Author: Jiawei, IOSG Ventures; Translation: Xiaozou from Jinse Finance

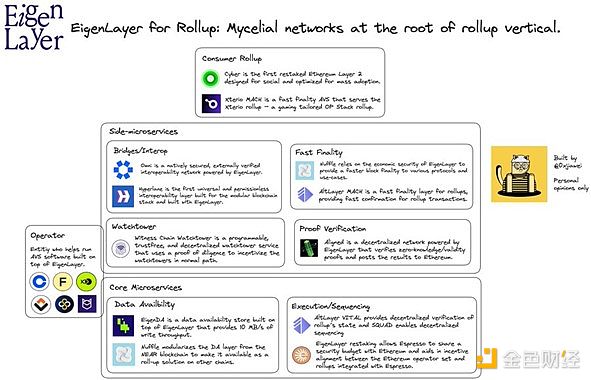

In this article, we will explore how EigenLayer’s cryptoeconomic primitives drive the development of the rollup ecosystem and why it is like a mycelium network at the root of its vertical field.

1. Why focus on rollup support ?

At the end of 2020, a rollup-centric roadmap was established as the main development direction of Ethereum. In the next few years, most user activities are expected to occur on rollups, with Ethereum acting as a security layer.

Recently, in addition to general-purpose rollups, there has been an increase in the number of app-specific rollups entering the market. (The L2Beats team suddenly has more unexpected work to do!) It’s clear that app-specific rollups have become a significant trend.

EigenLayer has proposed the idea of building the next 15 unicorns, and rollup services are a key category. It has worked with AltLayer to integrate many auxiliary services into a "re-pledge rollup" framework. So far, some progress has been made in this field, and Cyber, Xteri, and Dodo have all launched their own rollups based on this framework.

Looking ahead, based on crypto-economic security primitives, we can actually build a series of rollup services on top of EigenLayer, taking full advantage of the composability of EigenLayer. These services can be independently expanded according to specific needs, thereby enhancing the overall elasticity and scalability of the system.

We believe that with the support of these services, rollup can be started quickly.

2. Sorting

Sorting is a core component of the rollup system. Currently, most rollups rely on a centralized sorter to handle transaction sorting and transaction package submission.

Decentralized sorters are essential as the underlying infrastructure of the rollup system.

For early stage rollups, exploring these solutions can be very time-consuming and resource-intensive. Therefore, outsourcing this task to a shared sorter may be the best solution.

EigenLayer provides strong economic security guarantees for the sorter.

Espresso uses a re-staking mechanism to build its decentralized sequencer for greater security and performance.

By incorporating Ethereum’s staked capital into Espresso, the network can complete transactions in seconds, significantly improving node capital efficiency.

The re-staking mechanism ensures that Espresso’s security is tightly integrated with Ethereum, while optimizing resource utilization and economic security.

3. Data Availability ( DA )

Today's rollups still face some challenges in competing with L1.

- Data availability ( DA ) is expensive: The cost of writing data remains high.

- Uncertain DA cost: Even though the cost will decrease with the release of EIP-4844, there is still uncertainty that may overwhelm the entire bandwidth.

- Rollup exchange rate risk: Due to the potential volatility of the exchange rate of rollup tokens to ETH, there is uncertainty in fee calculation for rollups using native tokens.

-Token Utility: Unlike L1 tokens, most rollup tokens do not have token utility other than DAO governance.

EigenDA provides solutions to these challenges:

- Lower DA cost: EigenDA's ultra-large-scale system provides sufficient data availability at a lower cost.

- Long-term retention: Similar to reserving dedicated AWS instances, EigenDA allows users to obtain dedicated DA channels.

-Native token payments: Rollup can use its own native token for payments, effectively managing the inflation of DA operations.

- Double staking with rollup tokens: EigenDA’s security is enhanced by a committee of ETH stakers and user tokens.

These solutions are managed by EigenLayer and EigenDA, allowing developers to focus on their core products.

4. Watchtower

The fault proof system is designed to include a challenge period during which anyone can dispute a state transition. This mechanism is intended to ensure the integrity of the system and provide incentives for monitoring and challenging misconduct.

Given that early optimistic rollups may lack sufficient community attention and participation, this type of rollup relies more on watchtowers to monitor suspicious transactions and issue alerts.

Witness Chain leverages crypto-economic trust from EigenLayer to address this need by deploying the watchtower functionality.

Specifically, it ensures the continuous incentives and fairness of the watchtower through Proof of Diligence, and verifies the geographical location of the watchtower through Proof of Location, thereby achieving physical decentralization.

5. Proof Verification

In recent years, ZKApps (zero-knowledge proof applications) have developed rapidly. The verification of ZKP (zero-knowledge proof) has become a key component.

However, on Ethereum, proof verification is expensive and throughput is limited. In addition to the costs associated with the proof system and precompilation, there is also the impact of Ethereum network gas fees, which makes the cost structure unclear.

Aligned provides a verification network focused on reducing costs and increasing throughput. It implements proof verification through two modes: fast mode and aggregation mode. In fast mode, a portion of Ethereum validators re-stake through EigenLayer and use verification code written in a high-level language to verify the proof. After consensus is reached through BLS signatures, the results will be published to Ethereum.

This approach can not only optimize the verification speed through parallel processing, but also solve the problem of expensive proof systems on Ethereum, significantly improving verification efficiency and system scalability.

6. Bridging and interoperability

The multi-layer, multi-chain environment provides a wealth of choices, but also leads to fragmentation problems, bringing challenges to users and developers. Current bridge protocols and interoperability solutions face many difficulties when dealing with cross-chain interactions, such as security, efficiency, and user experience issues.

Hyperlane builds its interoperability protocol using EigenLayer’s re-staking mechanism to achieve a higher level of economic security. By staking and signing messages on the source chain, Hyperlane validators ensure the authenticity of the messages and perform fault checks through smart contracts.

This mechanism not only reduces Hyperlane’s operating costs, but also attracts more users and protocol fees through higher economic security.

7. Rapid finality

We need fast finality because Ethereum’s transaction finalization time is relatively long, around 12 minutes, making it unsuitable for latency-sensitive applications such as games and social applications. Due to the weak finality guarantees provided by sequencers, the transaction receipts they generate are not sufficient to support interoperability between rollups. Fast finality supported by cryptoeconomic security can enhance the reliability and security of these interactions, ensuring smooth cross-rollup operations.

AltLayer MACH is an AVS (Active Verification Service) of Eigenlayer, which helps rollup achieve fast finality and ensures the economic security and fast confirmation of rollup transactions. Each node in the MACH network is an operator, strictly verifies the rollup status, and actively challenges any possible deviations within the specified challenge window.

8. Conclusion

RaaS solutions such as AltLayer, Caldera, and Conduit can integrate all of these components, help applications quickly deploy infrastructure, and provide a simple one-click integrated development experience, allowing developers to focus on their products and applications.

These infrastructures exhibit a high degree of composability and are backed by strong economic security from EigenLayer.

Ethereum is the verifiable internet.

Rollups are verifiable web servers.

AVS is verifiable SaaS .

EigenLayer is a verifiable cloud.