The Altcoin season will only return once Bitcoin and Ethereum break above $70,000 and $4,000 respectively.

- Author: Arthur Hayes

- Compiled by: TechFlow TechFlow

(Any opinions expressed here are the personal opinions of the author and should not be used as the basis for investment decisions, nor should they be construed as a recommendation or recommendation to engage in investment transactions.)

Water, water, water everywhere,

All the boards have shrunk;

Water, water, water everywhere,

But there was not a drop to drink.

——Samuel Taylor Coleridge, Rime of the Ancient Mariner

I love specialty coffee, but the ones I brew at home always fail. I spend a certain amount of money on coffee beans, but my coffee is always worse than the coffee shop's. In an effort to improve my brewing, I started paying more attention to detail. One important detail I overlooked was the quality of the water.

Water is crucial to coffee quality. Recently, I was struck by an article in Issue 35 of "Standart".

I had a similar experience during my time as a barista when I learned that over 98% of a cup of coffee and about 90% of espresso is water.

…

This awareness often comes later, probably because the idea of investing money in new machines to improve coffee is easier. "Ah, you have a cone grinder! That's why your brew is cloudy. Switch to a flat grinder!" But what if the problem isn't the ingredients? Could focusing on the solvent itself solve our coffee problems?

——Lance Hedrick, On Water Chemistry

My next step is to understand the author's advice and order a home water distiller. I know a local coffee shop sells a mineral concentrate that can be added to the water that would provide the perfect base for my coffee to accentuate the flavor of their roasted coffee. By this winter, my morning coffee will be delicious...I hope. I pray for my adventurous friends who will taste my "Black Gold" coffee before climbing Mount Yotei.

Good quality water is essential for brewing great coffee. Turning to investments, water or liquidity is also important for accumulating Bitcoin (SATS). This is a recurring theme in all my articles. But we often forget its importance and focus on the little things that we think affect our ability to make money.

If you can identify how, where, why and when fiat liquidity is created, it will be difficult to lose money when investing. Unless you're Su Zhu or Kyle Davies. If financial assets are priced in dollars and U.S. Treasuries (UST), then it can be inferred that the volume of global currency and dollar debt is the most critical variable.

What we need to pay attention to is not the US Federal Reserve (Fed), but the US Treasury Department. This will help us determine the specific increase or decrease in fiat liquidity of Pax Americana.

We need to return to the concept of "fiscal dominance" to understand why Treasury Secretary Janet Yellen has made Fed Chairman Jerome Powell her "beta cuck towel bitch boy." Please read my article called Kite or Board for a more in-depth discussion. During periods of fiscal dominance, the need to fund the country outweighs any central bank concerns about inflation. This means that bank credit, and thus nominal GDP growth, must remain high, even if this results in inflation continuing to be above target.

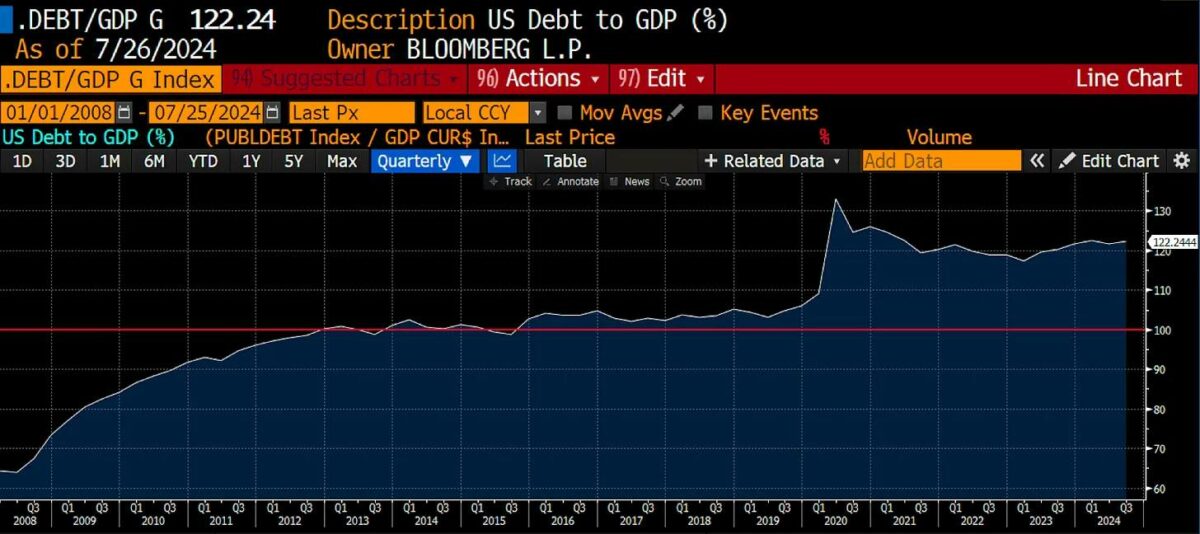

Time and compound interest determine the timing of the transfer of power from the central bank to the treasury. When the debt-to-GDP ratio exceeds 100%, debt is mathematically growing at a much faster rate than the economy. After this event horizon, the institution that controls the supply of debt is crowned emperor. This is because the Treasury determines when, how much, and when the debt will be issued. Furthermore, since the government now relies on debt-driven growth to maintain the status quo, it will eventually instruct the central bank to use its money-printing presses to cash checks from the Treasury. Central bank independence no longer matters!

The outbreak of COVID and the U.S. government's efforts to keep people at home and hand out stimulus checks in exchange for their compliance caused the debt-to-GDP ratio to quickly exceed 100%. It’s only a matter of time before Yellen transforms from “grandma” to “bad girl.”

Before the U.S. enters an outright hyperinflationary scenario, Yellen has a simple way to create more credit and boost asset markets. The Fed has two sanitized pools of money on its balance sheet that, if released into the market, would boost bank credit growth and push up asset prices. The first pool is the reverse repurchase pool (RRP). I've discussed this pool at length, where money market funds (MMFs) park cash overnight at the Fed and earn interest. The second pool is bank reserves, and the Fed's plan on this pool pays interest in a similar manner.

While money is on the Fed's balance sheet, it cannot be rehypothecated into financial markets to generate broad money or credit growth. By providing banks and money market funds with incentives to reserve interest and reverse repurchase interest, respectively, the Fed's quantitative easing (QE) program created inflation in financial asset prices rather than leading to rapid growth in bank credit. If QE is not sanitized in this way, bank credit will flow into the real economy, increasing output and inflation of goods/services. Given Pax Americana's current total debt, strong nominal GDP growth coupled with goods/services/wage inflation is exactly what the government needs to increase tax revenue and reduce leverage. So "bad girl" Yellen stepped in to correct the situation.

Yellen doesn't care about inflation. Her goal is to create nominal economic growth so that tax revenues rise and the U.S. debt-to-GDP ratio decreases. Given that no political party or its supporters have committed to spending cuts, the deficit will persist for the foreseeable future. Moreover, with the size of the federal deficit the largest in peacetime history, she must use all the tools at her disposal to finance the government. Specifically, this means moving as much money as possible from the Fed's balance sheet into the real economy.

Yellen needs to give banks and money market funds what they want. They want to have a yielding cash-like instrument that is credit-free and has minimal interest rate risk to replace the yielding cash they hold at the Fed. Treasury bills (T-bills) with maturities of less than one year, which offer a yield slightly higher than interest on reserve balances (IORB) or reverse repo rates (RRP), are perfect alternatives. Treasury bills are an asset that can be leveraged in the market and will generate credit and asset price growth.

Can Yellen afford $3.6 trillion worth of Treasury bills? sure. The federal government is running a $2 trillion annual deficit that must be financed through debt securities issued by the Treasury Department.

However, Yellen or whoever succeeds her in January 2025 will not necessarily issue Treasury bills to finance the government. She could sell long-term Treasury bonds, which are less liquid and carry higher interest rate risk. These securities are not cash equivalents. Additionally, long-term debt securities have lower yields than Treasury bills due to the shape of the yield curve. The profit motive of banks and money market funds makes it impossible for them to exchange the funds they hold at the Fed for anything other than Treasury bills.

So why should we crypto traders care about the flow of funds between the Fed’s balance sheet and the broader financial system? Take a look at this beautiful chart.

Bitcoin (gold) rebounded from the lows as the reverse repurchase program (RRP, white line) retreated from the highs. As you can see, this is a tight relationship. When money leaves the Fed's balance sheet, it increases liquidity, which causes the price of finite financial assets like Bitcoin to rise.

Why does this happen? Let's consult the Treasury Borrowing Advisory Committee (TBAC). In its latest report, TBAC made clear the relationship between increased Treasury issuance and money market funds (MMFs) holdings in RRPs.

Large overnight reverse repo balances may indicate strong demand for Treasury bills. In 2023-24, overnight reverse repo funds were transferred to Treasury bills almost one-for-one. The rotation facilitated smooth absorption of record Treasury bill issuance.

——Slide 17, TBAC July 31, 2024

Money market funds will move cash into T-bills as long as the yield on T-bills is slightly higher than the reverse repo rate - currently, the yield on 1-month T-bills is about 0.05% higher than the funds in the RRP.

The next question is whether bad girl Yellen can channel the remaining $300 billion to $400 billion out of the RRP and into Treasury bills. If you doubt bad girl Yellen, you could face sanctions! Ask those poor souls from developing countries what happens when you lose access to dollars to buy basic necessities like food, energy and medicine.

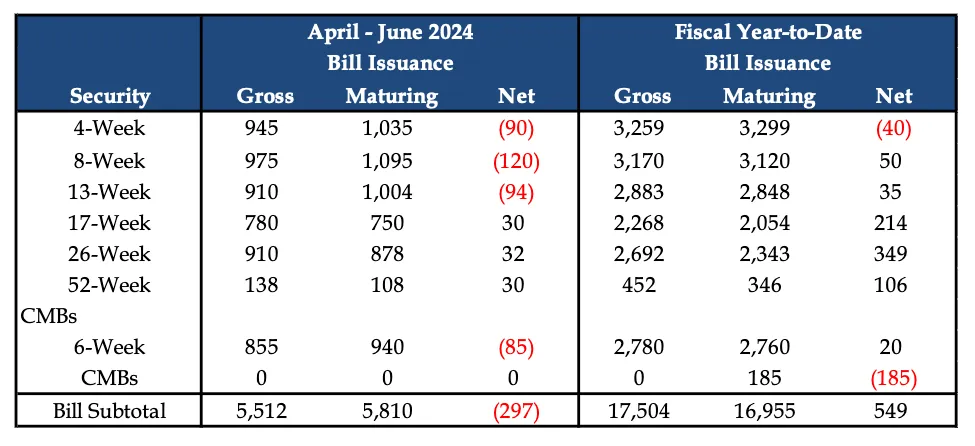

In the most recent Q3 2024 Quarterly Financing Announcement (QRA), the Treasury Department said it would issue $271 billion in Treasury bills by the end of the year. That's fine, but there's still money in the RRP. Could she have done more?

Let me quickly talk about the Treasury buyback program. Through this program, the Treasury repurchases illiquid non-Treasury debt securities. The Treasury Department can fund purchases by reducing its general account (TGA) or by issuing Treasury bills. If the Treasury increases the supply of Treasury bills and decreases the supply of other types of debt, it will have a net increase in liquidity. Funds will leave RRP, which is positive for USD liquidity, and as the supply of other types of Treasury bonds decreases, holders will move to the risk curve to replace these financial assets.

The latest buyback program through November 2024 will total purchases of $30 billion worth of non-Treasury bills. This is equivalent to another $30 billion in Treasury bills, bringing total outflows from RRP to $301 billion.

This is a solid liquidity injection. But how good is bad girl Yellen? How much does she want minority US presidential candidate "Momalla Harris" to win? I call her a "minority" because Kamala Harris changes her phenotypic affiliation in different situations depending on the audience. This is a unique ability she possesses. I support her!

The Treasury could inject huge amounts of liquidity by reducing the TGA from about $750 billion to zero. They can do so because the debt ceiling takes effect on January 1, 2025, and by law the Treasury can spend TGA to avoid or delay a government shutdown.

Bad girl Yellen will inject at least $301 billion and as much as $1.05 trillion before the end of the year. Bang! This would create a brilliant bull market across all types of risk assets, including cryptocurrencies, just in time for the election. If Harris still can't beat the orange guy, then I guess she needs to become a white male. I believe she has this super power within her/his abilities.

Table of contents

Togglegrenade

Over the past 18 months, an impressive $2.5 trillion has been injected into financial markets through the Reverse Repurchase Program (RRP). But there's still a lot of dormant liquidity eager to be unleashed. Can Yellen's successor create a situation after 2025 that pulls money out of bank reserves held by the Fed and into the broader economy?

In fiscally dominant times, all things are possible. But how?

For-profit banks will swap one income-generating cash instrument for another in terms of capital adequacy, as long as regulators treat them the same and the latter has a higher yield. Currently, Treasury bills yield less than the reserve balances held by the Fed, so banks won't buy Treasury bills.

But what happens next year when reverse repurchases are next to zero and the Treasury Department continues to dump tons of Treasury bills into the market? Sufficient supply and money market funds (MMFs) cannot purchase Treasury bills with funds parked in reverse repos, which means prices must fall and yields will rise. Once Treasury bills yield a few basis points above the rate on excess reserves, banks use their reserves to buy large amounts of Treasury bills.

Yellen’s successor—I’d be willing to bet it’s Jamie Dimon—will be unable to resist the ability to continue dumping Treasury bills on the market for the political benefit of the ruling party. Another $3.3 trillion in bank reserve liquidity is waiting to be injected into financial markets. Say it with me: T-bills, baby, T-bills!

I believe TBAC is quietly hinting at this possibility. Here's another excerpt from a previous report, with my comments in [ bold ]:

Looking forward, a number of factors may require further study to consider the share of future Treasury issuance:

[TBAC wants the Treasury Department to consider the future and how large the Treasury bill issuance should be. Throughout the report, they argue that Treasury bill issuance should be kept at around 20% of total net debt. I believe they are trying to explain what would cause this increase and why banks would be the bulk buyers of these Treasury bills. ]

The evolution and ongoing evaluation of the banking regulatory environment (including liquidity and capital reforms, among others) and the impact on banks and dealers’ meaningful participation in the primary Treasury markets to intermediate and warehouse (expected) future U.S. Treasury bond maturities and supply

[Banks don’t want to hold more long-term notes or bonds that attract tighter collateral requirements. They're quietly saying, we're not going to buy long-term debt anymore because it hurts their profitability and it's too risky. If major dealers strike, the Treasury is in trouble because who else has the balance sheet to absorb a huge debt auction. ]

The evolution of market structure and its impact on the Treasury Market Resilience Initiative, including,

- SEC’s central clearing rules, which will require substantial margin postings among covered clearing agencies

[If the Treasury market were to move to exchanges, it would require dealers to post billions of dollars in additional collateral. They cannot afford such costs and the result will be reduced participation. ]

- Future (expected) Treasury auction sizes and predictability in cash management and benchmark Treasury issuance

[If the deficit continues to be this large, debt issuance could increase significantly. Therefore, the role of Treasury bills as a "buffer" will become increasingly important. This means higher Treasury bill issuance is needed. ]

- Future Monetary Fund Reform and Potential Structural Demand for Treasury Bills

[If money market funds return to the market after reverse repos are completely drained, Treasury issuance will exceed 20%. ]

——TBAC July 31, 2024, Slide 26

Banks have effectively gone on strike and are no longer buying long-term Treasury securities. Bad girls Yellen and Powell nearly caused the banking system to collapse by flooding the banks with Treasury debt and then raising interest rates from 2022 to 2023... RIP Silvergate, Silicon Valley and Signature Bank. The remaining banks don't want to take the risk and see what will happen if they get greedy and buy overpriced Treasury bonds again.

Case in point: Since October 2023, U.S. commercial banks have purchased just 15% of non-Treasury securities. This is very bad for Yellen because she needs banks to step up as the Fed and foreign countries pull back. I believe that as long as banks buy T-bills, they are happy to meet their obligations, since T-bills have similar risk characteristics to bank reserves but offer a higher yield.

widowmaker

The move in the USD-JPY pair from 160 to 142 triggered a sharp reaction in global financial markets. Many people were reminded last week to sell what they can. That moment was textbook relevancy. USD-JPY will hit 100, but the next wave will be driven by a return of foreign capital from Japan Inc., not just hedge fund investors unwinding their yen carry trades. They will sell U.S. Treasuries and U.S. stocks (mainly large tech stocks like NVIDIA, Microsoft, Google, etc.).

The Bank of Japan attempted to raise interest rates, and global markets reacted violently. They compromised and announced that raising interest rates was not on the table. From a fiat liquidity perspective, the worst-case scenario is for the yen to trade sideways, with no new low-cost yen positions being opened. As the threat of the yen carry trade recedes, bad girl Yellen's market intervention is back in the spotlight.

dehydration

Without water, you will die. Without liquidity, you face collapse.

Why have cryptocurrency risk markets been trading sideways or down since April this year? Most tax revenue is generated in April, causing the Treasury to need to borrow less. We can see a decrease in the number of Treasury bills issued between April and June.

Liquidity is removed from the market due to a net decrease in Treasury bills. Even if overall government borrowing increases, a net decrease in cash-like instruments provided by the Treasury will lead to a reduction in liquidity. As a result, cash remains trapped on the Fed's balance sheet in the reverse repurchase program (RRP), unable to drive financial asset price growth.

This chart of Bitcoin (gold) vs. RRP (white) clearly shows that from January to April, when there was net issuance of Treasury bills, RRP fell and Bitcoin rose. From April to July, when Treasury bills were net withdrawn from the market, RRP rose and Bitcoin traded sideways, accompanied by several sharp declines. I stopped on July 1st because I wanted to show the USD-JPY interaction before the strong pullback from 162 to 142, which led to a general sell-off in risk assets.

So, following bad girl Yellen's words, we know there will be a net issuance of $301 billion in Treasury bills between now and the end of the year. If this relationship holds true, Bitcoin will quickly cover the sell-off caused by the rising yen. Bitcoin's next target is $100,000.

When is Altcoin season?

Altcoin are crypto-plays of high-beta Bitcoin. But in this cycle, Bitcoin and Ethereum now have structural buys in U.S.-listed exchange-traded funds (ETFs). Although Bitcoin and Ethereum have pulled back since April, they have escaped the Altcoin market’s drubbing. The Altcoin season will only return once Bitcoin and Ethereum break above $70,000 and $4,000 respectively. Solana will also exceed $250, but considering relative market capitalization, Solana's rise will have far less impact on the overall crypto market wealth effect than Bitcoin and Ethereum. By the end of the year, a rally in Bitcoin and Ethereum driven by USD liquidity will set the stage for the return of the sexy Altcoin party.

Trading settings

Liquidity conditions will improve as Treasury bill issuance and repurchase programs run in the background. If Harris falters and more firepower is needed to drive the stock market higher, Yellen will reduce TGA funding. Regardless, I expect cryptocurrencies to start breaking out of their sideways downward trajectory in September. Therefore, I will take advantage of this soft period at the end of the northern hemisphere summer to increase exposure to crypto risks.

The US election will be held in early November. Yellen will reach the peak of her control in October. There has never been a better time for liquidity this year. So I'm going to take advantage of the situation. I would not liquidate my entire crypto portfolio, but would take profits on more speculative momentum trades and park capital in staked Ethena USD (sUSDe) . Crypto market gains boost Donald Trump's chances of winning the election. Trump's odds peaked after the assassination attempt and Slow Joe's disastrous debate performance. Kamala Harris is a first-rate political figurehead, but she's not an octogenarian. That’s exactly what she needs to defeat Trump. The election is a coin toss and I would rather watch the chaos from the sidelines and get back in the market once the US debt ceiling is raised. I expect this to happen between January or February.

Once the U.S. debt ceiling drama is over, liquidity will pour from the Treasury and the Fed to allow markets to return to normal. Then the real bull market will begin. $1 million in Bitcoin remains my base case prediction.

PS: Once bad girl Yellen and towel boy Powell join forces, China will finally unleash its long-awaited fiscal stimulus. The US-China crypto bull market in 2025 will be brilliant.

This article is reprinted from TechFlow TechFlow with permission