BTC’s price performance has Bitcoin traders preparing for a retest of lower support levels in the near term.

After a promising weekend, BTC/USD ended the week on a sour note, offering little inspiration for traders tired of range-bound trading. Market sentiment is low, and while stocks have recovered from the flash crash of early August, cryptocurrencies have yet to recover.

The Federal Reserve is in the spotlight this week as the annual Jackson Hole Symposium kicks off, with investors hoping for a clear signal on rate cuts next month, and Chairman Jerome Powell to discuss current macroeconomic conditions, which could lead to a volatile market end to the week, with cryptocurrencies falling again. Although miners are keeping calm for now, anxiety is pervasive in the market.

BTC price increase is still unknown

Bitcoin gave up its weekend gains by the close of trading on August 18 — an all-too-familiar sequence of events for traders, who traditionally remain cautious about “after-hours” market moves.

Nonetheless, the Asian trading session did not offer much hope to bulls, with BTC/USD trading around $58,681 at the time of writing, according to data from Cointelegraph Markets Pro and TradingView.

BTC’s price action has frustrated investors due to the lack of a clear trend.

I think it is possible for the price to return to the mid $55k range. Slowly but steadily moving towards the 55k support level. Will look for longs then. My thoughts have not changed over the past two weeks as the initial uptrend was weak and the Bollinger Band Volatility indicator needs to give an advance signal that the market is ready to break out in a particular direction.

Meanwhile, analyzing long-term and short-term targets reveals a “buying opportunity” near $50,000.

To fill these wicks on the 1W and 1D timeframes, two potential levels that the price could reach are $536K and $515K.”

Therefore, if you missed the move, you will most likely be able to buy back at these levels again, and there could be a "false alarm" to the upside before prices fall back in the coming days. We may see a false breakout early this week before a drop to new levels in the $56,000s.

“Most retail traders will be watching and trading this channel; therefore, we can see some market maker manipulation here,” he explained alongside an illustrative chart.

Markets await Powell's attendance at Jackson Hole symposium

This week, risk asset traders are focusing on the Federal Reserve's Jackson Hole symposium as markets need clues on how to deal with inflation.

Fed Chairman Jerome Powell will speak at the annual event on August 23, and market watchers will closely analyze his words to confirm future policy easing.

Just weeks after Japan's stock market flash crash, markets are on edge - they believe the Fed will have no choice but to cut rates at its next meeting in September.

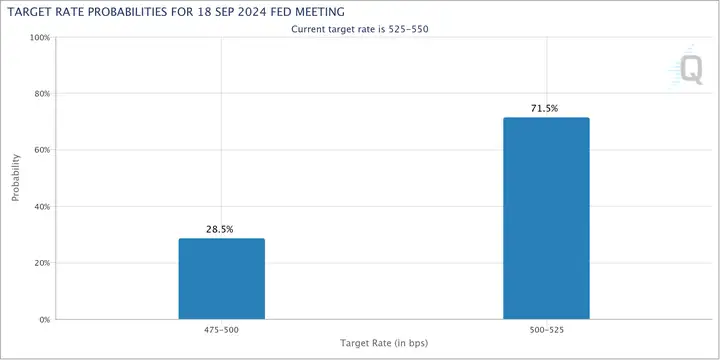

The latest data from CME Group's FedWatch tool puts the odds of a rate cut at 100%, including a 71.5% chance of a 25 basis point cut.

Since the shock, stocks have staged an impressive rebound. It took just a few days for Japan’s Nikkei 225 to erase its biggest two-day drop in history. The S&P 500 is now just 2% away from a new all-time high.

In just a few days, the market went from entering correction territory to setting new all-time highs.

This year, Powell will talk about the upcoming rate cuts.

Bitcoin miners halt wallet outflows

Optimism surrounding Bitcoin miners persisted this week as a number of on-chain indicators showed that BTC sales were cooling.

Currently, the BTC reserves in miners’ wallets are starting to stabilize. Miners have been selling their Bitcoin through OTC and exchanges, but they have not shown any signs of selling since the end of July.

Despite the recent sharp drop in Bitcoin prices, miners have not been forced to reassess profitability despite production costs per Bitcoin approaching current spot prices.

Miners' reserves are now at levels last seen in January 2021. The expected sell-off in mining stocks appears to be complete.

As of August 18, miner reserves were 1.814 million BTC, down about 25,000 BTC since the beginning of the year. At the same time, I don’t think it’s entirely possible that the situation will remain stable going forward.

Although one indicator shows only positives, considering that miners are whales and their actions always cause huge market fluctuations, I think it is worth watching the market for a while longer.

BTC market dominance shakes

Bitcoin’s share of the total cryptocurrency market capitalization has reached its latest macro peak, traders say.

Having hit nearly 58% earlier this month, Bitcoin’s dominance is wavering — and ultimately, Altcoin should benefit.

The accompanying chart, which uses the Elliott Wave Theory, suggests that dominance will fall back below the 50% mark, currently around 57%, predicting that the "bear market will end" for Altcoin.

At the same time, when BTC.D falls below 50%, the real alt movement will begin and the macro top will dominate.

“Bearish Sentiment” Trend Line Out of Reach

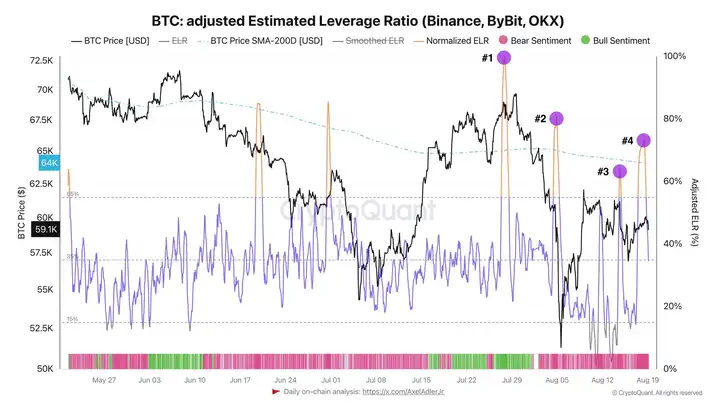

Some latest analysis suggests that Bitcoin sentiment is firmly “bearish” as prices fall back below a key long-term trendline.

I think that problems may arise as BTC/USD abandons its 200-day Simple Moving Average (SMA), currently at $62,750. BTC price is below the 200-day SMA, which officially indicates bearish sentiment.

Data shows that leverage usage on exchanges has surged to its highest level since Japan’s financial crisis. The nearest support is currently the 365-day SMA ($50,000)

Meanwhile, the latest data from the Crypto Fear & Greed Index shows that the average sentiment among crypto investors is just 3 points below “extreme fear” at 28/100.

In simple terms

The Federal Reserve is currently in the spotlight as the annual Jackson Hole Symposium gets underway. Traders are hoping for a clear signal on rate cuts next month, with Chairman Jerome Powell set to discuss current macroeconomic conditions, which could lead to market volatility at the end of the week, but at the same time, growing concerns over Bitcoin could cause cryptocurrencies to fall again. Meanwhile, the $50,000 price is in play, and while miners are keeping calm, anxiety still permeates the market. Supporting BTC's bearish outlook in the short term, market volatility at the end of the week is expected to see cryptocurrencies fall again, with limited upside potential in the short term, and bargain hunting by some investors to ease market volatility will help restore market confidence.