Despite Bitcoin’s 21% drop from its all-time high, most of the Bitcoin in wallets has not been sold or moved in the past six months.

According to on-chain data, about three-quarters of all Bitcoin in circulation has not been moved in the past six months or more.

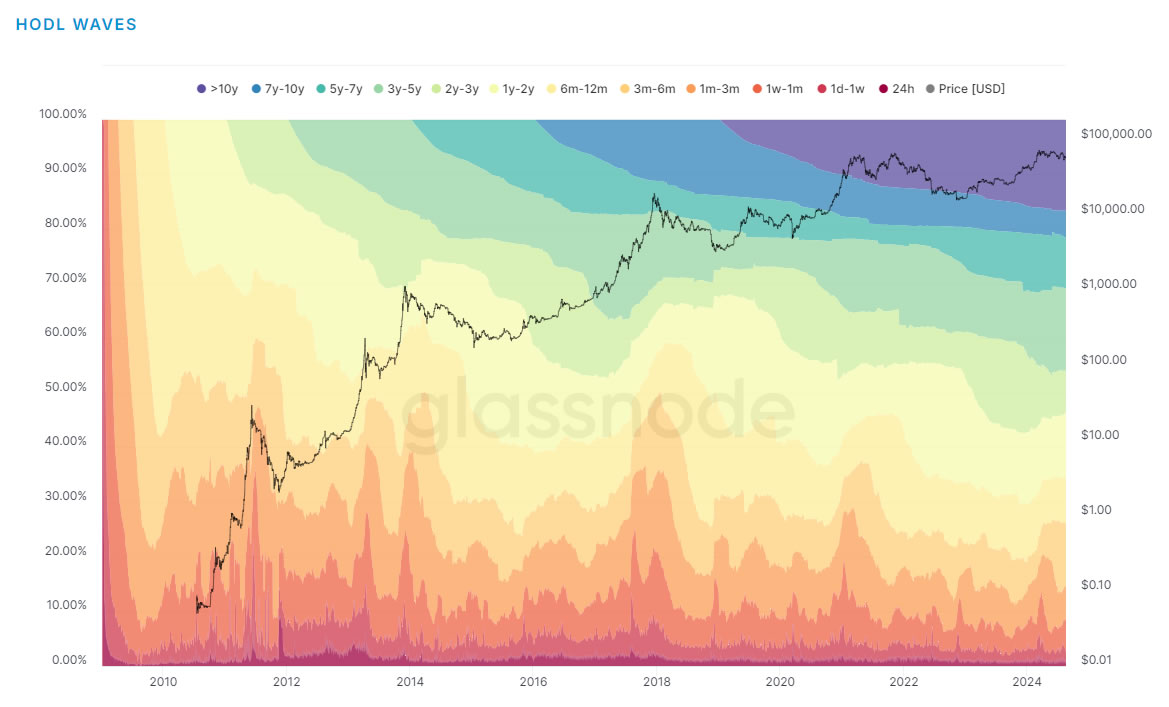

The finding comes from Glassnode’s Hodl Wave chart, which uses blockchain data to provide a macro view of Bitcoin (BTC) held in wallets based on the length of time since BTC last moved.

This is a significant increase from a week ago on August 11, when data from on-chain analytics platform Glassnode showed that nearly half of BTC’s supply (about 45%) had been idle for at least six months.

However, current data shows that while the asset is down 21% from its all-time high, around 74% of the asset has remained stable for most of the year.

BTC holdings fluctuate. Source: Unchained/Glassnode

The dominance of the old coin suggests that long-term investors are increasingly holding BTC as a store of value, possibly anticipating future price increases.

The holding trend also results in a decrease in the supply of Bitcoin available for trading. This can lead to higher prices as demand increases and supply tightens.

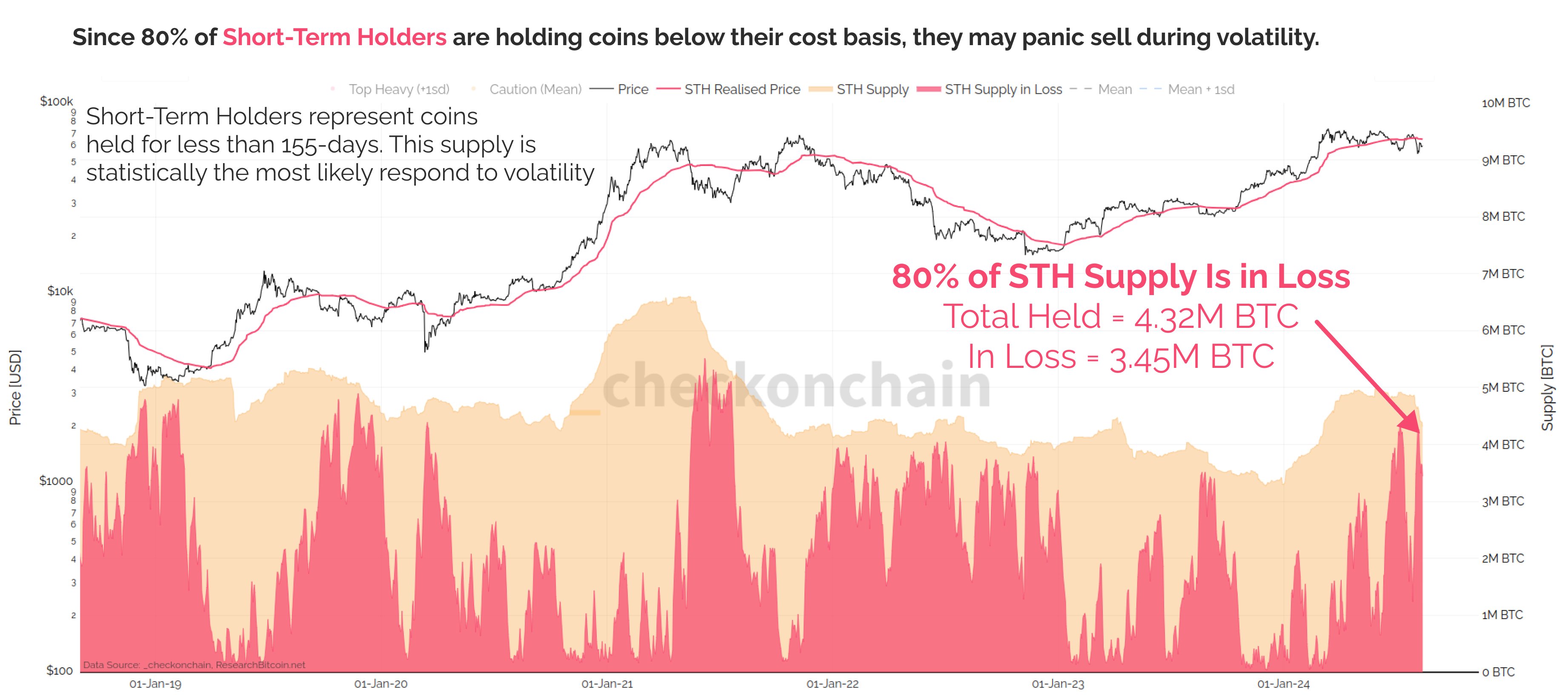

Meanwhile, on-chain analyst James Check pointed out in an August 19 article on X that more than 80% of short-term Bitcoin holders are at a loss because the Bitcoin they hold was acquired at a price higher than the current spot price.

He warned that if they panic sell like they did in previous years, this could lead to further declines. Short-term holders are those who hold BTC for less than 155 days.

This is similar to what happened in 2018, 2019, and mid-2021, suggesting that many investors are at risk of panicking and sparking a bearish trend.

STH BTC supply is high and losses are high. Source: James Check

Currently, overall market sentiment remains bearish, with the Bitcoin Fear and Greed Index at 28 and the Fear Index at 28. Over the past few weeks, it has returned to fear levels not seen since December 2022.

Late in the weekend, the price of Bitcoin surpassed $60,000. However, the price has since fallen back significantly, falling to $58,619 as of this writing.