As the crypto market gradually stabilizes, Grayscale’s Ethereum Spot ETF (ETHE) has also successfully ended its net outflows since the conversion; and asset management company CoinShares said that during the market recovery stage from last week to this week, Ethereum’s funds Compared with Bitcoin, the product seems to be more attractive to investors.

Table of Contents

ToggleGrayscale ETHE ends two weeks of net outflows

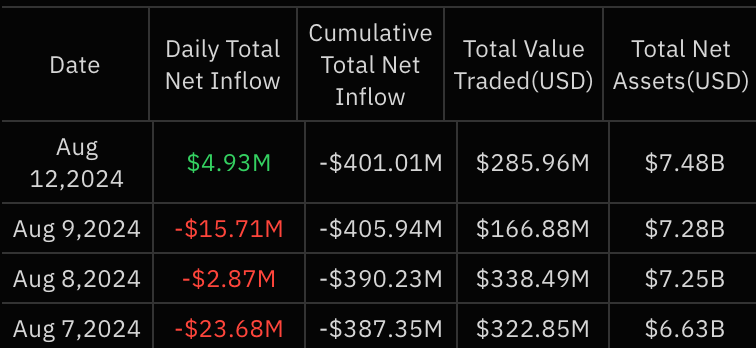

SosoValue data shows that the nine-tier Ethereum spot ETF in the United States had a net inflow of US$4.93 million on Monday, reversing the three consecutive days of net outflows totaling US$42.26 million caused by market panic last week.

Among them, Grayscale’s ETHE achieved a record of zero traffic for the first time since the conversion, finally ending the two-week net outflow. Previously, a total of US$2.3 billion in funds flowed out, with an outflow rate of approximately 45.2%.

At the same time, this is also the first time since the launch of VanEck's ETHV that there has been a net outflow, with a record of approximately US$2.92 million.

CoinShares: ETH wins again? BTC ETP investors pulling out?

During market recovery, investors favor ETH products over BTC

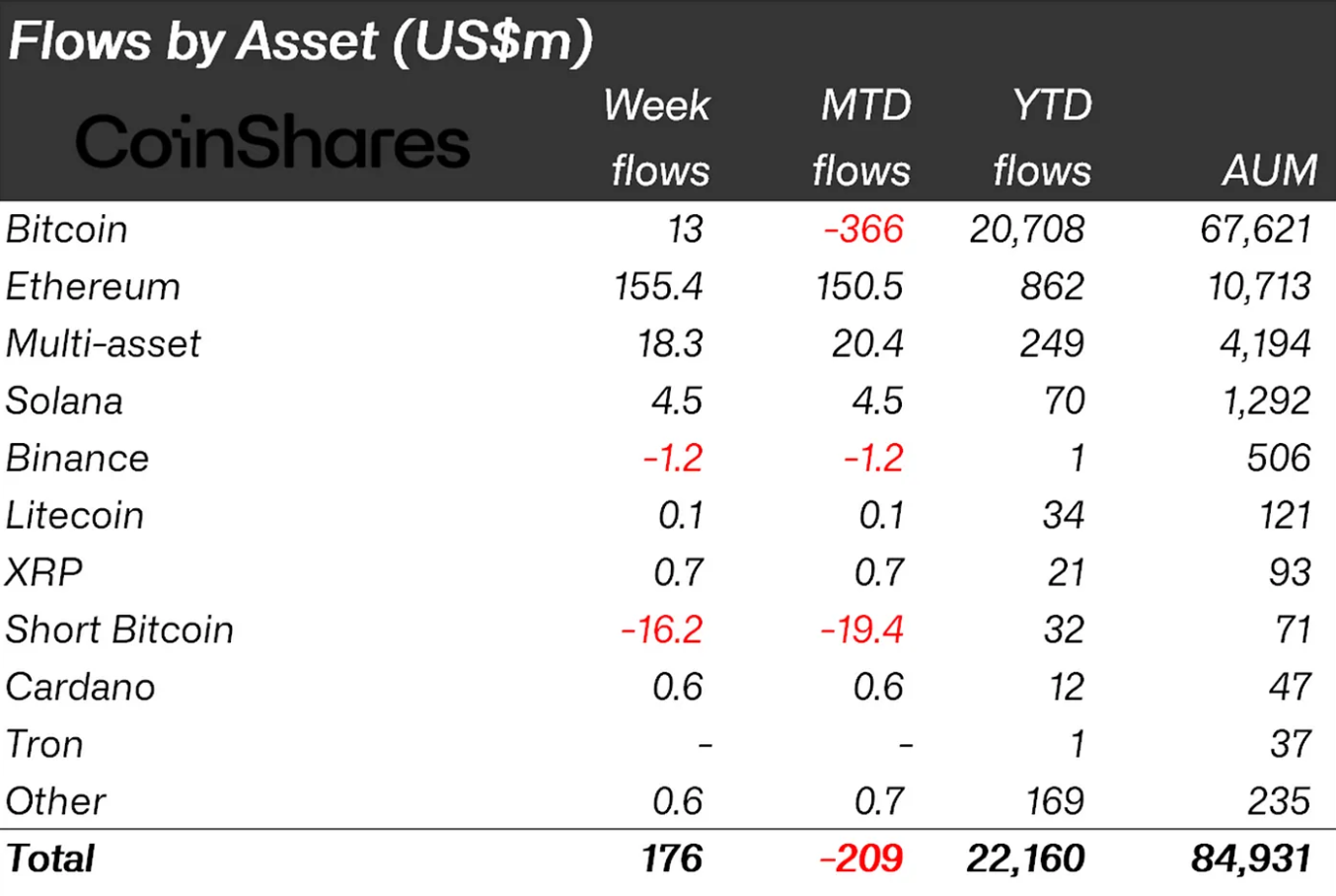

CoinShares noted in its weekly digital asset flow report that investors appear to be choosing ETH exchange-traded products (ETPs) over BTC during the market recovery after last week’s crash.

The report wrote that in the week ending August 11, digital asset investment products had a total inflow of US$176 million, of which ETH ETP accounted for US$155 million, accounting for approximately 88% of the total inflow. On the contrary, BTC ETP only had 1,300 US dollars this week. Inflow of USD 10,000:

ETH ETP benefited from the approval of the ETF and seemed to have successfully attracted the interest of institutional investors. It benefited the most from the market crash and recovery, bringing its year-to-date capital inflow to $862 million, the highest since 2021. numerical value.

Bitcoin Short ETP Withdrawal

At the same time, BTC ETP has experienced fund outflows of up to $366 million this month, including the largest outflow of short ETPs since May last year, totaling $16 million, accounting for approximately 23% of assets under management (AuM):

Assets under management on short positions have fallen to their lowest level since the beginning of the year, indicating a massive exodus from investors.

Optimistic about the crypto market

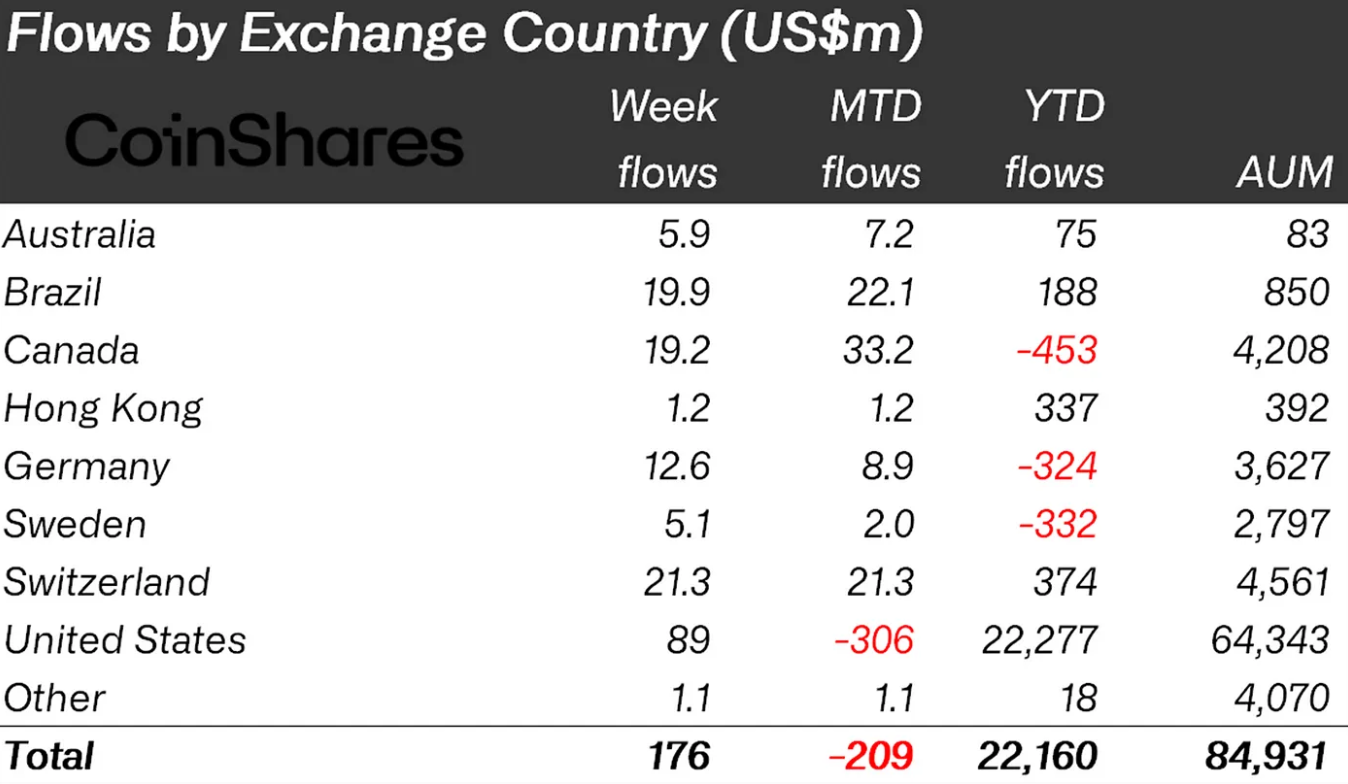

CoinShares finally mentioned that what was different from last week’s plunge was that capital inflows occurred in all regions around the world, indicating that after the recent price correction, the market seems to have a unanimously optimistic view of crypto assets:

Among them, the United States, Switzerland, Brazil and Canada have the most obvious inflows of funds, with an inflow of US$20 million to US$89 million.

( 3iQ applied for the first Solana ETP in Canada, code "QSOL" )