Author: Jay Yu Source: stanfordblockchain Translation: Shan Ouba, Jinse Finance

Interview Guest: Heath Tarbert – Circle Internet Finance Company

Note: Heath Tarbert is Circle’s chief legal officer and head of corporate affairs and a former chairman of the U.S. Commodity Futures Trading Commission (CFTC) and assistant secretary of the U.S. Treasury.

This article is an in-depth exploration of the discussions and opinions in an interview conducted by Jay Yu of the Stanford Blockchain Club in June 2024. Full video: https://youtu.be/r289H_4kRxA

introduce Today, stablecoins have become a staple in the cryptocurrency industry, combining the reliability of the U.S. dollar as a store of value with the tradability and ease of use of blockchain tokens. This includes USDC, Circle’s flagship product, one of the most widely adopted stablecoins and the sixth largest cryptocurrency token by market cap.

In this article, we will discuss USDC’s unique capabilities as a stablecoin product, its current adoption as a means of payment, the regulatory landscape that USDC and other digital assets may currently face, and what all of this means for the digital future of the dollar.

Creating a Trusted and Transparent Stablecoin At its core, USDC solves a very simple problem: How do you buy digital assets with USD? Before stablecoins, the solution was to transfer fiat dollars from the traditional banking system to cryptocurrency exchanges, which is often a slow, cumbersome, and expensive process. USDC solves this “onboarding” problem by creating a “digital dollar”, a programmable, tokenized representation of the U.S. dollar that is backed 1:1 by fiat cash and cash equivalents.

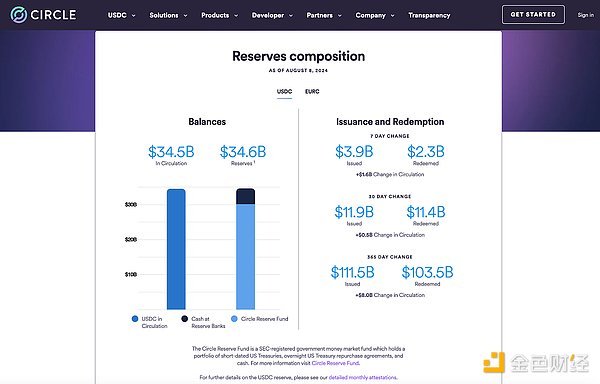

Since its inception in 2018, USDC has grown to become one of the leading stablecoins in the crypto industry. Perhaps the key difference between USDC and other major stablecoins is its emphasis on trust and transparency throughout the issuance process. Unlike other stablecoin providers, which are often based overseas and unregulated, Circle is a wholly-owned American company that operates in the United States and issues these "digital dollars." Every month, USDC's reserve assets are independently certified by the Big Four accounting firms, and Circle has a public dashboard where anyone can view the composition of USDC's reserves in real time. For example, as of August 8, 2024, Circle's dashboard recorded $34.5 billion worth of USDC in circulation.

Circle’s Reserve Compositions, accessed on August 8, 2024.

So, how are Circle's USDC tokens issued and redeemed? Direct issuance and redemption of USDC is handled through "Circle Mint," an application programmable interface (API) for institutional traders, fintech companies, exchanges, and other businesses. To receive any amount of USDC, Circle Mint customers need to initiate a fiat transfer of that amount to Circle's USDC reserve account through its API, and Circle will then issue an equivalent amount of USDC to the customer's Circle Mint account. Similarly, when a Circle Mint customer requests a fiat redemption of USDC, Circle will send that USDC to a "destruction address" and transfer the dollars to the business's associated bank account when a "destruction event" occurs.

The asset management process is also designed to promote trust by leveraging the expertise and transparency of traditional asset managers. Of USDC’s existing reserves of $34.5 billion, $4.5 billion is held at the Reserve Bank and the remaining $30.1 billion is held in the Circle Reserve Fund, an SEC-registered government money market fund managed by BlackRock with a 7-day SEC yield of 5.29%.

Fiat-backed stablecoins like USDC stand in stark contrast to the traditional fractional banking system. While most dollars in the bank are backed only by the bank’s loan portfolio (which is often composed of relatively illiquid and risky assets), each “dollar” of USDC is backed by an equal amount of highly liquid cash and cash-equivalent USD assets. In this sense, Circle’s USDC paves the way for the future of the dollar in a digital environment. By providing a secure, reliable, and innovative infrastructure framework for a “digital dollar,” Circle aims to reimagine one of the most important assets in the financial world.

Of course, the real value of a stablecoin lies in its use. No matter how well-designed or transparent the product is, the true test of a stablecoin lies in its adoption in everyday use cases — both in a blockchain environment and in traditional payment rails.

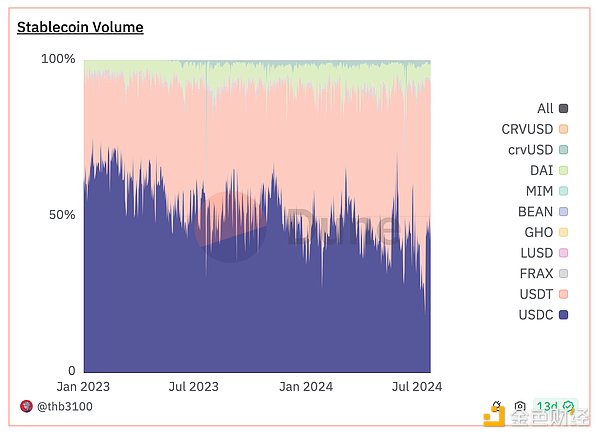

Stablecoin transaction volume in DeFi

Circle's USDC remains the world's largest regulated digital dollar and natively supports 16 different blockchains, where it has been widely used as the preferred stablecoin for DeFi protocols. Among them, the largest transaction volumes are Solana and Ethereum, and the main use cases are trading and other activities in the crypto ecosystem. To ensure compatibility between different supported blockchains, USDC has developed a native interoperability infrastructure for cross-chain transfers, called the Cross-Chain Transfer Protocol (CCTP).

The interoperability mechanism in CCTP is very similar to Circle Mint's fiat-to-token infrastructure. Currently, CCTP supports 8 different chains: Arbitrum, Avalanche, Base, Ethereum, Noble, OP Mainnet, Polygon PoS, Solana. To transfer USDC from one chain to another, for example, from Ethereum to Solana, there are three main steps:

First, USDC is burned on the source chain Ethereum.

The user then obtains a signed proof of the destruction from Circle as a receipt for this “destruction event”.

Circle uses this proof to authorize the minting of USDC on Solana.

One of the advantages of this burning and minting mechanism is that it allows compatibility across blockchains running different virtual machines — such as Ethereum’s EVM and Solana’s SVM, thereby supporting use cases such as cross-chain swaps, deposits, and purchases in decentralized finance (DeFi) systems.

But perhaps the most exciting area of growth for USDC is its applications beyond crypto trading and DeFi products. Traditionally, money has three main functions: (1) as a store of value, (2) as a unit of account, and (3) as a medium of exchange. In the real world, all three of USDC’s monetary functions are gaining adoption.

As a “store of value,” USDC becomes a natural solution for people in developing countries who don’t have reliable access to dollars or dollar-denominated bank accounts. In Argentina, where annual inflation has soared to over 200%, stablecoins have become the primary way for citizens to store value. In 2023, 60% of Argentina’s cryptocurrency purchases were in dollar-denominated stablecoins (such as USDC), and the country ranked 15th in the world in terms of cryptocurrency adoption. In December 2023, Circle also announced a partnership with Brazil’s Nubank to provide its 85 million customers with access to “digital dollars.”

As a “unit of account,” USDC has also made great strides over the past few years as Circle has conducted extensive pilots with Visa and Mastercard, two of the world’s largest payment processors. For example, Visa has been working with Crypto.com since 2021 to pilot the use of USDC as a settlement mechanism, and in 2023, Visa announced that it would work with new merchant acquirers Worldpay and Nuvei and leverage the Solana blockchain to increase support for USDC settlement. Similarly, in 2021, Mastercard announced that it would provide cryptocurrency companies with the ability to launch branded card products settled in stablecoins such as USDC.

As a “medium of exchange,” USDC is currently available at any Visa terminal through the Coinbase Visa Card. Launched in 2020 for U.S. consumers, the debit card allows consumers to use USDC directly at any Visa terminal, providing a fiat-like payment experience while earning cryptocurrency rewards.

The Coinbase Visa Card allows customers to use USDC at any Visa terminal.

Another example of using USDC as a “medium of exchange” is the Singapore-based Grab app, a Southeast Asian ride-hailing, food delivery, and grocery service super app with over 180 million users. In September 2023, Grab announced that they had partnered with Circle to create a web3 wallet that supports USDC payments and NFT government vouchers and food coupons. Today, consumers can use USDC on Ethereum and Solana as a means of recharging their Grab wallets.

Therefore, we see that USDC is gaining more and more support and integrating with traditional payment channels, integrating the Internet financial system with traditional financial services. But as a means of payment, how does the stablecoin compare to existing digital payment systems such as the Automated Clearing House (ACH)?

In many existing systems, such as ACH, funds and information are moved separately in a centralized ledger. If Alice makes a transaction to Bob via ACH or credit card, the transaction will first be marked as "pending" and will not be completed until up to a few days later. This is because at the time of the transaction, the system only sends a "message" that the transaction has occurred, but does not move the funds themselves. Funds are credited asynchronously, sometimes with a delay of several days.

A key advantage of stablecoin payments over these traditional systems is that funds and information flow simultaneously. Therefore, when Alice makes a stablecoin transaction to Bob, Bob receives the full amount of funds the instant the transaction information is sent, just like a cash payment. In this way, stablecoins as a payment mechanism represent a technological leap forward over many existing settlement solutions and are better suited to play the role of a "digital dollar" in the future.

As with any emerging technology, stablecoins raise a number of legal and regulatory questions. As stablecoins such as USDC move into the mainstream, a key concern is that they could become a tool for malicious actors to conduct money laundering, terrorist financing, and sanctions evasion. This is particularly important as the connection between traditional financial services and stablecoins matures over time to create a new internet-based financial system; a focus needs to be placed on improving regulatory compliance for stablecoin products.

In this article, we highlight how Circle is committed to making USDC a regulated, transparent, stable currency issued by an issuer that prioritizes regulatory compliance. As a regulated money transmitter, Circle complies with relevant FINCEN guidelines and state money transmitter laws, and all US users of Circle Mint are subject to anti-money laundering and know-your-customer regulations, such as the Patriot Act.

However, while it is necessary to introduce compliance to prevent malicious actors from abusing stablecoins like USDC, this regulation should be more sophisticated and fine-tuned to protect the interests of everyday consumers who want to use USDC; creating a regulatory system that excludes everyday consumers, especially those who have been marginalized by the existing financial system, is not in the best interest of the United States.

Today, the two main regulators attempting to regulate stablecoins in the United States—the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC)—were established long before the invention of the modern Internet, let alone digital assets such as cryptocurrencies and stablecoins. Today’s regulators are still using tools from more than 90 years ago, and while some guidelines are still useful in certain situations, regulators need to consider particularly carefully how to apply existing rules to this new industry and develop new rules to effectively regulate new activities based on blockchain technology innovations.

While the blockchain industry can make some technical innovations, such as decentralized digital identity systems, that make it easier to balance end-user privacy needs and regulatory requirements, this alone is not enough to fill this regulatory gap. Congress should take action to increase regulatory clarity around stablecoins and digital assets as a whole, and new legislation such as the draft Stablecoin Transparency Act represents a step in the right direction.

Several other jurisdictions, including the European Union, have gone further than the United States in this regard. Most recently, the European Union introduced the Markets in Crypto-Assets Regulation (MiCA), which will be fully implemented in December 2024. MiCA’s core innovation is that it seeks to create an entirely new regulatory framework for digital assets, including provisions that mandate liquid reserves for stablecoin issuers, restrict non-euro-denominated stablecoins, and provide a unified authorization system for the EU’s 450 million citizens. MiCA represents a major step forward in increasing regulatory clarity for stablecoin and digital asset regulation, and Circle’s stablecoins are among the first global stablecoins to comply with MiCA’s regulations. Based on its work in complying with MiCa, Circle’s products are well-positioned to gain adoption in the EU and become the leading compliant stablecoin.

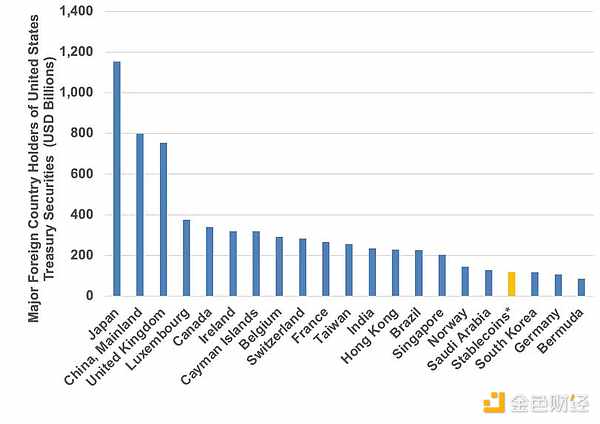

The largest foreign holder of U.S. Treasuries.

Therefore, the U.S. Congress has a strong incentive to act on stablecoin legislation. A regulated, dollar-denominated stablecoin like USDC can greatly advance U.S. interests in the digital asset space. USDC's reserve mandate means that there will always be demand for U.S. Treasuries. As of June 2024, stablecoins are the 18th largest holder of U.S. debt, holding more Treasuries than South Korea or Germany. This number will only increase as demand for stablecoins and digital assets grows. In other words, demand for dollar-denominated stablecoins translates directly into demand for dollars and U.S. debt. Therefore, Congress must increase regulatory clarity in the digital asset space to further strengthen the power of the dollar in the digital age.

Since its inception a few years ago, stablecoins such as USDC have made great progress and become one of the most compelling use cases of blockchain technology. The core idea of stablecoins is to bring the interoperability, composability, and accessibility of the Internet to traditional monetary institutions, and USDC is at the forefront of building a secure and transparent "digital dollar".

In the coming years, as stablecoin products, adoption, and regulation mature and evolve, we can expect millions of businesses and individuals to adopt new open standards for financial transactions. In this sense, Circle’s mission is to fulfill the unfinished promise of the Internet - to bring the openness and transparency of the Internet to the monetary field and ultimately build an Internet financial system.