETH breaks out of the ascending triangle pattern on the 4-hour timeframe, it could surge towards the $3,100 level.

- Despite the recent market crash, 66% of Ethereum holders are still profitable.

The overall market price of all major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have fallen sharply in recent days. During this market downturn, Ethereum (ETH), the world’s second-largest cryptocurrency, has formed a bullish price action pattern on the 4-hour timeframe.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

The daily chart shows that Ethereum is moving higher. After last week's drop and recovery, the second-most valuable coin is up nearly 25% from its August lows. If buyers take over today and break out and close above $2,600, as is the case currently, it could set the stage for another upswing towards $3,300 in a buy trend continuation formation.

Ascending Triangle Pattern

ETH has been consolidating in a tight range between $2,340 and $2,700 over the past week. During this period, ETH has formed a bullish ascending triangle pattern at key support levels.

66% of Ethereum addresses are profitable

There is a good chance that this price action will pan out. According to data from IntoTheBlock, Ethereum is in an interesting phase and has impressively shaken off the weakness seen in the first half of the week.

IntoTheBlock data points out that 66% of Ethereum addresses are in the green at spot rates. This development means that despite the volatility and ups and downs experienced in the past five months after the price peaked in March 2024, many holders are still profitable.

The fact that a large number of holders are taking profits is a positive sign, as it could mean that more ETH holders are willing to hold on and watch the price action in the coming days.

Typically, whenever a larger percentage of addresses are in the red and losing money, they may panic and seek an exit, adopting a self-preservation mode to protect their bottom line.

While this scenario is possible now that prices are higher, entities that might cash out now could be missing out on even bigger gains, at least based on past experience. The last time 66% of ETH addresses were profitable was in October 2023, according to data from IntoTheBlock.

ETH Holders Are Hoarding, Are Bulls Ready to Take Over?

Looking at historical price action, ETH bounced higher around October 2023, followed by a strong rally in the following months to $4,100 in March 2024. While this impressive past performance does not necessarily mean it will be replicated in the coming days, the recovery in the past few days and other market factors could support optimistic buyers.

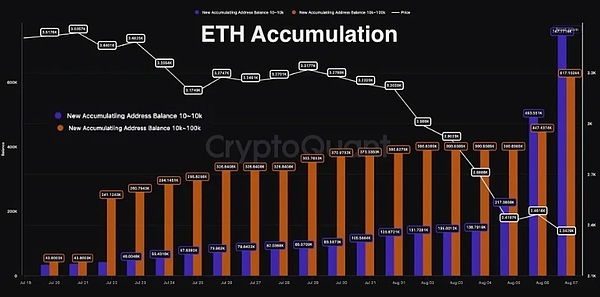

As of the end of last week, CryptoQuant data showed that addresses holding 10 to 10,000 ETH and addresses holding 10,000 to 100,000 ETH were busy buying. Their activities have added a cumulative 757,000 ETH to these groups, greatly boosting market sentiment.

The accumulation of these entities indicates that they are optimistic about the future, which is a positive for bulls. As of August 12, Ethereum is facing resistance around $2,700, the high from August 5.

At press time, ETH is trading near $2,800, having remained stable over the past 24 hours. During the same period, it also reached the $2,700 level. This stability, coupled with a bullish price action pattern, has led to a massive 95% increase in trading volume.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!