How Hedge Funds Could Operate Spot Bitcoin ETFs in Q2 2024

How Hedge Funds Could Operate Spot Bitcoin ETFs in Q2 2024

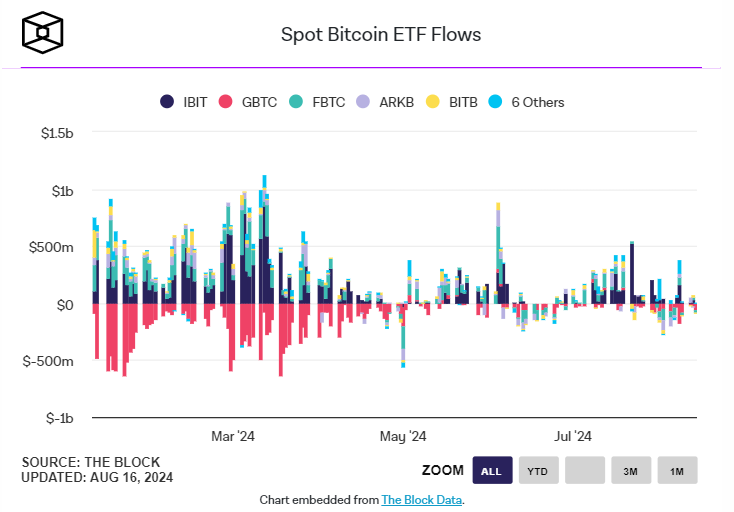

This week, institutional investment managers with at least $100 million in equity assets filed 13F reports with the U.S. Securities and Exchange Commission (SEC). Investment managers held $4.7 billion worth of spot Bitcoin ETFs in the second quarter of 2024. Here’s an overview of how some of the most prominent hedge funds bought or sold these ETFs during the quarter.

Four times a year, institutional investment managers that manage at least $100 million in equity assets must file 13F reports with the SEC within 45 days of the end of the quarter. The reports provide insight into managers' stock holdings, although they do not disclose any short positions.

13F filings offer a glimpse into how the largest portfolios and some of the most influential money managers operate the market. In May, Bitwise Chief Investment Officer Matt Hougan said that the spot bitcoin ETF allocations revealed in 13Fs — the first quarter these ETFs were eligible — were merely “down payments.”

“About six months after the initial allocation, many firms begin making allocations across their client base, typically in the range of 1-5% of the portfolio,” Hougan wrote in a client note at the time. “The great promise of Bitcoin ETFs is that they could open the door for professional investors to buy Bitcoin on a large scale, thereby substantially increasing the pool of money invested in the asset.”

From the perspective of multinational banking giants, Goldman Sachs held about 7 million shares of the spot Bitcoin ETF (worth $418 million) at the end of the second quarter, while Morgan Stanley held more than 5.5 million shares (worth $190 million). In addition, high-frequency trading company DRW Holdings disclosed that its current holdings in six cryptocurrency ETFs are worth at least $195 million.

Overall, investment managers held $4.7 billion worth of spot Bitcoin ETFs in the second quarter. Here’s how some of the most prominent hedge funds bought, sold, or held them.

Details on Bitcoin ETFs and Hedge Funds

In the first quarter, Millennium Management held shares in five spot Bitcoin ETFs with a total value of $1.94 billion. As of June 30, that number fell to $1.1 billion. It holds 371,321 shares of BlackRock's iShares Bitcoin Trust (ticker: IBIT), worth $371 million, making it the fund's largest single shareholder. But its largest holding is 11.22 million shares of Fidelity Wise Origin Bitcoin Fund (ticker: FBTC), worth $588 million.

Capula, one of the top European hedge funds, holds 7,419,208 shares of IBIT (valued at $253 million) and 4,022,346 shares of FBTC (valued at $211 million). Steve Cohen's Point72 took a new position of 1,668,578 shares of IBIT, valued at $57 million, and slashed its FBTC position to 57,192 shares, valued at $3 million. Apollo bought 750,000 shares of Ark 21Shares Bitcoin ETF (ticker: AKRB) in the second quarter, valued at $45 million.

Ken Griffin's Citadel tripled its ProShares Bitcoin Strategy ETF (ticker: BITO) holdings from the first quarter to the second quarter to 860,727 shares, currently worth $19 million. It also holds $67 million in call options and $52 million in put options. Citadel also holds smaller positions in its remaining Bitcoin ETFs - worth less than $10 million in total.

Jane Street holds sizable positions in four spot Bitcoin ETFs: 2,953,768 shares of ARKB ($177 million), 14,239,526 shares of BITO ($320 million), 233,843 shares of FBTC ($233 million), and 6,474,742 shares of IBIT ($221 million, a new position in the second quarter).

Fortress, which was recently acquired by Abu Dhabi sovereign investor Mubadala Capital, still holds 1.325 million shares (now worth $45.2 million) from the first quarter.

Hougan expressed one of his key points earlier this week: “If you think institutional investors are going to panic when they get the first wave of volatility, the data suggests that’s not the case. They’re pretty stable.”