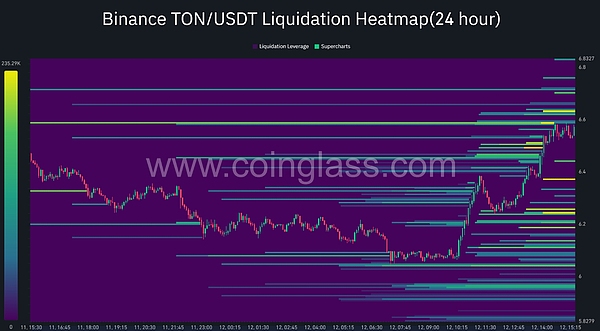

- TON faces a massive liquidation pool of 204,000 at the $6.63 price point.

- The number of active addresses increased by 10.69%, and the number of new addresses increased by 19.49%.

Toncoin, a cryptocurrency closely associated with the Telegram network, saw a sharp rise in price, rising 4.2% to $6.47 during U.S. trading hours on Monday.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

The rise marks a bullish start to the new week, hinting at potential stabilization in the market as Altcoin including Toncoin attempt to recoup losses incurred during the July correction.

While Bitcoin is still struggling to break through the $60,000 resistance level, Toncoin is seeing strong growth driven by recent listings on major exchanges and a significant increase in on-chain activity.

Liquidation pool is $6.63

At press time, Toncoin is facing massive liquidations totaling 204,000 TON at the $6.63 level.

This suggests that many investors have built positions around this price point, making it a key area for potential market moves. If the price of TON reaches this level, the market could see a wave of liquidations, exacerbating volatility.

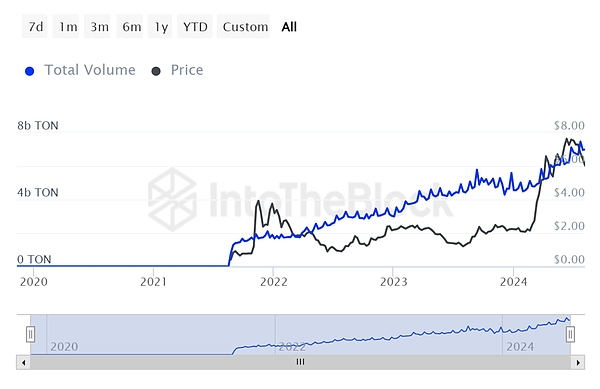

A surge in large transactions

During the same period, the number of large transactions surged by 1.98%. This growth indicates the growing interest and activity of whales and large holders.

Typically, such moves indicate confidence in the asset, which could hint at future price action. When large amounts of money start to flow, it’s often a precursor to broader market changes, making this a bullish indicator for TON in the short to medium term.

Growing adoption

In addition to the above, the number of active addresses increased by 10.69%. The number of new addresses also increased by 19.49%.

Both indicators point to growing interest and adoption of TON as more users participate in the network.

An increase in the number of active addresses generally correlates with increased network activity, which can further support price stability and growth.

What does this mean for TON?

Data suggests the network is maturing as user engagement and confidence grow. The $6.63 liquidation pool sets a clear battleground for future price action.

The increase in large transactions and active addresses indicates strong interest from both large players and new entrants. These indicators offer a bright outlook with the potential for both short-term volatility and long-term growth.

End

Investors must remain cautious. If Toncoin price fails to hold the $6 support, it could trigger a sharp decline where sellers could push the price down by 27% to $4.7.

This would invalidate the current bullish rhetoric and could portend further market volatility.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!