Original: Liu Jiaolian

Overnight, BTC failed to hold the $60,000 level and suddenly retreated to above $58k. " The market sentiment is indeed in a state of extreme panic now ."

According to Jiaolian’s observation, the current situation is that bulls are silent, bears are in tears, those who hold altcoins have cleared their positions, and those who hold BTC are also defending with half of their positions. It seems that there are not many men who hold full positions and even others are afraid of me adding positions.

Gold's historic breakthrough of $2,500 seems to strongly announce the U-shaped bottom phase of 2012-2020, and the complete failure of gold bears to suppress gold. Who is the biggest gold bear? Of course, it is America.

Obviously, in the macro cycle of 2021-2025, BTC seems to have the trend of repeating the strong signal on the right side of the 2012-2024 gold U-shaped bottom and then breaking upward.

If so, BTC will only take 6 years to complete the 12-year blood and tears journey of gold.

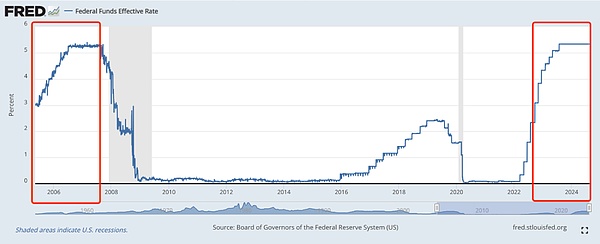

Looking at the macro interest rate cycle that is similar to the 2006-2007 one, Jiaolian couldn't help but fall into deep thought...

Recalling that in 2007, high interest rates lasted only one year before the subprime mortgage crisis broke out, triggering a global financial tsunami. The Federal Reserve was panicked and interest rates fell to zero.

Suddenly, I heard a children's song in my ears: Little mouse climbed up the lampstand to steal oil, but couldn't get down, so he rolled down!

The little mouse climbed up the lampstand to steal some oil, but couldn't get down, so he rolled down...

Jiao Lian clapped his hands and sang along to the rhythm in his mind twice, feeling very happy.

It turns out that mankind’s highest wisdom is written in nursery rhymes and fairy tales.

The long-term growth rate of human productivity is 2%, that is, the average value creation rate is only 2% per year. Therefore, in the ultimate sense, any rate of return exceeding 2%, no matter how high-sounding the reason is, is the transfer of stock value and wealth, in other words, it is the harvest of one group of people from another group of people.

The current risk-free high interest rate of 5.5% for the US dollar is far higher than 2%. This is definitely a harvest of the whole world. All arguments that deny the harvest are pale. The sophists are either beneficiaries of the harvest or pure fools, because this is mathematics, irrefutable mathematics.

Some people may simply dislike the word "harvest". In fact, it can be replaced with more elegant and advanced words, such as obtaining investment alpha, etc.

But the US dollar system actually doesn’t even have the last 2% left for the leeks. This is why the Federal Reserve sets its long-term inflation control target at 2% - using 2% inflation to offset the long-term productivity growth rate, that is, to absorb the incremental value.

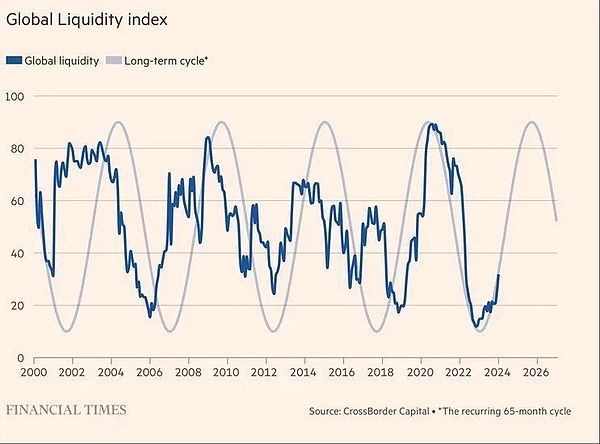

From 2007 to 2012, gold first began to rise again and again despite the Fed's interest rate hikes, and then as the Fed raised the white flag in 2008, interest rates plummeted and the surge accelerated.

Seeing the situation was not good, the United States introduced a bill in July 2011 to close the gold OTC market. The ten-year bull market in gold peaked and then fell back, falling into the abyss of the U-shaped valley.

It was precisely when the Federal Reserve resumed raising interest rates in 2016 that gold bottomed out on the left side of the U-shaped valley and began to rise again.

With the interruption of the major epidemic in 2020, the Federal Reserve’s interest rate hike collapsed halfway, and gold took the opportunity to regain lost ground and get out of the U-shaped valley.

When the Federal Reserve resumes its path of raising interest rates in 2022, gold has climbed out of the U-shaped valley and started to consolidate at the top.

Now it is 2024 again, after high interest rates have been maintained for more than a year. Gold has ended its three-year consolidation and has made a strong breakthrough upward, wiping out its previous shame. Carrying the banner of the dollar's recession, it is galloping forward!

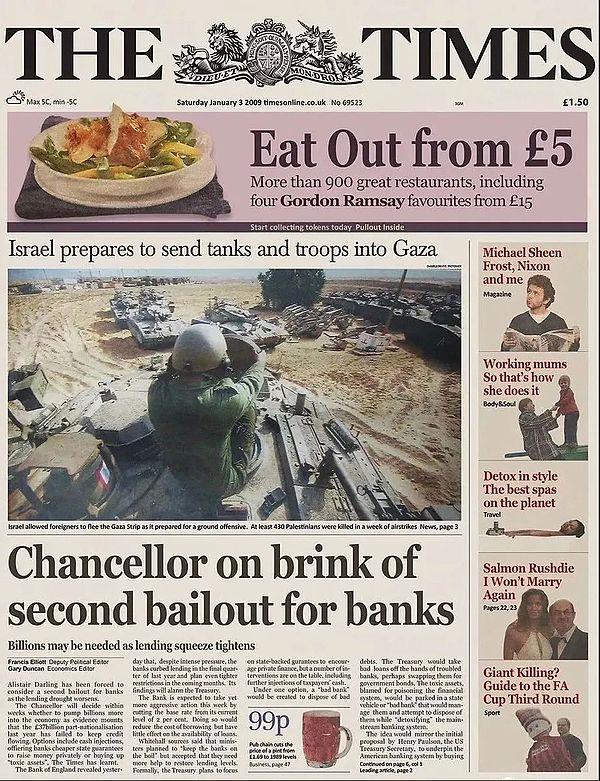

Perhaps it was the amazing performance of gold as a hedge against the Fed’s failure in the last rate hike cycle (harvest cycle) that inspired Satoshi Nakamoto. On the last day of October 2008, Satoshi Nakamoto published the white paper of his new invention, BTC. In January 2009, BTC was officially launched.

The decentralized and digital characteristics of BTC make it possible to overcome the shortcomings of gold, which is restricted and cracked down by the United States through legislation.

If you can't beat them, then make friends. In the martial arts world, it is said that you can't get to know each other without fighting. The underlying logic of human society is so pure. We should learn from elementary school that if we are bullied, we must fight back. If we kneel down, we will always be the one being bullied and will be looked down upon by everyone.

In 2024, the United States and China successively approved the listing of BTC ETF.

Now, the Fed once again stands on the brink of failure.

Recession or depression depends on the Federal Reserve's decision.

The macro-monetary cycle is about to reverse, and a new re-expansion cycle can no longer be suppressed and is about to come.

This time, can BTC replicate the amazing performance of gold that year and ride the wind and waves and soar to the sky?

The U.S. dollar, which has not harvested enough stock wealth, will reveal its true colors after expanding again and will depreciate rapidly relative to BTC and gold.