In response to the upcoming release of the US Consumer Price Index (CPI) data, cryptocurrency investors are increasingly accumulating and holding digital assets, especially Bitcoin. However, Bitcoin's short-term price trend is closely related to the upcoming inflation data. It is expected that there may be fluctuations based on the CPI release.

Market indicators suggest that the market is shifting towards accumulation, driven by investor sentiment and the potential impact of CPI data on the cryptocurrency market.

On-chain data shows renewed investor confidence in Bitcoin

As markets recover from last week’s sell-off, many investors are increasingly holding onto digital assets, especially Bitcoin, despite widespread uncertainty. This behavior is evident in on-chain data, which shows a notable shift toward accumulation, especially among large wallet holders typically associated with institutional investors.

Since Bitcoin hit its all-time high in March, the market has experienced an extended period of supply distribution. However, this trend appears to be reversing, especially among the largest wallets. The Accumulation Trend Score (ATS) supports this observation, showing a return to accumulation-dominated behavior over the past month, with a maximum value of 1.0.

Long-term holders (LTH) played a crucial role in setting new all-time highs, and after a period of large-scale withdrawals, they are now returning to a preference for holding. The trend is clear, with more than 374,000 BTC transferred to LTH status in the past three months. From this, it can be inferred that investors' tendency to hold tokens is now more influential than the pressure to spend.

The 7-day change in LTH supply provides additional insight. Following the massive distribution during the March ATH, recent data shows a return to positive territory, with LTH now more prone to accumulation than selling.

Despite the sharp increase in Bitcoin’s spot price between April and July, it remains above the active investor cost basis. This situation suggests that investors are optimistic about positive market momentum in the short to medium term.

Hopes of rate cuts and favorable regulations fuel optimism

Crypto markets saw significant volatility last week, with $1.06 billion in liquidations in 24 hours. Experts attributed the decline to weak U.S. economic data and geopolitical risks.

However, the next day, Bitcoin and other cryptocurrencies showed a significant recovery. As of this writing, Bitcoin is trading at $60,945, up 2.67% over the past 24 hours. From a broader perspective, the total cryptocurrency market cap is $2.14 trillion, up 2.17% over the same period.

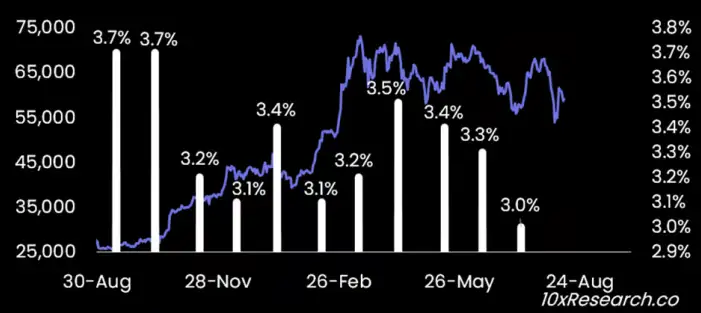

The expected rate cuts from the Federal Reserve could sustain the market’s upward momentum. Bitcoin’s movements have historically been closely tied to inflation trends, with Bitcoin typically rising when inflation falls. However, recent CPI releases suggest that this pattern may not always hold.

We are seeing short covering in Bitcoin and Ethereum due to expectations of lower inflation. However, the recent rally appears to be another bear market rally as fundamentals remain weak.

Despite the short-term volatility, investors remain optimistic about Bitcoin's long-term prospects. In addition to the expected rate cuts, other factors that could drive Bitcoin's rise include continued inflows into Bitcoin exchange-traded products (ETFs) and regulatory benefits.

Notably, inflows into Bitcoin ETFs have exceeded $17 billion since January, pushing the asset to a record high earlier this year. With major financial institutions such as Morgan Stanley approving Bitcoin ETFs, this trend is expected to continue, further supporting Bitcoin's price. In addition, significant progress and growing political support for cryptocurrency-friendly legislation in the United States indicate a favorable environment for further adoption and price appreciation.

Market expectations

The market expects CPI inflation to be around 2.9% year-on-year, which is considered neutral for the market as it is in line with current expectations and has been factored into market prices. If it is below 2.9%, it will be positive for Bitcoin and will lead to a small price increase. If it is above 2.9%, it will be a bearish signal that will cause market volatility and lead to a short-term price drop.

Will Bitcoin price fluctuate with CPI releases?

Bitcoin is currently experiencing a short-term bullish relief, replicating a historical pattern followed by a short-term pullback. We may see a slight bullish move in the short term, but the overall price action is likely to remain neutral. With less than 24 hours until the release of new inflation data, this upcoming information could have a significant impact on the market in the short term.

Meanwhile, Bitcoin RSI is around 50, which is at a neutral level with no significant buying or selling pressure. Bitcoin is approaching the $61,000 level. If this level can hold support, a break above $61,000 could be positive, but resistance remains strong.

In simple terms

As cryptocurrency investors prepare for the upcoming release of US CPI data, Bitcoin accumulation has increased. Large wallet holders are driving a trend of regaining confidence in Bitcoin's long-term potential, while interest rate cuts and cryptocurrency regulation are expected to support Bitcoin's future growth. It is expected that in the short term, due to weak fundamentals and the upcoming release of CPI, the market will be affected by a short-term correction. However, with significant progress in cryptocurrency-friendly legislation and growing political support, the environment for further adoption and price appreciation is favorable. And the continued inflow of Bitcoin ETF funds will also support the price of the market leader Bitcoin and drive prices up, which has good long-term potential.