Ethereum (ETH) price continues to recover, riding on the tailwind of increased demand in the ETF (exchange-traded fund) market. However, widespread market uncertainty and institutional selling pressure remain a burden.

The cryptocurrency market continues to show a turnaround, with global market cap up nearly 3%.

Ethereum Phased Recovery

The price of Ethereum has surged nearly 30% since bottoming at $2,111 on August 5th, as it continues its recovery efforts. Looking at the daily chart, we can see a pattern of higher lows in both price and the Relative Strength Index (RSI), indicating increasing bullish momentum. This momentum could be strengthened further if the RSI decisively crosses 50.

The surge in the volume profile (orange) shows that bulls are waiting for Ethereum price to interact with the bulls once the price enters the demand zone between $2,924 and $3,075. Notably, this order block turned into a bearish breaker when Ethereum price fell below it on August 3.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

The cryptocurrency market is showing a changing sentiment as Bitcoin recovers its psychological support level of $60,000 and global market cap rises 3%. Above all, it is benefiting from positive ETF flows led by the Ethereum ETF.

According to a report by BeinCrypto, Ethereum led the inflow of funds into cryptocurrency investment products last week, attracting $155 million out of a total of $176 million .

“Ethereum has been one of the biggest beneficiaries of the recent market correction, taking in $155 million last week. This brings its total inflows for the year to $862 million, the highest since 2021, driven by the recent launch of a U.S. spot-backed ETF,” the CoinShares report said .

Response to Ethereum Price Movements

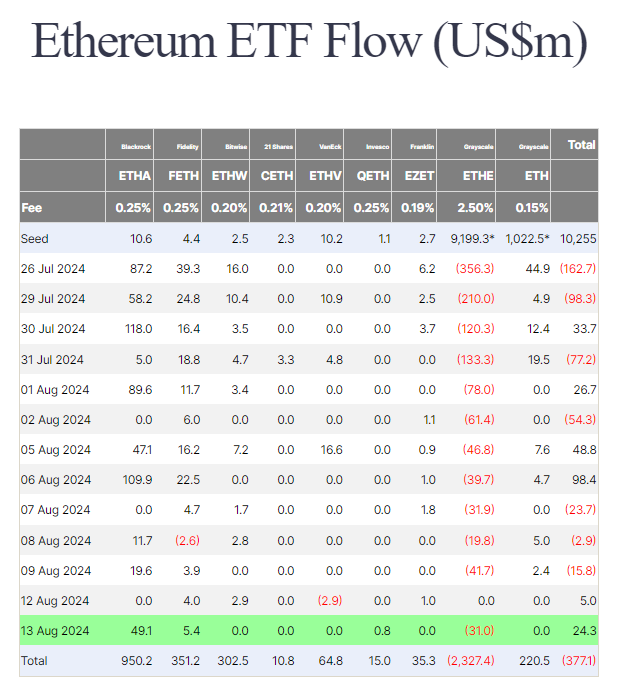

On Tuesday, the Ethereum spot ETF recorded net inflows of $24.34 million, surpassing the $5 million recorded on Monday. According to Farside Investors , BlackRock’s ETHA has seen steady inflows since its launch, showing strong investor confidence .

In particular, ETHA saw inflows of $49.1 million, bringing the total to $950.2 million. In contrast, Grayscale’s Ethereum continues to suffer from negative flows, recording a total outflow of $2.327 billion. This reflects the contrasting performance of the two prominent Ethereum ETFs, with Grayscale’s being attributed to customer redemptions from Bitcoin in January.

“Institutions have invested in Bitcoin before. They are doing it again with Ethereum. They almost made people believe that the BTC ETF failed. It’s almost the same story with Ethereum. This cycle may reverse and go up again, but until then, it’s painful. It’s very painful to see the next financial rail burn to ashes!” Vikas Singh put it .

Read more: How to invest in Ethereum ETFs?

Nevertheless, while Ethereum ETF inflows provide positive momentum for Ethereum, institutional selling is backfiring and creating a backlash. According to LookOnChain, Jump Trading resumed selling Ethereum on Wednesday. The Chicago-based trading firm’s crypto arm staked 7,049 Ethereum worth $46.44 million from Lido Finance and put it up for sale.

“Jump Trading just started selling ETH again! They claimed 17,049 ETH ($46.44M) from Lido and transferred it for sale. Jump Trading currently has 21,394 wstETH ($68.58M) left,” LookOnChain wrote .

BeinCrypto reported that the company applied for a redemption of over 14,000 ETH worth over $48 million on August 7. On the same day, it unstaked 11,500 ETH worth $29 million from Lido Finance and moved them to a centralized exchange. It also sold over $231 million of ETH on August 5.

The transfer of frozen assets to centralized exchanges often indicates a willingness to sell, potentially putting downward pressure on the Ethereum price. This selloff in response to ETF investor demand has limited Ethereum’s upside potential below $2,800, and a range-bound move is likely to emerge in this balance.