Author: The Rollup Source: therollup Translation: Shan Ouba, Jinse Finance

Chain abstraction is the next logical evolution of a modular ecosystem.

While a modular system allows us to independently optimize and scale specific components of the blockchain stack, this also creates a fragmented experience for many users who are new to blockchains.

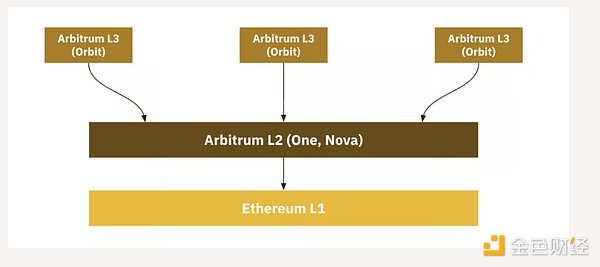

With the rise of Rollup frameworks and Rollup-as-a-Service providers, it is easier than ever to launch a new Rollup or AppChain. This has radically reduced the average transaction cost on Ethereum L1, but the user experience on L2 feels far less uniform than doing transactions on Solana or Ethereum in 2020.

The lower barrier to launching new chains has led to more experimentation and expansion of rollups, as shown in the figure below.

We believe that chain abstraction has the potential to be a quantum leap in on-chain experience, at a user-facing level, with teams focusing on different parts of the stack working together. When combined with high-performance, intent-based bridges, transport layers, and ordering networks, the ultimate goal of making Ethereum composable again seems achievable.

An abstracted wallet experience for all users combined with lightning-fast interoperability in the background will provide the ecosystem with a Web2-like experience of browsing websites (on-chain applications) with almost no friction.

However, the narrative around chain abstraction is confusing, and large gaps in understanding remain. As early adopters in this space, we have a unique opportunity to shape its trajectory. To realize this full potential, we must make the core ideas accessible to everyone. By simplifying complexity and demonstrating real-world applications, we can inspire broader adoption and move the industry forward.

What, why, how and when?

Essentially, chain abstraction aims to simplify the backend complexity of blockchain applications, particularly in the areas of cross-chain interactions and gas abstraction. A common end goal shared by many in the community is to create applications that users may not even realize are crypto-related. However, many current users still care about knowing which blockchain they are using, associating a specific chain with a unique community and experience.

This leads to a key question: Is complete abstraction what users actually want?

We should not view chain abstraction as an all-or-nothing solution, but rather build it as a spectrum that provides users with choice and flexibility. This provides a message that is consistent with the core ethos of optionality, modularity, and crypto as a whole.

In order to make the chain abstraction idea resonate, we believe that moving from talking about potential use cases to demonstrating tangible benefits with real use cases should be the focus of our ecosystem. We think the best way to do this is to focus on the top two core user pain points today: fragmentation in a multi-chain environment, aggregation clusters and bridges, and simplifying transaction signatures and gas fees.

Rather than overwhelming users with a full set of abstractions and further obscuring the definition of chain abstraction, the community could consider gradually introducing newer ideas and solutions. The rationale here is to build out a more comprehensive chain abstraction stack over time. This approach ties into the idea of providing users with checkpoints or a roadmap for chain abstraction. By showing where we are now and where we are heading, we can make the future of chain abstraction feel more tangible and less abstract, no pun intended.

We think it’s important to manage expectations, too. Since Aave yield farming opened up on Avalanche and Polygon in 2020, we’ve heard promises about “solving the UX” — but that experience has yet to fully materialize. Many in the community have lost money to bridge hacks, sending funds to the wrong chain, forgetting about gas on the target chain, or simply forgetting about tokens on a chain where the RPC connection in their MetaMask wallet wasn’t working properly.

To make chain abstraction a reality, we need to focus on clear education, real-world demonstrations across applications, and building solutions that have low friction for users to adopt. This isn’t about showing users everything that chain abstraction can do, but about solving the problems they currently face while gradually introducing them to the broader potential of the category.

Our goal in creating the Chain Abstraction Market Map is to provide a comprehensive understanding of the technologies, tools, and standards that are addressing the fragmentation problem. This post will break down each category of the map, explain our rationale, and the key projects that are building the future of chain abstraction.

As we put this together, we realized that several items could fit into two or even three of these categories. We know there will be debate and discussion. As always, we welcome this debate and encourage rebuttal and constructive criticism.

1. Permissions and Orchestration

Account abstraction: Safe, Avocado Wallet, Turnkey, Kontos:

Account Abstraction (AA) represents a fundamental shift in the way users manage blockchain interactions, simplifying account management and transaction signing. Traditional blockchain accounts typically require users to handle private keys directly, which poses risks if these keys are lost or compromised.

AA platforms address this problem by providing a more user-friendly account management solution. These platforms utilize smart contract wallets or "smart accounts" where private keys are abstracted away, providing users with a seamless and more secure experience. By focusing on security and ease of use, these tools are critical to attracting the next wave of blockchain users who don't have to learn how to manage private keys.

Business Automation: Halliday, Fun.xyz, Decent:

Commerce automation platforms are designed to simplify and automate the various processes involved in blockchain-based commerce. These platforms enable businesses to automate payments, settlements, and other commercial transactions, reducing the need for users to go through a multi-step checkout process. This not only speeds up transactions, but also reduces the potential for human error. By integrating with cryptocurrency and fiat currency providers, these platforms can speed up app checkout and provide a smoother purchasing user experience, allowing commerce to proceed smoothly on any chain.

Wallet abstractions: OneBalance, NEAR Protocol, Mycel, Particle Network, Socket Protocol, Orb Labs, Light, Intentify, XION, Arcana Network, Okto:

Wallet abstraction platforms (sometimes called account-level chain abstraction) focus on simplifying the user experience by abstracting the complexity of managing multiple balances and wallets across different blockchains. These platforms provide a simplified wallet user experience and aggregate token balances into one place. Users get a unified experience without having to manually bridge and swap tokens to manage assets between different chains.

Orchestration: NEAR Protocol, Orb Labs, Light, Intentify, Okto, Klaster, Aarc, Shogun, Agoric, Infinex, Li.Fi:

Orchestration services, or application-level chain abstraction protocols, coordinate activities between multiple blockchains, ensuring efficient execution of multi-chain operations. These projects provide tools for automating and managing various underlying execution platforms and blockchain infrastructure, such as RPC. For example, an orchestration platform might coordinate a transaction involving multiple steps between different blockchains, such as swapping tokens on one chain, bridging them to another chain, and then staking them into a DeFi protocol. By automating these processes, orchestration can create a one-click experience for users, reduce the risk of user error, and ensure that operations are performed in the most efficient order.

2. Order flow sources and auctions

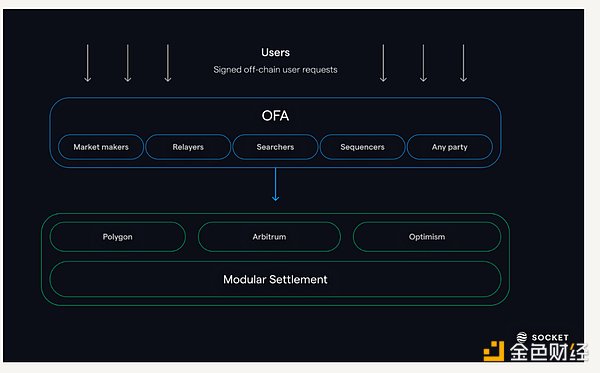

Catalyst, Socket Protocol, Uniswap, Aori, Across, Router Protocol, Synapse, Orbiter, Arrakis, Shogun, DLN, Li Fi, Sprinter, Squid, Anoma, Relay Protocol, CoWSwap, Essential, Espresso, Decent, Jumper:

Order flow sources are sources of user intent and are an important part of the DeFi ecosystem. Auctions facilitate the execution of order flow so trades are executed at efficient prices. Platforms specialize in managing order flow and conducting auctions. For example, UniswapX routes trades through multiple off-chain and on-chain liquidity sources to ensure best execution for users.

Cross-chain liquidity is an important aspect of the multi-chain ecosystem, and these platforms help enable seamless asset transfers between different blockchains. These platforms typically act as liquidity routers, connecting various DEXs and liquidity pools across multiple networks. By facilitating cross-chain liquidity, they ensure that users can trade assets and transfer funds between blockchains without facing liquidity restrictions or significant slippage.

3. Solver Network

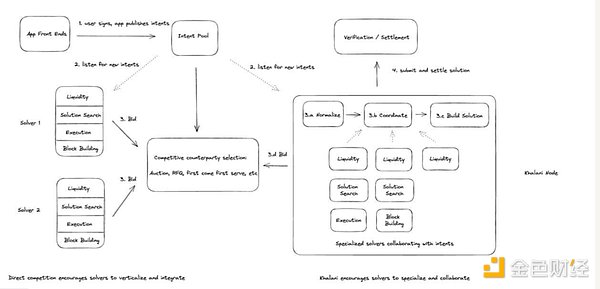

Enso, Khalani, Aori, Valantis:

Solver networks are specialized platforms that focus on solving complex computational problems in the blockchain ecosystem by leveraging third-party agents, called solvers. Solvers fulfill user intent and perform tasks such as transaction validation, price discovery, and other decentralized operations that require significant computational resources. These platforms optimize the performance and efficiency of blockchain networks by distributing these tasks across a network of solvers.

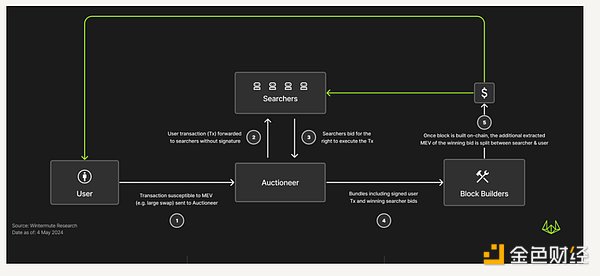

4. Solver

Wintermute, Amber, Propeller Swap, Anera Labs:

Solvers are off-chain participants that specialize in optimizing various blockchain functions, such as transaction batching, arbitrage, cross-chain liquidity provision, and fulfilling user intent. In cross-chain use cases, solvers can quickly fulfill user intent on the target chain, but incur finality risk due to the canonical bridge. For example, Wintermute is a well-known market maker in the DeFi space, providing liquidity and ensuring a smooth trading experience on decentralized exchanges. These solvers are an important part of the intent paradigm, which is shaping much of the chain abstraction discussion in the ecosystem.

5. Liquidation

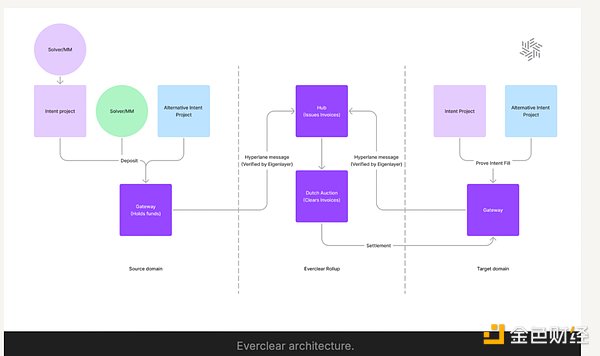

Everclear:

The clearing platform is responsible for ensuring that transactions between different blockchains are settled correctly and efficiently. Decentralized clearing services ensure that all parties involved in a transaction fulfill their respective obligations and rebalance asset inventories efficiently.

6. Standards

ERC-7281, ERC-7683, ERC-4337, EIP-3074, EIP-3370, EIP-7579:

Standards are the backbone of the blockchain industry, ensuring that different platforms and protocols can coordinate and interoperate. Each of the above standards plays a unique role in coordinating these chain abstraction systems:

ERC-7281: This standard enables token issuers to bridge tokens across multiple blockchains while retaining control over the bridging process. It allows bridgers to set rate limits on minting and burning bridge operations. The main goal is to avoid centralization of funds and ensure open competition between different bridging solutions.

ERC-7683: Standardized cross-chain intent resolver and settlement interface. It proposes the "CrossChainOrder" structure and the "ISettlementContract" interface to simplify the processing and settlement of cross-chain orders. The standard aims to connect different blockchains by creating a universal filling network.

ERC-4337: Introducing account abstraction for more flexible and easier interaction with dApps. Users can pay transaction fees with tokens other than ETH and use enhanced smart contract wallet functionality. Despite support for the account abstraction standard, there is still more research on upgrading existing EOA wallets to smart contract accounts.

EIP-3074: This proposal aims to abstract gas from the user experience by allowing sponsored transactions. This means that users can have their transactions sponsored by another account, making it easier to pay transaction fees and interact with applications.

EIP-3370: This standard proposes to add prefixes to signal chain specific addresses. For example, arb:0xAbc123.. would represent an address on Arbitrum One. This will help eliminate confusion and user errors of sending tokens to the wrong network.

EIP-7579: This standard proposes to upgrade the current account abstraction implementation to enable cross-chain user experience through modules. The proposal outlines the minimum interfaces and behaviors required for modular smart accounts and modules.

These standards are critical to ensuring that the blockchain ecosystem can grow and evolve in a cohesive way. Several other standards are in the research and implementation stages to improve the experience of accounts, wallets, and cross-chain transactions, achieving complete chain abstraction.

7. Settlement and Infrastructure

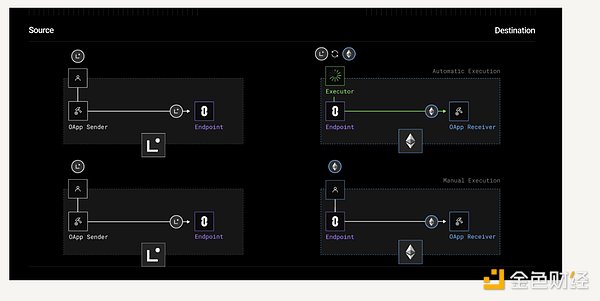

Transport layer: Layer Zero, Axelar, Union, Wormhole, SEDA, Polymer Labs, IBC Protocol, Omni, Hyperlane:

The transport layer is responsible for facilitating the transfer of data and assets between different blockchains. These projects provide the infrastructure that enables blockchains to communicate. The latency of these protocols is proportional to security, meaning that cross-chain messages are more secure but slower to transmit. Users use the transport layer less frequently than the faster intent-based transport layer.

For example, LayerZero is known for its universal messaging protocol, which allows dApps to interact with multiple blockchains. These transport layers are essential to creating a truly interconnected blockchain ecosystem where users can move assets and data across networks.

Fast Finality: Nuffle, Aligned, ZKV Protocol, Hyle:

Fast finality solutions focus on speeding up transaction settlements, making blockchain networks more efficient and user-friendly. Platforms provide technology to shorten the time it takes for a transaction to be considered final and irreversible. This is particularly important in high-frequency trading or real-time applications, where delays can result in significant losses. Fast finality solutions improve user experience and application efficiency, enabling blockchain networks to rival traditional financial systems in terms of speed and reliability.

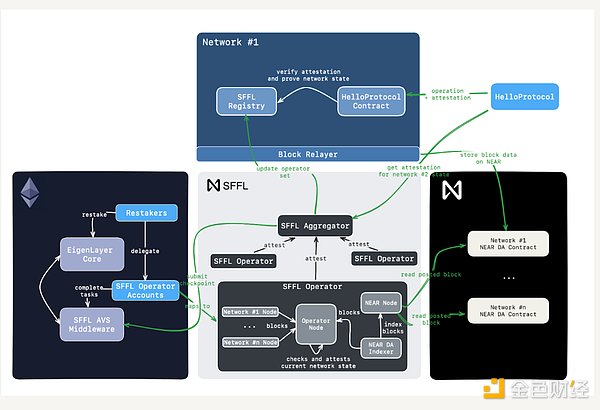

Rollup cluster: Optimism Superchain, Arbitrum Orbit, ZKsync Elastic Chain, Caldera Metalayer, Initia, Dymension, Polygon AggLayer, Astria, Espresso, Nodekit, Radius:

A Rollup cluster is a group of Rollup clusters that share liquidity and infrastructure to achieve network effects. By working together, these Rollups can process a large number of transactions, making the cluster more scalable and able to support a wider range of applications. Research is currently underway to make interoperability within and between clusters more efficient by combining the use of transfer protocols and an intent-centric cross-chain approach.

The future of blockchain will likely see more consolidation and abstraction as these technologies continue to break down barriers between different networks and more projects work on improving the on-chain experience.

If modularity is the great unbundling, then chain abstraction is the great rebundling.