According to a report published by cryptocurrency exchange Coinbase on August 16, institutional holders classified as “investment advisors” increased their holdings of Bitcoin spot exchange-traded funds (ETFs) in the second quarter of 2024. volume, while hedge fund holdings fell slightly. The report notes that the proportion of Bitcoin spot ETFs held by investment advisors is likely to only increase further as “more brokerages complete due diligence on these funds.”

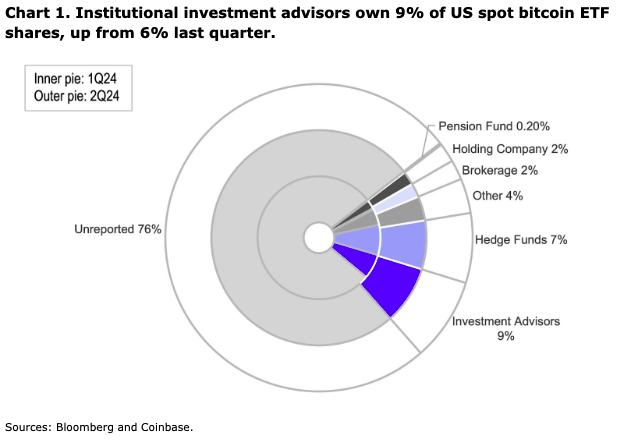

The proportion of Bitcoin spot ETFs held by "investment advisory" institutions increased by 3% in the second quarter of 2024, and currently accounts for 9% of total institutional investment. Coinbase notes that this is only based on companies with more than $100 million in assets under management, which are required to file 13-F reports with the U.S. Securities and Exchange Commission (SEC).

According to a previous report by CNBC, citing people familiar with the matter, approximately 15,000 Morgan Stanley financial advisors will be able to promote Bitcoin spot ETFs issued by BlackRock and Fidelity to eligible clients starting on August 7. . However, Coinbase noted that “significant inflows” may be delayed as financial advisors struggle to immediately onboard new clients during the U.S. summer period (June to August). Coinbase explained that more people are on vacation during this period and liquidity tends to be less, and reiterated that "price movements may be volatile."

At the same time, the decline in holdings by hedge fund managers may be due to taking advantage of the price difference between Bitcoin spot ETFs and Bitcoin futures contracts, also known as "basis trading." Coinbase pointed out that the CME Bitcoin futures contract increased by 15% in the second quarter of 2024, reaching $2.75 billion.

Coinbase emphasized that the "ETF complex" attracted a total of $2.4 billion in net capital inflows in the second quarter. Given that Bitcoin "underperformed" during this period, the exchange believes that the continued capital inflows of ETFs may be a new capital pool. A strong indicator of continued interest in cryptocurrencies.

Related reports: " The number of funds reporting holdings of Bitcoin spot ETFs increased by 701, and the total number of holders is close to 1,950 "