Author: Juan Leon, Senior Strategist at Bitwise; Translated by: 0xjs@ Jinse Finance

On August 5, global stock markets fell into panic, with Japan's Nikkei index falling 12%, the biggest single-day drop since 1987, and the S&P 500 closing down 3%.

Unfortunately, Bitcoin did not fare much better, plummeting 14.52% between August 2 and August 5. The sharp correction sparked a lot of questions in the media: Why did Bitcoin fail as a hedge tool? Is Bitcoin really a hedge asset?

Out of curiosity, I decided to dig deeper into the historical data.

Specifically, I analyzed daily declines of 2% or more in the S&P 500 over the past decade and observed how Bitcoin and gold responded.

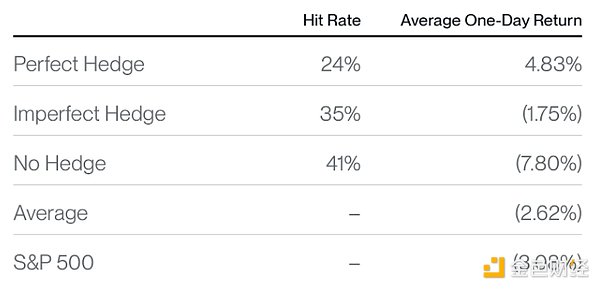

I then divided the returns of each asset into three categories based on how they performed on the day the S&P 500 fell:

Perfect Hedge – The asset provides a positive return

Partially hedged – the asset generates negative returns but outperforms the S&P 500

Without hedging - the asset's return is worse than the S&P 500

What I found was far more revealing and nuanced than what is usually reported.

Is Bitcoin a short-term hedge? Not really.

First, the bad news for Bitcoin: Data shows that Bitcoin is an unreliable short-term hedge. In fact, its daily returns appear to have no correlation with stock market movements.

More than half of the time (59% to be exact), it acted as a hedge, either rising sharply or falling less than stocks on days when the S&P 500 fell sharply. But the other 41% of the time, it fell more than the index.

Unfortunately, when this happens, it tends to be bad: when stocks fall 2% or more and Bitcoin underperforms, it really falls, falling 7.80% on average.

This tells me that not all single-day pullbacks are created equal. Of course, there are different reasons why a stock might drop 2% on a given day. The data suggests that some of these reasons led to big gains for Bitcoin and others led to big losses; there are no hard and fast rules.

If you’re looking for a foolproof one-day hedge against a sharp stock market correction, Bitcoin is not a good choice.

Bitcoin

Source: Bitwise Asset Management, data from Bloomberg. Data range is from January 1, 2014 to August 9, 2024.

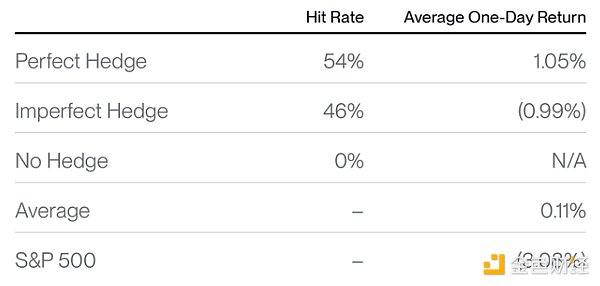

gold

Source: Bitwise Asset Management, data from Bloomberg. Data range is from January 1, 2014 to August 9, 2024.

Gold fared better, though its performance was mixed: it posted positive returns 54% of the time when the S&P 500 fell sharply, but on average it was up just 1.05% during that period. This makes gold challenging to use as an effective short-term hedge: you have to own a lot of it to have a real impact on your overall portfolio. If 5% of your portfolio is in gold, that 1% move will do little to cushion a pullback against a traditional 60% equity allocation in your portfolio. The other 46% of the time, gold fell an average of 0.99%, resulting in a portfolio loss.

Fortunately, most of us don’t invest for one day, but for the long term, so I wonder how these two assets perform as long-term hedges against these one-day shocks?

Has Bitcoin historically been a long-term hedge? Absolutely.

The two assets’ full-year performance records tell a completely different story. In a year when the stock market has corrected 2% or more, gold has returned an average of 7.88%, lagging far behind the stock market’s rebound. However, Bitcoin’s average return is as high as 189.68%, more than making up for its volatility.

Average one-year return after a sharp drop in the S&P 500

Source: Bitwise Asset Management, data from Bloomberg. Data range is from January 1, 2014 to August 9, 2024.

This dynamic makes sense. Gold is a trusted asset that many people instinctively buy during short-term panics. But its mature state means it underperforms over longer periods. Bitcoin, with its limited supply and decreasing issuance, has strong store-of-value properties, but is still early in its adoption phase. As such, it still has elements of a risk-on asset. This means its single-day reaction to market pullbacks is more variable, but the longer you watch, the better the returns.

For the past decade of returns, the record is clear: when the market pulls back, buying Bitcoin pays off.

Will Bitcoin outperform again?

The easiest criticism of this analysis is that past performance is no guarantee of future performance. While this time may be different, the 12-month outlook for Bitcoin is one of the most bullish I have ever seen.

Consider the following potential catalysts:

1. Spot Bitcoin ETP Inflows: Since January, inflows into Bitcoin ETPs have exceeded $17 billion, outstripping new supply and driving Bitcoin to record highs earlier this year. These inflows don’t even include some of the largest players. Last week, Morgan Stanley became the first major securities firm to approve the launch of a Bitcoin ETP on its platform. We expect Merrill Lynch, UBS, Wells Fargo, and others to follow suit.

2. Regulatory tailwind: The bipartisan coalition in Congress has pushed three cryptocurrency bills through the House of Representatives this year. With the Republican Party incorporating cryptocurrency into its official 2024 platform and the Harris campaign reassessing its position, the industry is about to usher in regulatory clarity.

3. Fed rate cuts: The European Central Bank, Bank of England and other central banks have already started to cut rates. As slowing inflation and weak economic data in the United States raise recession concerns, the Fed must catch up. Federal Funds futures already expect the Fed to cut rates at its September meeting.

Are we out of the woods yet? Probably not yet. Investors remain uneasy about market volatility caused by the unwinding of yen carry trades. Add to that uncertainty over the U.S. presidential election, signs of a global economic slowdown and the looming threat of a conflict between Iran and Israel, and there's more turbulence ahead. But the next time stocks sell off, you'll know which asset is the best long-term hedge.