$AAVE is leading the upcoming DeFi wave

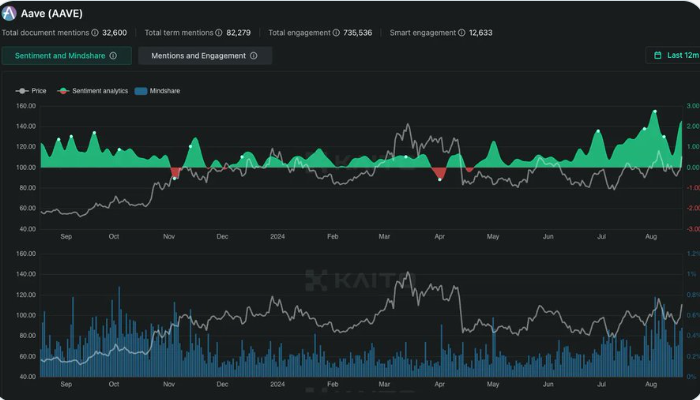

As sentiment and interest reach new highs, prices are also starting to gain traction

Strong fundamentals + Umbrella updates + new AAVEnomics = Just use AAVE

Here are the reasons:

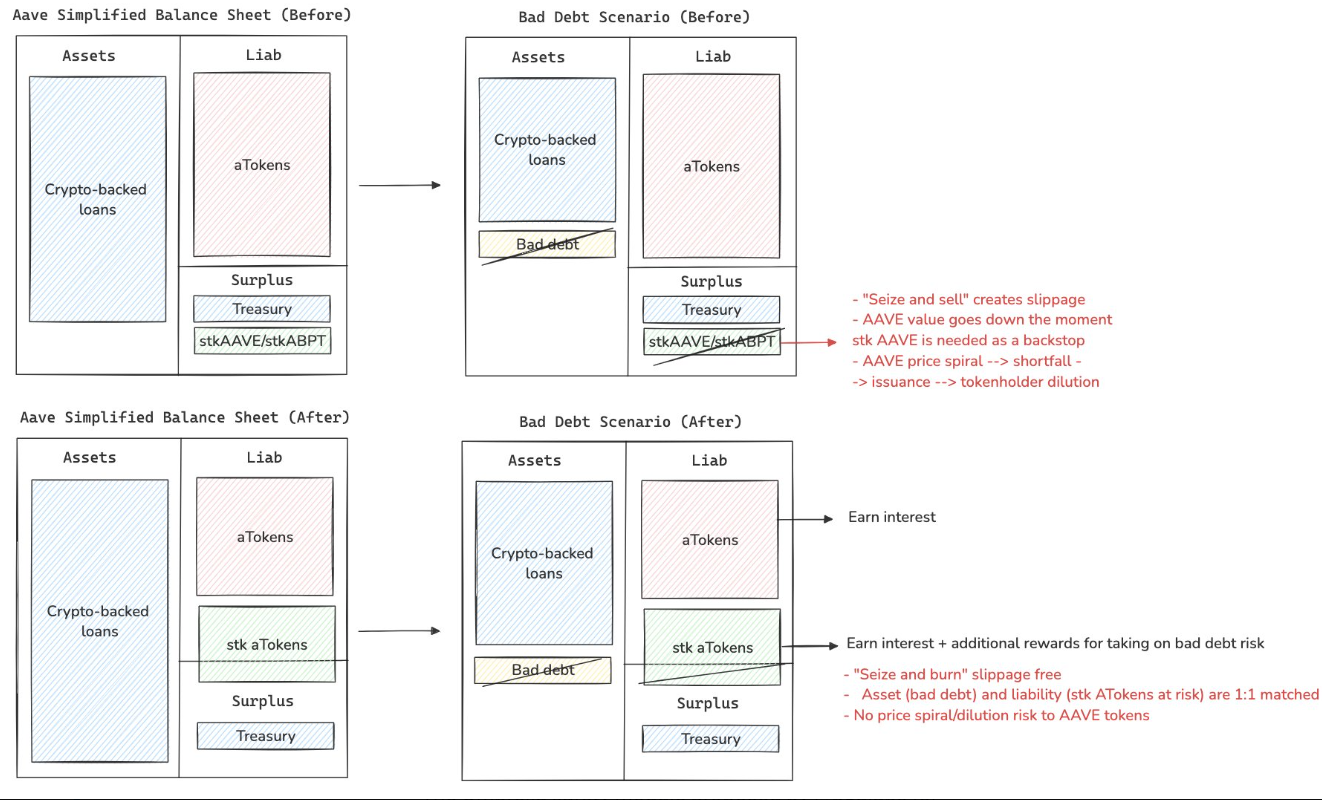

It has been pointed out many times: using $AAVE in a security module means $stkAAVE is the last guarantee against bad debts... but this is not ideal

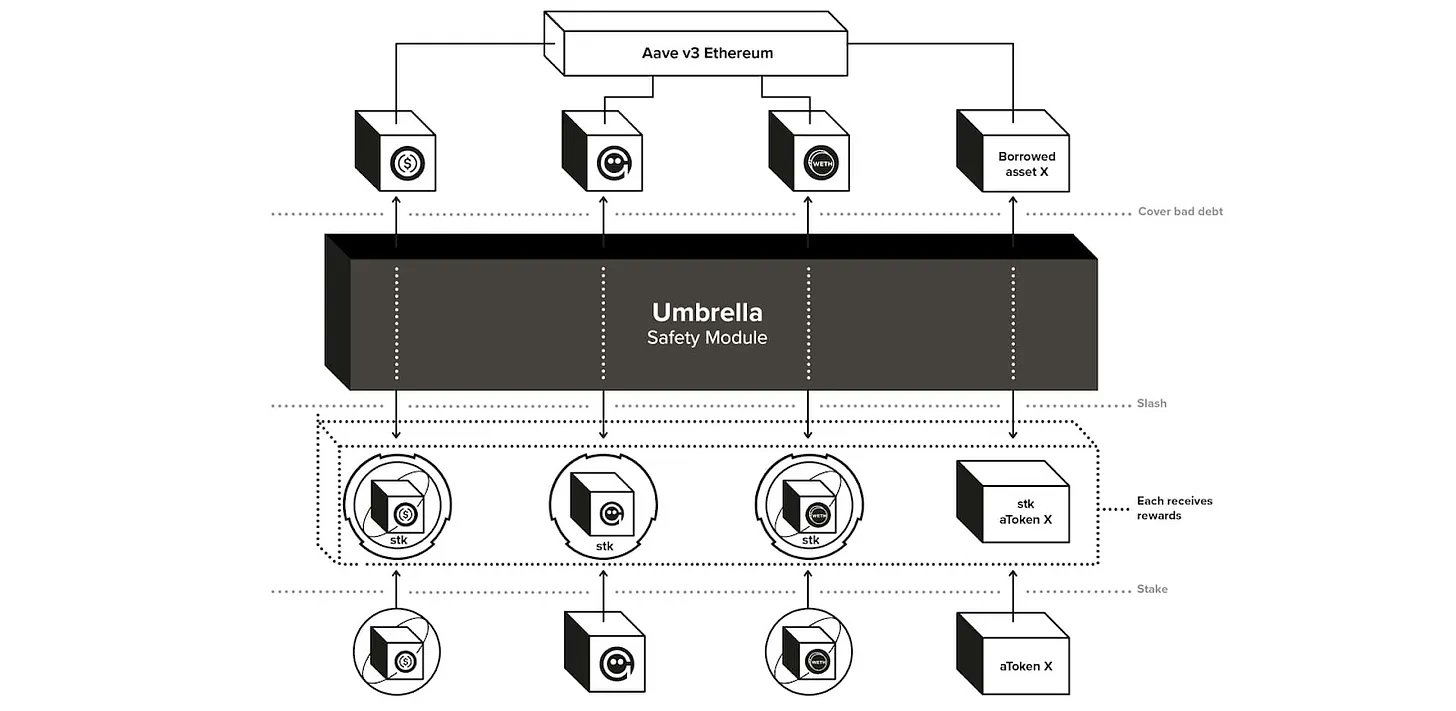

Umbrella solves this problem

While this is unlikely and rare, the current “seize and sell” model relies on selling $stkAAVE on the market to cover bad debts 📉

This could put pressure on the price of $AAVE and lead to inefficient use of capital as the assets sold may not match the liabilities to be covered.

Umbrella proposed moving to aTokens (Aave’s interest-bearing tokens) instead of $stkAAVE’s “seize and burn” model.

This makes the security mechanisms more aligned with the assets at risk.

@lemiscate highlighted the efficiency of this new model in a recent podcast with @MikeIppolito_: “With Umbrella, we expect to see a significant increase in the efficiency of bad debt coverage, from a theoretical $100 million to potentially billions in the medium term compared to today.”

The Umbrella mechanism will allow Aave to seize $aTokens from the security module and destroy them directly to offset bad debts.

This process is more capital efficient and avoids market slippage. For example, if there is $100 million of $aUSDC staked and there is $1 million of bad $USDC debt, Aave can implement a 1% slash on all staked $aUSDC, effectively clearing the debt without market manipulation. Why would a user choose to stake their $aTokens and accept this potential risk?

Stakers will receive significant benefits: not only will they earn the interest paid by borrowers, but they will also receive part of the protocol fees as cashback, greatly increasing their overall returns! How significant is this additional benefit?

@lemiscate gave an example in the podcast: "If 10% of USDC LPs opted into the Security Module, 3% of additional yield would cost about $3 million." He noted that this is manageable given Aave's fee structure. It is important to note that Aave has a good track record of risk management. Bad debts are rare and usually involve small amounts.

The most notable event was the $1.7M CRV event in November 2022, which is still relatively small considering Aave’s TVL and revenue.

The Umbrella update also introduces network-specific security modules, allowing for more targeted risk management across the different blockchain networks operated by Aave.

To better understand these changes, let’s take a look at this great chart by @sonyasunkim showing the before and after of Aave’s balance sheet and bad debt treatment:

Notably, this change removes a fundamental pressure on the $AAVE token.

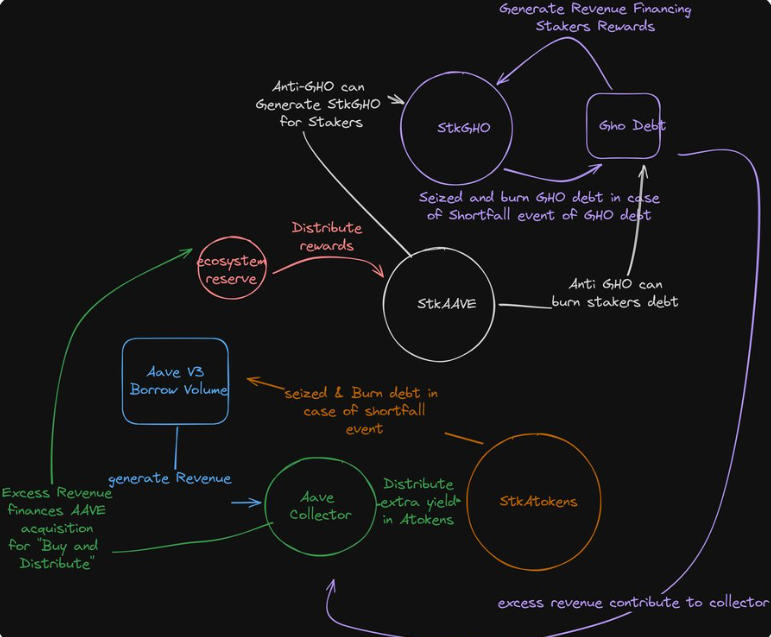

Previously, the potential for significant bad debts was a fundamental risk as $AAVE tokens would be sold to cover losses. With Umbrella, this risk is largely mitigated. $AAVE tokens are no longer the primary mechanism for bad debt resolution, which has the potential to improve its fundamental value proposition and remove significant pressure on the token price. Now, let’s turn our focus to the proposed “Buy & Distribute” program, a key component of the new AAVEnomics update.

Currently, Aave has no mechanism to return value directly to $AAVE token holders. The ecosystem reserve used for rewards will eventually be depleted. The Purchase & Distribute Program aims to use Aave's excess revenue to purchase $AAVE tokens on the market and distribute them to stakers, creating a sustainable reward system. The program will only be activated after certain milestones are reached.

For example, $GHO (Aave’s stablecoin) needs to reach a supply of 175 million to ensure the sustainability of the protocol before the plan is implemented. Other triggers include Aave Collector’s net holdings reaching 2x the annual service provider cost and 90-day annualized revenue reaching 150% of all protocol expenses.

@lemiscate stressed the importance of these milestones: “You need to reach a level of maturity where it makes sense to no longer reinvest everything you earn into growth.”

The buy and distribute model can create ongoing demand for the $AAVE token, potentially supporting its value while better aligning incentives between the protocol and token holders. This approach differs from the “buy and burn” model.

@lemiscate said the purchase and distribution "takes AAVE away from those leaving the ecosystem and returns it to those who are aligned over the long term." If these changes are implemented, they could significantly improve the value proposition of $AAVE. However, they are still subject to community feedback and governance approval.