Bitcoin experienced sharp fluctuations last night, with the price first falling 3.2% to $57,844 in less than an hour, before rebounding 5% in the next thirty minutes to $60,700. This price move reflects uncertainty about macroeconomic conditions, especially following the U.S. Federal Reserve’s speech over the weekend.

Table of contents

ToggleRecession is biggest risk to Bitcoin price collapse

According to Cointelegraph , traders are now worried about whether Bitcoin will retest the low of $49,248 on August 5, especially as interest in leveraged long holdings declines and the risk of a correction in global stock markets increases.

According to Bloomberg, due to the weakness in the labor market and the Federal Reserve's tightening policy, economists at JPMorgan Chase have raised the probability of a U.S. economic recession in 2024 to 35% from the previous 25%. Investors are now in a wait-and-see mode. Wait patiently for the US Producer Price Index (PPI) to be released on August 13 and the Consumer Price Index (CPI) to be released on August 14. The data are expected to provide guidance for the Federal Reserve on whether to cut interest rates at least twice before the end of 2024.

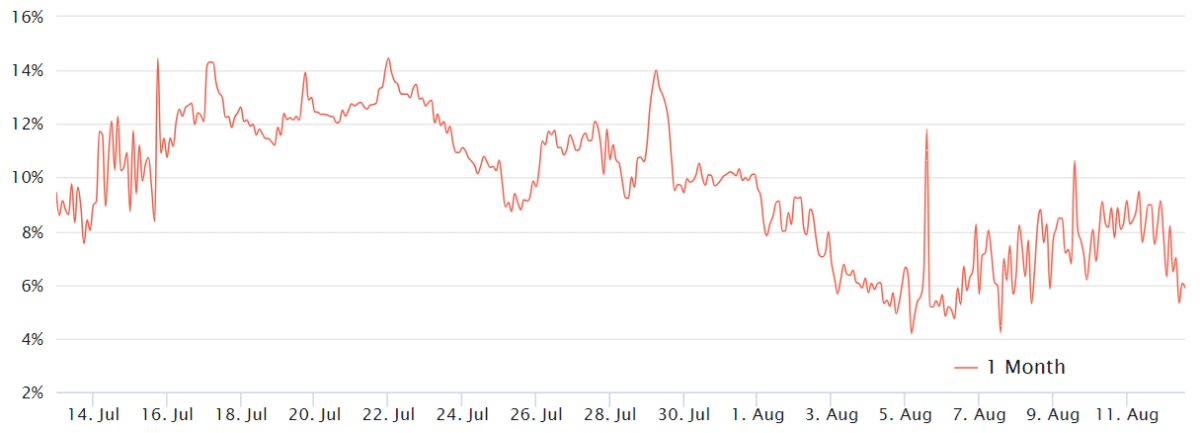

To assess the impact of recent Bitcoin price fluctuations, it is crucial to analyze the Bitcoin futures market. Bitcoin monthly futures have an inherent cost due to the delayed settlement period, and sellers typically demand an annualized premium of 5% to 10% to offset this factor.

On August 12, the annualized premium (basis) for Bitcoin futures fell to 6% from 9% on August 11, when support at $58,000 was being retested. While current levels remain within neutral territory, this suggests a lack of demand for leverage from bulls, a trend that has persisted since July 30 when premiums last exceeded 10%.

Derivatives market shows neutral sentiment

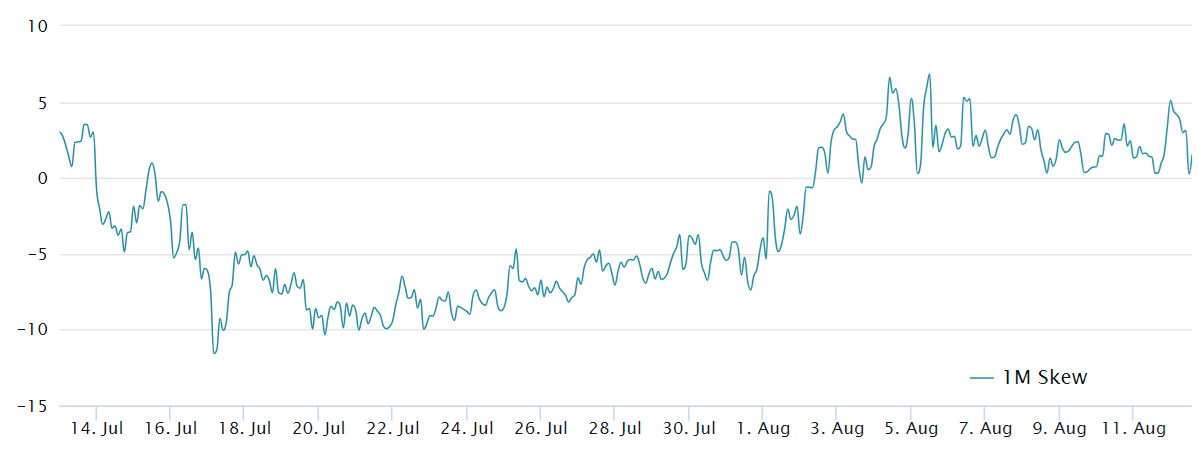

To determine whether this shift in sentiment is limited to the Bitcoin futures market, it is necessary to examine demand in the Bitcoin options market. Typically, when the delta skew indicator rises above 7%, it indicates that the market is expecting price declines, while a skew of negative 7% usually reflects bullish market sentiment.

The Bitcoin options skew indicator has been relatively stable over the past week, showing that there is no significant imbalance in the pricing of put and call options. The data points to a decline in market sentiment compared to late July, when indicators showed modest bullishness. However, although the price of Bitcoin briefly fell below $50,000 on August 5, there are still no signs of stress.

One possible explanation for the current neutral sentiment is that the volatility over the past week has eliminated a large amount of leveraged positions, with up to $634 million in long and short positions being liquidated in the Bitcoin futures market. However, this does not fully explain why there is still $28.8 billion in open interest in the Bitcoin futures market.

Another possible explanation for the lackluster Bitcoin derivatives indicators is the prevalence of arbitrage strategies, where traders capture futures contango through fixed-income operations. In this case, market direction becomes irrelevant as one side offsets the other. Overall, even if Bitcoin price volatility continues, there are currently no clear signs that traders are turning bearish or that excessive liquidation will trigger a cascading sell-off that could lead to a drop to $52,000.