Author: DFG Official Source: medium Translation: Shan Ouba, Jinse Finance

introduce

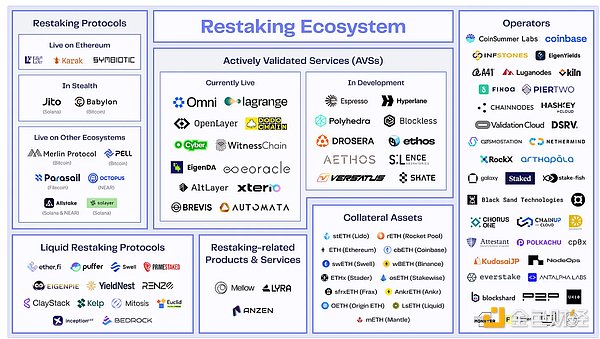

Re-staking and liquidity re-staking have gained a lot of attention among users who are looking to increase their ETH returns on top of the positive news brought by the ETH ETF. According to DeFi Llama, these two categories have seen incredible growth in TVL, ranking fifth and sixth among all categories respectively. The re-staking ecosystem has grown rapidly recently, but before understanding the additional benefits of re-staking and liquidity re-staking, let’s first understand the basic principles of staking and liquidity staking.

Background on Staking and Liquid Staking

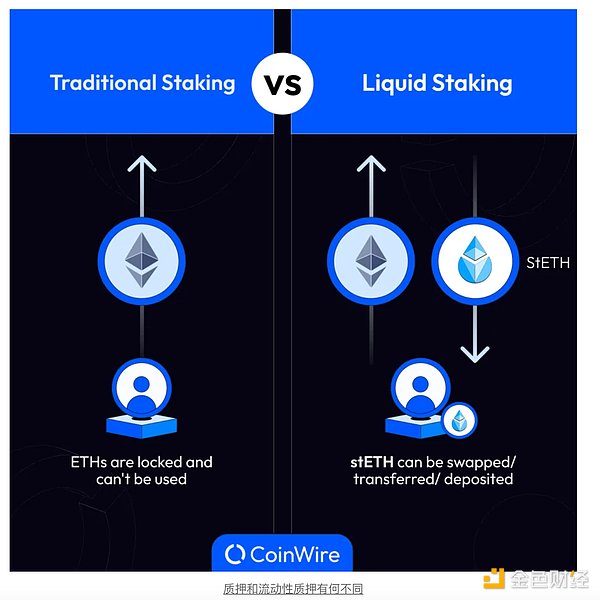

Ethereum staking involves staking ETH to secure the network and earn additional ETH rewards. While staking ETH generates returns, it involves taking on the risk of being slashed and the risk of illiquidity due to not being able to sell ETH immediately after the unstaking period.

To become a validator, individual stakers need a large amount of upfront capital, namely 32 ETH, which is an unaffordable threshold for many people. Therefore, validator-as-a-service platforms such as ConsenSys and Ledger provide pooled staking services, allowing multiple users to combine their ETH holdings to meet the minimum staking requirements.

While these services allow any amount of ETH to be staked, the staked ETH remains “locked” and inaccessible until it is unstaked (which takes a few days). Liquidity staking has emerged as an innovative alternative that mints a liquidity token in exchange for a user’s ETH deposit. The liquidity token represents their staked ETH, which accumulates rewards and can be used to participate in DeFi activities to increase returns. Lido was a pioneer in liquidity staking, followed by companies such as Rocket and Stader. These solutions not only make staking more accessible, but also increase flexibility and potential returns for investors.

The rise of re-staking

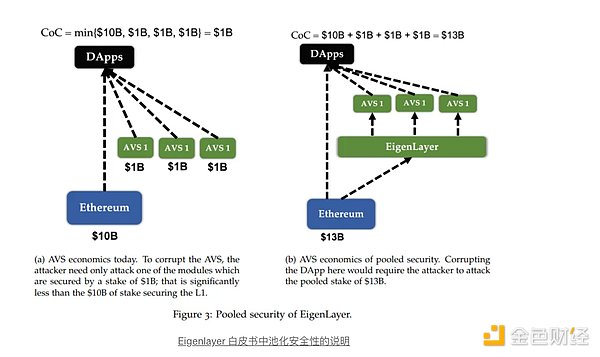

This is a concept first proposed by EigenLayer, which involves using staked ETH to protect modules that cannot be deployed or verified on the EVM, such as sidechains, oracle networks, and data availability layers. These modules usually require active verification services (AVS), which are secured by their own tokens and suffer from problems such as bootstrapping their security networks and low trust models. Restaking solves this problem because security can be bootstrapped from Ethereum's large validator set, and it is more expensive to attack its pooled stake.

While Eigenlayer is the first re-staking protocol, several other protocols have emerged as competitors. While they all aim to use re-staking assets to provide security, there are subtle differences between them, which we will discuss in the next section.

Overview of the Re-Pledge Agreement

Currently supported deposit assets

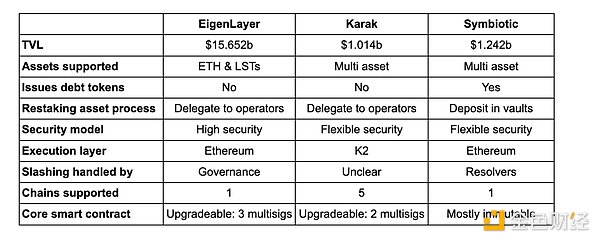

The variety of deposit assets supported by each protocol is important because it determines their ability to accommodate deposit flows. Protocols with a wider range of asset support are more likely to attract greater flows over time. Currently, Eigenlayer only supports ETH and ETH Liquid Staking Tokens (LST), while Karak and Symbiotic support a wider range of assets. This diversity is the main differentiating factor among these three re-staking protocols.

Karak accepts a variety of assets, including LST, Liquid Re-Pledge Tokens (LRT), Pendle LP tokens, and stablecoins. Meanwhile, Symbiotic supports LST, Ethena’s ENA, and sUSDE. While they currently accept different asset types, both plan to expand their product range. Karak can accept any asset for re-pledge, while Symbiotic allows any ERC-20 token as collateral for re-pledge. EigenLayer currently accepts a more limited range of assets, but future plans include dual staking and LP re-pledge options.

Security Model

Currently, Eigenlayer only accepts ETH and its variants, which are less volatile than other small-cap tokens. This is critical because it reduces the risk of large fluctuations that could compromise the security of the Active Validation Service (AVS) built on Eigenlayer. In contrast, protocols such as Karak and Symbiotic offer a wider range of assets for re-staking, providing more flexible security options for the Distributed Security Service (DSS) (on Karak) and the network (on Symbiotic) on their platforms.

Offering multiple assets for re-staking allows for customizable security, allowing services to determine the level of economic security they require. By accepting yield-generating tokens, services built on re-staking protocols can reduce the additional yield required to attract validators, making it more cost-effective to protect their services. This customizable approach allows services to decide the type and level of security they require.

In terms of design, both Eigenlayer and Karak have upgradeable core smart contracts that are managed by multi-signatures. They have 3 and 2 different multi-signatures respectively, controlling different parts of the infrastructure, distributing control among different users. On the other hand, Symbiotic has an immutable core contract that eliminates governance risks and single points of failure. While this eliminates the problem of centralized governance, it requires redeployment if there are any bugs or defects in the contract code.

While re-staking supports pool security, there is a risk of operator collusion. For example, if a $2 million network is secured by $10 million worth of re-staked ETH, then it is not economically feasible to attack that network because the cost of attack ($5 million) is higher than the reward ($2 million). However, if the same $10 million of re-staked ETH also secures 10 other networks with $2 million in stake, then the attack is economically feasible. To mitigate this, limits can be placed on the re-staked assets of validators who are overly committed to other services to prevent excessive concentration of re-staked ETH.

Supported chains and partners

Eigenlayer and Symbiotic primarily only accept assets deposited on Ethereum, but Karak currently supports deposits from 5 chains. Integrating more chains that accept re-pledged assets reduces the need for message bridges to access re-pledge infrastructure outside of Ethereum. However, the vast majority of TVL is still held in Ethereum, and utilizing re-pledged assets on Ethereum can provide the highest security.

Karak also launched a layer 2 network, K2, which acts as a sandbox environment for DSS to test upgrades before launching them on Ethereum. In contrast to Eigenlayer or Symbiotic, neither network offers a similar testing environment as Karak, but the protocol can also utilize different chains for testing.

Despite the differences among the above re-pledge protocols, it seems likely that they will eventually converge to provide services similar to each other, covering different re-pledged assets. Therefore, the success of each protocol ultimately depends on the partnerships they are able to establish in order to build services on top of their infrastructure.

Since Eigenlayer is a pioneer in the re-staking space, the number of AVS built on its infrastructure is also the largest. The more famous AVS on Eigenlayer include EigenDA, AltLayer, and Hyperlane. Although Karak has only announced one DSS, they have successfully integrated Wormhole to develop a decentralized validator network and a decentralized relayer network for its native token transfer (NTT). Although Symbiotic is the latest to launch, Ethena recently announced that Ethena will use its re-staking framework with LayerZero's decentralized validator network (DVN) to ensure cross-chain transfers of USDe and sUSDe assets.

Over time, more services are likely to leverage this type of re-staking infrastructure for security. Platforms that are able to consistently secure partnerships with large players are likely to outperform others in the long run. Having explored the landscape of re-staking, it is critical to delve deeper into the next layer of liquid re-staking protocols to understand the subtle differences and how they can add value to the entire ecosystem.

Liquid Restaking Overview

LRT Type

The Liquid Recollateralization Protocol provides you with its Liquid wrapped tokens when you deposit into the protocol. Depending on the protocol you choose, you have several asset deposit options to choose from.

For example, Renzo allows wBETH deposits in addition to native ETH and stETH, while Kelp allows ETHx and sfrxETH deposits. No matter which token you deposit into these protocols, you will receive their LRT, ezETH, and rsETH respectively. These 2 LRTs are considered basket-based LRTs because the LRT token is represented by a combination of underlying assets. Aggregating multiple LSTs into the same LRT may pose complex management challenges and additional counterparty risks.

Other liquid re-pledge protocols offer native LRT, where users can only deposit native ETH. For Puffer, while it currently accepts stETH, it will eventually convert stETH to native ETH for native re-pledge as well. Previously, this was an advantage because Eigenlayer had a deposit cap on LST but not on native ETH. However, they later removed the deposit cap for all asset types, and native LRT eliminates the risk of having to balance their LRT tokens with the underlying LST assets and their exposure to other LST protocol risks.

Both Eigenpie and Mellow currently have independent LRTs, each issuing specific LRT tokens in exchange for specific deposits and vaults. While this isolates the risk of LRT tokens to their respective LST/vaults, it also leads to further fragmentation of liquidity, as there is little or no DEX pool liquidity available to quickly swap back to ETH and its LST's underlying assets.

DeFi and Layer 2 Support

The value proposition of the Liquid Restaking Protocol is that you can unlock capital efficiency and earn cumulative yield from restaking and DeFi using your deposited assets. Pendle is the most widely used and integrated platform for these protocols because its yield trading mechanism allows users to farm points on the Liquid Restaking Protocol using leverage. Many depositors also provide liquidity on Pendle because they can provide liquidity without Impermanent Loss if they hold their positions to maturity.

Many DeFi integrations have expanded to other areas and protocols. These LRTs also serve as liquidity for DEX exchanges on platforms such as Curve and Uniswap for users who want to exit early without waiting for the withdrawal to unstake. Vaults have also emerged and provide different yield strategies for these LRTs through loops, options, etc. Now, some lending platforms such as Juice and Radiant also provide lending services with LRT as collateral.

In response to lower gas fees, these LRTs also support various Layer 2s. Users can choose to re-collateralize assets directly on L2, or transfer re-collateralized assets from Ethereum to L2 to reduce gas fees in DeFi. Although most TVL and transaction volume are still on Ethereum, expanding these LRTs to L2 can also expand their market share, as smaller players are hindered by high Ethereum gas fees.

Support re-pledge agreement

Liquidity re-hypothecation protocols were initially built on top of Eigenlayer, as it was the first protocol to offer re-hypothecation. Subsequently, Karak was launched, but it did not require these liquidity re-hypothecation protocols to be individually integrated with it, as users could deposit their LRT directly into Karak after re-hypothecating their underlying assets through the liquidity re-hypothecation protocol operator on Eigenlayer. As a result, most liquidity re-hypothecation protocols are currently integrated with Eigenlayer and Karak.

On the other hand, Symbiotic was launched at the end of June and, unlike Karak, does not allow LRT to be deposited on its platform. This makes it so that only LST can be deposited on Symbiotic for re-staking. If a liquid re-staking protocol wants to provide LRT for Symbiotic, they must set up a vault or operator to allow users’ deposits to be delegated to them for re-staking on Symbiotic.

Given the recent controversy surrounding the Eigenlayer airdrop, many users were unhappy with the terms of the airdrop, and some users began initiating withdrawal requests on the platform. As users and farmers look for the next protocol to earn yield and farm airdrops, Symbiotic seems to be the next logical choice. Although Symbiotic has set its deposit cap at around $200 million, it has also been working with many other protocols. Mellow is the first liquidity re-staking protocol built on Symbiotic, but many protocols that were previously built on Eigenlayer are now also working with Symbiotic to maintain market share.

Growth in re-mortgages

Re-pledge deposits have surged since late 2023. The liquidity re-pledge ratio (TVL in liquidity re-pledge/TVL in re-pledge) has reached over 70% and has been growing by about 5-10% in recent months, indicating that the majority of re-pledged liquidity is through liquidity re-pledge protocols. As the re-pledge category expands, liquidity re-pledge protocols are expected to expand as well.

However, there are clear signs that withdrawal outflows from Eigenlayer and Pendle deposits fell by more than 40% after their expiration on June 27. Although expiring deposits on Pendle can be rolled over, the outflows were likely caused by the TGE and token distributions of most major liquidity rehypothecation protocols in 2024.

Farmers will continue to farm. Although Eigenlayer’s airdrop EIGEN has been launched, it will still not be tradable until the end of September 2024. Therefore, farmers may withdraw their deposits and look for other airdrops to farm. Over time, some of this liquidity may flow to other protocols, namely Karak and Symbiotic.

Even for liquidity re-staking protocols that have already launched tokens, they have subsequent airdrop seasons, and their LRTs are still available in Karak while working on integrating with Symbiotic. With future TGEs for Symbiotic and Karak and increases in their deposit caps, users are likely to continue to farm on these protocols.

in conclusion

As of July 1, 2024, there are nearly 33 million ETH staked in the balance, of which about 13.4 million ETH ($46 billion) is staked through the Liquid Staking Platform, accounting for 40.5% of all staked ETH. This proportion has recently declined due to the increase in native ETH deposits on Eigenlayer and the limited upper limit of LST deposits.

With AVS rewards and slashing activated, new services on the restaking protocol could be rewarded with new tokens, similar to staking rewards on Lido. While airdrop farmers may remove liquidity from distributed airdrop rewards, yield seekers may be attracted over time.

Currently, the ratio of re-staking to liquid staking is about 35.6%, close to the ratio of liquid ETH to total ETH staked. As the re-staking platform eventually removes the deposit cap and expands to other assets (including trying to re-stake Milady), it will have the potential to attract more capital inflows in the future.