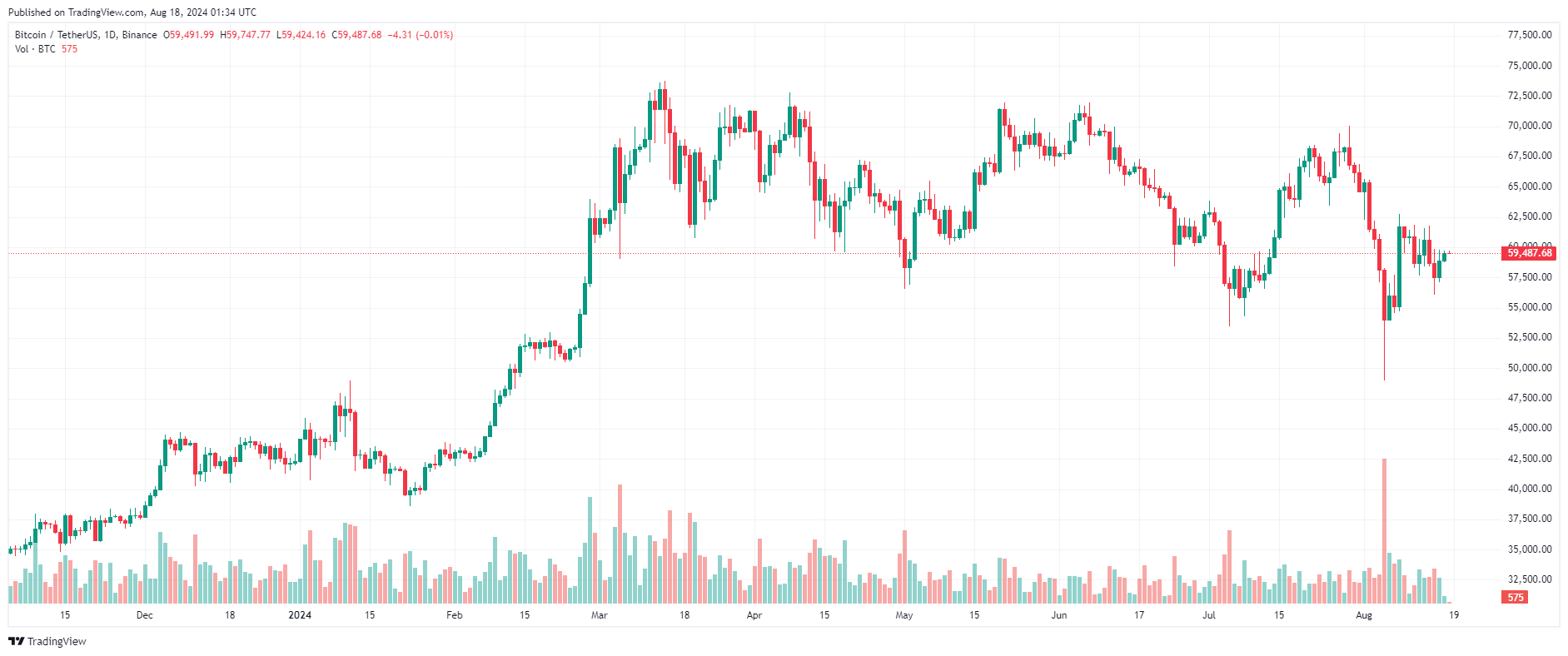

After recovering to near $62,000 on August 13 and 14, Bitcoin continued to decline, hitting a local Dip for the week around $56,000 on August 15.

Since then, BTC has recovered slightly back above the $59,000 mark as bulls attempt to pull the price back to the $60,000 region.

BTC Price Chart – 1 Day | Source: TradingView

Let's join Bitcoin Magazine to review the outstanding news of the week starting from August 12 to August 18, 2024.

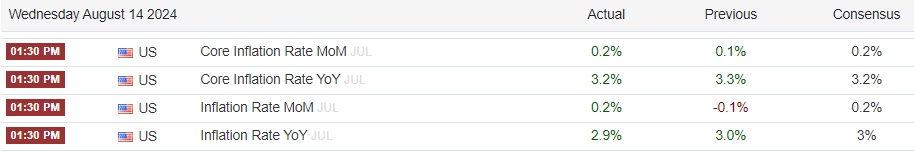

US inflation in July came in as expected, which could set the stage for the Federal Reserve to consider cutting interest rates at its upcoming meeting in mid-September.

The consumer price index rose 0.2% in July, the U.S. government reported Wednesday morning. That was up from a 0.1% decline in June and above expectations of a 0.2% gain. Year-over-year, the CPI rose 2.9%, below expectations of 3% and 3% in June.

US inflation data. Source: Trading Economics

The core CPI – which excludes food and energy costs – rose 0.2% in July, in line with expectations and up from a 0.1% increase in June. Year-over-year, the core CPI was 3.2%, in line with expectations and down from 3.3% in June.

US July Inflation Matches Forecasts

Franklin Templeton has filed an S-1 application with the US Securities and Exchange Commission (SEC) to launch a cryptocurrency index ETF.

The proposed fund – the “Franklin Crypto Index ETF” – aims to provide investors with access to the performance of Bitcoin and Ethereum through a regulated financial product.

The proposed ETF would track the CF Institutional Digital Asset Index, which currently only includes BTC and ETH. However, the filing states that the fund may incorporate other cryptocurrencies in the future, depending on regulatory developments and market conditions.

Coinbase Custody Trust Company has been selected as the custodian for the fund's digital assets, while Bank of New York Mellon will manage cash holdings and perform administrative duties.

If approved, the ETF will be listed on the CBOE BZX Exchange under the ticker “EZPZ.”

Franklin Templeton Files S-1 for Crypto Index ETF Including BTC, ETH

The Sandbox (SAND) Price Outlook Remains Negative Even Though 98% of Holder Are Losing Money

AVAX Prepares for $196M Supply Shock Amid Strong Unlock Next Week

Binance Coin (BNB) Aims for Breakout as Bullish Signals Get Stronger

AAVE Price Could See a Strong Surge in the Coming Period

Grayscale, the asset management firm behind Bitcoin (BTC) and Ether (ETH) ETFs and other cryptocurrency investment funds, introduced a new fund on Tuesday that invests in the Governance Token of decentralized lending platform MakerDAO (MKR).

According to the press release, the Grayscale MakerDAO Trust is only accessible to accredited individual and institutional investors, and is structured similarly to the company’s other single-asset trusts. This means it is a closed-end fund that cannot be withdrawn directly, which can lead to price differences between the fund’s shares on the secondary market and the underlying assets.

Grayscale Introduces Cryptocurrency Fund for MakerDAO’s MKR

Hamster Kombat Rejects All Venture Capital Offers

TapSwap Game Adds City Building Mode Linked to Token Airdrop

Layer 2 Shiba Inu Supports Meme Gaming and Play-to-Earn

Telegram Launches New Way for Creators to Earn TON Token

Uniswap Announces $2.5M Security Fund for v4 Upgrade as Most UNI Holder Lose Money

EigenLayer Implements Permissionless Token Support

MetaMask and Mastercard Launch Debit Card That Lets You Spend From Your Ethereum Wallet

Optimism is developing a native interoperability system for Layer 2 chains

Symbiotic launches Devnet, plans full mainnet in Q3

DYDX Prepares Major Upgrade for Blockchain Network DYDX Chain

Binance exchange has reappeared on India’s Google Play Store and Apple App Store after a seven-month ban for failing to comply with local regulations.

On August 15, the Binance website and Android and iOS apps were made available to crypto investors in India. The exchange confirmed that it has registered as a reporting entity with the Financial Intelligence Unit of India (FIU-IND) – a regulatory requirement for all crypto exchanges operating in India to combat money laundering.

Binance Returns to India as Registered Crypto Exchange After 7-Month Ban

Binance July Report: Crypto Market Cap Up 6.1% – DeFi TVL Up 3.5%

US Appeals Court Overturns HEX Manipulation Case Against Binance.US

Binance Ends Dispute With CVM Brazil With $1.7 Million Payment

US-based Ethereum spot ETFs had their first week of positive net Capital since launching on July 23.

According to ETF tracker SoSoValue, nine newly launched Ether spot ETFs in the United States had a total positive Capital inflow of $104.8 million in the week beginning August 5 with a total of $1.9 billion traded, bringing total net assets to $7.3 billion as of August 9.

The Capital come amid a sharp 23% drop in the price of the underlying asset Ether since the beginning of August.

US Spot Ethereum ETF Records First Positive Week Since Launch

Wisconsin Pension Fund Increases Stake in BlackRock’s Bitcoin ETF

Nasdaq ISE Withdraws Proposal for Bitcoin and Ethereum ETF Spot Options Trading

Jeremy Allaire, CEO of stablecoin company Circle, said the company is planning to introduce tap-and-go payments on iPhones following a move from Apple to open up the development of secure iPhone payment chips to third-party developers.

In a statement on August 14, California-based tech giant Apple said it will expand the use of its NFC chip and Secure Element (SE) to third-party app developers, paving the way for developers to integrate blockchain-based payment functionality into Apple devices.

Allaire explained that Apple opening up access to its NFC chip would apply to “a lot of things” beyond USDC, including Non-Fungible Token for tickets, other certificates, and other stablecoins like EURC.

USDC Embraces Tap-and-Go Payments After Apple Expands NFC

BlackRock Could Launch Its Own Blockchain With $10 Trillion AUM

Singapore's largest bank DBS pilots ' Treasury Token' on blockchain platform

Stablecoin Issuance Could Be Key to Bitcoin’s Next Bull Run: 10x Research

NEAR Stablecoin Market Capital Surges 717% in Last 6 Months

PYUSD Stablecoin Supply on Solana Surpasses Ethereum

Stablecoin Growth Doesn’t Sink Crypto Market Share: JPMorgan

Elon Musk has announced the beta version of the Grok-2 AI engine, the successor to Grok-1.5, for users on the X platform. Grok-2 includes two language models: Grok-2 and its “smaller” version, Grok-2 mini.

Both the Grok-2 and Grok-2 mini are available to users with Premium or Premium+ plans on X. They are not offered to standard users.

Elon Musk Introduces Two New AI Versions for X Platform

Coinbase's Brian Armstrong Makes Important Statement About AI

Sahara AI Raises $43 Million to Develop Decentralized, Collaborative AI Platform

5 of the world's 10 most valuable companies are developing metaverse hardware

Non-Fungible Token are fighting for attention from memecoin

DeFi Market Revives as Derivative Soar

According to Thanh Nien newspaper, Le Trung Duc, a credit officer working at a bank branch in Thua Thien - Hue, took advantage of his position to commit a series of sophisticated frauds. By borrowing money from many acquaintances under the legitimate pretext of paying off bank loans, Duc successfully appropriated nearly 1.2 billion VND. This amount, instead of being used for the promised purpose, was converted into gold and invested in Bitcoin on online trading floors.

On August 12, the Office of the Investigation Police Agency (IPA) of Thua Thien - Hue Provincial Police officially issued a decision to prosecute the case, prosecute the accused, and temporarily detain Le Trung Duc (30 years old, residing in Dong Ba Ward, Hue City) for fraud and appropriation of property. This move by the investigation agency sent a strong message about the determination to fight against fraud in the financial sector, especially in the context of the increase in cryptocurrency and gold investment activities that are causing many risks for investors.

Google Faces $5 Million Lawsuit Over Cryptocurrency Theft

China's Elderly: New Victims of Crypto Scam Projects

Canadian Cryptocurrency Exchange Seizes $9.5 Million in Bitcoin and Ether from Users for Gambling

SEC Charges NovaTech Founder in $650 Million Cryptocurrency Scam

South Korean CEO Indicted for Fraud in $365 Million Crypto Scam

12 transactions related to the 2021 AnubisDAO carpet-pulling incident surfaced

Democratic Senator Chuck Schumer, the majority leader in the US Senate, said he aims to pass bipartisan legislation supporting cryptocurrencies by the end of 2024 if Vice President Kamala Harris is elected president.

Speaking at a Crypto4Harris Town Hall meeting — a pro-crypto group pushing for a “reset” of crypto policy during Harris’ presidential campaign — Schumer said lawmakers can no longer afford to be blindsided when it comes to promoting crypto innovation in the United States.

Senator Chuck Schumer Pledges to Enact Pro-Crypto Legislation if Harris Is President

Dubai Approves Crypto Wages in Landmark Court Ruling

You can XEM coin prices here.

The "Weekly News" section will be updated at 9:30 every Sunday with general market news. We invite you to follow along.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine