Mantra is an L1 public chain focused on RWA, which may have been overlooked.

Mantra recently announced an airdrop of 50 million OM, worth over $50 million at current market prices! This airdrop is for certain NFTs shown in the screenshot below. But you might be asking yourself, what exactly is Mantra? Mantra is an L1 public chain focused on real-world assets (RWAs) that we think may be overlooked.

The RWA narrative has waxed and waned, but overall it has been one of the strongest narratives in the current cycle. MKR is the first token to have some connection to the "real world" by investing in treasuries. We also identified Canto as a potential RWA project, which, despite performing well in the short term after our initial report, did not live up to the broader vision.

There are also projects like ONDO, which is favored by Kuaiqian as a bet in the RWA field. Although the "1 ONDO = 1 CONDO" joke is interesting, it is difficult to get excited about ONDO's fully diluted valuation of more than $7 billion, especially considering the huge oversupply and upcoming venture capital unlocking.

Projects like Centrifuge, while having interesting technology, seem to have failed to make significant progress in tokenizing real-world assets. This brings us to Mantra (OM). To our surprise, almost no one is talking about this project, despite it being one of the best performers in the entire market this year (rising from ~$0.04 to over $1):

Figure: $OM price performance in 2024

Naturally, we wanted to explore this story to see if this was just a small circle of tokens being manipulated to move higher, or if there was something more interesting going on.

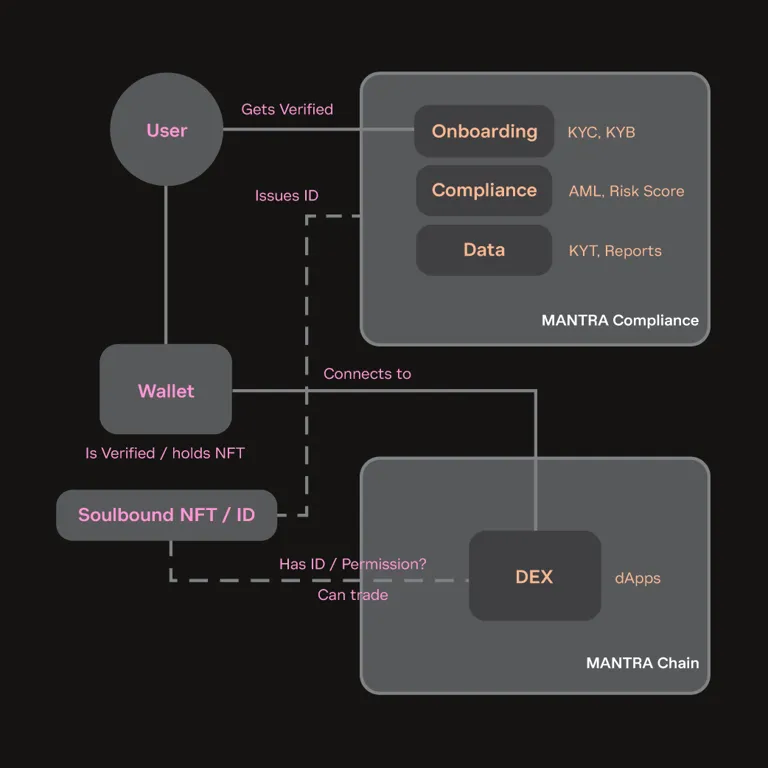

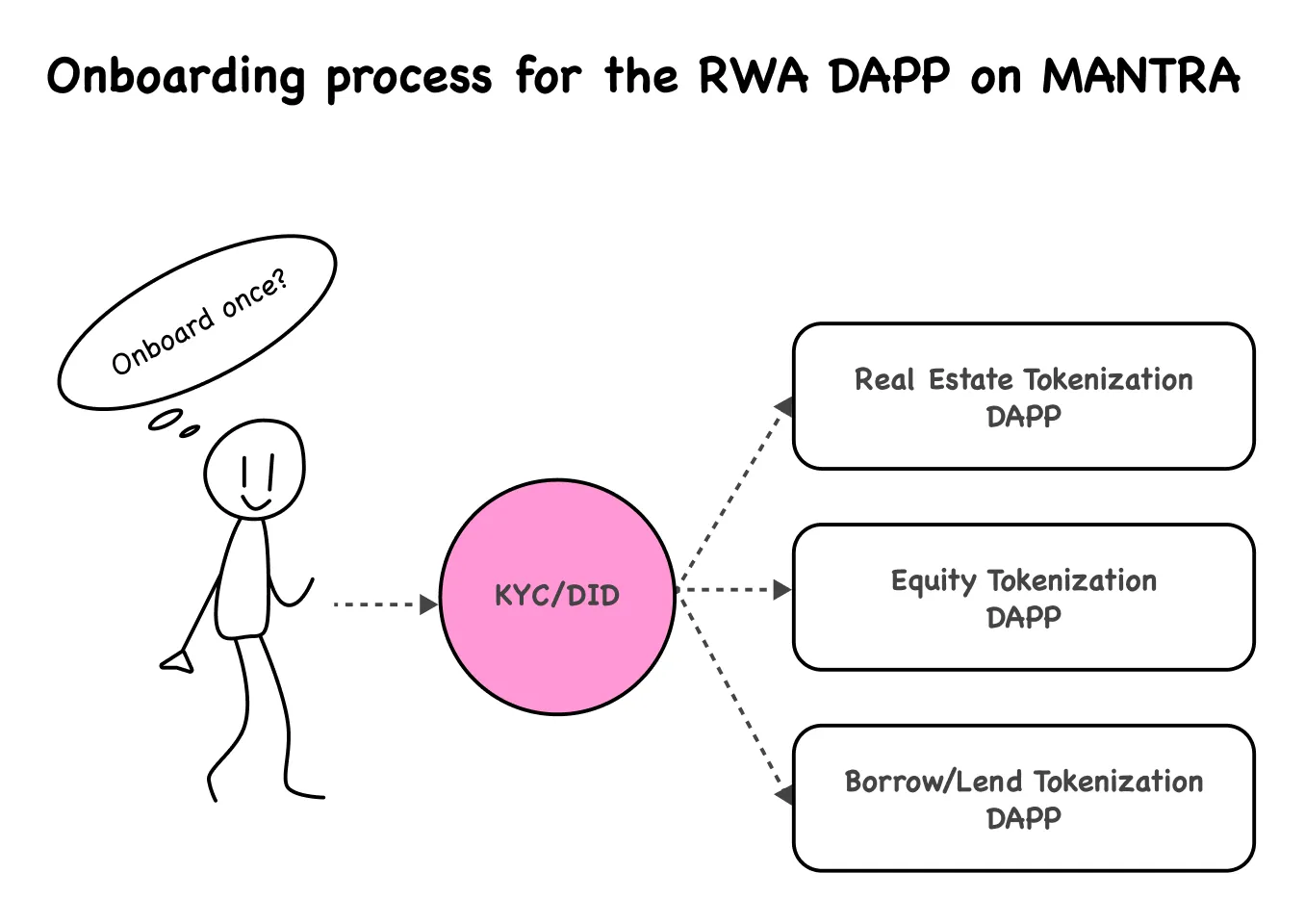

Overall, Mantra started in 2020. The Mantra chain is a Cosmos L1 customized for asset tokenization, which means it emphasizes security and customization to allow for the execution of regulatory requirements. In their own words, it is a "permissioned application on a permissionless blockchain."

Through their identity system, users obtain a soul-bound NFT/ID which can then be used for KYC of any activity conducted on-chain.

For the tech enthusiasts, some key technical features:

• Built with Cosmos SDK, IBC compatible, supports CosmWasm

• Secured by a sovereign PoS validator pool

• Scalable to 10k TPS

• Built-in modules, SDKs and APIs for creating, trading and managing regulatory compliant RWAs

• Improved user experience to attract non-native users and institutions to Web3

Mantra Chain is currently in the Hongbai testnet stage, and the mainnet will be launched soon™.

You might be thinking: "They've been operating for 4 years and they're still on testnet!?". That's because Mantra didn't start out as a chain, but rather started out as a DAO in 2020. It was a community DAO that was involved in a variety of different initiatives like validating on the Kusama network, growing the DeFi ecosystem in China, and various other miscellaneous activities. In 2022, Mantra pivoted to building the chain they are completing today.

Putting aside the technology and history for a moment, let's discuss some of the traction Mantra is seeing.

It was recently announced that Mantra will be working with MAG (one of Dubai’s largest real estate developers). This collaboration involves MAG tokenizing the financing of a $500 million land parcel/development project, allowing on-chain investors to fund the project and then also participate in equity once it is built.

In effect, as a participant, this looks like a bond during the funding period. It is a bond that pays an 8% yield, payable in USDC, with an additional OM incentive. Once development is complete, participants can choose to redeem the principal or convert to equity ownership of the property.

Mantra has also signed a Memorandum of Understanding (MOU) with Zand (Dubai Bank) to streamline the process of tokenizing real-world assets, including the identification, listing and distribution of RWAs.

This is part of Mantra’s wider effort to build credibility and reputation in the UAE region, where they hold a license from the Virtual Asset Regulatory Authority (VARA). It seems that Mantra is currently focusing fully on the UAE and paying less attention to other places. This focus makes sense given the region’s relatively open regulatory regime and thriving real estate industry.

MAG<>Mantra’s announcement is certainly encouraging, but it is currently the only public tokenization project on Mantra. We certainly hope to see other developers or asset issuers join over time to prove the viability of Mantra as an RWA platform.

OM currently has a fully diluted valuation (FDV) of just under $1 billion, with the remaining supply set to be distributed via their currently ongoing airdrop campaign, with approximately 32% of the circulating supply being staked.

Mantra isn't an obvious buy opportunity, but a sub-$1 billion FDV isn't totally outrageous for a thoughtfully designed L1 that is achieving product-market fit in what could become a critical market. OM has definitely earned a spot on our watch list!